How to lend UST Stablecoin on Anchor Protocol and Earn 20% APY

0

1

The growth in popularity of blockchain-powered decentralized financial products in recent years has led to the emergence of numerous products and services that allow investors to generate passive income flows that can easily rival or even outmatch those of their centralized counterparts.

Anchor Protocol (ANC) is one of the premier solutions for users that are seeking to earn passive income with their crypto holdings by lending. Anchor is a Terra-native savings protocol that allows investors to lend TerraUSD (UST) and earn 20% yearly yields on their Terra stablecoins holdings. The returns are algorithmically managed and in large part generated by users who are paying a fee to borrow crypto funds for trading, staking, and other purposes.

How to earn 20% APY with UST using Anchor Protocol

To begin earning high-interest rates with your stablecoin holdings, you need to connect a Terra digital wallet with UST in it to Anchor Protocol. For an added layer of security, you can also choose to manage your crypto via a cold wallet solution, such as Ledger. The whole process is very straightforward and requires only basic crypto knowledge. We are going to explain it in full in the following step-by-step guide.

1. Buy UST on Binance

Obviously, in order to start generating passive income with UST, you first need to buy some UST. For the purposes of this guide, we are going to use Binance since it is the most popular trading platform and used by most of our readers. If you don't have a Binance account, consider registering with the link below to earn up to $100 in promotional rewards reserved for new users.

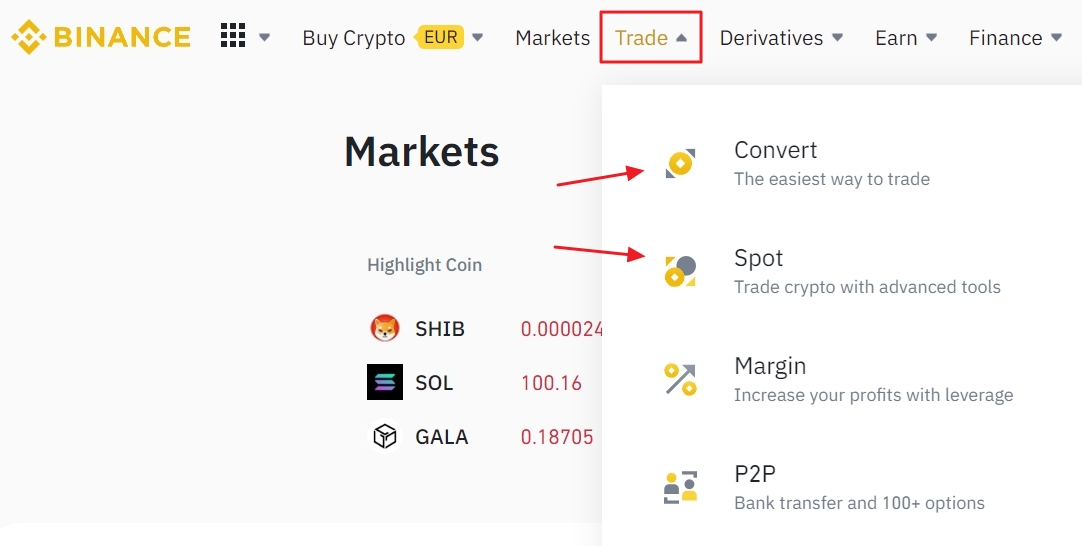

Once you’ve created the account, you can pick several different options to get UST, including buying it in a spot market trade or exchanging it for some of your existing digital assets via’s Binance Convert feature.

Let’s head to the spot market to buy some UST. At the moment, Binance supports the following UST trading pairs:

- UST/USDT

- UST/BUSD

- BNB/UST

- BTC/UST

- BTC/UST

- ETH/UST

- LUNA/UST

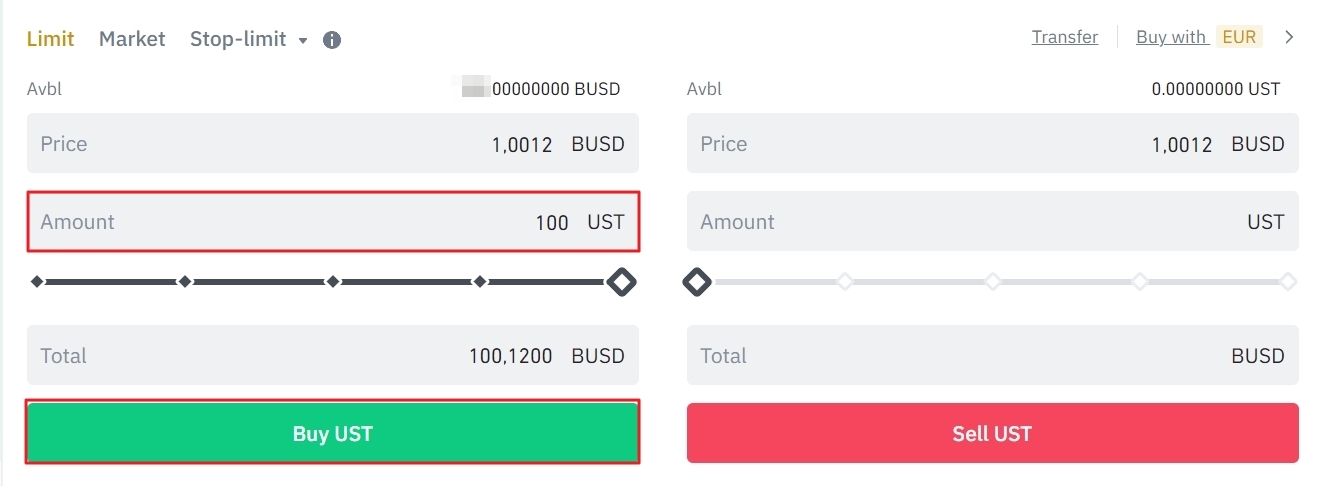

Select one of the trading pairs and enter the amount of UST you would like to buy and click on the “Buy UST” button to proceed. In our case, we are going to use Binance USD (BUSD) funds to purchase 100 UST.

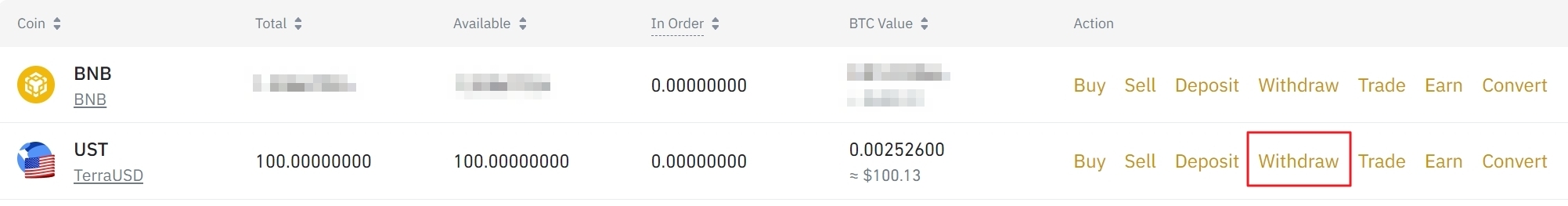

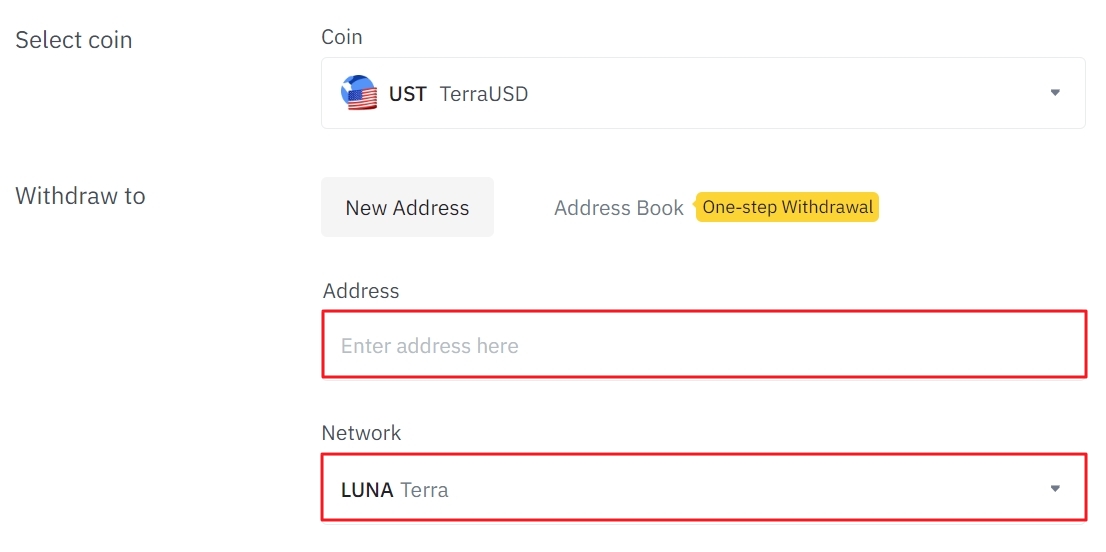

UST should now be in your spot wallet. In order to send UST from Binance to Anchor Protocol, you need to click on the “Withdraw” button highlighted in red in the image below.

We are going to copy our Terra wallet address later in the guide and enter it into the currently blank address field to transfer UST from Binance. But first, we need to create a Terra wallet account.

2. Create Terra Wallet

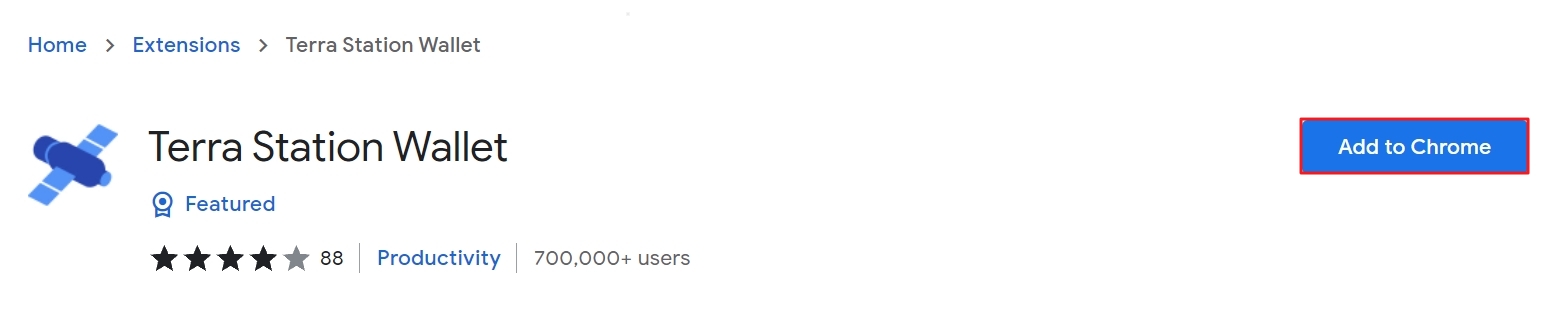

In order to deposit UST to Anchor Protocol, you will need to create a Terra wallet account. One of the simplest ways of doing so is to install the Terra Station Wallet for your favorite internet browser. The Terra Station web extension allows you to access DApps powered by smart contracts on the Terra blockchain and supports Ledger hardware for an added layer of security.

Install Terra Station Chrome app

Search for Terra Station Wallet in the Chrome Web Store and add it to your browser. The wallet extension is supported on popular internet browsers Edge and Firefox as well.

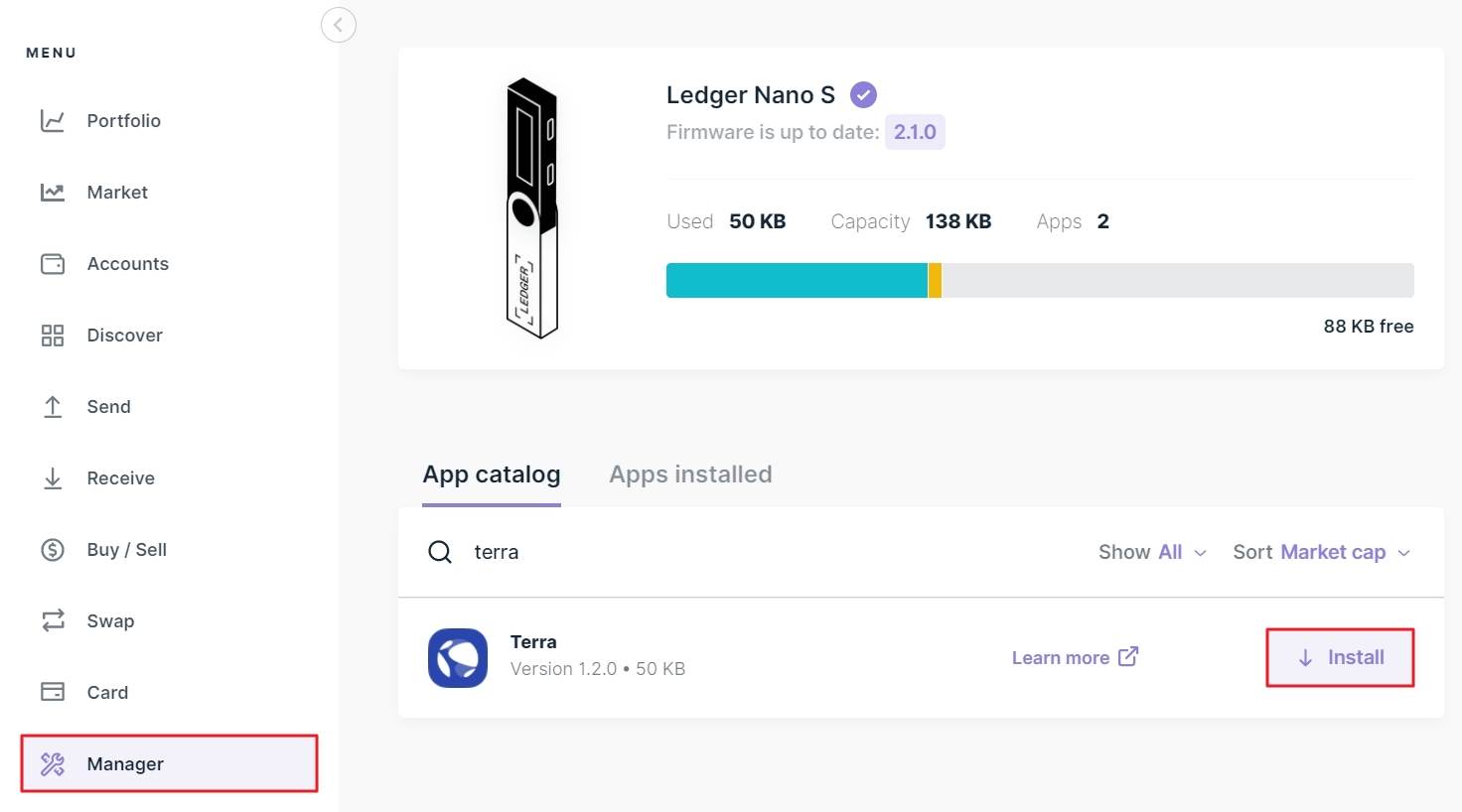

Install Terra app on ledger

Open the Ledger Live software on your computer and search for “Terra” in the application catalog. Install the app on your Ledger device.

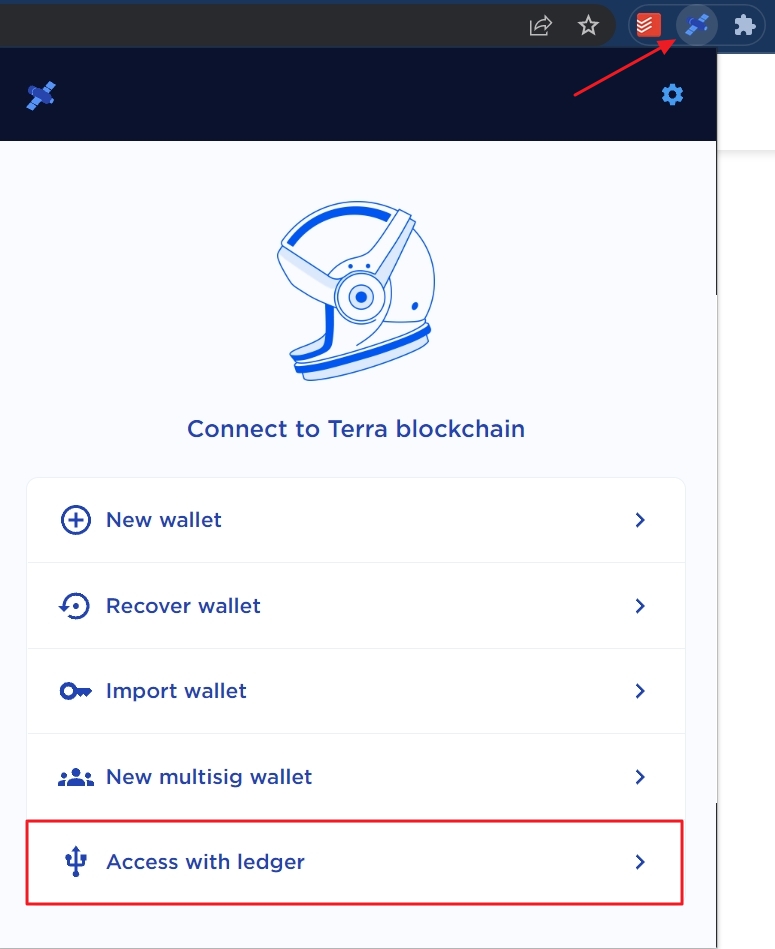

Open Terra Station Chrome app and connect with ledger

After installing the Ledger Terra app, open the Terra Station wallet from the extension panel in your browser window. Click on “Access with ledger” to continue.

You will be prompted to authorize the connection between the wallet extension and ledger on your device. After confirming the connection, you will be taken to your Terra Station account.

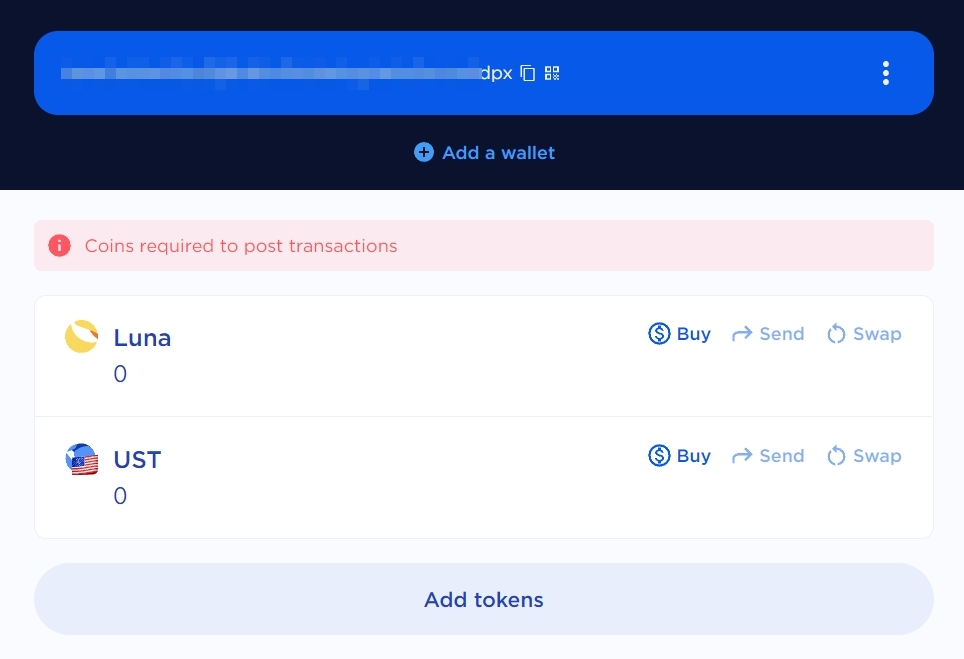

Copy wallet address

As you can see, our Terra wallet balance is currently empty. In order to send crypto to the wallet, first copy the blockchain address (blurred section in the screenshot below) and then head back to your Binance account.

3. Transfer UST from Binance to copied Terra address

In your Binance account, navigate to the Withdraw section for UST (see the third image in the Buy UST on Binance section earlier in the guide). Enter the copied Terra address to the blank window highlighted in red.

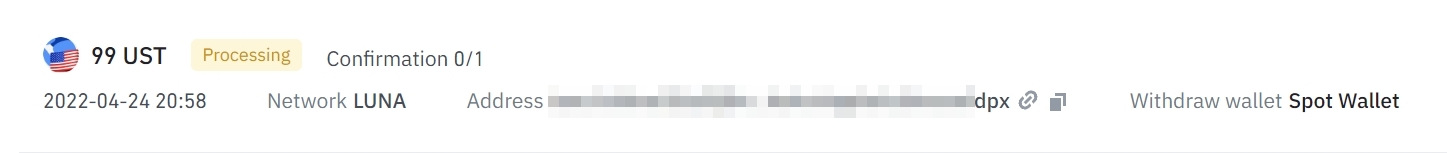

The transaction should take a couple of seconds to complete. Once processed, you will see the status of the UST transaction change from “Processing” to “Completed”.

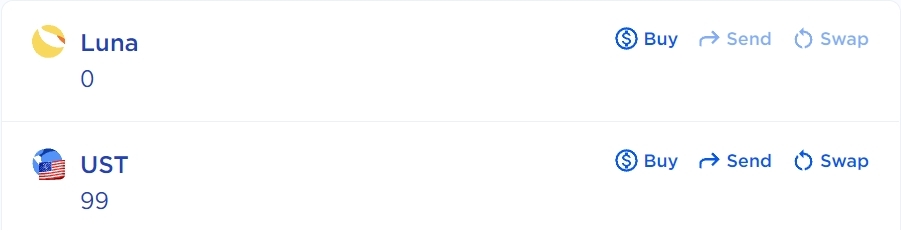

Go back to your Terra Station wallet. The funds you withdrew from Binance should now be available in your account.

4. Go to Anchor Protocol website

With funds securely stored in our ledger-protected Terra wallet, we are finally prepared to go to the Anchor Protocol website. To quickly navigate to the “Earn” section in the Anchor web app, click here.

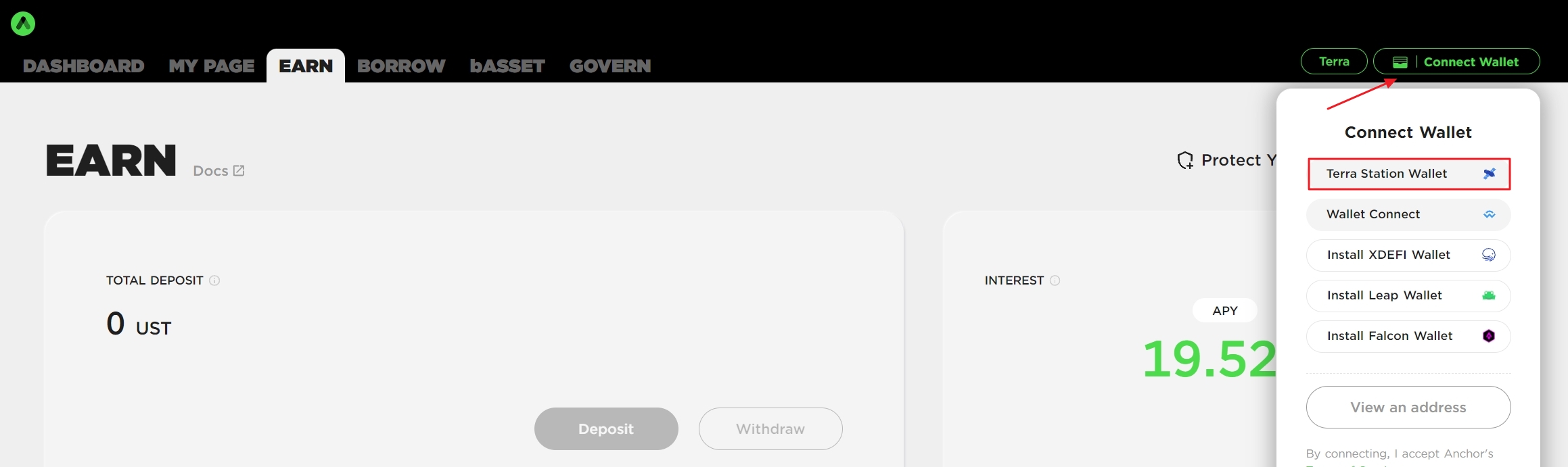

5. Connect with Terra Station Chrome app

Once in the Earn section of the Anchor’s web app, click on the “Connect Wallet” button in the upper right corner, and select Terra Station Wallet from the list of available options.

You will be prompted to allow Anchor Protocol access to the Terra Station Chrome app. Click “Connect” to proceed.

6. Send UST to Anchor Protocol to start lending

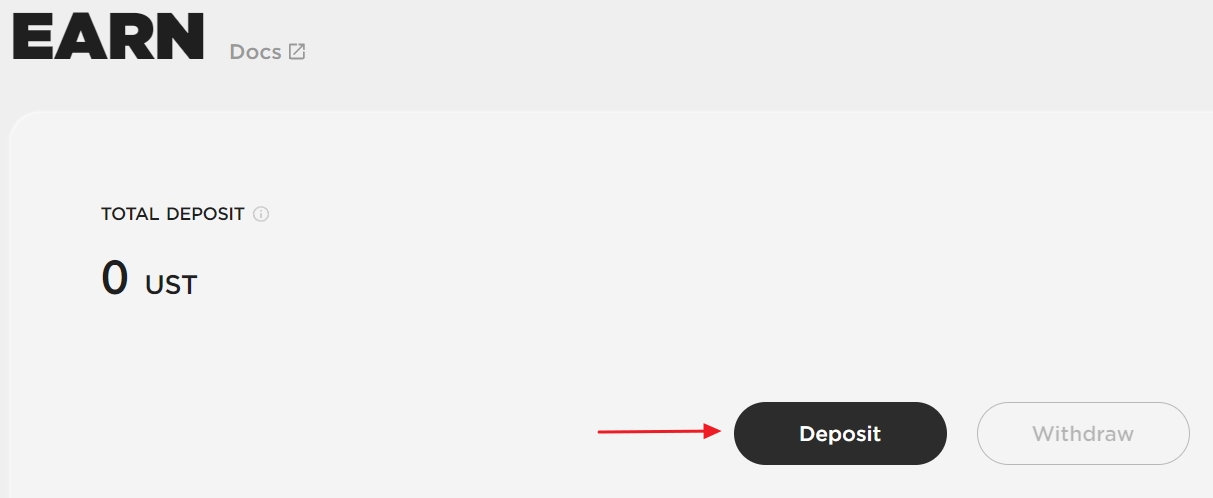

With the wallet connected to the Anchor Protocol, you are now ready to deposit UST and begin earning some interest. Click on “Deposit”.

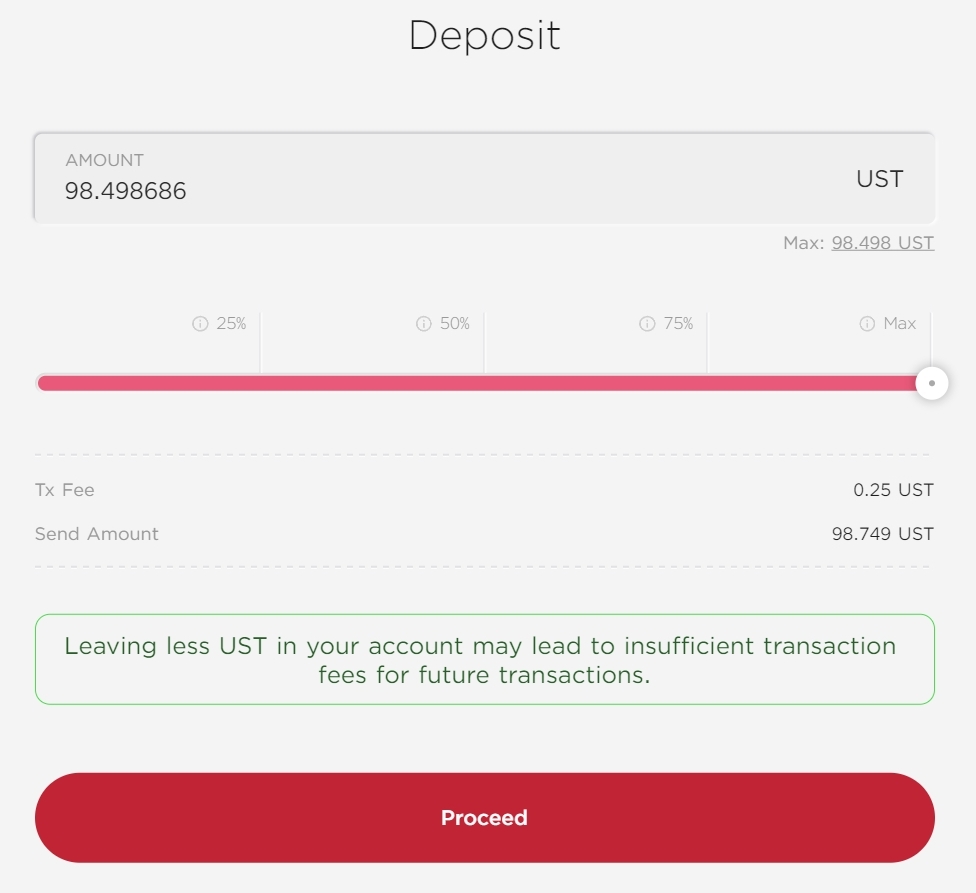

Enter the amount of funds you wish to lend. Keep in mind that there is a small fee of 0.25 UST associated with each transaction. Click “Proceed” once ready.

7. Confirm on your ledger

At this point, you will be prompted to confirm the transfer of funds from the wallet to Anchor Protocol on your ledger device.

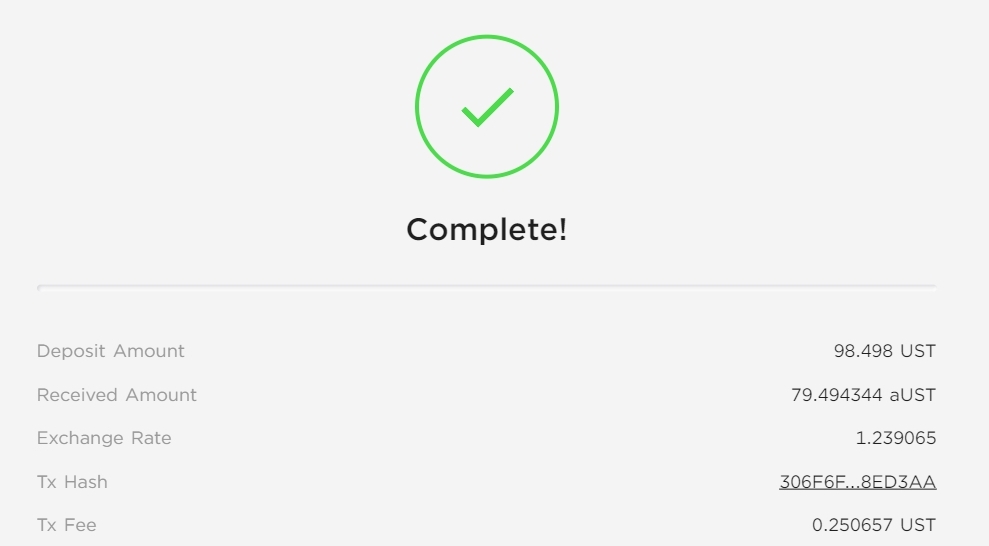

After confirming the transaction, the funds from your Terra Station account will be transferred in a matter of seconds. You will be notified about the successful transfer with a pop-up message that looks like the one in the image below.

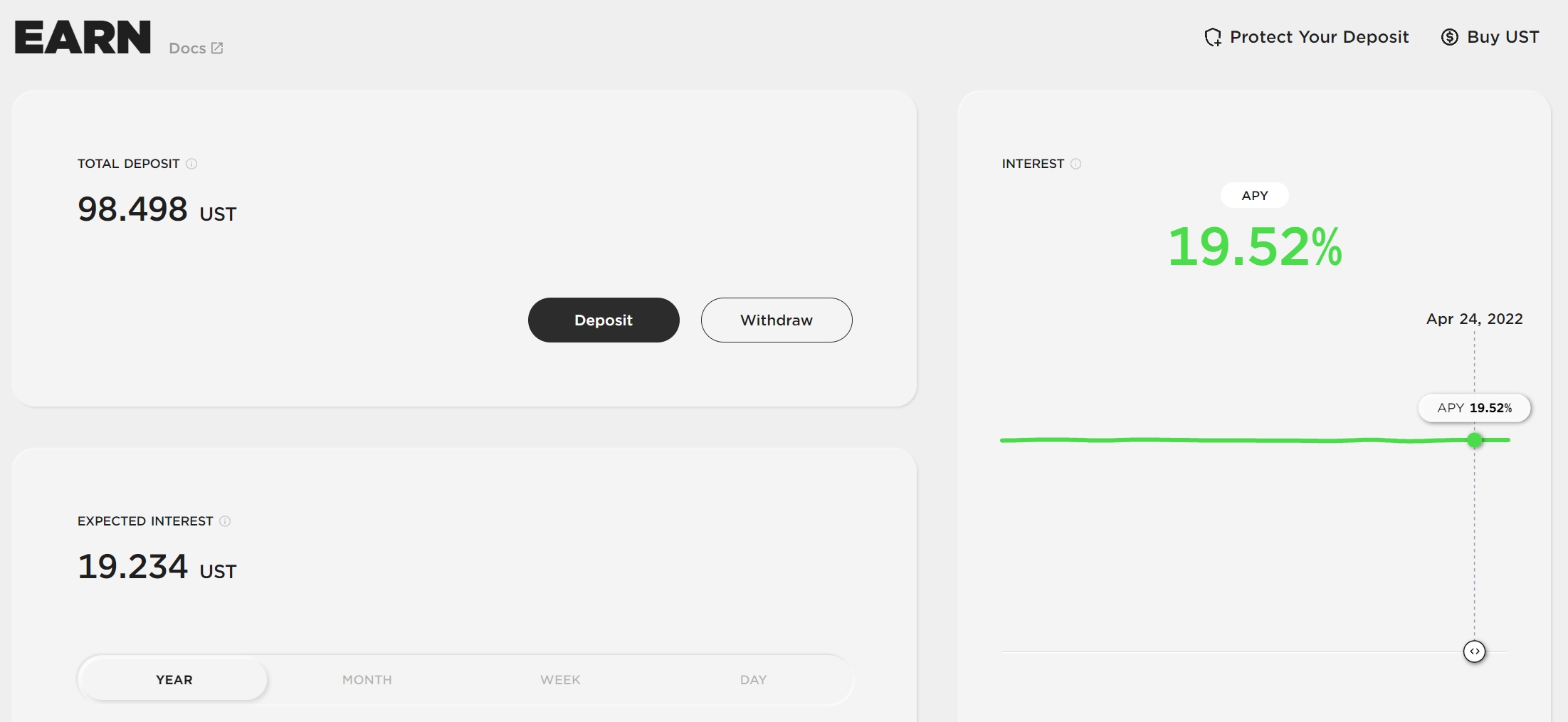

Congratulations, you have successfully transferred UST to Anchor Protocol and started lending. At the time of writing, our UST will accrue 19.52% yearly compounded interest. You can check day, week, and month-adjusted returns on the Earn homepage.

Example of UST yearly return calculation with $5,000 UST

At the time of writing, Anchor Protocol provides an APY (Annual Percentage Yield) of approximately 19.5%. In practice, this means that an investment of $5000 worth of UST would net an investor 975 UST in yearly earnings. The profit formula is very easy to understand - simply add the yearly percentage yield to the principal (ex.: 5000 UST +19.5% APY = 5975 UST) and then subtract the initial investment amount to get the profit margin (5975 UST - 5000 UST = 975 UST).

For added context, a 5000 UST investment would net 2.44 UST in earnings on the first day and 81.25 UST after a month.

It is worth noting that the effect of compounding yields becomes even more prevalent at longer time scales. For instance, over five years, our 5000 UST investments would generate a whopping 7185 UST in profit. You can try the helpful Anchor Protocol earnings calculator and enter your own parameters to see how much earnings can you expect to generate with various investment amounts over different time scales.

Final thoughts

UST has seen its supply grow by over 900% in the past year, in large part due to the growing popularity of the Anchor Protocol. In addition to interest-bearing features, Anchor Protocol allows investors to borrow bunds, join liquidity pools and participate in the protocol’s governance by staking ANC tokens at an over 10% APR.

Hopefully, this article helped you on your journey of generating passive income with UST holdings using Anchor Protocol lending.

0

1

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.