How to Buy Serum [Step-By-Step Guide]

Serum is a permissionless decentralized exchange and DeFi ecosystem built on the Solana blockchain. It brings unprecedented speed and low transaction costs to decentralized finance and enables cross-chain swaps. The Serum ecosystem uses an on-chain central limit order book (CLOB) and is run by smart contracts. Serum aims to match buyers and sellers, giving them complete control over their trading.

SRM is Serum’s native utility and governance token based on the Solana Program Library (SPL). It’s an SPL token and is also cross-listed as ERC20.

SRM token holders benefit when someone adds liquidity and volume to the protocol and can receive up to a 50% discount on their trade fees. They can also stake SRM to vote and participate in the platform’s governance mechanism.

Some of the best exchanges for buying SNX are Kraken, Uphold, Binance, KuCoin, and Huobi Global.

Follow our step-by-step buying guide below to buy SRM tokens:

Step #1: Select a Crypto Exchange

Serum (SRM) tokens are available on leading cryptocurrency platforms, so visit the market page on CoinStats to view the exchange platforms supporting SRM. Compare the exchanges’ security, user experience, fee structure, supported crypto assets, etc., to choose the one with the characteristics you need, such as affordable transaction fees, an intuitive platform, round-the-clock customer service, etc. Also, consider whether the cryptocurrency exchange is regulated by the Financial Industry Regulatory Authority (FINRA) and allows you to buy crypto using your preferred payment method.

In the crypto world, any trader is confronted with the initial choice between centralized and decentralized crypto exchanges, so let’s look into the details of each type below.

Centralized Exchange

A centralized crypto exchange or CEX, such as Coinbase, eToro, Binance, etc., is governed by a centralized system and charges specific fees for using their services. Most crypto trading takes place on centralized exchanges, allowing users to convert their fiat currencies directly into crypto easily. Centralized exchanges require their users to follow KYC (know your customer) and AML (anti-money laundering) rules by providing some information and personal identification documents. However, a CEX holds your digital assets on its platform while trades go through – raising the risk of hackers stealing the assets.

Decentralized Exchange

On the other hand, a decentralized exchange (DEX), like Uniswap, SushiSwap, Shibaswap, etc., is not governed by any central authority; instead, it operates over blockchain and charges no fee except for the gas fee applicable on a particular blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use smart contracts to let people trade crypto assets without needing regulatory authority. They deploy an automated market maker to remove any intermediaries and give users complete control over their funds. Decentralized exchanges are less user-friendly in terms of interface and currency conversion. For instance, they don’t always allow users to deposit fiat money in exchange for crypto; users have to either already own crypto or use a centralized exchange to get crypto. It also takes longer to find someone looking to trade with you as DEX engages in peer-to-peer trade, and if liquidity is low, you may have to accept concessions on price and quickly sell or buy low-volume crypto.

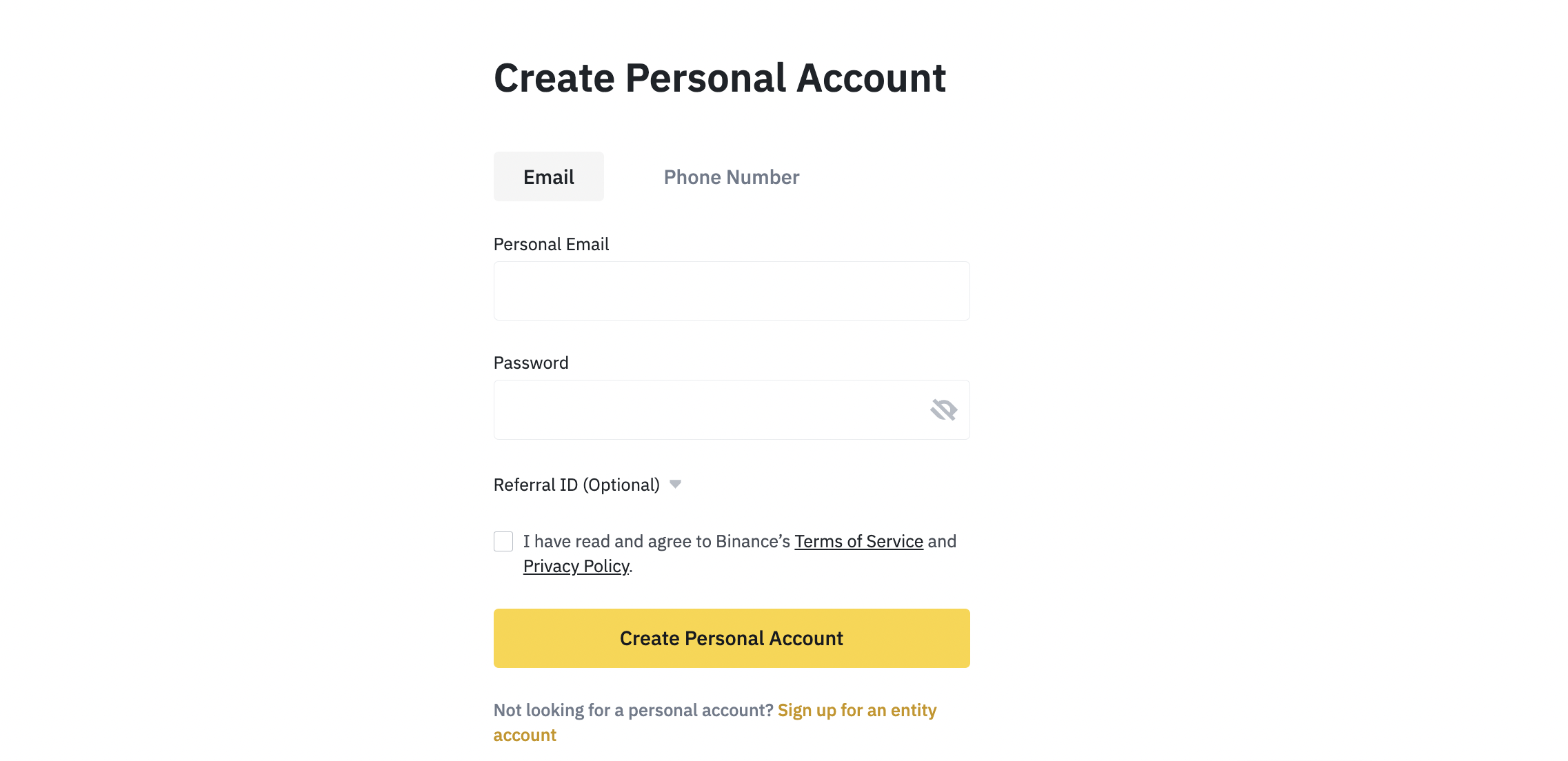

Step #2: Create an Account

After you’ve chosen a cryptocurrency exchange that fulfills all your criteria, the following step is to register with the exchange using a valid email or mobile number. A link will be sent to your address, and you must click it to verify your account. Once the account is activated, you must create an elaborate password, and you’re good to go.

Some exchanges have strict KYC and AML requirements, and in order to get verified, you must provide personal information such as:

- Full name

- Residential address

- Date of Birth

- ID Document.

In some cases, you might also need to upload a selfie or undergo video verification to finalize the verification process.

Once your identity verification is complete, it’s recommended to activate two-factor authentication (2FA) for an extra layer of security.

Step #3: Deposit Funds

The next step is to deposit funds into your account. Many crypto exchanges support fiat currencies like USD, EUR, etc. Simply select your preferred deposit method, such as a bank transfer, wire transfer, credit or debit cards, e-wallets, PayPal, etc., and the currency you wish to deposit. Tap on “Deposit Funds,” enter the amount you want to deposit, and click “Deposit.”

Some deposit methods are extremely fast, while others, depending on the amount, require confirmation from authorities. Remember to evaluate the fees of different deposit methods since some have larger fees than others.

- Credit or Debit Card

Linking your debit card to your crypto account is advantageous as it lets you make instant or recurring purchases, but be aware that it attracts an additional fee.

- Bank Account

It’s usually free to make a bank transfer from your local bank accounts, but you should still double-check with your exchange.

- Cryptocurrency

SRM can be traded for another cryptocurrency or a stablecoin; the trading pairs vary between exchanges. So, you must search for SRM on the spot market to select a pair from the list of available trading pairs.

Step #4: Buy SRM

Follow the steps below to place a market order to buy SRM instantly at the current market price:

- Click the search bar, enter SRM, and select “Buy SRM” or the equivalent.

- Select a trading pair you wish to buy SRM against.

- Choose the payment method, the currency you wish to use, and input the amount of SRM or the fiat amount to be spent. Most exchanges will automatically convert the amount to show you how many SRM tokens you’ll get.

- Double-check the transaction details and click “Confirm.”

- The SRM tokens will be displayed in your balance once the transaction is processed.

You can also place a limit order indicating that you want to buy SRM at or below a specific price point. Your broker will ask you the number of coins you wish to acquire and the maximum price you’re ready to pay for each once you’ve placed an order. The coins will only appear in your wallet if your broker fulfills your order at or below your requested pricing. The broker may cancel your order at the end of the day or leave it open if the price increases over your limit.

If you’re planning to keep your newly purchased coins for an extended period, we highly recommend securely storing them in a hardware wallet.

To trade SRM on spot markets, go to the Trade page and search for the SRM pairs (SRM/USD, SRM/USDT, etc.). Select the trading pair and check the price chart. Click “Buy SRM,” select the “Market,” enter your amount or choose what portion of your deposit you’d like to spend by clicking on the percentage buttons. Confirm and click “Buy SRM.”

Congratulations on adding Serum (SRM) tokens to your crypto portfolio!

How to Buy Serum on CoinStats?

Did you know that you can buy Serum directly on CoinStats with 0 additional fees? It’s super quick and secure and allows you to buy crypto with your credit card right where you track and manage it. Here’s how you can buy Serum on CoinStats on web and mobile in a few simple steps.

- Head over to the CoinStats homepage

- Navigate to the Cryptocurrencies tab in the menu bar above and pick your desired cryptocurrency.

- Click Buy Crypto

- Select a portfolio or add a wallet address where the funds will be deposited

- Choose MoonPay as the provider

- Add the credentials of your payment method

- Complete the payment

Store SRM

While your SRM tokens can be stored in your brokerage exchange wallet, experts highly recommend storing your precious coins away from exchange wallets, as those might be susceptible to hacks and interference.

We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets:

Software Wallets

If you’re looking to trade SRM regularly, software or hot wallets provided by your selected crypto exchange will suit you. The strength of software wallets lies in their flexibility and ease of use. A software wallet is the most easy-to-set-up crypto wallet and lets you easily interact with several decentralized finance (DeFi) applications. However, these wallets are vulnerable to security leaks because they’re hosted online. So, if you want to keep your private keys in a software wallet, conduct due diligence before choosing one to avoid security issues. We recommend a platform that offers 2-factor authentication as an extra layer of security.

Examples of software wallets include CoinStats Wallet, MetaMask, Coinbase Wallet, Trust Wallet, and Edge Wallet, amongst others.

Hardware Wallets

Hardware or cold wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. These are more suitable for experienced users who own large amounts of tokens.

Ledger hardware wallets are arguably the most secure hardware wallets letting you securely manage your digital assets. The Nano X is designed for advanced users and offers more storage space and advanced features than Ledger Nano S, designed for crypto beginners.

A hardware wallet is more expensive than a hot wallet, with prices ranging between $50 – $200.

Examples of cold wallets are Trezor Model T, Ledger Nano X, CoolWallet Pro, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

Bonus Step: Track SRM Tokens

The crypto market is volatile, and managing your portfolio could get tricky if you hold multiple assets. Utilizing a portfolio tracker will help you keep track of your SRM tokens and all your crypto investments from one platform at all times. CoinStats offers one of the best crypto portfolio trackers in the market.

You can also monitor the profit, loss, and liquidity of Serum (SRM) across several exchanges on CoinStats.

CoinStats supports over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It offers charting tools, analytical data, advanced search features, and up-to-date news. Here you have the opportunity to connect an unlimited number of portfolios (wallets and exchanges), including:

- Binance

- MetaMask

- Trust Wallet

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To connect, go to the CoinStats Portfolio Tracker page and:

- Click Add Portfolio and Connect Wallet.

- Click the wallet you want to connect to (e.g., Ethereum Wallet).

- Input the wallet address and press Submit.