ZKsync (ZK) Price Down 22% Following Airdrop as 40% of Addresses Sell

0

0

ZKsycn has been the highlight of the week owing to the launch of its native token, ZK. The airdrop recently concluded, and trading over the past 24 hours has not produced the expected result.

The overall skepticism surrounding the crypto market is also affecting ZK, as evident in the price drop.

ZKsync Losses the Upperhand

ZKsync’s ZK token launch was anticipated to be one of the biggest airdrops of 2024. Owing to multiple mega-bullish events such as Bitcoin halving, Spot Bitcoin, and Ethereum ETF approval, a positive outcome was expected.

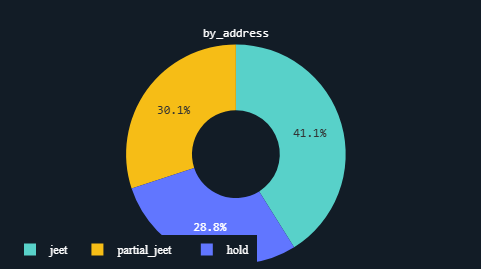

However, the investors seem to have taken a different approach, moving to sell their holdings soon after trading began. According to Nansen’s ZK airdrop dashboard data, only 30% of all addresses have actually held on to all of their assets.

Of the remaining 70%, 41% have completely sold all of their airdropped ZK, while 29% have partially sold their holdings.

ZK Aidrop Distribution. Source: Nansen

ZK Aidrop Distribution. Source: Nansen

As of yet, the addresses have sold about 495.8 million ZK, worth over $109.6 million in terms of the token. Most of the investors have done this with the intention of booking profits.

This happening in small numbers is common in airdrops, but the broader market’s bearishness has resulted in other addresses selling to secure their gains.

Read More: What Is zkSync?

ZK Total Selling. Source: Nansen

ZK Total Selling. Source: Nansen

The crypto market’s volatility seems to be affecting the potential of these huge airdrops, as claimants’ first move is to sell for profit. This was observed in March 2023 as well during the Arbitrum native token ARB’s airdrop.

Following the airdrop, about 74% of the ARB coins successfully claimed were sold within days. This skepticism affected ARB’s price, as the altcoin, which opened trading at $10.29, fell to $1.3 in less than a week.

Thus, rising market volatility, as well as uncertain policies and attitudes surrounding crypto globally, seems to be the cause of investors’ bearishness.

ZK Price Prediction: Hit Taken, What’s Next?

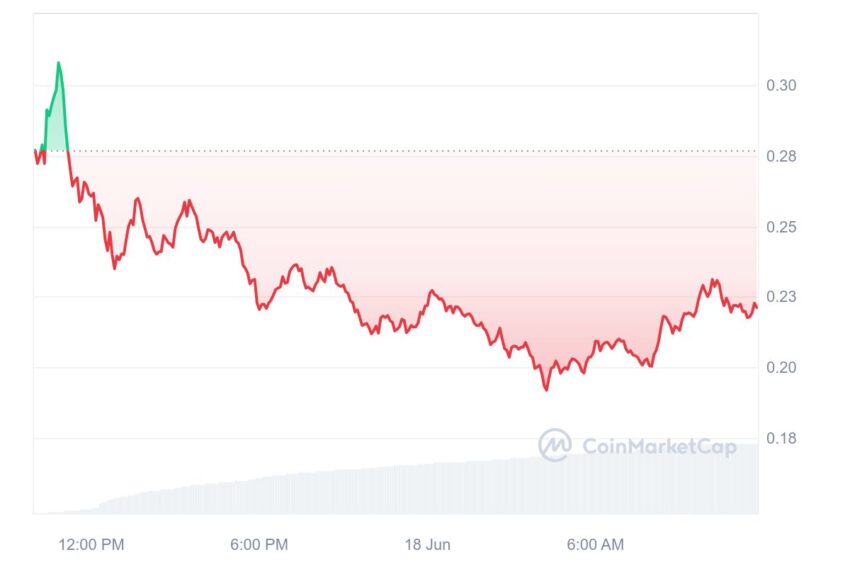

The ZK price began trading on June 17, opening at $0.289. It did manage to rally slightly, hitting an all-time high of $0.309. However, the drawdown that began right after is still continuing, with ZK currently down by 22%.

Trading at $0.220 at the time of writing, ZK price is struggling to find any support to bounce back. This could take some time as the hype and concerns need to settle for the altcoin to witness normal trading.

Read More: Top New Crypto Listings To Watch For in June 2024 (beincrypto.com)

ZK Price Action. Source: CoinMarketCap

ZK Price Action. Source: CoinMarketCap

However, a price decline is likely if claimants continue to sell and traders move to place bearish short contracts on the asset. How much lower that pulls ZK’s price is yet to be seen, potentially below $0.20.

0

0

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plek

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plekVerbind de portfolio die je gebruikt veilig om te beginnen.