AAVE Price Jumps 14% as Aave Labs Proposes New Token-Centric Revenue Model

0

0

This article was first published on The Bit Journal.

Aave governance proposal marks an important strategic change within the protocol, as the team explores whether current regulations make it possible for token holders to receive direct financial benefits again. The initiative was published on Feb. 12 by Aave Labs as an initial governance temperature check.

The proposal lays out a detailed plan to direct all revenue from Aave-branded products into the DAO treasury. It also aims to protect the Aave brand and highlights the development and launch of Aave V4 as a key priority.

What does the Aave governance proposal aim to change?

The Aave governance proposal asks token holders to approve a plan that would send 100% of revenue from Aave-branded products directly to the DAO treasury. This revenue includes fees from the aave.com interface, the mobile app, the Aave Card, Aave Pro, Aave Kit, Aave Horizon, and a future AAVE exchange-traded product.

The initiative is officially called the “Aave Will Win Framework.” Although it has not been implemented yet and currently serves as an early signal, its goals are clear. Aave Labs emphasized that now is the right time to unite the ecosystem under a token-centric model designed for long-term growth and competitiveness.

Why is regulatory timing central to the proposal?

The Aave governance proposal is framed around the view that enforcement pressure in the United States is gradually easing after several years of aggressive regulatory oversight. The document emphasizes emerging clarity in crypto regulations and points to measurable changes in enforcement patterns that signal a more permissive environment for protocols.

Data from Cornerstone Research shows that SEC crypto enforcement actions fell by 60% in 2025, declining from 33 cases in 2024 to just 13 cases last year. This significant drop coincided with the first year under SEC Chair Paul Atkins, marking a notable shift in the agency’s approach toward digital assets.

In addition to this decline, the SEC’s 2026 exam priorities placed considerably less emphasis on crypto compared with previous years, signaling a reduced focus on strict enforcement. The agency also voluntarily dismissed its high-profile lawsuit against Binance with prejudice, a move that aligns with broader policy direction under the administration of President Donald Trump.

Taken together, these developments form the basis for Aave Labs’ assessment that the current regulatory environment may allow protocols to resume value capture without triggering major enforcement risks. The Department of Justice echoed this softer stance through a memo that scaled back certain crypto-platform enforcement efforts and dismantled its national crypto enforcement team.

Together, these moves support Aave Labs’ assumption that protocols can now plan revenue models without immediately triggering securities concerns. The Aave governance proposal reflects this view, showing that token holders could capture value while the regulatory environment remains relatively favorable.

How does the Aave governance proposal affect DAO revenue and operations?

At the center of the Aave governance proposal is a significant revenue base that would be managed directly by the DAO. Aave Labs estimates that the swap integration on aave.com alone generates around $10 million in annualized revenue. In addition, Aave V3 already produces over $100 million in annualized revenue.

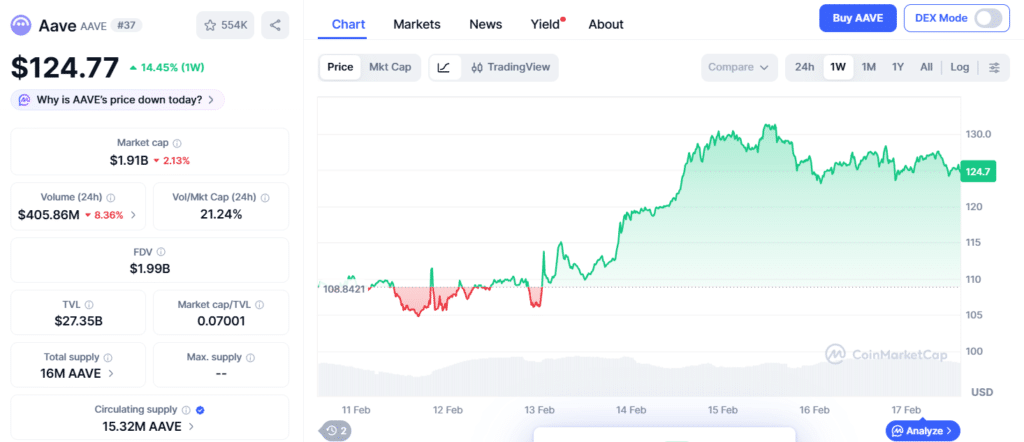

The AAVE token has risen about 14.67% over the past week, reaching $125.01, with a 24-hour trading volume of $407.32 million, and it also gained around 2% immediately following the proposal announcement.

If the proposal is approved, these revenue streams would be fully incorporated into governance, allowing the DAO to act as a capital allocator, manage the brand, fund development, and pursue regulated product goals. Analysts following DeFi treasuries say this scale would elevate Aave’s DAO from a mainly procedural role to a functioning operating entity.

What operational model is Aave trying to build?

The Aave governance proposal goes beyond simply routing fees. It sets out an operating model that links value capture with brand and intellectual property protection. Aave Labs shared that it has historically self-funded product development and legal defense, including efforts related to the SEC. The framework aims to shift these responsibilities into a transparent structure aligned with the token.

The proposal notes that when enforcement risk is high, protocols avoid profit-like mechanisms, but when that risk decreases, governance-only tokens have an opportunity cost. By designing the DAO to operate more like an institution, Aave seeks to compete for market share while maintaining on-chain economic functions.

How does this compare with other DeFi value-accrual efforts?

Supporters of the Aave governance proposal point to a broader trend across decentralized finance. Uniswap has already activated a fee-based buyback and burn mechanism on Ethereum, allocating 17% of fees to UNI buybacks since Dec. 28, 2025, based on DefiLlama methodology. Other protocols, such as Pendle, show active token holder directed revenue flows tracked as “holders revenue.”

Data transparency now allows institutions to measure protocol fees and token-linked value more clearly. Market participants say this growing clarity makes the transition from abstract governance tokens to assets with measurable economic capture easier to evaluate, and it demonstrates how token holder value accrual is becoming a standard across DeFi ecosystems.

What risks could still derail the framework?

Despite its ambition, the Aave governance proposal remains pending a DAO vote and faces ongoing governance tensions. Disagreements over funding limits, brand ownership, and distribution of power have appeared before and are still not fully resolved.

Regulatory risks continue, as a renewed enforcement effort by the SEC or DOJ could require protocols to pause revenue routing or move operations offshore. Competitive pressure is also a factor, because if projected revenues do not materialize or competitors offer better terms without routing funds to token holders, the framework’s appeal could weaken.

Conclusion

The Aave governance proposal asks token holders to support more than just a budget. It invites them to endorse a vision in which decentralized protocols can function like businesses while remaining fully on-chain. This vision relies on the assumption that the current regulatory easing continues. For now, market participants are observing closely.

The AAVE token gained following the proposal announcement, signaling early market approval. Whether this framework sets a template for the next decade of DeFi or becomes another temporary pause shaped by regulatory cycles will depend on how long the current enforcement window remains favorable.

Glossary

Aave Governance Proposal: Plan to send all Aave product revenue to the DAO.

Aave DAO: Community-led body that votes on protocol decisions.

DAO Treasury: Wallet where the DAO stores and manages protocol funds.

Aave Will Win Framework: Plan giving full revenue control to the DAO.

Aave Labs: Team developing Aave’s products and upgrades.

Frequently Asked Questions About Aave Governance Proposal

What is the Aave governance proposal?

The Aave governance proposal is a plan to send 100% of product revenue to the DAO treasury.

What is the main goal of the proposal?

The main goal is to give the DAO full control over revenue from Aave-branded products.

What products will send revenue to the DAO?

Revenue will come from the Aave website, mobile app, Aave Card, Aave Pro, Aave Kit, Aave Horizon, and future products.

How much revenue does Aave currently generate?

Aave V3 generates over $100 million per year, and the website swap feature generates about $10 million per year.

What does this proposal mean for the DAO?

This proposal would allow the DAO to manage revenue, fund development, and protect the Aave brand.

Sources

Read More: AAVE Price Jumps 14% as Aave Labs Proposes New Token-Centric Revenue Model">AAVE Price Jumps 14% as Aave Labs Proposes New Token-Centric Revenue Model

0

0

Gerencie todo seu criptograma, NFT e DeFi de um só lugar

Gerencie todo seu criptograma, NFT e DeFi de um só lugarConecte com segurança o portfólio que você está usando para começar.