On-chain Data Reveals A Hidden Phase Of Bitcoin Accumulation

0

0

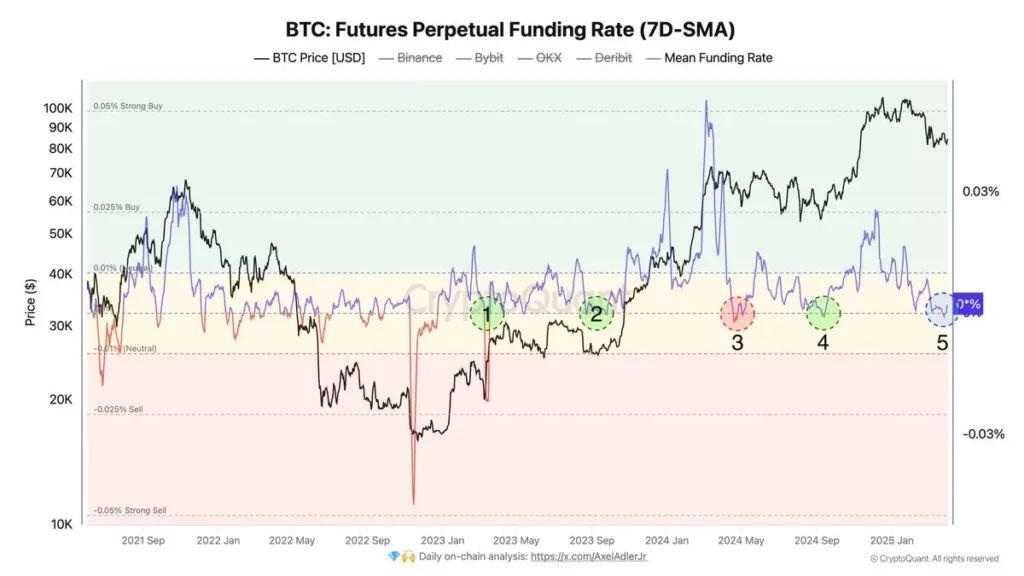

As bitcoin (BTC) holds above $81,000, signals of a changing dynamic are multiplying. Recent data suggests a shift towards an accumulation phase, marked by a decrease in spot sales and negative funding rates on trading platforms. This technical context, often a precursor to a bullish reversal, may hint at a forthcoming impulsive movement.

Bitcoin: signals of a reversal

While the behavior of whales suggests an immediate rebound of BTC, funding rates have moved into negative territory across several major exchanges, including Binance, Bybit, OKX, and Deribit. This indicates that short positions are outweighing long positions. Historically, this phenomenon reflects excessive market distrust, often followed by a rebound when short sellers are forced to cover. In short, traders betting against bitcoin may soon find themselves trapped if the price starts to rise.

Another key signal: the drop in spot sales volume. Bitcoin investors are no longer rushing to cash in their gains, preferring to hold their positions. This attitude reflects a growing confidence in a long-term bullish trend. According to on-chain data, long-term holders are back in accumulation mode.

A resistance to overcome to confirm momentum

Despite these promising signals, bitcoin still faces a major technical resistance around $86,000. Breaking through this threshold would confirm a bullish recovery. For now, buyers are firmly defending the $81,000 zone, creating a favorable environment for a future explosion in volatility.

On the macroeconomic front, global trade uncertainties continue to impact assets. Especially right now as Donald Trump has just announced new tariffs, which have plummeted the stock markets into the red. However, bitcoin’s resilience in the face of these disruptions demonstrates its growing role as an alternative asset. Institutional investors, while cautious, seem ready to gradually reintegrate into the market.

Not all indicators are yet green, but the current context resembles a calm before the storm. If the selling pressure continues to wane and the resistance at $86,000 gives way, bitcoin could enter a new bullish phase. For savvy investors, now might be the time to accumulate, before the market takes off. But things could soon change, as there is a 70% chance that a crypto crash occurs before June.

0

0

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。