How Coinbase Retail Balances Rise Despite Market Volatility

0

0

This article was first published on The Bit Journal.

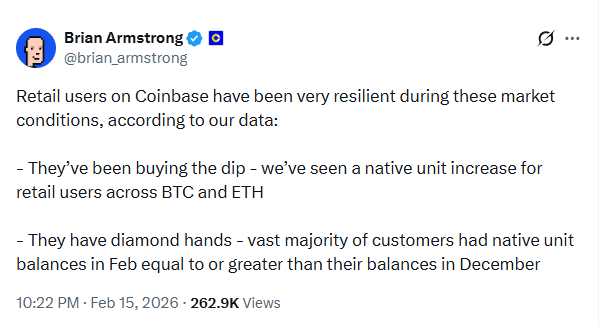

Coinbase retail investors held steady during the recent crypto downturn, according to company data shared by Brian Armstrong. He said most retail users did not sell into weakness. Instead, many increased their Bitcoin and Ethereum holdings.

The update arrives after crypto markets experience wild swings. Prices have been whipsawed by inflation data, rate outlooks and regulatory headlines. But internal figures indicate that retail conviction remains strong.

Coinbase Retail Investors Increase Native-Unit Holdings

Coinbase accounts show account balances in the native equivalent of US dollars, not dollar amounts. This process indicates if a user is depositing more tokens or removing them from the system. New data says that buildup is the answer.

Most retail investors on Coinbase had February balances that were at or above their December levels. That pattern extends to Bitcoin and Ethereum both. The pattern is a departure from previous downturns.

Native-Unit Data Shows Accumulation

Armstrong said retail balances rose during the pullback. Users bought the dip across BTC and ETH. The increase appeared in native-unit terms.

This approach avoids distortion from price changes. A falling dollar value does not mean users sold. The number of coins held offers a clearer signal.

The figures show that Coinbase retail investors did not rush for the exits. Many added to positions as prices fell.

Behavior Differs From Prior Cycles

In earlier corrections, retail traders often sold fast. Volatility triggered fear. That pattern seems weaker this time.

Market watchers say Coinbase retail investors may now understand crypto cycles better. Education and experience have improved. Many now treat Bitcoin and Ethereum as long-term holdings.

This shift may signal a maturing retail base. It could also reduce panic-driven sell-offs.

Market Conditions Remain Uncertain

Crypto prices continue to swing. Inflation reports move markets. Interest rate expectations shift weekly. Regulatory updates add pressure.

In spite of this backdrop, retail investors in Coinbase have continued to show interest. They trade regularly, even when there doesn’t seem to be a price trend in sight.

Indeed, institutions continue to account for the most trading volume. But stable retail flows can support volatility. Steady buying on the dips can help to limit further drops.

Wall Street Lowers COIN Targets

While retail data looks resilient, analysts have trimmed stock targets for Coinbase. Several brokerages lowered their forecasts.

Targets now range from $350 at H.C. Wainwright to $148 at Barclays. Other firms, including Canaccord Genuity and Goldman Sachs, also reduced estimates. Most kept Buy or neutral ratings.

These revisions reflect market caution. They do not signal a full loss of confidence. Analysts still see long-term potential, though near-term pressure remains.

Armstrong’s Stock Sales Raise Questions

Armstrong recently sold over $100 million in COIN shares. Over the past year, he has sold roughly $500 million worth of stock.

Such sales are common among executives. Many follow pre-set trading plans. Still, large disposals often attract investor attention.

The timing of the sales has sparked debate. However, there is no indication that retail user data has changed.

Earnings Miss Adds Pressure

Coinbase reported a net loss of $666.7 million for the fourth quarter. The results fell short of Wall Street expectations.

Lower revenue and higher costs weighed on performance. The earnings miss adds to short-term uncertainty.

Yet user engagement remains active. Coinbase retail investors continue to hold and accumulate crypto assets despite corporate challenges.

Why Retail Trends Matter

Retail flows can reflect sentiment. Strong holding behavior during down markets could indicate increasing confidence.

If there are more of Coinbase’s retail investors to come, it could be a boon for long-term market stability. Bitcoin and Ethereum frequently rise on the back of stolid holders.

Still, risks remain. Macro conditions can shift quickly. Regulatory and policy shifts can affect sentiment.

Conclusion

Coinbase retail investors have shown resilience during the latest market pullback. Internal data shows rising native-unit balances in Bitcoin and Ethereum. Most users did not reduce exposure.

At the same time, Coinbase faces stock target cuts and earnings pressure. Armstrong’s recent share sales have added scrutiny.

Even so, retail engagement appears steady. That behavior may signal deeper conviction in crypto markets. The coming months will test whether this trend holds under continued volatility.

Appendix: Glossary of Key Terms

Native-Unit Balance The sum of all reception-native crypto, measured in whole coins instead of dollar value.

Bitcoin (BTC): The best-known cryptocurrency and the largest by market value.

Ethereum (ETH): A popular blockchain that is used for smart contracts and DAPPs.

Buy the Dip: Method of investing where traders buy assets following a price decline.

Market Volatility: High degree of unstable price activity where markets are moving up and down in on short time frame.

COIN Stock: Shares of Coinbase Global Inc. on Nasdaq exchange.

Price Target: An analyst’s prediction of where a stock price can go in the future.

Quarterly Earnings: A company’s quarterly financial performance report.

Frequently Asked Question About Coinbase Retail Investors

1- What did Coinbase say about retail investors?

The company said most retail users held or increased their Bitcoin and Ethereum balances during the downturn.

2- How does Coinbase measure retail activity?

It tracks changes in native crypto units rather than dollar values.

3- Did Coinbase retail investors sell heavily?

No. Data shows most maintained or increased holdings.

4- Why is this trend important?

Steady retail participation can reduce sharp market sell-offs.

References

Read More: How Coinbase Retail Balances Rise Despite Market Volatility">How Coinbase Retail Balances Rise Despite Market Volatility

0

0

すべての暗号通貨、NFT、DeFiを1か所から管理

すべての暗号通貨、NFT、DeFiを1か所から管理開始に使用しているポートフォリオを安全に接続します。