Whale Withdrawal Sparks Bullish Momentum as Solana Price Holds Key Range

0

0

The Solana price gained renewed attention this week after a large whale withdrawal removed more than $28 million worth of SOL from Binance. The move came during a period of tight consolidation.

This raised speculation that major players may be preparing for a shift in market structure. With the Solana price holding firm inside a clear range, traders now watch for signs that the market is building pressure for a breakout.

Whale Wallet Absorbs Massive SOL Supply

A newly created wallet absorbed 200,001 SOL from Binance in a single transaction. This action reduced available supply at a moment when the Solana price had already stabilized near the top of its accumulation block.

Analysts note that whales tend to build positions early, often before broader sentiment shifts. The withdrawal also tightened liquidity on centralized exchanges, which can strengthen price behavior during periods of growing demand.

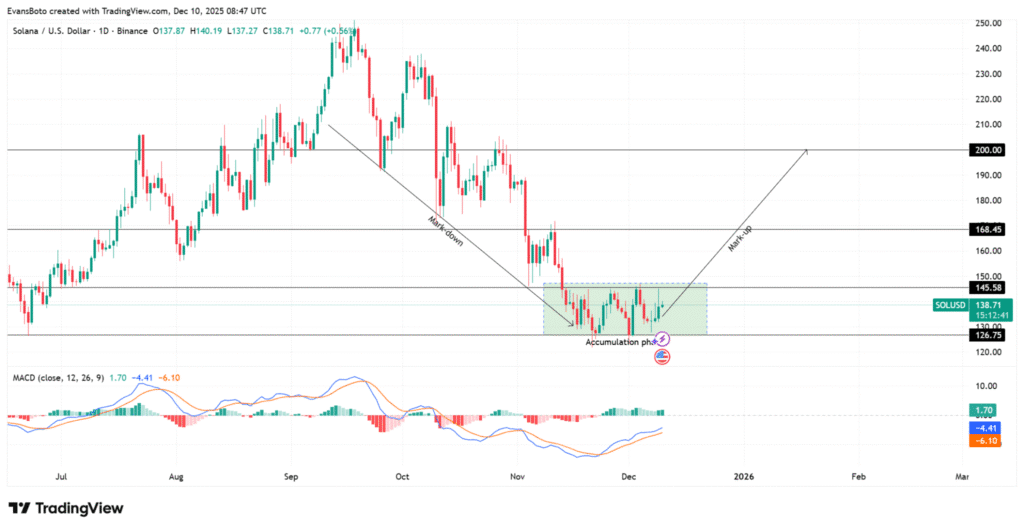

Solana Price Holds Firm Within Established Range

The Solana price continues to trade between $126 and $145. This range has held for several weeks, forming a base that limits downside movement. Buyers appear active near the lower band, and each dip has been met with swift rejection.

The structure suggests steady improvement after a long markdown period earlier in the year. Traders now wait to see whether momentum can build enough to challenge the upper boundary.

Accumulation Zone Strengthens

The Solana price shows consistent support inside its accumulation zone. Each attempt to push the asset lower has failed. Higher lows form near the bottom of the range, hinting that buyers continue to step in.

Also Read: Solana Liquidity Is Crashing But Analysts Say a Major January Rebound Is Coming

The market has also held above the midpoint, which often marks early signs of strength in a developing trend. This steady behavior may become a signal for traders seeking long-term positioning.

Breakout Above 145 Could Shift Momentum

A break above 145 remains the key trigger level. If buyers push through this resistance, the Solana price may target the next liquidity cluster near 168. That region attracts interest because it aligns with previous congestion seen during earlier rallies.

For now, traders treat the range top with caution. Yet the structure builds a case for potential continuation if volume increases.

MACD Shows Early Momentum Recovery

Momentum indicators support the improving tone. The MACD line recently crossed above the signal line. This shift shows that buyers are slowly regaining control of short-term momentum.

The histogram sits near the neutral zone, which often appears before a stronger move. While the signal is early, it aligns with the broader accumulation pattern seen on the Solana price chart.

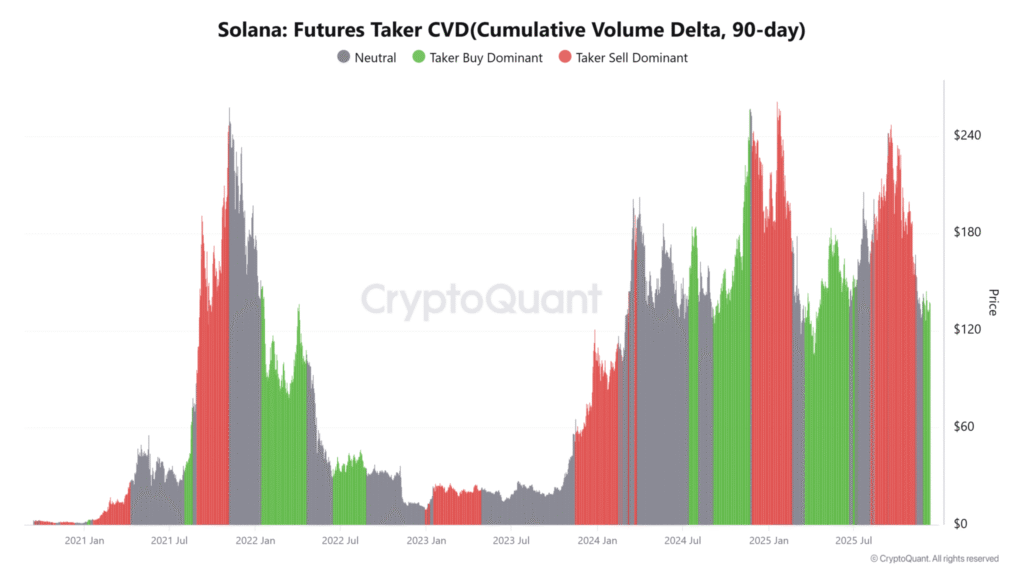

Buyers Absorb Sell Pressure Through CVD

Taker Buy CVD trends upward, signaling steady absorption of sell orders. This pattern confirms that buyers continue to step in during moments of weakness. Because sell pressure fails to break the range floor, bearish momentum weakens over time.

The stronger CVD profile supports the idea that deeper demand is returning to the market. Combined with whale accumulation, it strengthens the long-term outlook for the Solana price.

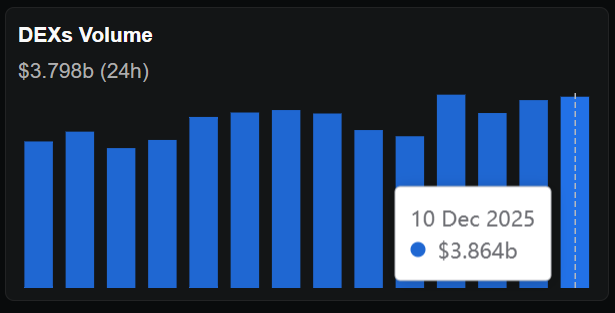

DEX Activity Signals Organic Growth

On-chain activity shows strong participation. Solana decentralized exchanges saw more than $3.79 billion in volume over 24 hours and more than $24.6 billion over seven days. This marks a weekly rise of 12.76 percent.

DEX dominance reached 16.11 percent, showing that traders rely more on non-custodial methods. Rising DEX use often reflects organic network demand, which can benefit the Solana price as user activity grows.

Short Liquidations Add Upward Pressure

The market saw $293,000 in short liquidations over the past day. Long liquidations totaled only $132,000. The imbalance shows that traders betting on downside movement faced swift losses.

Most short liquidations came from Binance, where bearish traders expected a breakdown near 138. The range floor held, while volatility compressed. This pressure often builds conditions for a possible upside expansion in the Solana price.

Conclusion

A series of strong signals now support a constructive outlook. Whale accumulation increases. Momentum improves. Buyers absorb sell pressure as DEX activity rises.

Short sellers lose footing. While resistance at 145 must still be cleared, the overall structure suggests that the Solana price may be preparing for a shift from accumulation to markup if demand continues to rise.

Also Read: Solana Mobile Announces SKR Token Launch for 2026

Appendix: Glossary of Key Terms

Liquidity Cluster: A price zone where heavy order activity gathers and often creates strong support or resistance.

MACD: A momentum indicator that tracks shifts in trend strength through moving average movements.

CVD (Cumulative Volume Delta): A tool that shows whether buyers or sellers dominate real-time market order flow.

Markup Phase: A market period when price breaks out of consolidation and advances with sustained buying pressure.

Whale Activity: Large transactions made by major investors that can influence supply, demand, and market direction.

Liquidity Withdrawal: The removal of assets from exchanges, tightening available supply and affecting market stability.

Range High: The upper boundary of a trading range where price often meets resistance from sellers.

Short Liquidation: A forced close of bearish positions when price moves higher, adding momentum to upward moves.

Frequently Asked Questions About Solana price

1- Why did the whale withdrawal matter?

It removed a large amount of SOL from circulation and suggested early confidence from major holders.

2- What level must the Solana price break to confirm strength?

A clear move above 145 may open a path toward 168.

3- Are buyers showing stronger commitment?

Yes. CVD data shows consistent absorption of sell pressure.

4- Does on-chain activity support the trend?

Rising DEX volume indicates growing user engagement and healthier liquidity.

Reference

Read More: Whale Withdrawal Sparks Bullish Momentum as Solana Price Holds Key Range">Whale Withdrawal Sparks Bullish Momentum as Solana Price Holds Key Range

0

0

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。