Why The Chainlink GLNK ETF May Not Fully Capture Oracle Adoption

0

0

This article was first published on The Bit Journal.

Chainlink has taken a fresh step into traditional finance with the launch of GLNK, a new exchange-traded product that holds LINK as its only asset and trades on NYSE Arca. Grayscale converted its long-running Chainlink vehicle into this ETF format on December 2. In the first 48 hours, GLNK ETF saw about $13 million in first day trading volume, roughly $41 million in new inflows and total assets near $64 million, a strong debut for a single asset crypto fund.

On the surface, the narrative looks simple. Professional investors now have a clean way to gain exposure to Chainlink without handling private keys or specialist exchanges. The structure of GLNK and the way banks are approaching tokenization, however, raise a sharper question. Will rising use of Chainlink infrastructure actually translate into sustained demand for the LINK token, or can large institutions route around the token while still relying on the rails?

From speculative token to tokenization plumbing

The timing of the launch fits a wider shift. Tokenization has moved from conference panels to boardroom agendas. Major research houses project that tokenized private assets could approach $16 trillion by 2030, while separate forecasts see stablecoin circulation pushing toward the multi-trillion level by the end of the decade.

Chainlink already sits close to the center of that story. The network secures more than $100 billion in value and holds about 70% market share in decentralized finance, providing price feeds and data services that many protocols treat as critical infrastructure. At the same time, large financial institutions are testing Chainlink powered interoperability tools to move value between internal ledgers and public blockchains.

GLNK wraps this infrastructure thesis into a simple ticker. The product is structured as a physically backed, commodity-style vehicle under NYSE Arca Rule 8.201 E, seeded with a temporary 0% fee that is scheduled to rise to 0.35% after an initial period or once assets cross preset thresholds. That fee level undercuts the 2% range that older trust-style products often charged and signals that GLNK is designed for asset allocators rather than short-term traders.

The private banking “loophole”

The bullish case is intuitive. If tokenized finance grows and global markets depend on shared oracle infrastructure, demand for LINK should, in theory, rise with usage. The analysis around GLNK argues that this connection is not guaranteed.

Large banks can consume oracle services in ways that do not require significant, long term LINK balances. Fees can be paid in fiat, or LINK can be acquired briefly and recycled, which keeps velocity high and limits sustained buying pressure. At the same time, major institutions are building private chains and may develop in house oracle systems that bypass public middleware altogether.

This creates a private banking loophole. Real world adoption of Chainlink rails may expand, while the economic bridge to the token weakens. In that scenario, GLNK functions less as a pure bet on network usage and more as a referendum on whether public oracle networks will dominate over bank-controlled infrastructure in the long run.

Yield tradeoffs and the cost of safety

GLNK also changes the familiar profile for many LINK holders. On chain, LINK can be staked to help secure the network and earn rewards that partially offset inflation. Inside the ETF wrapper, those staking rewards do not currently reach shareholders. GLNK charges a management fee and offers no native yield, so investors accept a cost of carry in an environment where government bonds and several staking-enabled assets generate income.

In practical terms, investors are paying for regulatory clarity, institutional custody and operational simplicity. The setup resembles the early phase of gold ETFs, when holders accepted storage and management costs in exchange for a liquid, brokerage friendly instrument. For GLNK to justify that tradeoff over time, appreciation in the LINK price has to outpace both the fee drag and the opportunity cost of alternative yield bearing positions.

Early verdict and possible paths

The first data points hint at a real appetite for a focused Oracle-themed ETF. On a market cap-adjusted basis, GLNK’s early trading outperformed several other single asset launches in 2025 and contrasted with softer demand for more speculative meme-oriented products.

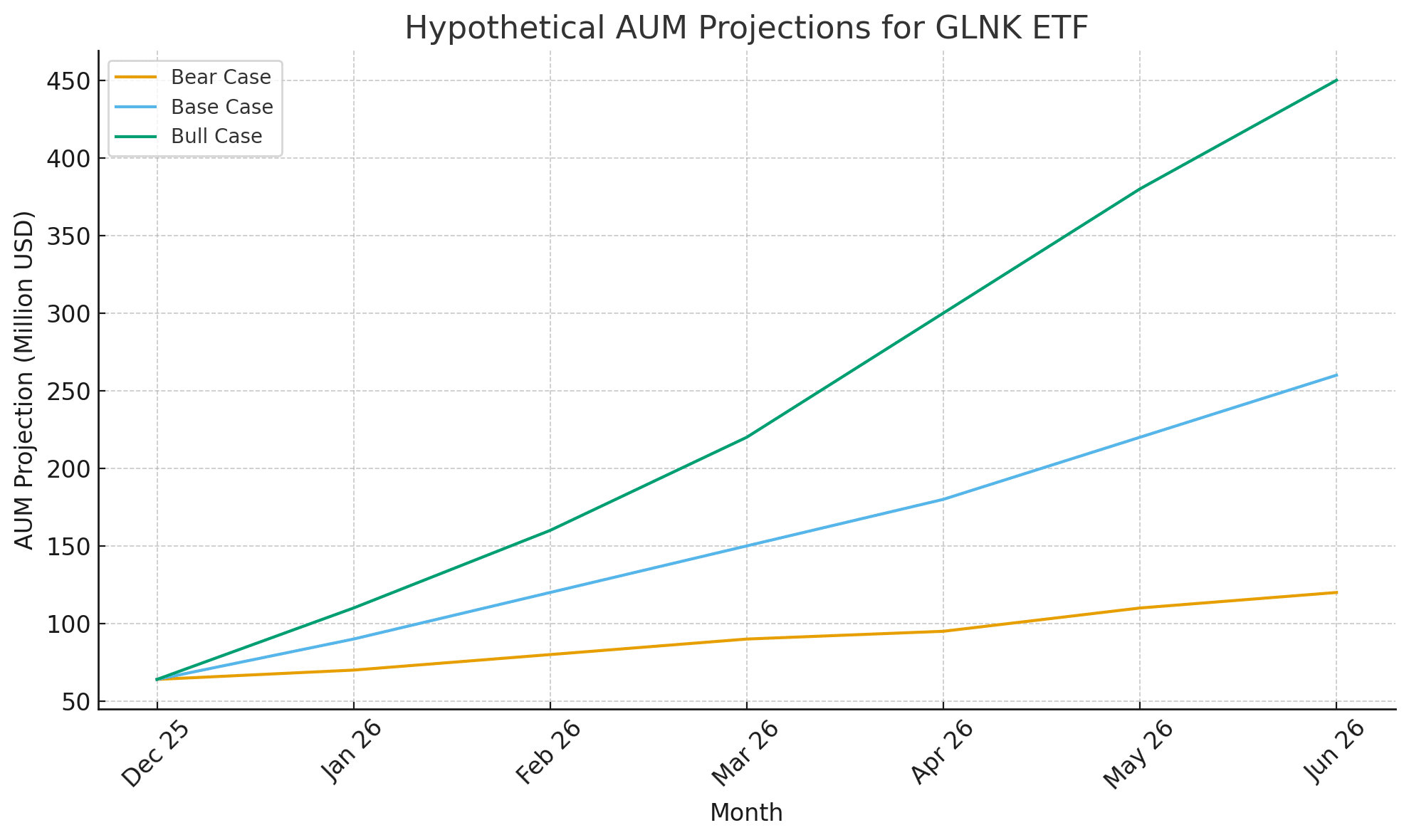

Scenario analysis in the underlying research suggests a base case where assets rise into a $150 million to $300 million range by mid-2026, with a potential $400 million to $600 million bull path if major institutions move from pilots to full production that explicitly relies on LINK.

A bear case in the $75 million to $125 million band remains credible if private chains dominate tokenization flows or if broad crypto index products absorb most institutional demand.

Conclusion

GLNK turns Chainlink from a specialist infrastructure token into a regulated portfolio line item that sits beside commodities and thematic equity funds on institutional dashboards. The launch validates oracle infrastructure as an investable theme but also exposes the uncomfortable reality that technology adoption and token performance can drift apart.

Over the next several years, flows into GLNK and the direction of bank led tokenization projects will help answer a key question for the crypto market. Will public oracle networks like Chainlink capture durable value from the next phase of financial plumbing, or will much of that value remain locked inside private banking systems?

Frequently Asked Questions

Q1: What exactly does the GLNK ETF hold?

GLNK is a physically backed product that holds LINK tokens as its sole asset, giving investors price exposure to Chainlink without direct on chain custody.

Q2: How is GLNK different from holding LINK directly on chain?

Direct LINK holders can use staking and DeFi strategies, while GLNK investors gain regulated exposure through a brokerage account but accept fees and no staking rewards.

Q3: Why are analysts worried about a “loophole” in Chainlink’s design?

Analysts highlight that banks can use Chainlink infrastructure while paying in fiat or cycling LINK quickly, which may weaken the link between rising usage and sustained token demand.

Glossary of Key Terms

Oracle infrastructure

The data and messaging layer that connects blockchains to real world information, such as asset prices, interest rates or proof of reserves, so that smart contracts can react to external events.

Tokenization

The process of representing real world assets, such as securities or private credit, as digital tokens on a blockchain, with the goal of improving settlement speed, transparency and capital efficiency.

Physically backed ETF/ETP

An exchange traded product that holds the underlying asset directly, rather than using derivatives. In the case of GLNK, the fund custodies LINK tokens to back shares.

Staking rewards

Income paid to token holders who lock their assets to help secure a network or provide services. Direct LINK stakers can earn such rewards, while ETF shareholders currently do not receive them.

Reference

Read More: Why The Chainlink GLNK ETF May Not Fully Capture Oracle Adoption">Why The Chainlink GLNK ETF May Not Fully Capture Oracle Adoption

0

0

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。