Bitcoin Mining Rig Maker Canaan Could Have 5X Upside, Says Wall Street Analyst

0

0

Singapore-based developer of bitcoin mining ASIC chips and rigs Canaan (CAN) has had a rough run, but could be a five-bagger, suggests Benchmark analyst Mark Palmer.

Palmer on Tuesday initiated coverage of the ADRs with a buy rating and a $3 price target. The shares closed yesterday at $0.62, lower by 72% year-to-date.

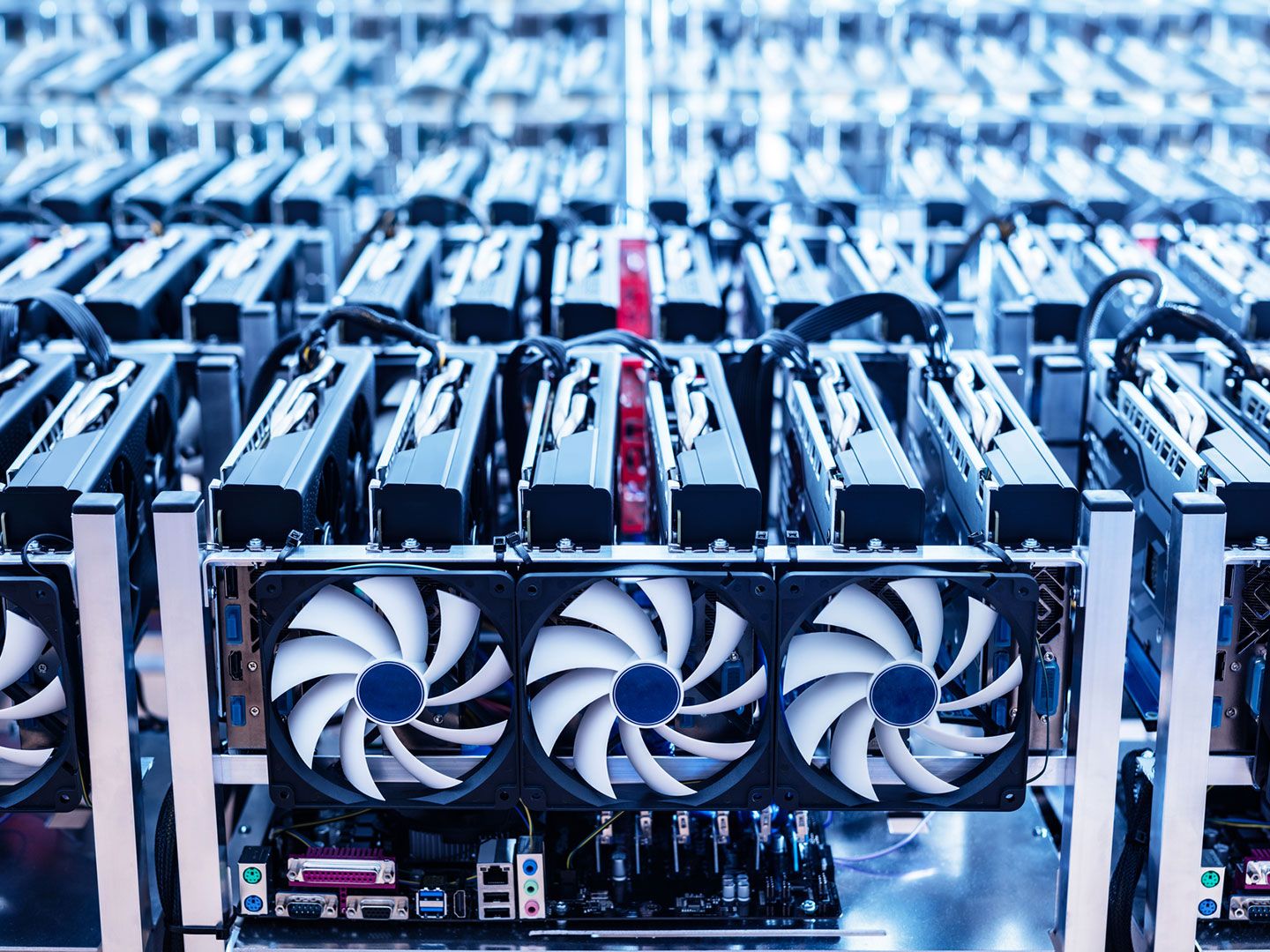

Canaan's dual strategy is focused on the development of ASIC bitcoin chips and rigs, and the expansion of its self-mining operations, especially in the United States, said Palmer.

"CAN’s vertically integrated approach differentiates it within the bitcoin mining space while positioning it to capitalize on both chip/rig sales and proprietary mining revenues," he wrote.

Canaan's push into home mining rigs has diversified the company's revenue, he further noted.

The equipment maker is also growing its self-mining capacity in the U.S. and globally.

"While the company derived just 16.3% of its 2024 revenues from its self-mining operations, it intends to increase the total computer power driving its self-mining operations by mid-2025 to 10 EH/s in North America and 15 EH/s globally," Palmer added.

Canaan has a stack of 1,408 bitcoin with a current value of around $133 million, or nearly 70% of its current market cap, said Palmer. That should be supportive of the company's valuation.

Read more: Bitcoin Miners With HPC Exposure Underperformed BTC for Third Straight Month: JPMorgan

0

0

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。