Chainlink Joins Bank of England’s Synchronization Lab to Advance Tokenized Asset Infrastructure

0

0

Highlights:

- Chainlink has joined the Bank of England’s lab to test tokenized settlement with central bank funds.

- The program explores syncing digital assets with real-time gross settlement systems.

- Findings will help shape the UK’s live synchronization system for tokenized finance.

Chainlink has been chosen by the Bank of England among 18 firms that will participate in its new Synchronization Lab. The initiative aims to modernize the settlement processes between tokenized securities and central bank funds. The move is part of a broader UK initiative to modernize its core real-time gross settlement system, known as RT2.

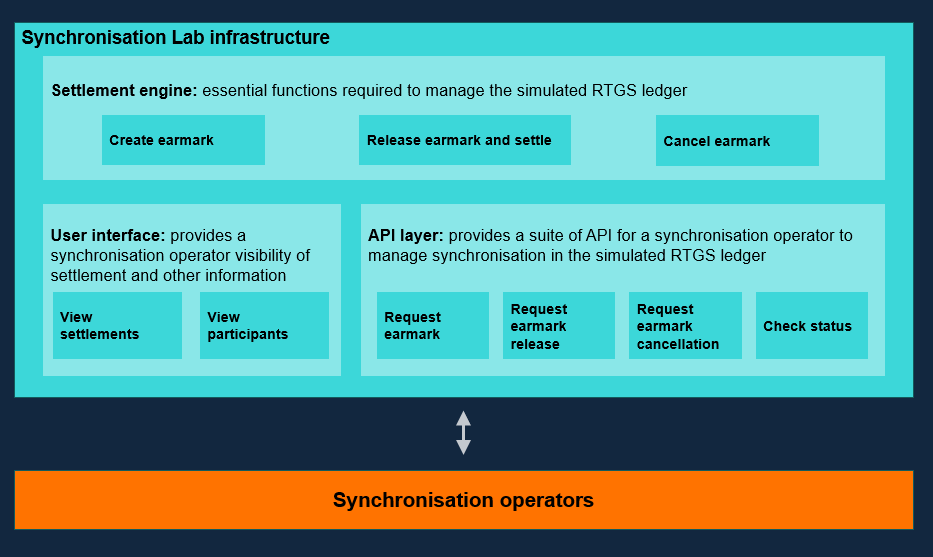

The lab, which is scheduled to last six months since spring 2026, provides a testing ground for atomic settlements. It provides the opportunity for the chosen operators to model the interaction of blockchain-based assets with traditional money infrastructure. Unlike the previous experiments, the environment has API integration and a user interface, which mimics actual settlement processes.

JUST ANNOUNCED: Chainlink has been selected to participate in the Bank of England’s Synchronisation Lab.

Chainlink is supporting synchronized settlement between central bank money and onchain securities.

This is how the UK financial system moves onchain. pic.twitter.com/b3ho0gN1DY

— Chainlink (@chainlink) February 10, 2026

Aims and Use Cases Behind the Lab

The purpose of Chainlink in the lab is to experiment with the decentralization of synchronization between central bank funds and tokenized securities. A similar use case will be supported by the UAC Labs AG. Meanwhile, companies such as Swift, LSEG, and Partior will work on applications in tokenized bonds, foreign exchange, and digital collateral.

Even though the lab will not deal with live money, it serves a larger strategic purpose. Future live support, in particular, to support synchronization under RT2, will be guided by the findings. This project builds on the previous research of Project Meridian, which showed that synchronization through atomic settlement is technically feasible.

In addition, all the participants must show full end-to-end functionality. They also need to simulate the behavior of account holders, asset platforms, and end users. Such simulations will assist the regulators and infrastructure operators in testing reliability, cost, and design flexibility among several models.

Exploring the Technical Design of RT2

The Lab infrastructure consists of a simulated settlement engine, API suite, and dashboard for operators. Chainlink and other participants will use integrations on top of this platform to demonstrate the interaction of their systems with RT2 users. The Bank of England will experiment with two synchronization flow models.

The first model allows operators to send earmarking instructions and complete settlements directly. The second model involves the RTGS account holders issuing earmark instructions through operator instructions. In both flows, operators are able to initiate, cancel, or complete a synchronized transaction.

Full specs will be given to participants before the Lab begins. These provide adequate time to develop test-ready prototypes. The Bank aims to hold an industry showcase once the lab is over. Moreover, this will be followed by a detailed report that will summarize the learnings that will be used in future design decisions.

The UK anticipates that it will have acquired sufficient experience in the Lab to make its final decisions about the implementation of synchronization in live RTGS systems by mid-2026. Until now, experimentation in this controlled setting will provide a clear insight into the next era of digital settlement architecture.

Chainlink’s Role in Broader Settlement Standards

In addition to its engagement with the Bank of England, Chainlink is also active in other settlement standardization projects. It recently collaborated with WEMADE to support the Global Alliance to Korean Won Stablecoin (GAKS). This project aims to boost the trust in KRW-backed stablecoins and enhance the data accuracy in the region.

The involvement of Chainlink in these top-tier projects indicates its growing role in bridging real-life infrastructure to decentralized platforms. The lab alliance adds to its record of collaborating with institutional-grade systems and building compliant blockchain connectivity.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

すべての暗号通貨、NFT、DeFiを1か所から管理

すべての暗号通貨、NFT、DeFiを1か所から管理開始に使用しているポートフォリオを安全に接続します。