“The dominance of the United States, which started after the end of the Cold War, has effectively come to an end”

— S.L. Kanthan (@Kanthan2030) May 13, 2024

— India’s Foreign Minister, Jaishankar. pic.twitter.com/LrfOjwHGbk

The IMF sees the dollar give way to other reserve currencies

2j geleden•

bullish:

2

bearish:

0

Delen

The IMF admits that geopolitical tensions are a bad omen for the dollar. The BRICS want to cut ties. Why not adopt Bitcoin?

Dollar and geopolitics

The war in Ukraine is just the tip of the iceberg. The BRICS want to restructure the international monetary order, which greatly irritates Washington.

IMF Deputy Managing Director Gita Gopinath implicitly acknowledged this in a paper titled “Impact of Geopolitics on International Trade and the Dollar”. She states that we have to go back to the Cold War era to observe such a shift in global economic ties.

“Countries are reassessing their trading partners based on their economic and security concerns. Foreign investment flows are also being redirected according to geopolitical alliances. Some countries are reevaluating their heavy dependence on the dollar in their international transactions and reserves,” she said.

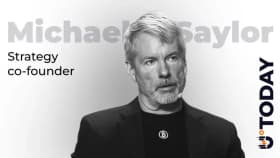

India’s Foreign Minister would agree. According to Subrahmanyam Jaishankar, “The dominance of the United States, which began after the end of the Cold War, has ended.”

That said, despite the increase in geopolitical risks, the dollar remains dominant. “Probably because a large part of commodity trade continues to be invoiced and settled in dollars,” says Gita Gopinath. #petrodollar…

The greenback also represents 58% of foreign exchange reserves. However, the trend is heavily downward. For example, the share of China’s holdings in U.S. Treasury bonds has fallen from 2015 to 2023 “from 44% to 30% of its foreign exchange reserves.”

To be more specific, China’s U.S. Treasury reserves have dropped from $1.2 trillion in 2018 to $775 billion today (-35%).

Gold Standard…

The most notable recent development in global foreign exchange reserves is the increase in gold purchases by central banks.

“Gold is generally considered a politically neutral asset that can be stored domestically, protecting it from sanctions or seizures. It can also serve as a hedge against inflation but cannot be easily used in transactions,” it can be read in the paper.

If fragmentation intensifies, the IMF warns that the “global payment system could fragment according to geopolitical alliances, leading to the emergence of new payment systems with limited or no interoperability. Additionally, foreign exchange reserves could evolve to reflect new economic ties and geopolitical risks.”

The IMF’s Deputy Managing Director nevertheless believes that a “global system with multiple reserve currencies could offer several advantages, including diversification of foreign exchange reserves.”

Finally, Gita Gopinath did not forget to mention that many countries are closely following ongoing discussions on the potential use of Russia’s euro reserves to support Ukraine. For her, it is important that “any action should be based on sufficient legal grounds and should not compromise the functioning of the international monetary system.”

In other words, the IMF warns that seizing Russia’s 220 billion euros in reserves (+ 6 billion dollars and 40 billion in yen, francs, etc.) would open a Pandora’s box.

It is certain that China and Saudi Arabia would be concerned about being next on the list. This would be the end of globalization and the beginning of an extremely inflationary era. On this topic, don’t miss our article: Bitcoin and Endless Inflation.

BRICS and Bitcoin

Gita Gopinath’s analysis echoes that of Bruno Martarello De Conti. The Brazilian professor warns that militarizing currency is a dangerous game.

“We all know that the dollar is used as a weapon. The international monetary and financial system is completely dysfunctional. This is a problem for Russia, but also for the rest of the world,” he said on Sputnik’s microphone:

“It is really necessary for the BRICS to build alternatives to the dollar. For example, through the use of local currencies for bilateral trade. This is what Russia is doing with China. Developing some form of common currency is also a good idea. It is a complex project that is not for the immediate future, but it needs to be discussed.”

The creation of a new payment system is equally important. For the professor, “the SWIFT payment system is similarly used as a weapon.”

In this regard, Sputnik recently quickly relayed the “Unit” project, presented as a “form of apolitical currency influenced by no political agenda.”

We can also read on their site:

“Currently, the BRICS are not ready to launch their own currency. The need for an independent and reliable international financial and monetary system is nevertheless urgent. The UNIT ecosystem offers BRICS+ countries a unique framework that can fully take into account exchanges between blocs.”

The UNIT (token) is a unit of account of the UNIT ecosystem. It represents a proportional share of the underlying UNIT basket, which contains 40% gold and local currencies.”

Let’s be serious. There are already thousands of shitcoins… Bitcoin can only be invented once. It is the currency as well as the payment system (two-in-one) dreamed of by the BRICS. Why make things complicated?

Truly stateless and uncensorable, Bitcoin is a proven solution for over 15 years and ready to use.

2j geleden•

bullish:

2

bearish:

0

Delen

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plek

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plekVerbind de portfolio die je gebruikt veilig om te beginnen.