Why These Altcoins Are Trending Today — March 26

0

0

The total cryptocurrency market capitalization holds at $2.81 trillion, with minimal losses recorded over the past 24 hours.

While most major assets remain relatively stable, some altcoins have received increased attention from traders and investors. Particle Network (PARTI), Sui (SUI), and Ondo (ONDO) are among the trending assets today.

Particle Network (PARTI)

The newly launched Layer-1 (L1) coin PARTI is one of today’s trending altcoins. It trades at $0.37, noting a 26% surge over the past 24 hours.

On Tuesday, Particle Network completed its token generation event and airdrop, leading to PARTI’s listing on major exchanges, including Binance, OKX, and Gate.io.

Although PARTI has posted double-digit gains in the past day, its hourly chart reveals a period of consolidation following an intraday peak of $0.44 during Tuesday’s trading session. The altcoin has struggled to break past resistance at $0.37 while finding support at $0.31.

This consolidation is reflected by the coin’s flatness in the Chaikin Money Flow (CMF), a trend that indicates a lack of strong buying or selling pressure in the market. It suggests neither PARTI bulls nor bears have full control, reflecting indecision or consolidation in price action.

If demand strengthens and PARTI breaks above the resistance at $0.37, it could continue its uptrend and climb to $0.40.

PARTI Price Analysis. Source: Gecko Terminal

PARTI Price Analysis. Source: Gecko Terminal

However, if sellers gain dominance and profit-taking soars, PARTI could break below $0.35 and fall to $0.33.

Sui (SUI)

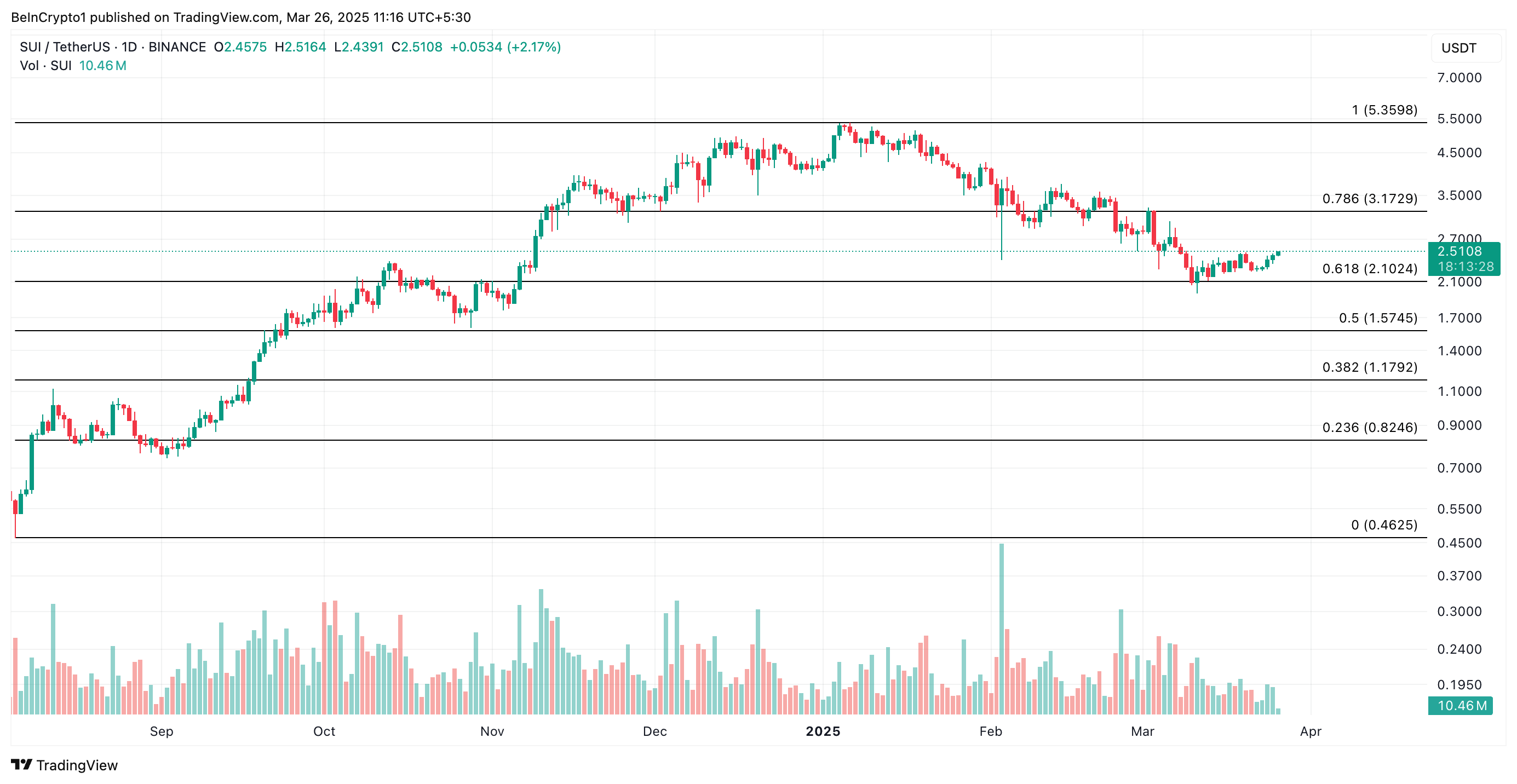

SUI is another altcoin trending today. Its price is up 6% over the past 24 hours and currently trades at $2.51.

While its price has climbed, SUI’s trading volume is down 7% during the review period, forming a negative divergence. A price/volume negative divergence is a bearish signal, indicating that SUI’s price rally is not driven by actual demand for the altcoin but instead fueled by speculative trades, making it unsustainable.

If this persists, SUI could shed its recent gains and fall to $2.10.

SUI Price Analysis. Source: TradingView

SUI Price Analysis. Source: TradingView

On the other hand, a resurgence in actual demand for the altcoin would invalidate this bearish projection. In that scenario, the coin’s price could surge toward $3.17.

Ondo (ONDO)

RWA token ONDO is one of the most searched altcoins today. As of this writing, it exchanges hands at $0.93, registering a 6% price uptick in the past 24 hours.

Its rising Relative Strength Index (RSI) confirms ONDO’s growing buying pressure among market participants. The key momentum indicator is in an uptrend at press time and has just broken above the 50-neutral line.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

When an asset’s RSI breaks above the center line, it signals a shift toward bullish momentum. This suggests that ONDO buying pressure is increasing, potentially supporting further price gains.

If buying pressure gains momentum, ONDO could extend its rally and climb to $1.03.

ONDO Price Analysis. Source: TradingView

ONDO Price Analysis. Source: TradingView

Conversely, if profit-taking makes a comeback, ONDO’s price could fall to $0.87.

0

0

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plek

Beheer al jouw cryptovaluta, NFT en DeFi vanaf één plekVerbind de portfolio die je gebruikt veilig om te beginnen.