Why traders opt for centralized exchanges when it comes to digital assets

3

2

If you're just getting started in the world of digital currencies, or even if you have some sort of track record as a crypto-investor already, you may be wondering why traders are using centralized exchanges to buy and sell digital assets.

Custodial transactions on centralized exchanges

First, let's explain what a centralized exchange is, in contrast to a decentralized exchange, in the lens of digital assets.

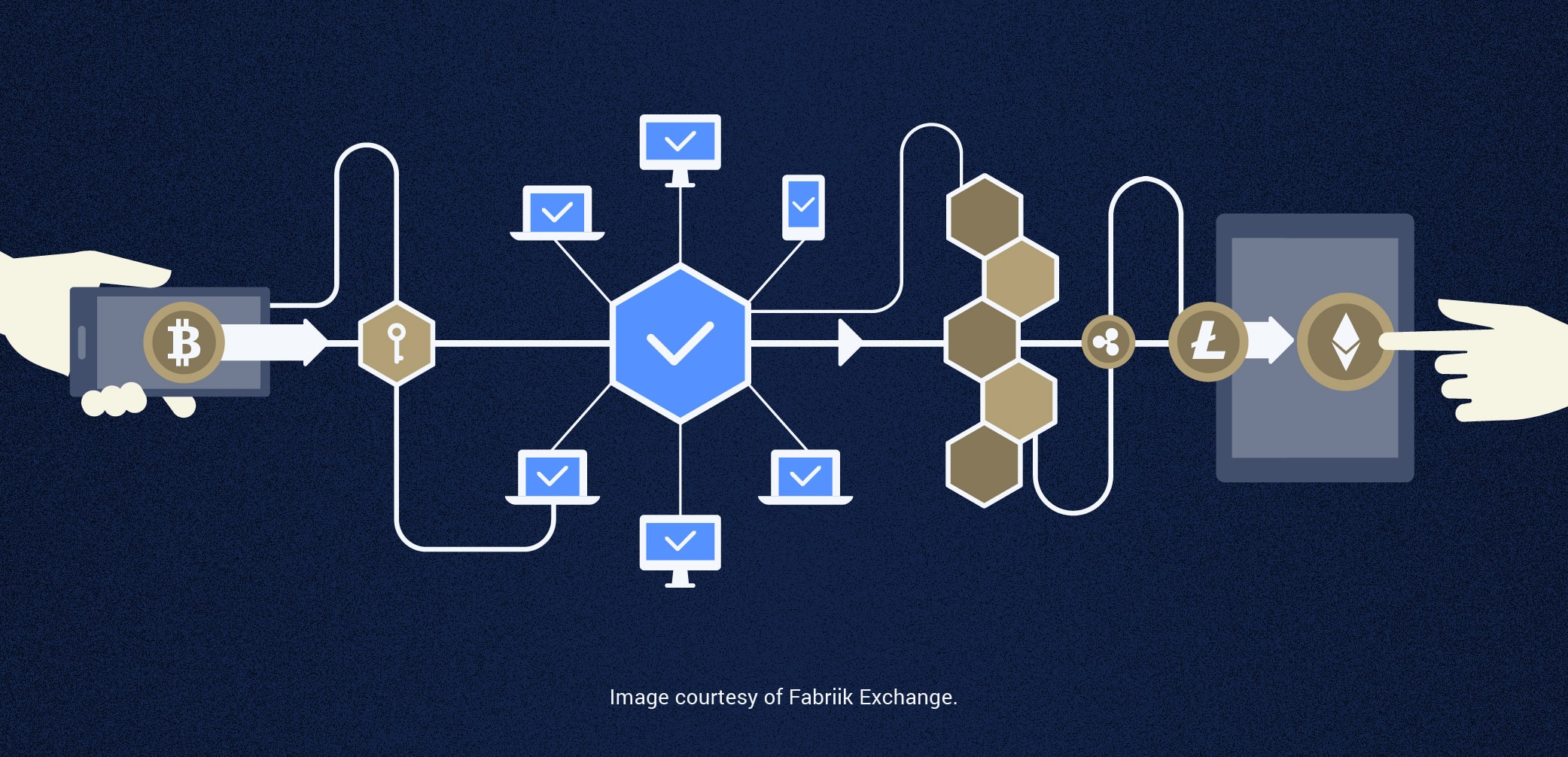

The centralized digital currency exchange aggregates a lot of market options and provides them to the end-user (the trader) through a custodial type of account where a middleman typically takes custody of the assets, if only briefly, in order to convert them from one form of asset to another.

Centralized cryptocurrency exchanges also tend to have broader markets online. The platform invests in various linking of markets, tools, and resources, in order to offer value to the trader.

"A centralized exchange creates broader access to digital currencies for everyone, because it removes the barrier of understanding or working with blockchain technology."

By contrast, a decentralized exchange for digital currencies would resemble something like a simple currency swap, and not involve a third-party holding custody. It might look like a simple exchange of one type of blockchain smart contract for another where instead of the centralized exchange verifying the trade, the transaction is automatically verified by the individual parties and their observance of the transaction.

This is what experts mean when they talk about "consensus-based verification." Let’s use the analogy of a wedding - Even if there was no certificate of the ceremony, the marriage would be verified by the crowd of attendants.

Here are 3 benefits of a centralized digital assets exchange:

Breadth of available trading opportunities

Some people call these exchanges ‘market aggregators’ – They tend to offer hundreds or thousands of trading pairs so that someone with a certain amount of asset value can convert it to a wide range of choices – Bitcoin and Ethereum, various altcoins, and other products, such as derivatives.

High liquidity

Liquidity is how quickly and easily a digital currency can be converted to another currency in the exchange. High liquidity indicates there are many buyers and sellers, which creates a stable marketplace without price fluctuations.

Centralized exchanges tend to have higher liquidity due to narrow "bid-ask spreads." This small spread drives further volume, which further secures liquidity. High liquidity exchanges also reduce the possibility for market manipulation in that fraudulent orders would be much harder to place.

Direct access to derivatives

The derivatives market for digital currencies is really taking off. You have all sorts of Bitcoin Futures and Bitcoin Options menus, allowing traders to put their money on a specific future value. Again, these are not typically transactions that can be done on a decentralized platform.

Another way to think about centralized versus decentralized exchanges for crypto is that the decentralized exchange is really DIY – You could compare it to the open-source movement in software - There is not a centralized party controlling all the transactions in a direct way.

On the other hand, the decentralized exchange is fairly limited in the services that it can offer. Developers and users who try to get around vendor licensing by using something that’s open-source quickly see that it involves a lot more work. There’s no vendor support, and with vendor-licensed tools, clients enjoy and rely on that support. The same can be said for centralized digital asset exchanges. They offer an enhancement of service for investors, things that they couldn’t do or would have trouble doing themselves.

Find your optimal trading strategy

These are all considerations to think about when choosing where to buy, sell or trade digital assets. It always makes sense to look at the regulatory track record of a given exchange as federal and state agencies scrutinize the business models of various digital currency exchange platforms. With a better idea of centralized vs. decentralized exchange options, it’s easier to pick a venue for converting one fiat or digital currency to another.

Fabriik Exchange is coming soon. Our new centralized exchange is a unique, fresh, and intuitive trading environment to help you buy and sell digital currencies faster. Fabriik’s simple, swift, and seamless digital asset trading experience is part of the Fabriik ecosystem, one where anyone can transform, hold, trade, and grow every asset they own all in one accessible place.

- Daniel Skowronski, General Manager at Fabriik Exchange

--

About Fabriik

Fabriik is a transformative financial services organization, designed for the pace of tomorrow. Our vision is for a world where everyone has full control of their finances to live the life to which they aspire – where possibilities are limitless, not limited. Our mission is to evolve the very fabric of the global financial system, for the 1.7 billion people who cannot access it, and the rest of us at the mercy of it.

We’re weaving a better future of finance, so everyone can thrive, by creating a safe, open, and fully transparent ecosystem built on innovative technology, where anyone can transform, hold, trade, and grow every asset they own. All in one accessible place, where everything is digital, and anything is possible.

Our journey has only just begun and launching regulated, digital financial services is our first step in this transformation.

Fabriik. Reimagine Prosperity.

Disclaimer: This is a paid post and should not be considered news/advice

The post Why traders opt for centralized exchanges when it comes to digital assets appeared first on AMBCrypto.

3

2

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plek

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plekVerbind de portfolio die je gebruikt veilig om te beginnen.