Why is Bitcoin Rangebound and When Will it Breakout?

0

0

Bitcoin retraced below $60k for the first time in more than a year. The event happened two weeks ago, and the asset is yet to surge following the massive decline.

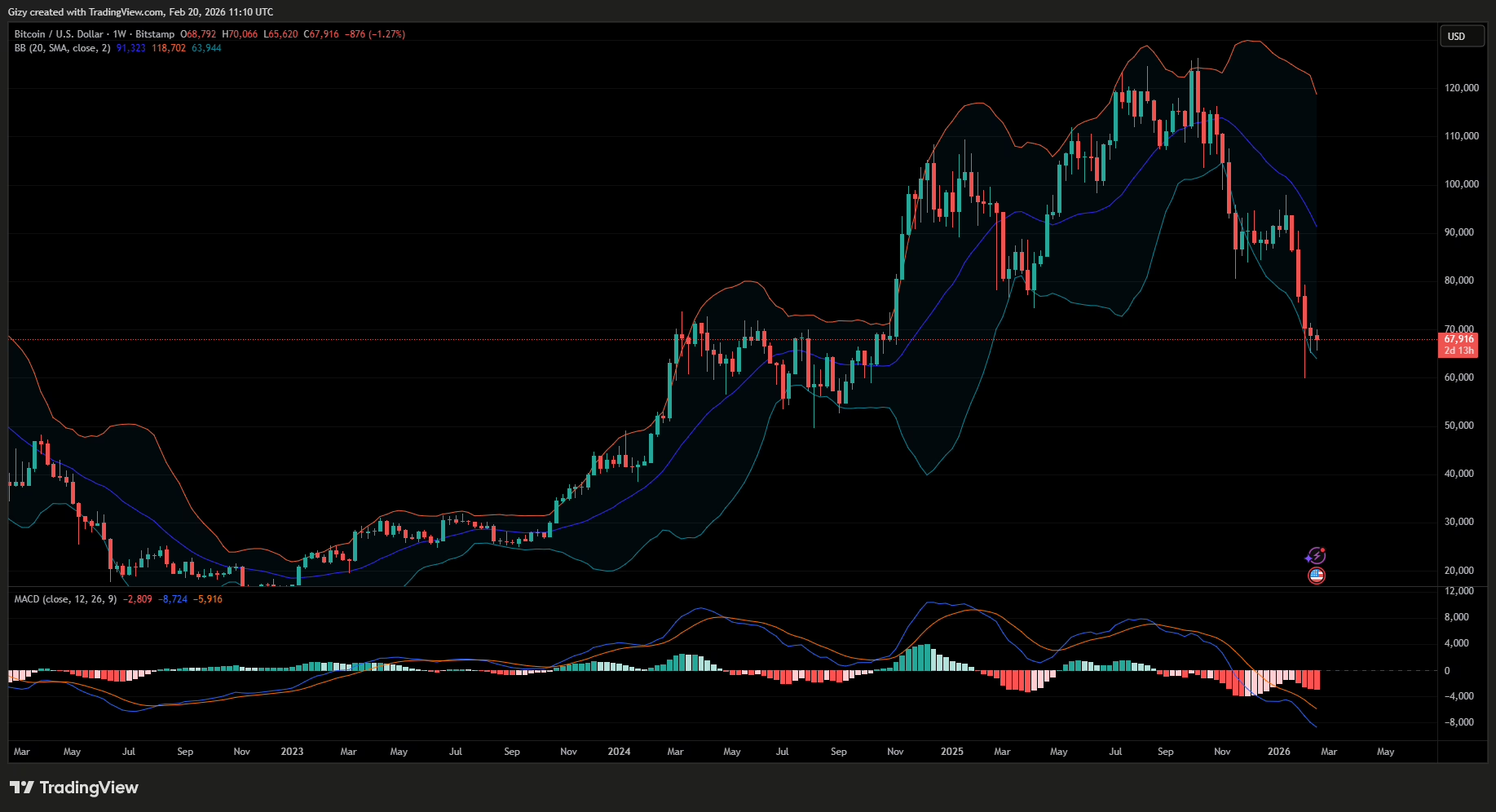

Although it recovered the next day, the 1-day chart shows it’s been rangebound. A closer look shows that it briefly broke above $72k following its rebound, but subsequently retraced. Since its failure to decisively flip the mark, the apex coin has not attempted the mark.

As of the time of writing, the trend is the same as BTC: it experienced notable selling congestion after flipping $70k. With the top established, the bulls staged several buybacks at $65k. These two levels have formed the top and bottom of the present range-bound movement.

However, many expected further increases following the sharp rebound two weeks ago. It did not happen last week, and the chances of the massive surge happening this week are also decreasing. With the asset locked in a consolidation phase, questions about why it remains locked in this trend and when it will break out rage.

Why is Bitcoin Stuck?

Investors are still reeling from the massive losses they incurred a few weeks ago. Although selling slowed last week, the asset lost over 2% and marked its fourth consecutive week of decline. The current price action is no different as the apex coin is currently declining.

Traders have yet to stage a massive rally, as market psychology remains less positive, with more participants opting to do nothing. Their apprehension stems from the fact that several bullish metrics are currently negative.

A recent report from Glassnode noted that on-chain activity is significantly reduced. Capital flow, a key metric measuring liquidity inflows into the market, has cooled. It means the market is not attracting fresh investors.

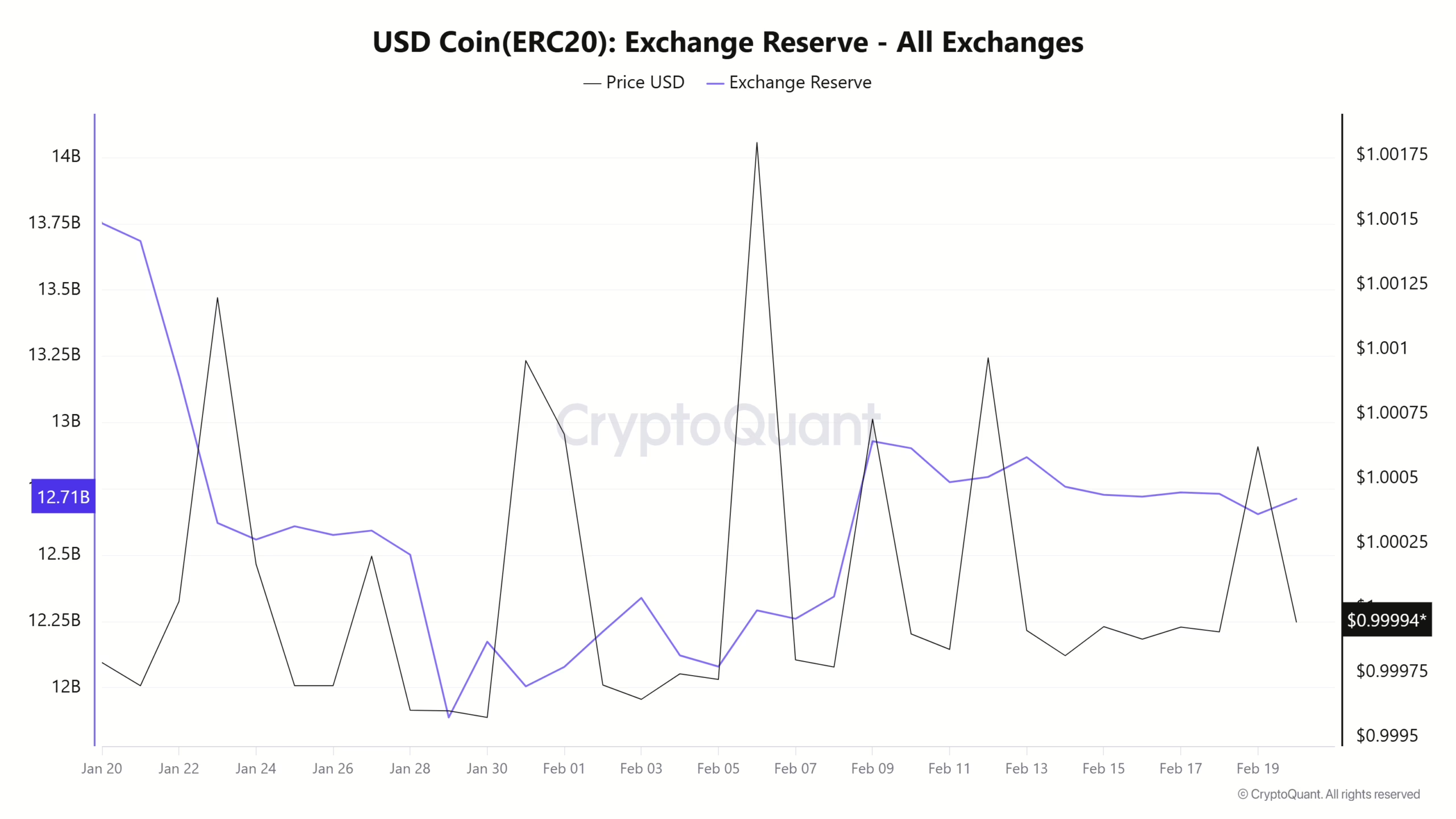

Worse still, the crypto market is losing money. The stablecoin exchange reserves are dropping, shedding more than $9 billion since November. It indicates that investors are sending their funds to risk-off assets.

In addition to explaining one of the reasons for the BTC downtrend, the stablecoin economy has recently halted its decline. This means investors are no longer moving funds in or out. With capital inflows at their lowest, the market has yet to receive the fuel for an uptrend. It is one of the reasons for the range-bound movement.

Aside from capital inflows, participation in the derivatives market is at its lowest level. Leverage trading is low, and traders are currently maintaining low exposure while defending key levels. A closer look at the liquidation map shows clusters at $71k, where shorts exceeding $200 million face extinction.

Below the current prices lies the $65k cluster, where longs worth $100 million face liquidation. With bears holding a larger share of current positions, BTC is unable to break $71k as the bulls defend $65k.

Amid low participation in the derivatives market, spot is struggling to pick up, as fundamentals remain relatively weak. Since shedding the post-election gains, investors have lacked strong reasons to stage rallies.

Nonetheless, a group of holders is currently propping Bitcoin above $65k. A recent review of the cost basis for long-term holders shows that the apex coin recently retraced below the CB of investors who accumulated in 2024. However, these investors defended the mark, leading to in rebound from $59k.

The coin is currently trading above the 2024 cohort CB as they continue to defend the mark. This explains why BTC continues to hold $65k despite a lesser liquidation cluster on the derivatives market.

A Missed Opportunity

The apex coin has missed several opportunities to break out due to immense pressure. One such was last week when economic data came in strong. Although the bulls staged rallies, they were unable to cause a breakout.

Options expiry, which had a max pain price at $71k, ended with no serious attempt at the mark. The economic data are not strong enough to dispel the market’s fear.

The same is playing out at the time of writing, as investors shrugged off a decline in initial jobless claims. The release of the PCE will come in a few hours; it may not provide the needed trigger that the market needs.

Aside from fundamentals, the apex coin saw another option worth over $1 billion expire a few hours ago. However, its max pain price was not close to $70k, hence, the small price increase.

In summary, a breakout is less likely this week, even if the weekend becomes as volatile as last week’s.

When Will Bitcoin Breakout?

A look at price movements over the last six months reveals a pattern that may help deduce when a breakout will happen. Bitcoin sees notable volatility during the last week of the month, except in December.

If the trend repeats, a breakout next week is almost inevitable. The next question to answer is “what direction?”

It is worth noting that the apex coin still has a fair value gap to fill on the 1-week chart. Its bearish close last week brought it a step closer to filling the gap. Another red close this week will have the same effect. Slowly creeping towards the FVG, with lower volatility, suggests that when it returns, the asset will experience a sharper decline.

At the time of writing, there are strong indications of fundamentals that could alter the bearish trajectory. Additionally, there are fears of deeper corrections as the 2024 cohort faces immense pressure to sell amid little gains.

In a nutshell, current data favor a massive decline next week. BTC may retrace below $63k before rebound.

The post Why is Bitcoin Rangebound and When Will it Breakout? appeared first on CoinTab News.

0

0

すべての暗号通貨、NFT、DeFiを1か所から管理

すべての暗号通貨、NFT、DeFiを1か所から管理開始に使用しているポートフォリオを安全に接続します。