tBTC x Noon: New Bitcoin Vault

1

0

Bitcoin markets have stabilized, shifting participants' focus from short-term price action to disciplined, capital-efficient structures and advanced risk management. As adoption matures, demand rises for BTC-denominated frameworks that let holders maintain exposure while engaging with onchain financial infrastructure.

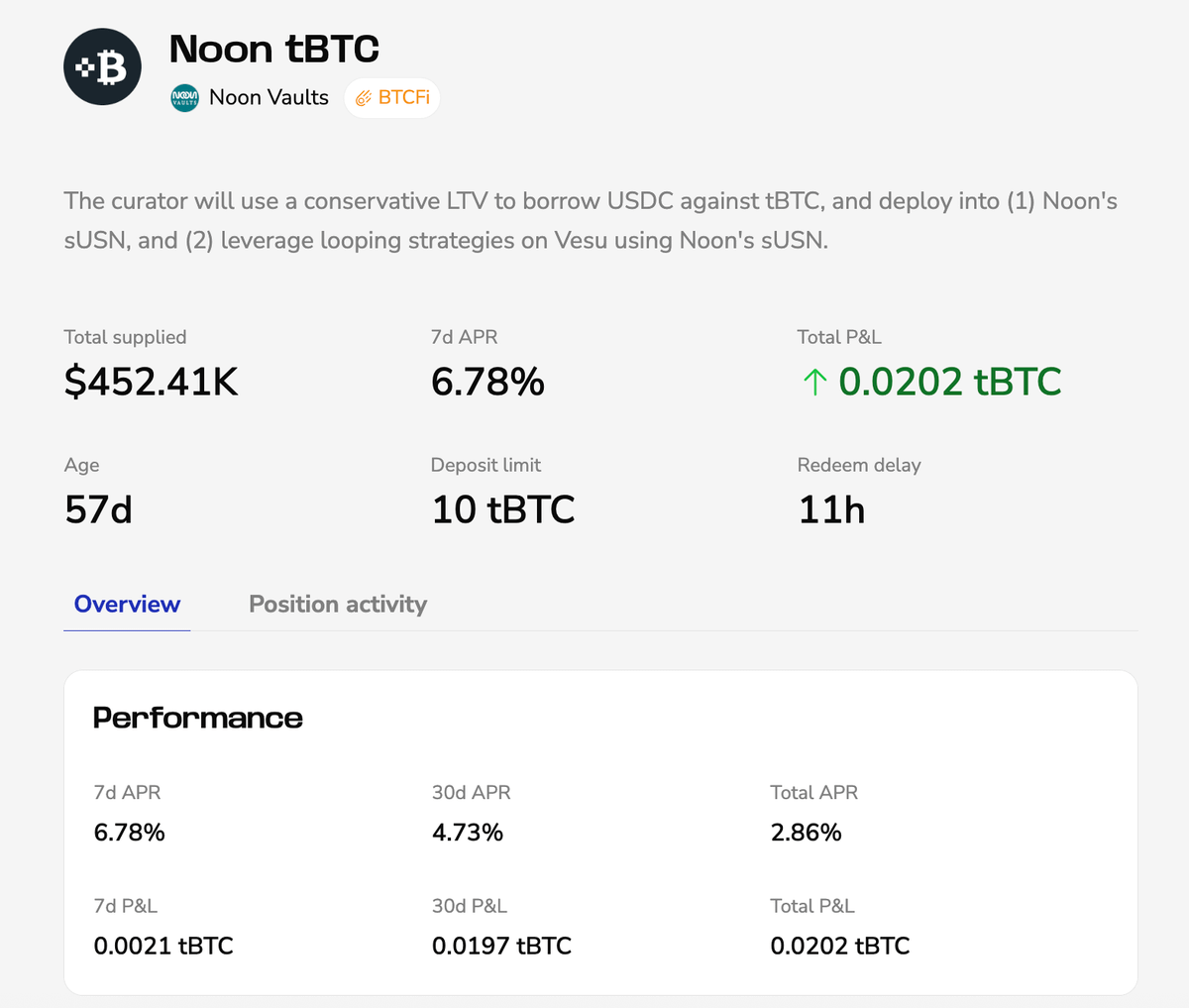

Noon is extending its vault framework to Bitcoin, launching the tBTC Vault on Starknet via Vesu. This vault lets Bitcoin holders keep BTC exposure while using onchain financial tools with clear risk controls.

This launch brings together three complementary systems in a first-of-its-kind integration:

- tBTC’s trust-minimized Bitcoin bridge for native BTC

- Noon’s multi-venue strategy framework that delivers diversified exposure

- Vesu’s institutional-grade lending infrastructure on Starknet.

Demand for structured, reliable BTC frameworks is growing among institutions and sophisticated participants, with interest rising in tBTC-based strategies as DeFi infrastructure matures. (Source: Forbes https://www.forbes.com/sites/digital-assets/2025/12/01/bitcoins-november-selloff-was-a-stress-testand-defi-quietly-passed/)

Using tBTC as Collateral

Noon’s tBTC vault lets users access stablecoin strategies while keeping BTC as the core asset. Borrowing starts at a conservative 50% loan-to-value, and automated controls reduce risk if thresholds are reached, protecting users during volatility.

A Track Record of Outperformance

Over the past several months, Noon has delivered stronger performance than competitors such as Ethena, Resolv, and other-structured yield protocols. This has not been accidental.

Noon’s advantage comes from widening its search for yield beyond a single sector. The team actively evaluates opportunities across DeFi, CeFi, and TradFi, selecting strategies that balance attractive returns with disciplined risk management. Many of these opportunities are typically available only to large-scale investors due to high minimum allocations, but Noon structures them so they are accessible to its users. These strategies ultimately determine the performance of sUSN.

The tBTC-Denominated Vault

The new tBTC vault on Starknet follows the same principles but is tailored to Bitcoin holders' needs. After borrowing stablecoins against tBTC, Noon deploys those stablecoins into lending markets to execute leveraged looping strategies. This involves lending stablecoins, borrowing against them, and repeatedly redepositing. The objective is to amplify yield from interest-bearing positions while keeping leverage and risk levels under control.

The target APY for this vault is approximately 10%, reflecting a balanced approach to performance and stability.

Positioning for the Next Phase of Bitcoin Finance

Integrating tBTC into Noon’s vault framework reflects a broader evolution in how Bitcoin is used onchain. The structure enables BTC holders to maintain Bitcoin exposure while engaging with BTC-denominated strategies implemented under defined risk parameters and transparent infrastructure.

By combining tBTC’s trust-minimized design with Noon’s strategy framework and Vesu’s lending architecture on Starknet, the vault provides a clear, disciplined model for structured Bitcoin participation in onchain markets.

The Noon tBTC Vault is now available

on the new Threshold Network App:

Disclosure: Participation in Noon vaults carries market, smart contract, and counterparty risks, as well as the potential loss of capital. Target outcomes and projected metrics are not guaranteed; actual results may vary with market conditions. This material is for informational purposes only and does not constitute investment advice, an offer, or a solicitation.

1

0

すべての暗号通貨、NFT、DeFiを1か所から管理

すべての暗号通貨、NFT、DeFiを1か所から管理開始に使用しているポートフォリオを安全に接続します。