Balancer Hack Uncovers Hidden DeFi Frauds As xUSD Depeg Threatens Morpho And Euler

0

0

Get your money out of Morpho and Euler! That’s the unfortunate clarion call when Bitcoin, Ethereum, and some of the top cryptos to buy dangerously plunged to crucial support levels.

It is a worrying message that only raises more questions than answers. How come? Morpho and Euler are nothing but blue-chip DeFi protocols cumulatively managing over $1 billion of assets, at least before the Balancer disaster on November 3.

Big money or not, on X, one analyst thinks the liquidity crunch that Balancer-forking dapps, not only on Ethereum but also on the BNB Smart Chain and Ethereum layer-2s, is a cause for concern.

Get your money out of @MorphoLabs and @eulerfinance!

Here's why.

They take your USDC and give it out to insolvent protocols that leverage loop scam stables like xUSD by Stream Defi which just lost $93M of user money.

The incentives are totally misaligned. Curators on Morpho… pic.twitter.com/38fH6Nkczt

— Duo Nine

YCC (@DU09BTC) November 4, 2025

DISCOVER: Best Meme Coin ICOs to Invest in 2025

What’s Going On? DeFi Doomsday?

If you are an avid DeFi user, supplying liquidity, borrowing, and lending, then you have every reason to be cautious.

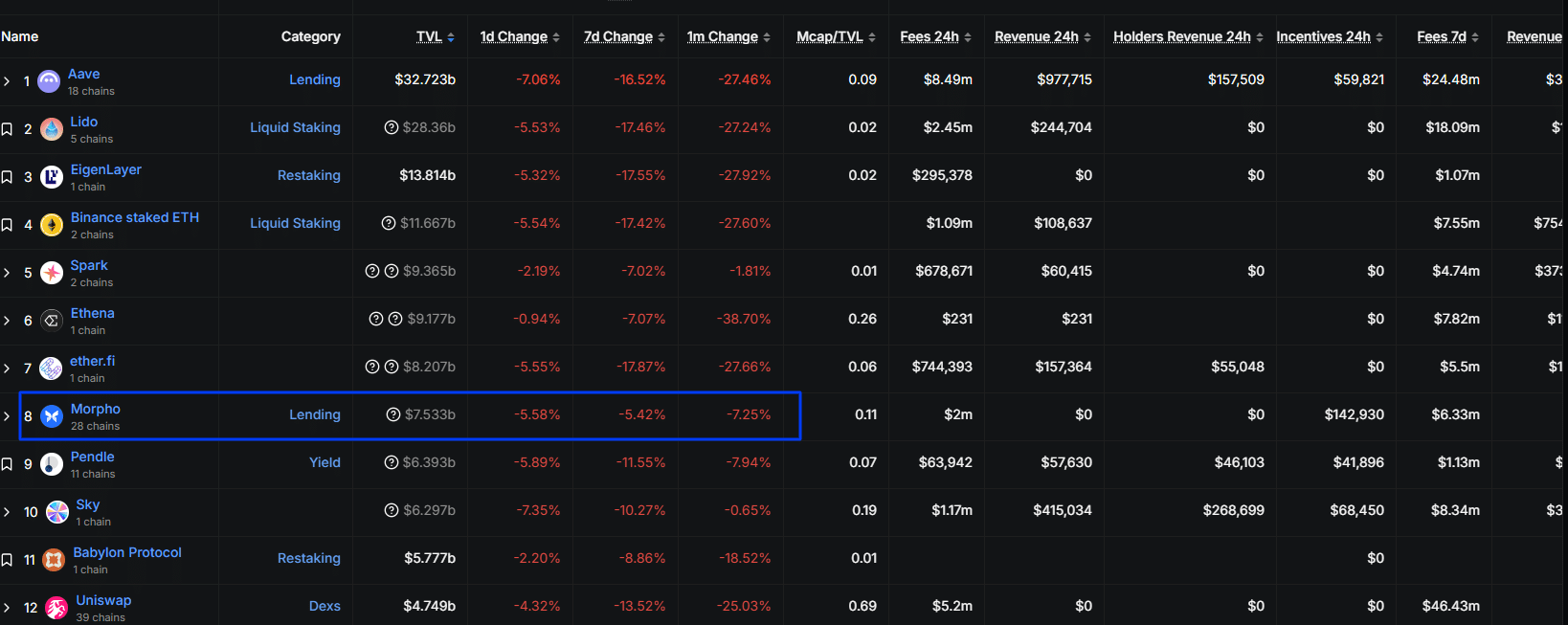

According to DefiLlama, the total value locked (TVL) across all DeFi protocols is down by nearly double-digits in the past 24 hours. In early October, the DeFi TVL stood at over $170 billion, less than a month later, over $40Bn have been withdrawn across all protocols, especially Ethereum and its layer-2s, including Base and Optimism.

Curiously, even the most stable of them all, Aave, which is also the largest by TVL, has lost over -27% of its deposits in the past month alone. The same can be seen on Lido, whose TVL has shrunk by the same margin over the last month. On Ethena, whose algorithmic stablecoin depegged on October 10, its TVL is down 38% in four weeks.

Interestingly, on Morpho, less than -10% of assets have been withdrawn in the past month.

(Source: DefiLlama)

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Morpho and Euler Playing Games With User Funds?

Curious, right?

It simply doesn’t make sense because Morpho and Euler, whose TVL is also down by over -47% in one month, are two DeFi protocols facing severe liquidity issues.

One analyst on X alleges that the two protocols are having a rough time following the collapse of Stream Defi because they have been engaging in dangerous leverage.

Reportedly, the two have been taking user USDC deposits and dishing them out to “insolvent” protocols like Stream Finance, which then “leverage loop scam stables” like xUSD.

DeFi is failing its users when curators act like black boxes. The recent Beefy → Silo → Valarmore → xUSD situation proves it.

FYI – I personally had funds and family savings in this “safe USDC vault on Arbitrum” promoted on Beefy.

What we actually got was 100% exposure to… pic.twitter.com/SNjuqHB4ye

— JohnnyTime

(@RealJohnnyTime) November 4, 2025

As it turns out, xUSD is probably dead and is likely to go down with other DeFi protocols.

When Balancer was hacked, it only took a couple of hours before xUSD depegged, falling from $1.26 to as low as $0.24. But that was not the only thing that happened on that day.

Stream Finance, the issuer of xUSD, disclosed a separate $93 million loss tied to an “external fund manager’s mistake” that led to the freezing of $160 million in user deposits. As a result, they had to halt all withdrawals and deposits.

Yesterday, an external fund manager overseeing Stream funds disclosed the loss of approximately $93 million in Stream fund assets.

In response, Stream is in the process of engaging Keith Miller and Joseph Cutler of the law firm Perkins Coie LLP, to lead a comprehensive…

— Stream Finance (@StreamDefi) November 4, 2025

It turns out that xUSD, which was, following the depegging, nothing but mud, was heavily used as collateral in multiple vaults, including Morpho and Euler.

Now, Morpho and Euler, who promised up to +18% on USDC, are left holding a big bag of worthless xUSD, as users scramble to exit.

Was this a high-profile rug pull?

Seems so, because Stani Kulenchov of Aave is warning that the “next Terra Luna moment” could be in the works.

DeFi lending lives and dies by trust. One of the biggest mistakes is trying to compare DeFi lending with AMM pools because they work in completely different ways.

Lending only works when people believe the markets are sound, that collateral is solid, risk parameters make sense,…

— Stani.eth (@StaniKulechov) November 4, 2025

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Balancer Hack, xUSD Depeg, Morpho and Euler Troubles

- Balancer hacked for over $128M

- Stream Finance’s xUSD depegged

- Euler and Morpho are facing liquidity challenges

- Expect a “Terra Luna Event”?

The post Balancer Hack Uncovers Hidden DeFi Frauds As xUSD Depeg Threatens Morpho And Euler appeared first on 99Bitcoins.

0

0

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.

Gérez tous vos cryptos, NFT et DeFi à partir d'un seul endroit.Connectez de manière sécurisée le portefeuille que vous utilisez pour commencer.