Thread

— Credefi (@credefi_finance) January 23, 2025

1/Credefi's Integration with @BuildOnLumia

The integration is in motion! Combining Lumia’s advanced L2 tech with Credefi’s platform, this collaboration fully redefines DeFi and asset tokenization.

Expected launch: Q1 2025.

Lumia And Credefi: A Breakthrough In The Tokenization Of Real-world Assets

3月 之前•

看涨:

2

看跌:

0

共享

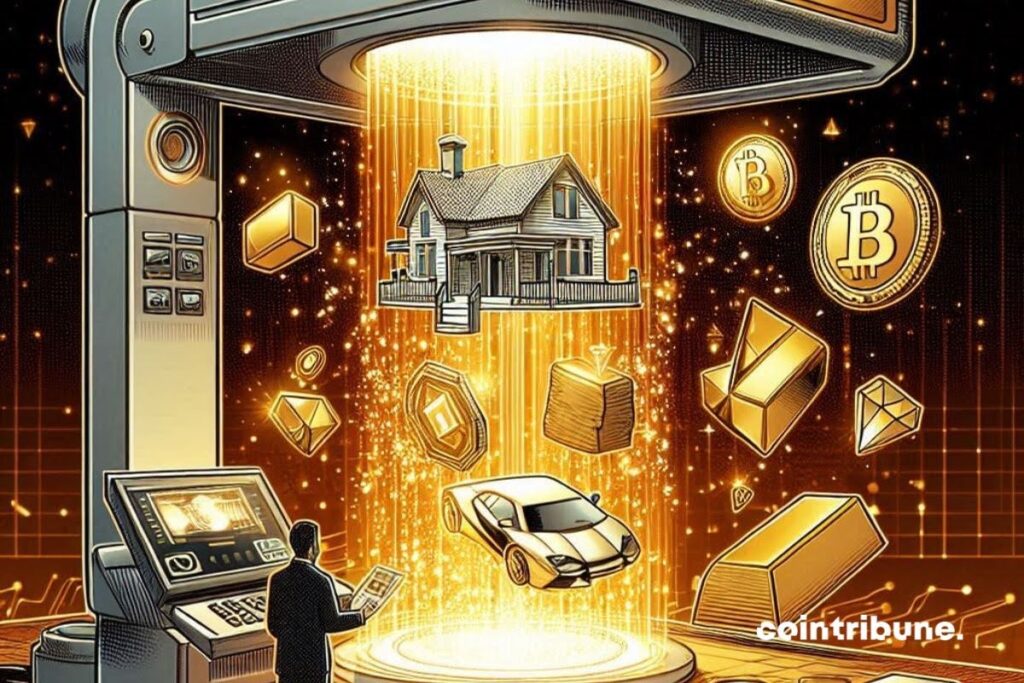

Blockchain-based finance is evolving rapidly, offering innovative solutions to democratize access to investments and financing. Among the ongoing challenges in this ecosystem, the integration of real-world assets (RWA) remains a central issue. The collaboration between Lumia and Credefi aims to address these challenges by combining layer 2 (L2) infrastructure with expertise in RWA-backed loans.

Tokenization of RWAs: a lever for financial inclusion

Tokenization of traditional assets is one of the most promising areas of blockchain. By transforming physical assets into digital tokens, it helps to lower entry barriers, improve liquidity, and facilitate access to markets. However, the implementation of this vision faces several obstacles:

- Insufficient liquidity: Many projects struggle to maintain a fluid market for tokenized RWAs.

- Scalability: Existing blockchains face issues with cost and transaction speed.

- Limited access to complex financial tools: Diversification and risk management often remain out of reach for individual investors.

It is in this context that Lumia and Credefi unite their strengths to offer integrated solutions, combining Lumia’s L2 infrastructure with Credefi’s real asset-backed lending services.

Lumia and Credefi: A partnership to improve liquidity and accessibility

One of the key aspects of this collaboration is the liquidity provision by Lumia to the Credefi ecosystem. Improved liquidity means more competitive interest rates, faster transactions, and increased adoption of RWA-backed loans.

Furthermore, the introduction of synthetic assets on Lumia L2 represents a major advancement. Inspired by traditional ETFs, these instruments will allow investors to access diversified baskets of tokenized assets, thereby reducing risk and paving the way for more sophisticated financial strategies. Additionally, Lumia’s L2 infrastructure offers a cost-effective, fast, and scalable environment, addressing the challenges of blockchain finance such as high fees and network congestion.

With a launch planned for the first quarter of 2025, this partnership could mark an important step in integrating traditional finance and blockchain. This will make investment opportunities more accessible to a global audience.

3月 之前•

看涨:

2

看跌:

0

共享

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。