2

0

The emergence of the Proof-of-Stake consensus algorithm and its first functional utilization with Peercoin in 2012 birthed the concept of crypto staking, a less energy-intensive alternative to Proof-of-Work mining. With staking, miners no longer have to solve convoluted mathematical equations with expensive GPUs. Instead, they can now simply hold their cryptos on a supported blockchain such as Stellar and earn rewards.

Stellar is a decentralized blockchain-based payment protocol that acts as a bridge between people, financial institutions, and payment systems. The network facilitates swift cross-border transactions between cryptocurrency pairs and fiat money. Stellar Lumens (XLM) is the native coin that powers the operations on the Stellar blockchain.

For context, XLM does not rely on Proof-of-Stake (PoS) or Proof-of-Work (PoW) but instead uses an FBA-based algorithm known as the Stellar Consensus Protocol (SCP). This protocol offers advantages not available on PoS or PoW, such as flexible trust, decentralized control, asymptotic security, and low latency.

You are probably already eager to know how “staking” applies to XLM and how you can earn rewards.

Not to worry, this guide will provide you with a step-by-step procedure on XLM staking, its benefits, and drawbacks.

XLM staking describes how holders put their Stellar tokens to work and earn passive income rather than sell them. Think of XLM staking as the equivalent of putting your USD, GBP, or EUR in a high-yield investment portfolio or savings account in a bank where you receive rewards without having to do anything—although at minimal rates. The bank takes your money, lends it out to borrowers, and you earn rewards for making your funds available.

Typically, staking a crypto asset will require you to lock it up to become a participant on a particular blockchain by validating transactions and maintaining the network’s security. In return, you receive rewards calculated in annual percentage (%) yield, which are often more significant than the rates offered by traditional financial institutions. It is important to note that most crypto staking platforms will require a minimum balance of a particular coin before you can begin staking.

XLM cannot be mined, but holders can receive rewards through the earn or lend program offered by crypto exchanges like Coinbase, Nexo, or Crypto.com. To begin earning rewards on your XLM, you must first look for an exchange with an APY that suits you, meet the minimum balance requirements, and then opt-in for “Flexible or Fixed” staking for a specific period (1, 3, 6, or 12 months). With the flexible option, you can take out your XLM, but you can’t until the end of the locking period with the latter.

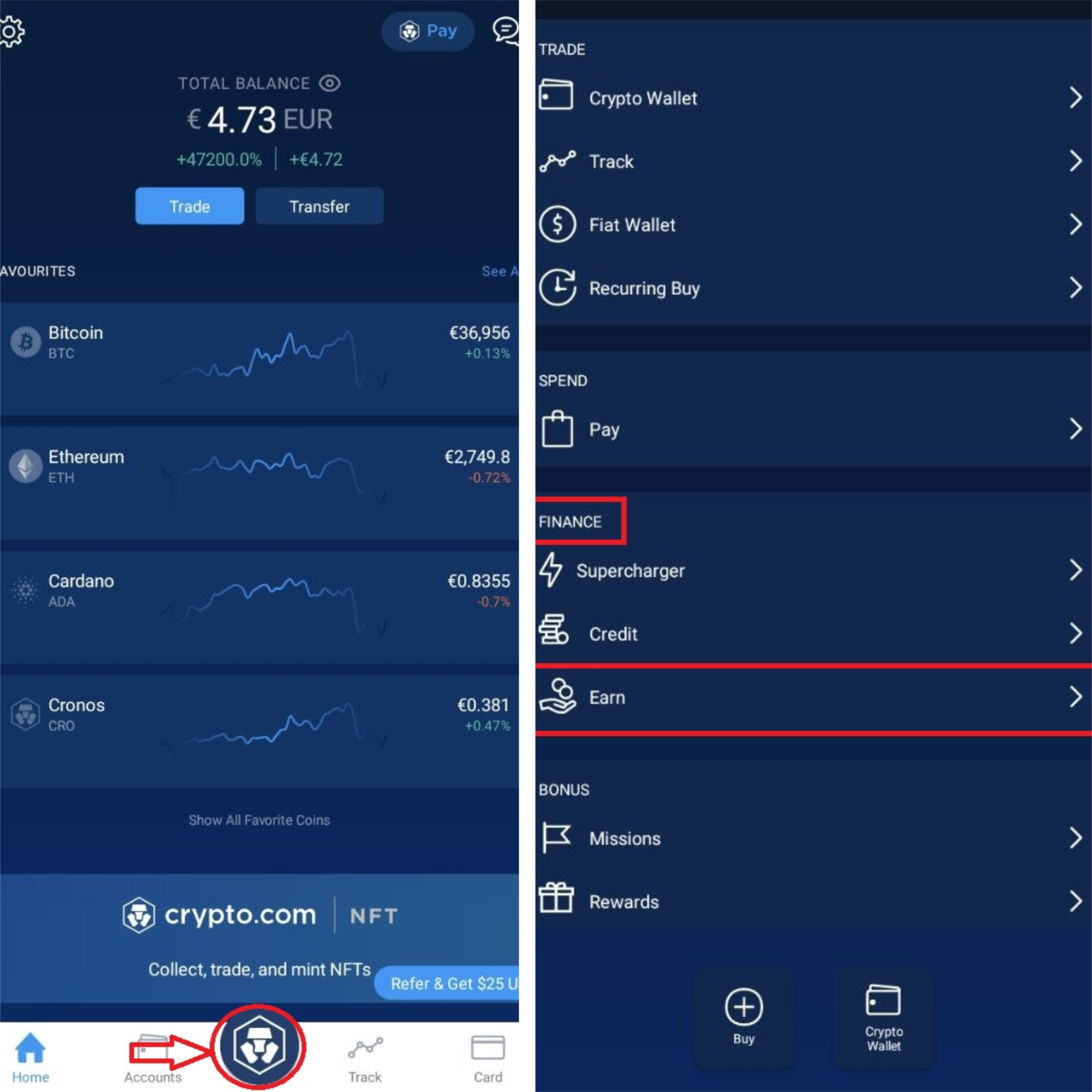

To begin earning XLM rewards and commission on Crypto.com, here are the steps to follow:

Step 1: Visit Crypto.com APP or WEB, register a free account, and complete KYC where necessary. If you already have an account, just sign in instead.

Step 2: Top up your wallet with a minimum balance of 450 XLM.

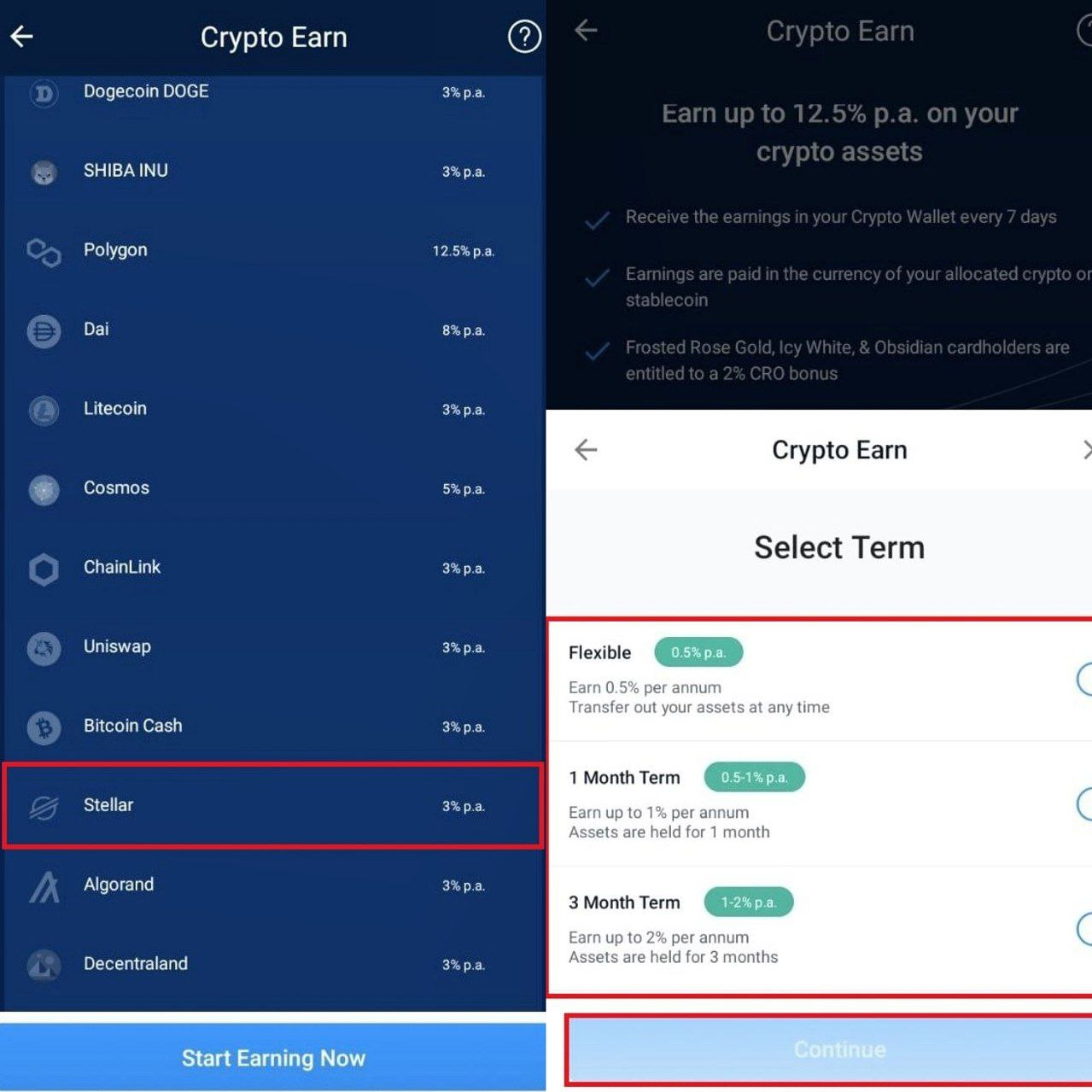

Step 3: On the Crypto.com APP, navigate to Finance, and select Earn.

Step 4: Select Stellar, choose between Flexible, 1 month or 3 months term. Click Continue.

Step 5: Read and Check the Crypto Earn Terms, and click Continue. Type in the volume of Stellar Lumens (not less than 450 XLM), and choose Transfer.

Voilà! You are set to begin earning rewards on your XLM.

This video also provides a detailed explanation of the earning process. https://www.youtube.com/watch?v=mFhYxrJfRTQ

Note that the rates highlighted in the video are outdated.

The amount of XLM users will earn in rewards will depend on the volume of the asset you have locked in, the holding period, and the APY offered by your preferred crypto exchange. While some offers can reach an 8% annualized reward rate, others can be as low as 3%.

In addition, your earnings will be influenced by the asset’s value after the staking period. If XLM gains value at the end of the period, you’d have made profits, but if otherwise, your initial XLM plus the rewards could be worth less than what you started with.

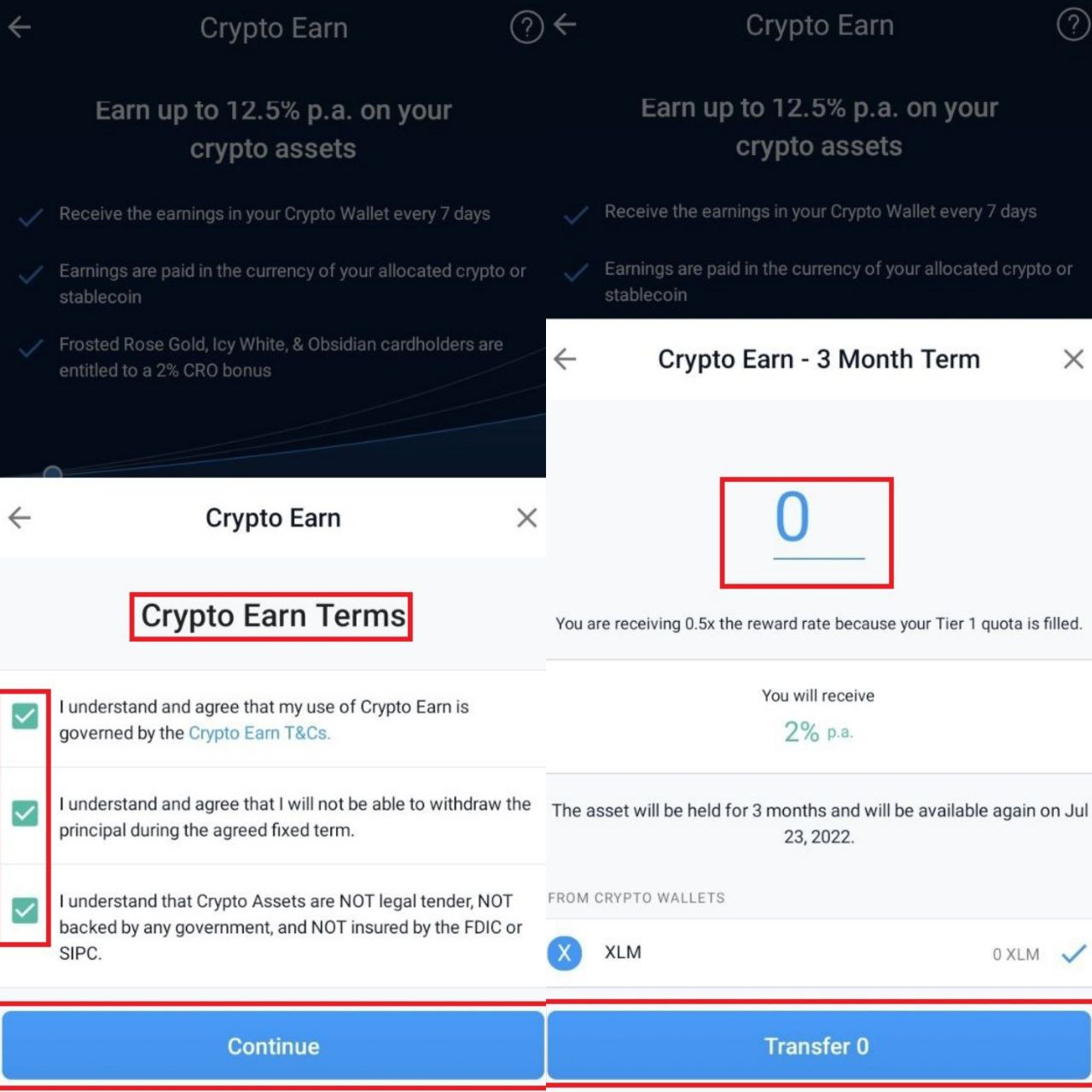

To ascertain the profitability of staking XLM, let’s quickly compute the rewards. Based on a 4.01% annualized interest rate, staking 1000 USD worth of XLM will turnover a monthly earning of $3.3. After one year, you would have earned a simple interest of $40.1 (204.26058 XLM).

However, if the interest rate is compounded, you would have received $40.91 estimated yearly reward.

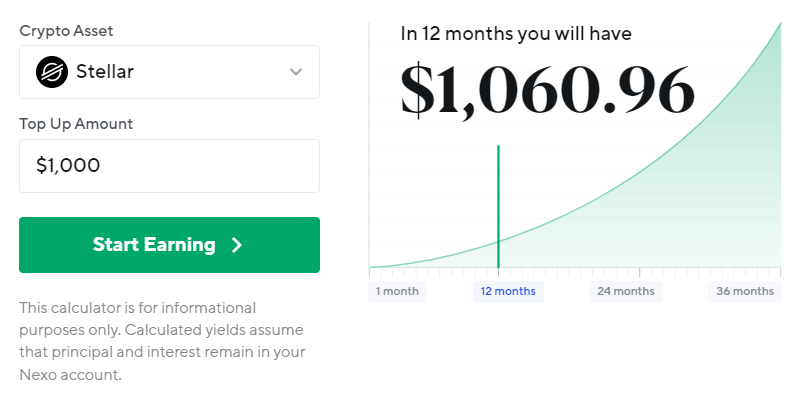

Nexo offers 8% APY with compounding 24-hr payouts and flexible earnings. It provides holders with the opportunity to earn more on their XLM.

XLM is growing in popularity due to the low transaction fees on the network. In the long run, its market value could rise, making a significant difference in the profitability of the coin.

As earlier established, XLM is not a PoS coin, nor does it use the PoW algorithm. However, its consensus verification is similar to PoS. XLM can be “locked away” to earn interest/rewards but not “staked” in the technical sense.

Crypto staking is an exciting concept but not without its drawbacks. Here are some of them:

Staking is a less energy-intensive and secure way to earn rewards and passive income on the blockchain. With as little as 450 XLM, you can stake stellar and begin earning up to 4% in rewards. However, some research and a bit of patience will be needed.

2

0

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。