Community Update

0

0

After a very productive week in Las Vegas last month, it’s good to sit down at the keyboard, collect my thoughts and update you all on some of the key activities that have been keeping me and the team well and truly occupied.

As mentioned in the previous update, some members of the executive team met in Las Vegas to attend the Money 2020 conference in October. As well as being an awesome event, it was just as good for the team to meet in person — the first time in almost two and a half years.

In this update I’ll share some of the broad themes from the conference, as well as sharing some of the specific highlights for Connect Financial. Finally, I’ll provide a glimpse into the current areas of focus for November and the rest of the final quarter of 2023.

Money 2020: Industry themes

To save you a ChatGPT prompt, Money 2020 is the largest fintech conference in the world. There are three core events each year, in the US, Europe and Asia. October’s conference in Las Vegas had 11,000+ attendees representing 3000 companies.

The event is loosely organised around four activities:

- Summits where industry pros, regulators and thought leaders join panels to discuss a range of topics.

- The conference floor where dozens of companies peddle their wares

- Spaces that support prolific networking, often in speed-dating style.

- Meetings held in suites where a lot of the major firms did their actual product displays vs the conference floor.

While the networking is the main event (including the off-site suites, events and dinners), some interesting themes emerged from a variety of speakers. A few notes, below:

Regulation

Financial regulation in America was THE topic on everyone’s lips. In general, there was a sentiment of “we’re headed in the right direction, just not quickly enough”. Particular concern was aimed towards the inevitable brain drain of innovation away from the US while the regulatory gears slowly grind.

Everyone shared the same basic message that I’ve been banging on about for many, many months: the time of “begging for forgiveness” has past. Companies that do not embrace total regulatory and licensing guidance will be choked off from critical banking services and will face unconquerable headwinds. The businesses that embrace regulation (especially those related to crypto) will have significant retail and B2B opportunities presented to them.

AI

Personally, I was underwhelmed with the showing of AI innovation at the conference. 90% of AI tech that I saw presented was ChatGPT skinned chatbot helpers. With that said, there was a huge amount of talk about AI and ML, in particular its application in mitigating fraud and risk on payment rails.

I expect that 2025 attendees will be stunned by how quickly the tech has evolved.

Risk and Fraud

I am prone to exaggeration at times, but it seemed like every second exhibitor had a product related to KYC, managing risk and fraud prevention. Talking with folks on the floor, there were many stories of the perpetual arms race between fraudsters and the technology designed to prevent them.

Of course, many of the threads of regulation and AI were weaved through the narrative of risk management.

Venture Capital

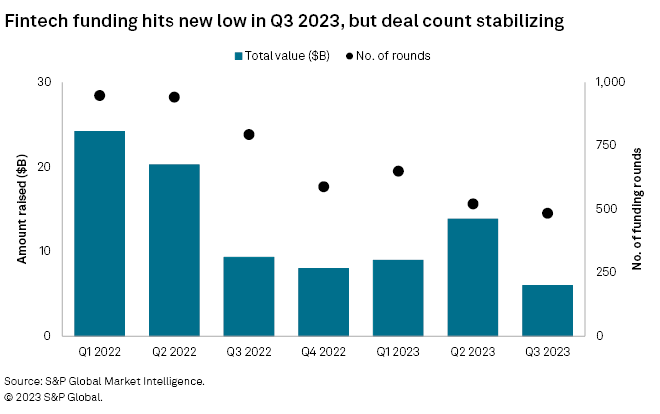

On the surface, the scattering of VCs represented at the conference put slightly different spins on this chart:

Mature companies and late stage deals have been soaking up the majority of VC funding in the USA, as well as other markets, but several speakers were cautiously optimistic for more regulatory certainty and a macro environment more friendly towards risk-on investments.

Crypto

There was a modest showing of larger crypto companies at the conference. Treasury management, custody and settlement projects were well represented. The topic of crypto was relatively cool at the start of the meet… but got significantly warmer once news of the SEC’s apparent stand down from the bitcoin ETF challenge dropped!

For better or worse (I think for the better, fwiw), the crypto companies showing at Money 2020 represented a paradigm shift. The wild west elements of previous cycles will never be repeated. It is the time for crypto to grow up and do proper business.

Connect Financial Highlights

Coming into the event, the team’s goals were to deepen existing relationships with key partners, form new relationships in some core market segments and explore potential partnerships.

Existing partners

When you develop a new relationship with a company like Mastercard, you quickly realize the scale of the enterprise. It is a huge challenge to navigate the ‘who’s who’ of the business and even to get an overview of all of the business units. We had the opportunity to spend time face to face with team member’s from Mastercard’s risk, rewards and program management teams where we explored a range of potential options for the growth of the Connect cards program. We also got to spend some social time with the MC team and their partners: we attended the main Mastercard event at Top Golf… which if you’re not familiar is quite the spectacle in and of itself…

Other highlights included meeting with our plastics (and metal!) manufacturer where they showcased some of their most recent card materials and finishes. Chantel had a chance to geek out a little on design, packaging and card innovation… she’s already working on some very interesting potential applications.

We also spent time with our existing banking partners, processors and technology providers. Chantel continued to shore up relationships at key publications and martech providers.

These engagements were fruitful across the board.

New opportunities

Coming into Money 2020, we knew that there was going to be a real risk of developing a severe case of Shiny Thing syndrome. With that in mind, we focused on keeping level headed and avoiding potential scope creep. We have a clear vision of the MVP of the product and want to keep the broader team to task without distraction.

With that said, the one category that I remained open to is B2B opportunities. As mentioned earlier, appropriately licensed and compliant fintech companies will be attractive to both retail users and other providers. Leveraging our technology, risk and relationships to other highly vetted businesses is potentially a high value activity for Connect, without significantly distracting us from our core offer.

Conversations are ongoing.

Current Focus

The development team is making excellent progress in ensuring that the codebase is robust, efficient and compliant with all of the requirements laid out by accreditation standards (SOC 1, SOC 2, PCI-DSS L3, GDPR and others), as well as finalizing the integration of the backend functionality into the brand new frontend (shared in September’s update in great detail).

Initial products are getting their final run throughs for data consistency, availability, and iteration for support of items like ISO20022 and major localization coverage.

We continue to work towards obtaining all required licenses in our main markets. Although this is a protracted affair with its fair share of red tape and bureaucracy, we continue to make good progress here.

The marketing site is also going through a light redesign to reflect the changes made to the product and approach since the last site was released. A revised whitepaper and the support document site will also be released shortly after to ensure our public facing materials are current and representative.

There is still work ahead of us, but the intensity of development and corporate activities has never been higher. We are looking forward to the not-too-distant future where we will be able to release the industry leading product that the team has been working on for so many months.

Be safe and well.

0

0

すべての暗号通貨、NFT、DeFiを1か所から管理

すべての暗号通貨、NFT、DeFiを1か所から管理開始に使用しているポートフォリオを安全に接続します。