Solana DeFi Protocols Drive TVL to All-Time High of $12.1B in 2025

0

0

According to recent market data, Solana DeFi TVL has surged to a new all-time high of $12.1 billion. This rise shows strong demand from both retail users and major institutions. Rather than being a short-lived rally, the growth highlights how Solana has secured a place in the global DeFi arena.

Institutional Momentum Strengthens Solana

Institutional investment is playing a key role in lifting Solana DeFi TVL. Firms have directed billions into Solana-based protocols through liquid staking and structured products. A notable move came when Forward Industries allocated $1.6 billion into Solana to diversify its crypto holdings.

ETF filings are also adding fuel. Earlier this year, the SEC clarified that liquid staking tokens are not automatically classified as securities. This decision opened the door for ETF proposals tied to Solana staking products, such as JitoSOL and Marinade.

If approved, these products could attract mainstream investors who prefer regulated exposure.

Also read: Solana DeFi TVL Hits Record $8.6B But Low Fees Raise Growth Questions

Leading Protocols in Solana’s Ecosystem

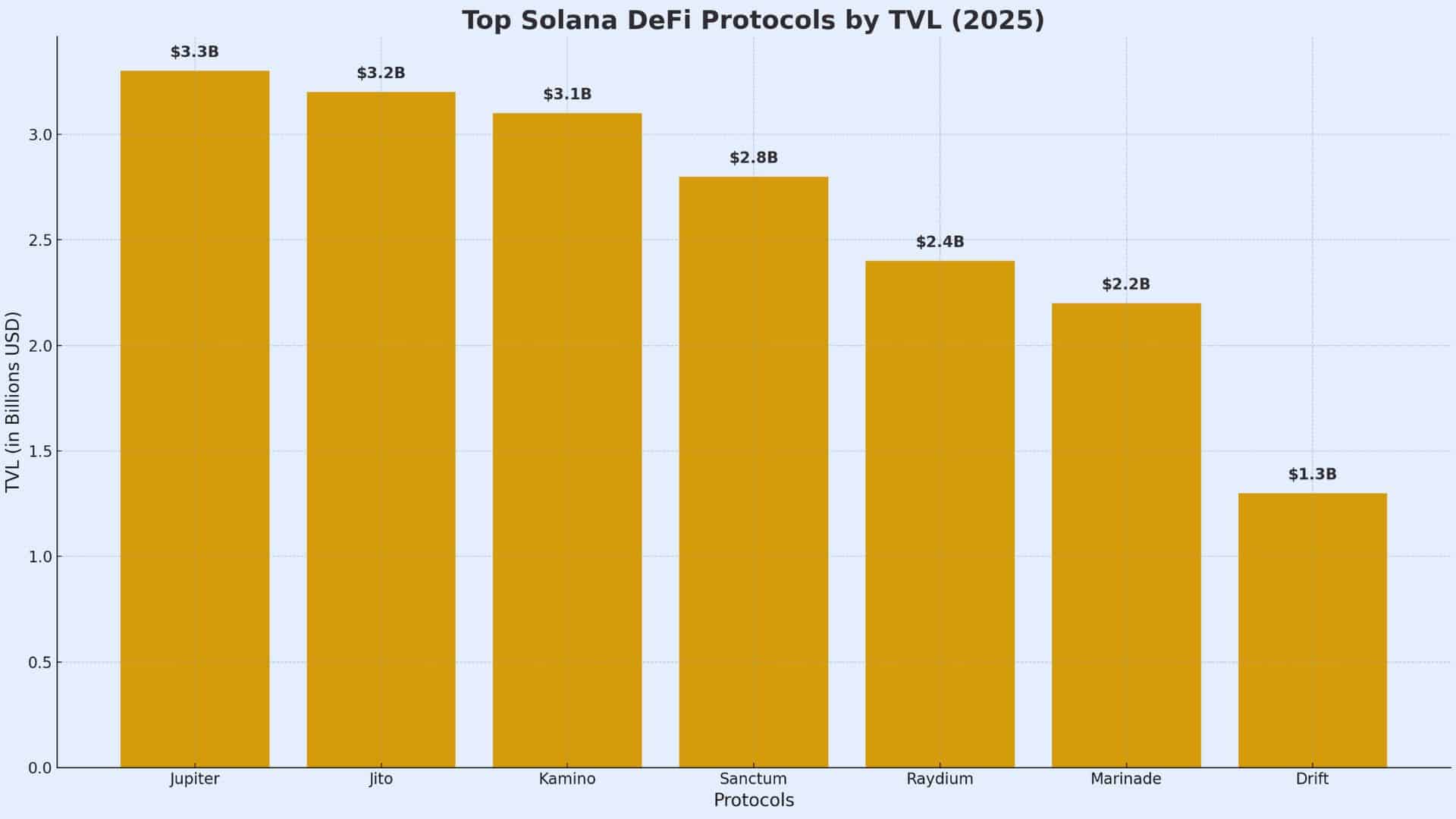

The bulk of the TVL increase comes from high-performing protocols:

| Protocol | Approx. TVL (USD) | Segment |

|---|---|---|

| Jupiter | $3.3B | DEX & Aggregator |

| Jito | $3.2B | Liquid Staking |

| Kamino | $3.1B | Lending & Liquidity |

| Sanctum | $2.8B | Staking |

| Raydium | $2.4B | DEX |

| Marinade | $2.2B | Liquid Staking |

| Drift | $1.3B | Derivatives |

Unequal balance favored in the trading platform, staking solution, and lending tool indicates that Solana DeFi TVL growth does not solely come from any one sector. User-centric trading, staking, and borrowing do describe a more complete picture of a diverse ecosystem, at least.

User Demand and Market Sentiment

User adoption is growing in parallel with institutional support. Stablecoin activity on Solana has expanded, and transaction fees remain lower than on rival blockchains. Analysts note that developers continue to prefer Solana for building fast and scalable applications.

One report highlights how Solana’s TVL has surged to new highs “a sign of growing trust in its ecosystem”

Price Action and Market Outlook

SOL’s price has reflected the network’s rising traction, holding firm above key resistance levels. Charts show steady demand from long-term holders. While short-term volatility remains, the broader outlook is tied to the growth of Solana DeFi TVL. If ETF approvals move forward, the impact on price and adoption could be substantial.

Conclusion

Based on the latest research, Solana DeFi TVL at $12.1 billion signals more than a numerical milestone. It confirms that Solana’s DeFi ecosystem has entered a stage of global recognition, backed by institutional inflows, user activity, and strong developer support.

With staking ETFs in progress and protocols expanding, Solana is shaping into one of the most influential networks in decentralized finance.

Also read: Solana Outpaces Ethereum? DEX Volumes and DeFi TVL Tell a Wild Story

Summary

Solana DeFi TVL has climbed to a record $12.1 billion, powered by institutional inflows, user adoption, and staking growth. Leading protocols such as Jupiter, Jito, and Kamino are at the core of this rise, while ETF filings promise further momentum. With stablecoin activity and low fees adding fuel, Solana is securing its position as one of the strongest ecosystems in decentralized finance.

Glossary of Key Terms

DeFi: Decentralized Finance, financial services built on blockchain.

TVL (Total Value Locked): The total amount of assets held in DeFi protocols.

Liquid Staking: Staking tokens while keeping them tradable through derivative assets.

Protocol: A platform or application built on blockchain infrastructure.

FAQs for Solana DeFi TVL

Q1: What is Solana DeFi TVL?

It refers to the total value of assets locked in Solana’s decentralized finance protocols, including staking, lending, and trading platforms.

Q2: Why is Solana DeFi TVL rising in 2025?

Institutional investments, regulatory clarity around staking ETFs, and strong user adoption are driving the growth.

Q3: Which Solana protocols hold the most TVL?

Top contributors include Jupiter, Jito, Kamino, Sanctum, Marinade, and Raydium.

Q4: How does Solana compare with Ethereum in TVL?

While Ethereum still leads in overall DeFi TVL, Solana is closing the gap with rapid institutional inflows and lower transaction costs.

Read More: Solana DeFi Protocols Drive TVL to All-Time High of $12.1B in 2025">Solana DeFi Protocols Drive TVL to All-Time High of $12.1B in 2025

0

0

Կառավարեք ձեր բոլոր կրիպտարժույթները, NFT-ն և DeFi-ն՝ մեկ տեղից

Կառավարեք ձեր բոլոր կրիպտարժույթները, NFT-ն և DeFi-ն՝ մեկ տեղիցԱպահովաբար կցեք ձեր օգտագործած պորտֆոլիոն՝ սկսելու համար: