Ripple vs Bitcoin: Epstein Files Reveal How Early Power Struggles Still Shape Crypto

0

0

This article was first published on The Bit Journal.

In the early days of crypto before ETFs, regulatory settlements, and institutional custody, the industry was smaller, louder and much more personal. Builders fought in forums, investors chose sides, and each new project was seen either as a friend or foe.

That era came rushing back this week, as newly released documents from the United States Department of Justice publicly known as the Epstein Files brought back an overlooked 2014 email.

The message, transmitted from a senior member of Bitcoin-infrastructure leader, rekindled an ancient question that has never fully gone away: Was Ripple simply ever another crypto project or was it regarded as something that had to be stopped?

The question is more relevant in 2026 than it was a decade ago. Ripple is no longer on the outside looking in. It is regulated, institutionally embedded and deeply woven into global finance while Bitcoin remains the backbone of the industry.

The Email That Refused to Stay Buried

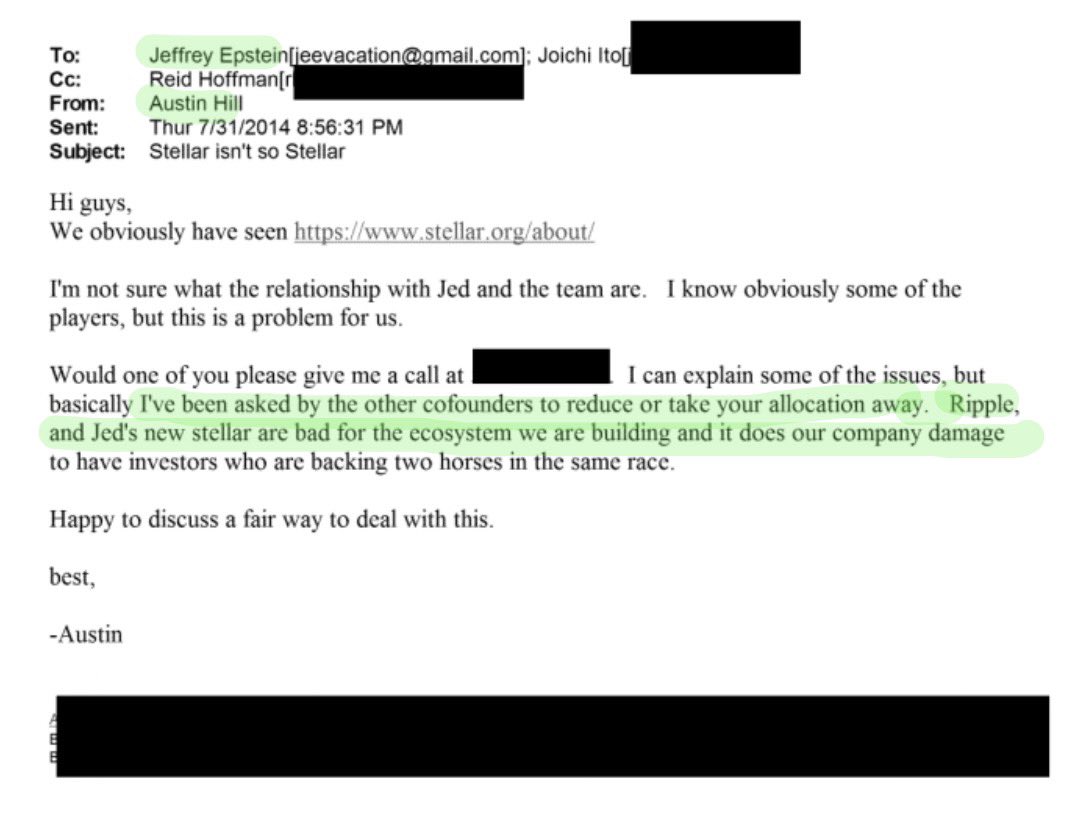

The document, which has become the focus of renewed controversy, is dated July 31, 2014. In it, Austin Hill who at the time was identified as Blockstream’s chief executive sent a note to an influential list of figures that included Reid Hoffman, Joi Ito and Jeffrey Epstein.

Hill’s message was blunt. Ripple and Jed McCaleb’s newly launched Stellar, he said, were “bad for the ecosystem.” The capital pouring into those projects was not healthy competition as he saw it. To him, it was dilution and distraction. Something that could impact the future of Bitcoin by drawing attention, developers and investors from a network that maximalists were trying to protect.

“The ecosystem,” at that time, meant something very specific. The category was not crypto, for the early Bitcoin purists. It was Bitcoin and just the tools that made Bitcoin stronger without altering what it represented.

The email has re-emerged after the Department of Justice recently made millions of pages of material available as part of the Epstein Files Transparency Act. Epstein’s name, of course, pushed the controversy, but industry figures were quick to draw a distinction between shock value and substance.

There is no proof of Epstein having financed Ripple or molding its direction, nor any role in operating the project.

It didn’t matter who got the email. It was what the email revealed about how some of the Bitcoin community really felt about rivals in private.

How Ripple’s Supporters Saw the Message

Within the XRP community, however, the email was received differently.

To many longtime Ripple watchers, it validated what they had long suspected: that early Bitcoin insiders had actively discouraged investors from supporting competing networks.

Leonidas Hadjiloizou described the message as an attempt to force investors to choose sides i.e., to “pick a horse” rather than allowing multiple technologies to develop at the same time.

David Schwartz, Ripple’s former CTO shared the same sentiment. He said he was not surprised that the email might be “the tip of a giant iceberg,” and that similar arguments were probably made behind closed doors to a lot of investors over the same period.

“Hill felt that support for Ripple or Stellar made someone an enemy/opponent. It seems quite likely that Hill and others expressed similar views to many other people.”

At the same time, Schwartz drew a very clear boundary about what the email does not prove. And there is no evidence of a coordinated attack, illegal conduct, or direct interference with Ripple’s business in general.

What it reveals is instead something much more recognizable to those who lived through the early days of crypto forums: tribalism.

At that time, it was not uncommon for design choices to be seen as existential threats. A project that was doing business with banks was believed to have betrayed Bitcoin’s political origins. A corporate-backed token was deemed illegitimate before anyone even looked at its technology.

From ‘Bad for the Ecosystem’ to a Regulated Giant

The irony is now impossible to ignore that Ripple didn’t kill Bitcoin. Bitcoin grew anyway.

While maximalists debated, the industry grew. Quietly, Ripple went in the direction few would have guessed in 2014, toward regulation, compliance and institutional finance.

In August 2025, Ripple agreed to pay a $125 million penalty and was permanently restrained from certain future securities offerings under Section 5 of the Securities Act.

That transition became undeniable after Ripple’s long legal battle with the U.S. Securities and Exchange Commission came to an end in 2025.

The settlement brought to a close years of uncertainty, validated secondary market XRP sales were not securities transactions and removed a “regulatory overhang” that had been used by major institutions as an excuse for staying on the sidelines.

Once legal clarity emerged, the action moved fast.

In late 2025, several spot XRP ETFs were approved and launched, including products from Bitwise, Grayscale, Franklin Templeton, Canary Capital, and 21Shares. These ETFs collectively brought in hundreds of millions in assets under management within weeks of launch.

At the same time, Ripple grew aggressively. It amped its custody business through acquisitions, deepened its presence in trading infrastructure for institutions and set its network even more as a settlement layer for cross-border payments.

RippleNet, the company’s enterprise blockchain solution, supports fast settlement times of 3-5 seconds with low transaction costs, giving it advantages over older systems like SWIFT for cross-border payments.

Partnerships with banks and payment leaders such as Santander, Standard Chartered, SBI Holdings, and American Express have also helped buoy Ripple’s technology as a serious alternative to traditional rails.

Ripple’s push into regulated stablecoins also creates a name for it in the financial ecosystem. Ripple USD (RLUSD), custodied by BNY Mellon and operating under federal guidance from the newly established Ripple National Trust Bank (RNTB), offers regulated stablecoin infrastructure that institutional players can integrate into treasury operations and tokenized finance.

The company looked no more like a Bitcoin ideology challenging startup. It seemed to take the form of a regulated financial firm building plumbing for the modern payments system.

The disastrous result that the early Bitcoiners predicted never came. Bitcoin remained dominant. Ripple found its lane. The system expanded instead of collapsing.

Old Forum Wars, New Political Combat

The rediscovered email also connects neatly with more recent battles.

Then, in early 2025, Bitcoiners publicly clashed with Ripple supporters on the merits of a U.S. strategic crypto reserve. Voices like that of Jack Mallers held that a Bitcoin-only reserve made sense, and criticized XRP for being far too centralized and corporately controlled.

That discourse intensified when U.S. President Donald Trump made it clear that any potential future U.S. strategic crypto reserve would consist of Bitcoin and also XRP, not to mention other large-cap coins.

The announcement deepened old fault lines. To Bitcoin maximalists, it seemed like a rerun of 2014. To some, it was evidence that crypto had moved past single-asset thinking.

Throughout it all, Ripple’s CEO, Brad Garlinghouse has struck a very different note from some of the company’s early detractors. He has made the case for the industry to work together repeatedly, along with his claim that regulatory progress and mainstream adoption is good for all, no matter which network they root for.

Important Moments in Ripple’s Journey

| Year | Event | Why It Mattered |

| 2014 | Blockstream email criticizes Ripple and Stellar | Revealed early ideological divisions |

| 2020-2025 | SEC lawsuit against Ripple, eventually settled with $125M penalty | Defined XRP’s regulatory status |

| 2025 | XRP ETF approvals | Marked institutional acceptance |

| 2026 | Epstein Files release | Reopened debate about early crypto rivalries |

Conclusion

The release of the Epstein Files and the resurfacing of Austin Hill’s 2014 email have opened up an old Bitcoin Ripple feud, but the context around the dispute seems to have changed.

In those early years of crypto, the battle was never only about technology. It was about identity, it was about control and it was an argument over who would define the future.

Bitcoin maximalists thought that preserving purity demanded exclusion. The direction Ripple has taken shows that the industry ultimately opted for growth instead.

In 2026, Bitcoin and Ripple are in very different positions, both being part of the financial system but deeply embedded in their own ways.

Glossary

Bitcoin and Ripple rivalry: Ideological and market long tense relationship between Bitcoin maxis and Ripple lovers.

Blockstream: Bitcoin infrastructure company operating during the early years of Bitcoin development.

XRP ETF: An institutional-grade investment product that provides exposure to XRP.

RippleNet: Ripple’s blockchain-based payment and remittance system.

Frequently Asked Questions About Bitcoin and Ripple Feud

What sparked the latest Bitcoin and Ripple feud?

An email from Austin Hill in 2014 was one of many references to XRP found in the Epstein Files, revealing early Bitcoin insiders saw Ripple and Stellar as potential threats to the Bitcoin ecosystem.

Is there any proof that Epstein manipulated Ripple’s build?

There is no evidence that Epstein guided Ripple or influenced its strategy; the documents simply reveal he received copies of emails.

How did Ripple’s courtroom fight with the SEC end?

In 2025 Ripple settled, paying a $125 million fine and securing an acknowledgement that some XRP sales did not constitute securities offerings.

What is the significance of XRP ETFs now?

Spot XRP ETFs have been approved, Regulated institutional money has entered the XRP market by pushing down exchange liquidity.

How has the battle affected XRP’s adoption levels?

Recent institutional interests and regulatory clarity have enabled XRP to evolve into a financial infrastructure asset without pressing itself in conflicts.

References

Read More: Ripple vs Bitcoin: Epstein Files Reveal How Early Power Struggles Still Shape Crypto">Ripple vs Bitcoin: Epstein Files Reveal How Early Power Struggles Still Shape Crypto

0

0

Tüm kripto, NFT ve DeFi varlıklarınızı tek bir yerden yönetin

Tüm kripto, NFT ve DeFi varlıklarınızı tek bir yerden yönetinKullanmaya başlamak için portföyünüzü güvenli bir şekilde bağlayın.