What Are Block Rewards in Crypto

Have you ever wondered if you could earn passive income through mining or staking cryptocurrency from your spare computer? A block reward is a certain number of coins given to a miner or validator in return for successfully adding an entirely new block of transactions to the blockchain.

Block rewards act as incentives for blockchain miners to verify transactions and validate new blocks to ensure the overall security of the blockchain.

Read on to learn everything you need to know about block rewards, their structure, and how to successfully verify transactions on a blockchain protocol to earn rewards.

Let’s get right to it!

Executive Summary

- Block rewards in crypto are cryptocurrency tokens given to individuals or groups who participate in the verification process of the blockchain network.

- The block reward consists of two components – block subsidy (newly-minted coins) and transaction fees.

- Users who verify transactions are called validators or (depending on the underlying consensus mechanism) miners or stakers.

What Is a Consensus Mechanism?

Just a reminder that a consensus mechanism is the foundation of the technology that enables miners to verify transactions on the blockchain. Consensus mechanisms regulate the token issuance, block verification, and, yes, the block rewards.

Simply put, consensus mechanisms are systems that allow cryptocurrencies to work without a central authority. In so doing, they enable users to validate transactions by utilizing their computing power, locking their token holdings, etc. While the market is flooded with consensus mechanisms of many shapes and flavors, two of the most popular ones include Proof-of-Work (PoW) and Proof-of-Stake (PoS).

Block Rewards in Crypto: Explained

Block rewards are, simply put, a portion of newly minted tokens and/or transaction fees given to miners or stakers for validating a new block.

When a validator successfully adds a block to the blockchain, they receive a certain amount of crypto as a reward. As the name suggests, a block reward is a compensation given to the miner who successfully adds a block of transactions to the blockchain. In addition to incentivizing miners to participate and secure the network, these rewards effectively ‘issue’ new currency into the markets, serving as the blockchain’s monetary policy.

The reward is determined by a specific cryptocurrency protocol. For example, Bitcoin’s block rewards have halved three times since the protocol launched in 2009 and will continue to halve in the future until the total number of coins in circulation reaches the maximum supply of 21 million coins. As such, its block reward was initially 50 newly-generated coins per block, but currently, Bitcoin miners get 6.25 bitcoins per block. Halving often pushes the fiat value of the coin up, i.e., fewer coins in circulation mean less supply vs. demand.

Block rewards play a crucial role in cryptocurrency networks, providing incentives to validators to contribute to the security and stability of the network.

Whether you decide to mine, stake, hodl, or invest your crypto any other way, CoinStats can help you track all your holdings from one place!

Block Rewards and Transaction Fees

Transaction fees are dynamic fees users pay for processing their transactions by validators. The fee can be higher or lower depending on the network congestion and a user’s willingness to expedite the process.

Transaction fees are part of the reward validators get for adding a new block to the blockchain. They ensure that the network remains secure and efficient. When the network experiences a high volume of transactions, users often compete for limited block space by increasing their transaction fees. As validators get a fixed issuance reward, they tend to prioritize transactions with higher fees by including these in the newest block.

In summary, transaction fees and block subsidies are the two essential components in the block reward structure. While block subsidies provide a fixed reward for adding a block, transaction fees offer a dynamic way of prioritizing transactions and ensuring quick and efficient processing.

Now, let’s explore the block reward structures for the PoW and PoS consensus mechanisms.

Block Rewards in PoW (Mining)

Proof-of-Work consensus mechanism enables users to validate transactions utilizing their computing power to help secure the network. In this case, validators are also called miners.

The mining node that solves the computational problem first is rewarded with a block reward, which includes a pre-determined amount of cryptocurrency. Additionally, they receive any transaction fee associated with the transactions included in the new block.

The PoW mechanism is designed to prevent double-spending, ensure network consensus, and maintain the integrity of the blockchain. Also, it’s the only way of releasing new bitcoins into the ecosystem.

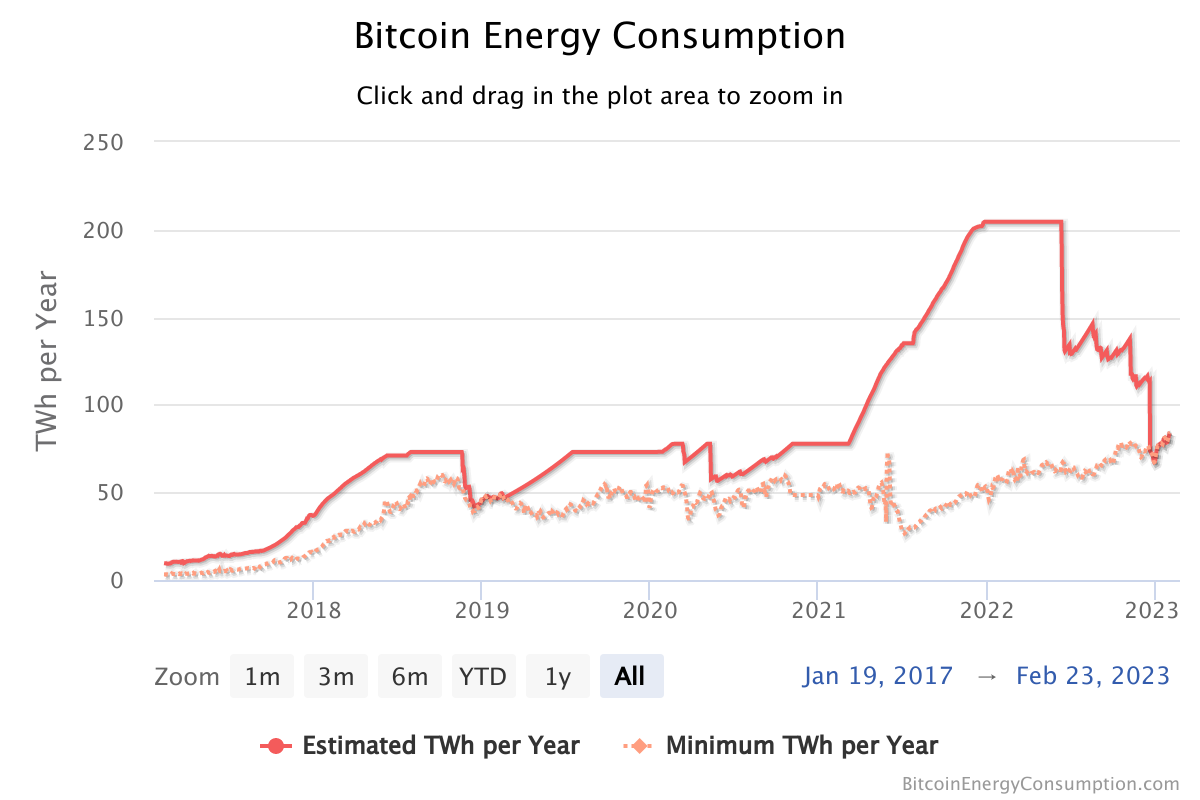

However, PoW’s drawback is that it’s not energy efficient – the algorithm is computationally intensive, requiring significant energy and computational power.

Bitcoin Halving

The Bitcoin blockchain currently offers a block reward of 6.25 BTC — meaning this amount of BTC is minted approximately every 10 minutes (every block). The reward is cut in half roughly every four years (or every 210,000 blocks) in a process called Bitcoin halving.

Here’s a chronological list of Bitcoin’s block rewards:

- 2008: 50 BTC per block

- 2012: 25.00 BTC per block

- 2016: 12.50 BTC per block

- 2020: 6.25 BTC per block

As mentioned, when the BTC supply comes into circulation (around 2140), the Bitcoin block reward will only consist of transaction fees.

Mining Difficulty

Mining difficulty is a figure representing how hard it is for competing miners to validate a block of transactions and get a reward. The degree of difficulty changes to ensure blocks are created safely and at a steady rate, regardless of the number of miners.

Mining difficulty is measured by the number of calculations required to solve the PoW problem. As more miners join the network and the total mining power increases, the difficulty will increase to keep the block rate steady.

In the case of Bitcoin, mining difficulty automatically adjusts with every 2,016 blocks to keep the average block time to approximately 10 minutes.

Mining Pools

However, it’s not all fun and games – with time, as new users keep joining the network, validating a new block is getting more difficult. The PoW mechanism favors miners with high-tech and expensive equipment, who practically squeeze smaller miners out of competition.

As the chances of a single user validating the transaction by themselves are slim to zero, validators combine their resources in mining pools to increase their chances of obtaining a block reward. Mining pools are groups of miners who work together by pooling their computational resources over a network to mine cryptocurrencies more effectively.

By combining resources, miners can earn a consistent stream of smaller rewards rather than infrequent but larger ones. This helps them minimize the volatility of block rewards and create a more stable income stream. The pool collectively earns rewards for each block mined and then distributes those rewards to individual miners based on the amount of computational power they contributed.

However, the centralization of the mining process through mining pools poses a threat to the network’s decentralization. For example, the top three combined mining pools would own the majority stake in the network, allowing them to approve fraudulent transactions if they choose.

Ecosystem Flaws

The PoW in blockchain technology has resulted in large mining farms and significant energy consumption. According to Digiconomist, Bitcoin mining alone consumes 83.76 TWh of electricity, more than entire countries.

PoW rewards miners with specialized equipment, resulting in pool mining that might centralize the blockchain. Therefore, creating a new, effective consensus algorithm is paramount to addressing these issues.

Block Rewards in PoS (Staking)

As discussed above, the Proof-of-Work algorithm requires a lot of computational power.

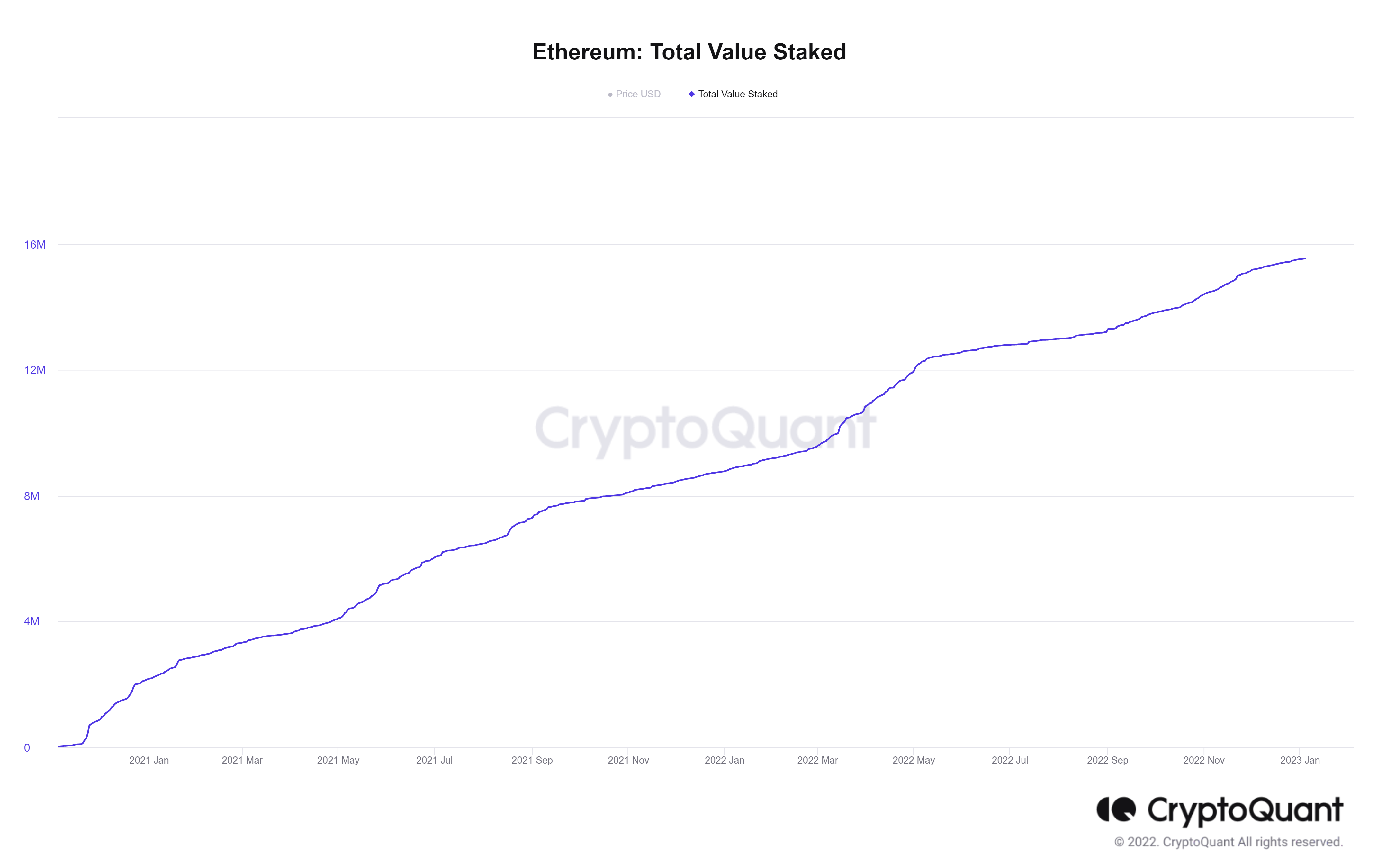

Proof-of-Stake, a consensus algorithm created in 2011, aims to address this issue by using an election process to randomly choose a node to validate the next block and get a block reward. The significant difference between PoW and PoS is the way they determine who gets to validate a block of transactions.

Unlike PoW, PoS doesn’t have miners but rather “validators” who “mint” or “forge” blocks. A node must lock or stake a certain amount of coins into the network to become a validator. The size of the stake correlates linearly with the validator’s chances of being chosen to forge the next block, process transactions, and obtain more block rewards.

Example: If Tom locks 1 ETH, while Mary locks 10 ETH in the staking process, Mary’s chances of being selected to forge the next block is ten times higher. This may seem unfair, favoring those with greater financial resources, but it’s, in fact, more equitable than PoW as it doesn’t permit the economies of scale enjoyed by those who can purchase more mining equipment and electricity at a discounted rate.

For a validator, staking is akin to a bank deposit into a savings account. The more money you deposit – the more interest you earn. Similarly, the more coins a validator stakes or locks up as collateral in a blockchain network, the more they earn.

Trust in PoS

While nodes are randomly chosen to become validators, the selection is not entirely arbitrary. A node must stake a certain amount of cryptocurrency to become a validator. This serves as a security deposit and creates a financial incentive for validators to act honestly, as they will lose a portion of their stake if they approve fraudulent transactions.

Trust in the Proof-of-Stake mechanism is achieved through a combination of factors, including selecting validators based on their stake and using a “slashing” mechanism to penalize validators who cheat or behave maliciously. This mechanism uses considerably less energy than Proof-of-Work and has a punishment mechanism for fraudulent blocks.

Block Reward Structures

It’s worth noting that block rewards vary in size and structure. Some blockchains have a specific block subsidy that changes occasionally; others carefully plan their reward payouts to maintain the token’s price; some don’t even offer block rewards at all!

If you plan on participating in the validation process of any blockchain, ensure to explore all the ins and outs of their block reward systems and reward schedules. You can find all the information regarding the inner workings of a consensus mechanism in the crypto whitepaper of the project.

Closing Thoughts

Every technology has its pros and cons. Mining or staking can be a way to earn passive income, support a blockchain network, promote a project, learn and experiment with technology, etc.

However, as with everything related to the crypto world, it requires in-depth research, communication with the corresponding community, and keeping in touch with the current trends.