0

0

After a decade of explosive growth in the crypto industry, global capital, regulators, and institutions are shifting focus away from cycle-driven narratives such as GameFi, DeFi, and Meme tokens—back toward blockchain’s original mission: becoming the global infrastructure for value transfer. The next phase of real growth in blockchain will not come from token prices, but from real-world financial use cases such as cross-border payments, RWA settlement, on-chain custody, and compliant issuance of digital assets.

However, as traditional finance begins moving on-chain, an unexpected reality has emerged: most leading blockchains were never designed for financial systems. Their ledger models, execution mechanisms, node architecture, and compliance semantics are fundamentally misaligned with the operational requirements of global payment and settlement networks.

This is where MOVA presents a fundamentally different approach. But to understand its significance, MOVA must be examined alongside its closest blockchain peers in a structural comparison.

This analysis places MOVA alongside four major blockchain categories:

By comparing MOVA across system architecture, network topology, finality models, node roles, compliance infrastructure, and RWA readiness, a decisive conclusion emerges:

MOVA is not competing with other public chains—it is filling a gap that has never existed before: the global settlement chain.

The difference between MOVA and other blockchains begins at first principles—their original design intent.

MOVA, from its inception, rejected all of these paths.

MOVA was built specifically to become a global payment and settlement network.

This single design choice impacts everything: ledger architecture, node structure, compliance logic, and data semantics.

Ethereum’s global state machine ensures expressiveness—but forces linear execution.

Solana improves throughput using optimistic concurrency but still relies on leader-based blocks.

Aptos and Sui manage object-level parallelism but cannot represent institutional roles like custody, audit, and regulatory control.

Avalanche’s subnets isolate networks, but do not form a unified global ledger.

MOVA’s DAG-driven event ledger is not built for general computation, but for payment concurrency at scale.

Its role-based nodes are designed for financial responsibility separation, not for decentralized experimentation.

MOVA is the only blockchain architected for financial settlement first—compliance is not a patch, it is native to the protocol.

Ethereum operates on a single chain with state transitions executed sequentially. While consistent, this structure makes real-time settlement at payment scale mathematically impossible.

Although Solana executes transactions in parallel, finality is still block-driven. Performance is achieved through engineering—but the paradigm remains block-based.

Move-based execution improves concurrency, but confirmation still requires sequential ordering. The block model remains intact.

Subnets isolate chains but do not build a shared global financial ledger.

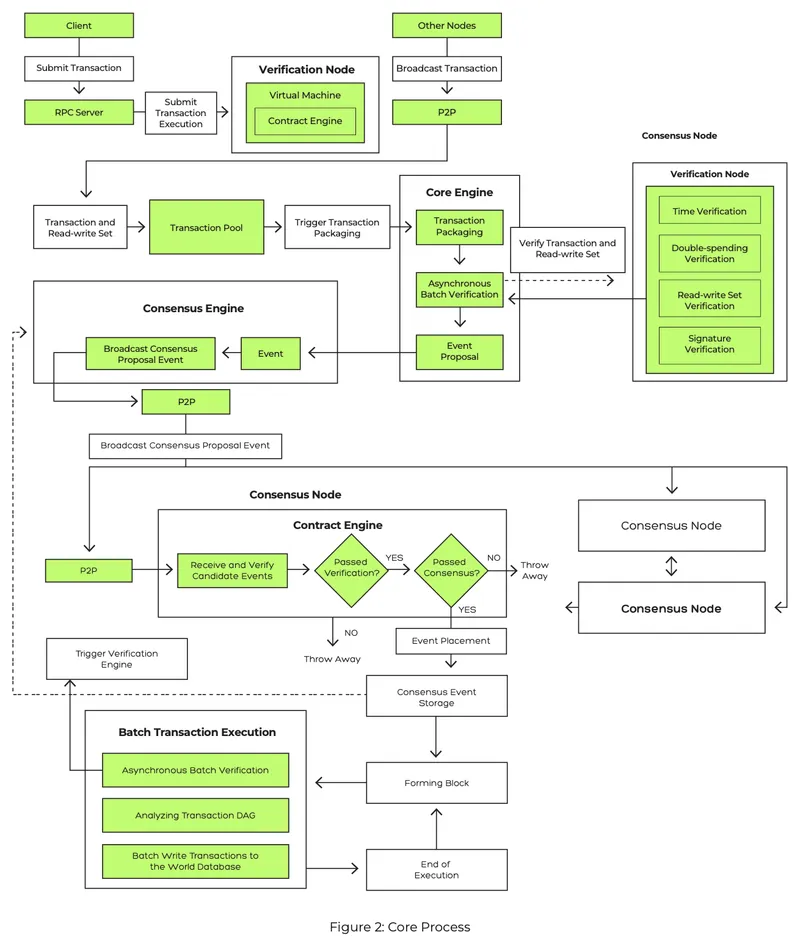

MOVA replaces blocks with events. Transactions attach directly to the DAG, and finality is derived from network visibility—not block creation.

This makes concurrency structural rather than forced, confirmation probabilistic by propagation, and settlement continuous.

MOVA is built as a payment ledger, not a smart contract chain.

Mainstream blockchains depend on random gossip networking. Message propagation is probabilistic, variable, and uncontrollable in latency—unacceptable for financial systems.

MOVA uses structured Hypercube Routing with mathematically bounded propagation latency. Network complexity grows logarithmically, not randomly.

Finance requires predictability—not luck.

In most blockchains, nodes are homogeneous. Each node does everything.

MOVA adopts deliberate financial role separation:

This mirrors real-world finance—not crypto abstractions.

No mainstream blockchain uses this model.

Merkle-based verification is expensive, heavy, and unsuitable for institutional auditing.

MOVA uses Verkle Trees by default, enabling:

For RWA and compliance, this is non-negotiable.

MOVA embeds regulatory infrastructure at the protocol level:

MOVA is a financial ledger first—not a DeFi sandbox.

MOVA’s economy is built around financial infrastructure:

MOVA is not a miner economy—it is a clearing economy.

MOVA is building:

MOVA does not compete in the public chain race.

It fills a void.

Mova is a next-generation blockchain engineered for high performance, institutional-grade trust, and a versatile modular architecture — setting the new standard for compliant and scalable Web3 infrastructure.

X:https://x.com/MovaChain

Telegram:https://t.me/MovaChain

Website:https://www.movachain.com/

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

0

0

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。