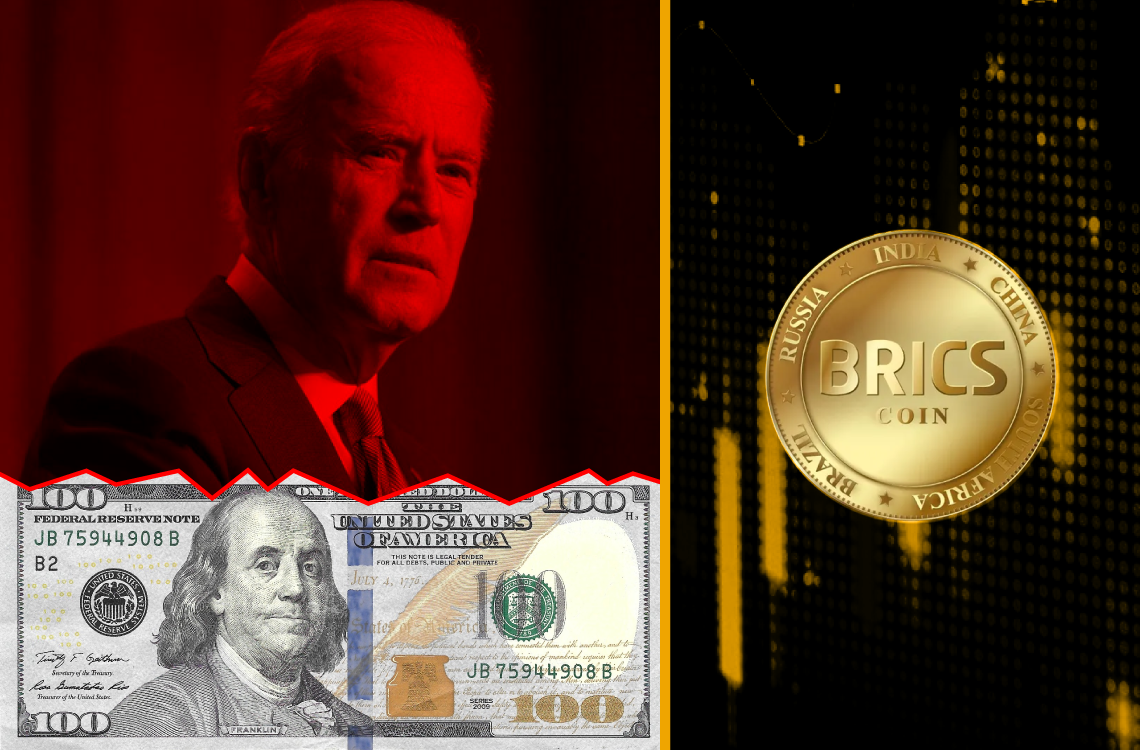

BRICS currency could diminish the power of US sanctions—here’s what you need to know

0

1

Historically, when the United States imposed sanctions on other countries, their economies often crumbled as allies halted business dealings, leading to financial paralysis and a sharp decline in GDP. These sanctions showcased the power of the US dollar in the global economy and forced rogue nations to toe the line. However, under the Biden administration, sanctions appear to be losing effectiveness as countries discover new ways to bypass penalties, such as the potential creation of a BRICS currency.

Russia evades sanctions, challenging US supremacy

The Biden administration imposed sanctions on Russia for its invasion and war against Ukraine. However, Russian President Vladimir Putin found a way around the sanctions by collaborating with China, Saudi Arabia, and India. In doing so, Russia evaded the sanctions and challenged US global supremacy.

For instance, the Chinese Yuan has become the most traded currency in Russia, ending the dominance of the US dollar. Additionally, Saudi Arabia has sided with Russia and China, purchasing Russian oil at record levels and funneling it into European markets.

Other countries, such as Brazil, are following suit by ditching the US dollar for international trade.

The implications of a weakening US Dollar

The unfolding events have greatly benefited BRICS nations, leading them to consider a new alternative currency that could challenge the dollar. Suppose BRICS adopts a new currency at the upcoming summit in August, US sanctions may lose their potency in the coming years, allowing sanctioned nations to trade without significant economic strain or consequences.

The power of sanctions may soon fade if the US dollar’s dominance wanes and the BRICS currency gains traction. A further decline in the USD could lead to an economic crisis that directly impacts American households.

0

1

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。