3 Key Ways Retail Investors Can Profit from Stablecoin Growth, Expert Explains

0

0

The stablecoin market has experienced a significant surge in recent months. Its total market capitalization is up by 90% since late 2023, surpassing the $230 billion threshold.

As stablecoins play an increasingly vital role in global finance, experts are identifying key ways for retail investors to capitalize on this growing trend.

How Retail Investors Can Profit from the Stablecoin Boom

Patrick Scott, a decentralized finance (DeFi) expert, outlined three primary strategies for investors looking to benefit from the stablecoin boom.

“There are 3 ways to play the stablecoin boom: 1) Chains stablecoins are issued on 2) Stablecoin issuers 3) DeFi protocols stablecoins are used in,” Scott explained.

According to Scott, the best opportunities lie in investing in the blockchains that host stablecoins, specifically exploring projects that issue stablecoins with investable tokens and participating in DeFi protocols where stablecoins are actively used.

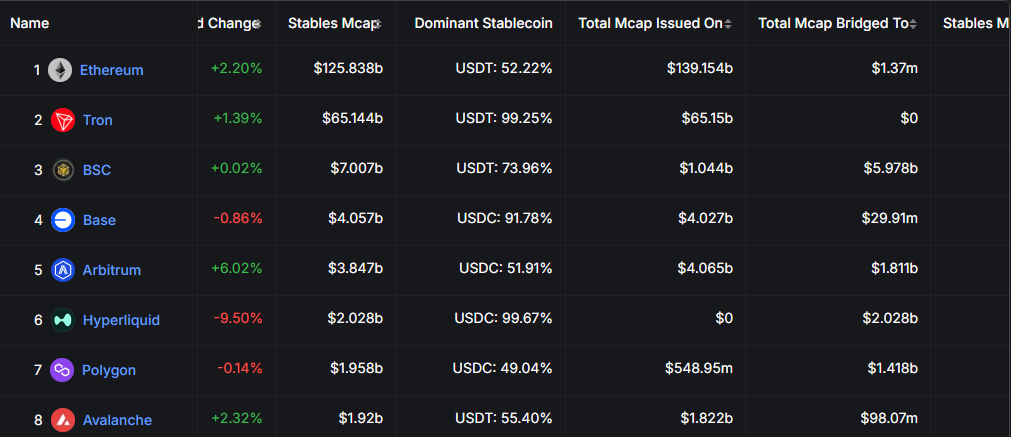

A major component of the stablecoin ecosystem is the foundational blockchains that facilitate their issuance and operation. Ethereum (ETH) and Tron currently lead the market regarding stablecoin supply.

Ethereum hosts approximately $126 billion in stablecoins, while Tron (TRX) follows with $65 billion. Both networks have reached all-time highs in stablecoin circulation.

Foundational blockchains for stablecoins. Source: DefiLlama

Foundational blockchains for stablecoins. Source: DefiLlama

Tron’s growth has been more consistent, driven by its widespread adoption of peer-to-peer (P2P) transactions, particularly in developing regions.

As stablecoin adoption continues to rise, investing in native tokens like ETH and TRX could offer lucrative opportunities for investors seeking exposure to the stablecoin market’s expansion.

“…within a few years it will be obvious in hindsight that the best way to invest in the coming stablecoin boom was simply just to buy ETH where the most stablecoins are and will be settled and ultimately a key beneficiary of the economic activity which emerges around them,” analyst DCinvestor added.

Notably, the leading stablecoin issuers, Tether and Circle, remain privately held and do not offer direct investment opportunities. However, other emerging projects present viable alternatives. Stablecoins such as Ethena (USDe), USDY (Ondo), HONEY (Berachain), and crvUSD (Curve) provide governance or utility tokens that allow investors to participate in their growth.

These tokens often come with benefits such as voting rights or revenue-sharing mechanisms. Such incentives allow retail investors to profit as the stablecoin sector expands.

Growing Allure of Stablecoins in DeFi

Stablecoins play a crucial role in the DeFi ecosystem, serving as a primary means of liquidity, lending, and yield generation. Leading DeFi protocols with strong stablecoin integration include Aave, Morpho, Fluid, Pendle, and Curve.

Investors can engage with these platforms by providing liquidity or participating in lending and borrowing activities. Based on transaction fees and interest rates, they could earn attractive returns.

The surge in stablecoin adoption has not gone unnoticed, with several major financial players entering the space, including Bank of America. Fidelity Investments is reportedly developing its stablecoin as part of a broader initiative to expand its digital asset offerings.

In addition, Wyoming has taken a pioneering step by launching its state-backed stablecoin, WYST. Similarly, World Liberty Financial, a firm linked to the Trump family, has officially introduced USD1. The US government treasuries and cash equivalents will fully back this stablecoin.

Despite the optimism surrounding stablecoins, concerns have emerged about potential risks. Specifically, the possibility of a financial crisis is similar to the 2008 bank run scenario. If investors rush to redeem their stablecoins during market instability, issuers may be forced to liquidate their reserve assets. This could trigger wider disruptions in the financial system.

Regulatory efforts, including proposals like the GENIUS and STABLE Acts, aim to mitigate these risks by enforcing stricter oversight and requiring issuers to maintain fully backed reserves.

0

0

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.Connectez de manière sécurisée le portefeuille que vous utilisez pour commencer.