Cardano: A Holochain Perspective

3

0

This has been a good year so far for Cardano. It successfully forked to become a multi-asset blockchain, enabling users to create tokens that run on Cardano natively, similar to how tokens operate on Ethereum. (Full smart-contract functionality remains on their roadmap.) Its token, ADA, became tradeable on Coinbase in mid-March. And investors lined up: the price of ADA rose 560% over Q1, the most among the CoinDesk 20, a core group of cryptocurrencies tracked by the news site. Then in April, Cardano announced a major blockchain-identity initiative in Africa, beginning with a partnership with the Ethiopian government to improve the quality of education.

Cardano makes some promising claims about its platform that seem mainly aimed at differentiating from Ethereum, still the giant in the smart contract space with a market capitalization roughly six times as large as Cardano’s as of this writing. Among its core features:

- Protocols for scalability and security are supposedly more scientific, based on “peer-reviewed academic research”.

- A unique algorithm, called Ouroboros, billed as “the most environmentally sustainable blockchain protocol”. Ourobouros’s consensus system empowers various types of stakeholders, including “input endorsers’’ and “slot leaders”, to mine coins and verify transactions.

- A hierarchical structure that includes a settlement layer for accounting and a control layer for executing smart contracts, supposedly making Cardano ideal as both a medium of exchange and a decentralized world computer.

Whether Cardano is actually better than other blockchain protocols isn’t something we’ll try to settle here. What we can say is that Cardano is seeking to be a better blockchain protocol, which is fundamentally different than what Holochain is doing. Cardano and Holochain may ultimately be solving some of the same problems, but they face very different challenges along the way.

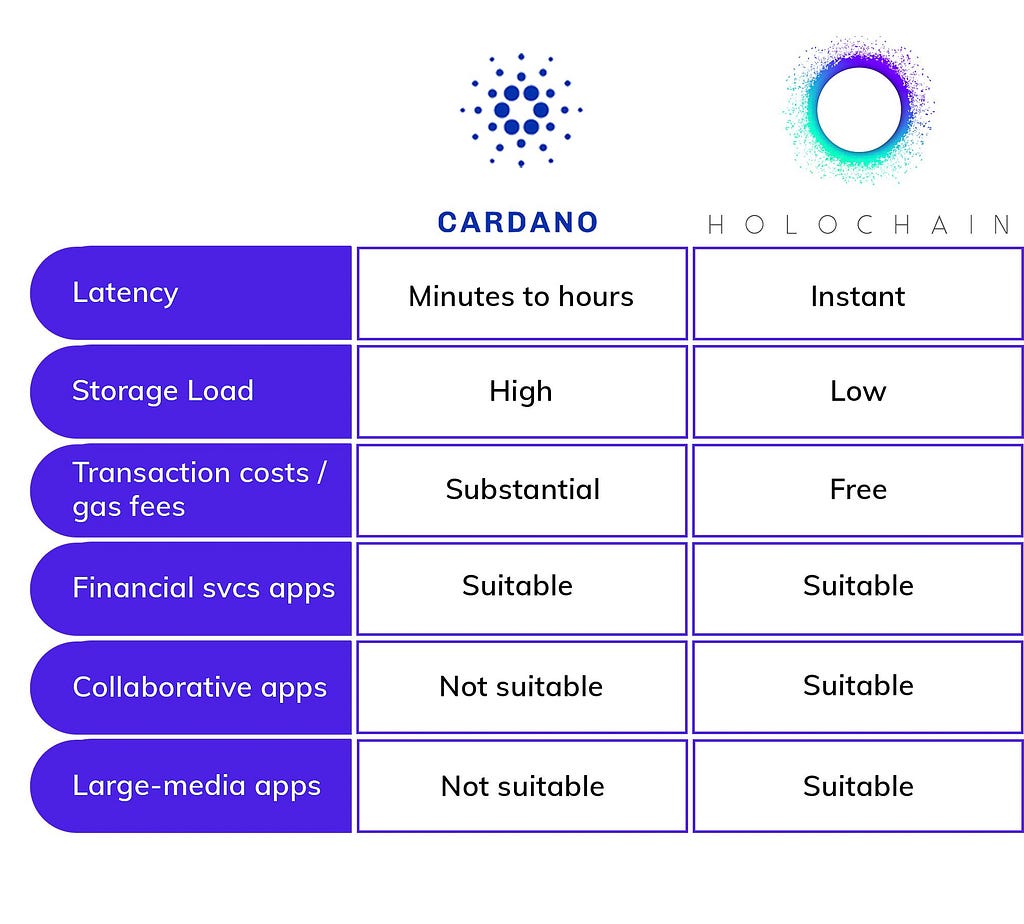

For example, one of blockchain’s biggest challenges is efficiency (or scalability). The computing costs of recording everything that happens on every node of a blockchain are huge, as is the storage load of keeping all of that data forever, so it’s hard to imagine blockchain being suitable for applications involving any kind of big media files. Another issue is latency: blockchains often take several minutes or more to record even simple events, so they’re not very suitable for collaborative applications that rely on fast update times. Users have recently reported transaction wait times on Cardano ranging from 1 to 18 hours.

For these reasons, blockchain projects seem to be primarily setting their sights on financial services applications, which tend to hold relatively little data and don’t require real-time processing. Cardano is no exception, making “interoperability with legacy financial systems” one of its core objectives.

Holochain is not limited in the same ways and, as a result, is capable of enabling virtually all the activities you’re accustomed to doing on the internet now. Holochain is so flexible and scalable because:

Cost: Holochain is completely free to use and run. Because users host themselves and each run a local copy of the application to perform a small amount of the shared workload of validation and storage, there is no need to pay any intermediary miners or stakers. No gas fees also means no built-in token is required to run Holochain apps, eliminating a major usability hurdle. (The tokens people commonly associate with Holochain, Holo Token [HOT] and HoloFuel, actually power the Holo Hosting Network, a peer-to-peer hosting marketplace which enables anyone to participate in a Holochain application through a web browser without having to purchase any cryptocurrency or have a crypto wallet.)

Storage: Holochain is capable of handling large-media applications. Shared data is replicated only enough times to provide a healthy amount of redundancy — perhaps 25 or 50 times, not on every single node as in blockchain — so it is completely feasible to store and serve large documents, images, and videos. Even live video streaming is possible through the shared data environment of a Holochain app.

Speed: Holochain has a number of features that combine to make for near-zero latency:

- You write data to your local chain instantly. Once your data is recorded on your own source chain and then published to the network, the other computers update to your change in their own time — seconds for most computers, perhaps minutes for some — but you typically don’t have to wait for that to happen to continue moving forward. For example, if you’re posting in a social media application, you see your own post immediately, and you can add a comment to it right away.

- In addition, you can send ‘signals’, which are real-time updates transmitted to the specific parties you’re interacting with, ahead of validation by the network. In a chat application, for example, the person you’re chatting to gets a signal so that their screen updates right away with your message, as fast as in any centralized chat application.

- When you are interacting in a way that needs to be validated before you can interact again — such as if you’re transacting with currency — your next transaction only depends on your history being validated by the user you’re transacting with, not by the whole network. (Because all users host a copy of the application, including the app’s validation rules, they don’t need to consult anyone else.) So if there are computers on the network that are slower to update or are offline, that doesn’t slow you down. Incidentally, this feature also makes for infinite transactions per second, increasing with the number of users on the network: if there are a billion people using a currency app, there could be half a billion transactions taking place at the same time — one transaction for every pair of people who are transacting.

For all of these reasons, Holochain is suitable not just for financial services applications but for collaborative applications like:

- Chat applications like Slack or WhatsApp. (Elemental Chat is now live.)

- Project-management systems like Trello and Asana. (Acorn is one example in development.)

- Social media applications similar to Twitter, Facebook, and so on. (Junto is one example.)

- Wikis and other knowledge bases. (H-Wiki and Fractal Wiki are both in development.)

- Calendaring and scheduling applications. (CalendarEvents is one under development.)

- Real-time collaboration tools like Google Docs and HackMD (We created Syn as a simple but powerful protocol for these types of apps.)

- Marketplaces and e-commerce networks for any imaginable good or service, from vacation rentals like Airbnb to ride-sharing networks like Uber to general-purpose marketplaces like eBay or Amazon. One exciting marketplace in development is RedGrid, a peer-to-peer, clean-energy power network.

- Media-sharing platforms like YouTube and Spotify.

- Innovative social organisms like collaborative land stewardship, supply-chain tracking, and novel currency systems.

So what advantages does Cardano have relative to Holochain? The biggest one might be awareness — both of the project itself and of the underlying technology. Cardano has gotten a lot more press than Holochain to date. And Cardano aims to improve on technologies that are already widely understood: distributed ledgers, block production, and consensus-based adoption of global state.

Holochain, by contrast, needs to overcome deep-seated beliefs in order to get developers and users to understand its capabilities. People are so used to the idea that global consensus and universal data replication are the only way to make data secure and immutable that they tend to have trouble believing that it’s possible to guarantee data integrity in a more efficient way. Holochain is a technology at least as disruptive as Ethereum, and remember how many years it took for developers to basically understand Ethereum smart contracts and start building with them? Holochain’s path to awareness is probably more like Ethereum’s in 2014–2017 than Cardano’s today. Then again, more people do seem to be taking notice: the price of Holo Token (HOT) rose even more than ADA over Q1 2020.

The bottom line: Cardano may be positioned to meet a market demand for a better blockchain and give Ethereum a real run for its money. But Holochain may be poised to leapfrog beyond the lot of them, since it is capable of addressing a set of use cases that blockchain protocols simply cannot, with even higher data integrity and the kind of scalability blockchain can only dream of.

Originally published at https://blog.holochain.org on May 26, 2021.

Cardano: A Holochain Perspective was originally published in Holochain on Medium, where people are continuing the conversation by highlighting and responding to this story.

3

0

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。