How to Buy Storj [The Ultimate Guide 2023]

Cryptocurrencies and blockchain technology have the potential to change traditional finance and redefine businesses and economies. As an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way, blockchain ensures peer-to-peer transactions between individuals and organizations. With the idea of decentralization at its core, blockchain eliminates the need for any intermediary and is used for settling transactions, verifying ownership, and securing networks and user data.

Blockchain technology’s myriad utility across various disciplines accounts for the growing interest the industry has been enjoying for the last 13 years. Between 2009 and 2022, the sector’s market capitalization soared to nearly $3 trillion, attracting thousands of new projects and investors.

Storj is one such project aiming to disrupt the traditional cloud storage systems by changing how individuals store data. It’s an open-source, decentralized file storage solution that uses encryption, file sharding, and a blockchain-based hash table to store files on a peer-to-peer network. Storj is designed to offer an alternative to the traditional cloud storage solutions, like Amazon, Dropbox, or Google Drive, by making cloud file storage faster, cheaper, and more private.

STORJ is the native token of the platform used to pay network participants for providing their storage capacity.

Let’s get right to it!

What Is STORJ

Storj is an open-source, decentralized blockchain project that enables users to store their data with access to privacy and security. The project operates without a central authority and stores data by splitting it into smaller fractions and distributing it across the Storj global cloud network. It uses encryption, file sharding, and a blockchain-based hash table to make cloud storage faster, cheaper, and private.

Storj presents an alternative to traditional cloud storage platforms provided by Google and Amazon and allows users to rent and use redundant disk space through decentralized peer-to-peer servicing. The project works through a distributed network of independent nodes, i.e., individuals across the globe who offer unused hard drive space to users looking to store their files on the platform.

Storj uses the Tardigrade software on node computers to organize and secure user data. The Storj system also ensures each file is securely encrypted before being scattered to the network of various individual nodes. To safeguard users’ data against hacks and malicious attacks, each node only gets a random fragment of the entire file, and decryption keys are divided among each node and the host. This system also eliminates the risk of storing data in a few isolated storage units which may be susceptible to a planned and coordinated attack.

Storj also claims to provide “lightning-fast, CDN-like performance” and bridge the gap between Web 2 and Web 3 by allowing developers and creators minting Non-Fungible Tokens (NFTs) to store and serve those digital assets from Storj DCS, the leading decentralized cloud storage provider.

Storj was created by Storj Labs, the brainchild of Shawn Wilkinson and John Quinn, in 2014. The company’s vision of revolutionizing cloud storage has earned it the support of venture capital firms globally, with three successful funding rounds completed. In a public crowdsale in 2014, the firm raised $460,000 worth of Bitcoin and went on to raise $3 million and an additional $30 million in 2017.

How Does Storj Work

Storj stores files in a decentralized manner by encrypting the data and splitting it into indistinguishable fractions, making it impossible for any party to access all the uploaded data. First, the uploader must compress and encrypt their file that has only one key and keep the key locally on their computer or the Bridge. The Bridge is Storj’s server that stores encryption keys for you without centralizing access to those keys. It safely stores your keys so that you can access your files from multiple devices.

The process of splitting the data is known as sharding, enabling users to download data in fragments from various sources at the same time. The pieces are sent to nodes around the world. STORJ has over 13,000 node operators worldwide, and it has grown to 39 billion object pieces. For a user to retrieve the files, only 29 pieces of files out of the 80 pieces are needed to reconstitute them to the original state for download.

Sharding makes file transfer quicker, meaning that Storj downloads work faster when compared with traditional cloud storage services like Amazon or Google Cloud. Another advantage of sharding is that the uploader is the only person who knows where all the shards are located. Storj uses a distributed hash table called Kademlia that requires a private key to discover the shards.

When you upload a file, Storj will help you set the level of redundancy you require for your file to reduce significantly the chances of losing a shard of data from your file if one of the computers gets turned off or stops running Storj.

File verification is another essential feature of Storj. It completes an hour audit by sending a request to data hosts, called farmers. Farmers receive a micropayment for storing and maintaining the file. To get paid, farmers must prove that they have the shards they’ve sent by answering the request correctly. If the farmer has changed or deleted the encrypted shard, they won’t be able to answer the request.

At the center of the Storj ecosystem is STORJ, an ERC-20 token. STORJ is used to pay for storing files, and users who want to sell their unused storage capacity and bandwidth can accept STORJ to earn extra money. The STORJ token enables easy payments and reduces users’ transaction charges and currency conversion fees. STORJ has risen exponentially in value since creation and reached a high of $3.49 in March 2021.

STORJ has a total supply of 424,999,998 and a market capitalization of $273.7 million, putting it in the category of small-cap coins. STORJ has a market dominance of 0.03% and is ranked as the 100th most prominent cryptocurrency in the market.

If you’re considering buying STORJ, get started by checking the STORJ current price on CoinStats, one of the best crypto platforms around.

How to Buy Storj

Now that you know how Storj works, here’s our simple step-by-step guide to help you in your STORJ purchase!

Step #1: Select a Cryptocurrency Exchange

Several cryptocurrency exchanges allow you to buy Storj. You’ll have to compare them to choose the one that supports Storj and has the features you want, such as low transaction fees, an easy-to-use platform, and 24-hour customer support. Also, consider if the cryptocurrency exchange allows buying Storj with your preferred payment methods, such as a credit or debit card, another cryptocurrency, or a bank transfer.

Step #2: Create an Account

After selecting a cryptocurrency exchange that ticks all the boxes, the next step is to create an account on the exchange with your email or mobile number. The requirements differ depending on the platform you pick. You will need to enter the verification code sent to your email or mobile phone to get verified and start trading.

Some exchanges might require stringent KYC and AML procedures, and you need to provide personal information like your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID to get verified. You must provide this information to be authenticated if you plan to deposit fiat currency from your bank account to purchase the Storj token.

It’s advisable to enable two-factor authentication (2FA) to keep your funds safe once you’ve verified your identity.

Step #3: Deposit Funds

The next step is to deposit funds into your account. Many exchanges will allow you to use fiat currency like USD or EUR to fund your account. Simply choose your preferred method, such as a bank transfer, Master and Visa credit/debit cards, e-wallets, wire transfer, PayPal, etc. The payment method used to buy STORJ coins will be determined by the platform, location, and preferences.

Some deposit methods are almost instantaneous, while others require a confirmation from authorities depending on the amount. Remember also to check the costs associated with different deposit methods because some attract higher fees than others.

Step #4: Buying STORJ

The process of purchasing STORJ is similar across all exchanges. Search for STORJ in the search bar, select STORJ, and click on “Buy STORJ” or its equivalent. Input the amount of STORJ or the fiat amount to be spent. Most exchanges will automatically convert the amount to let you know how much you’ll spend and how much STORJ will be obtained. Before making your purchase, double-check the details and confirm.

You can place a market order to buy STORJ immediately at the current market price. Otherwise, you can place a limit order indicating that you want to buy STORJ at or below a specific price point. The coins will only appear in your wallet if your broker fulfills your order at or below your requested pricing.

Some cryptocurrency exchanges provide peer-to-peer (P2P) platforms to let users buy STORJ from other users directly. Users must select STORJ, a seller, and a payment method. After making your selections, just click the “buy” button. After confirming the transaction, the seller releases the STORJ tokens to the buyer.

Best Exchanges to Buy STORJ

Now that you know how to buy STORJ let’s explore the best crypto exchanges for buying the asset. Although the market capitalization of STORJ is small, leading exchanges worldwide have gone ahead to list the token on their platforms after it met their stringent criteria.

1. Crypto.com

Crypto.com, founded in 2016, is a top exchange to buy and trade STORJ. The Crypto.com exchange has a high transaction volume and supports over 260 cryptocurrencies. The platform provides its 50 million users with innovative features, a mobile app on Android and Apple devices, and a wide range of deposit and withdrawal methods.

2. Coinbase

Coinbase, the largest exchange in the US, was among the first exchanges to list the STORJ token. The exchange has more than 98 million verified users in over 100 countries and maintains approximately $256 billion in assets. Coinbase allows you to trade more than 130 types of cryptocurrency. The exchange is user-friendly, with professional customer support.

Despite the decline in crypto prices and bearish sentiments in the crypto markets, the exchange is still regarded as one of the best places to buy STORJ.

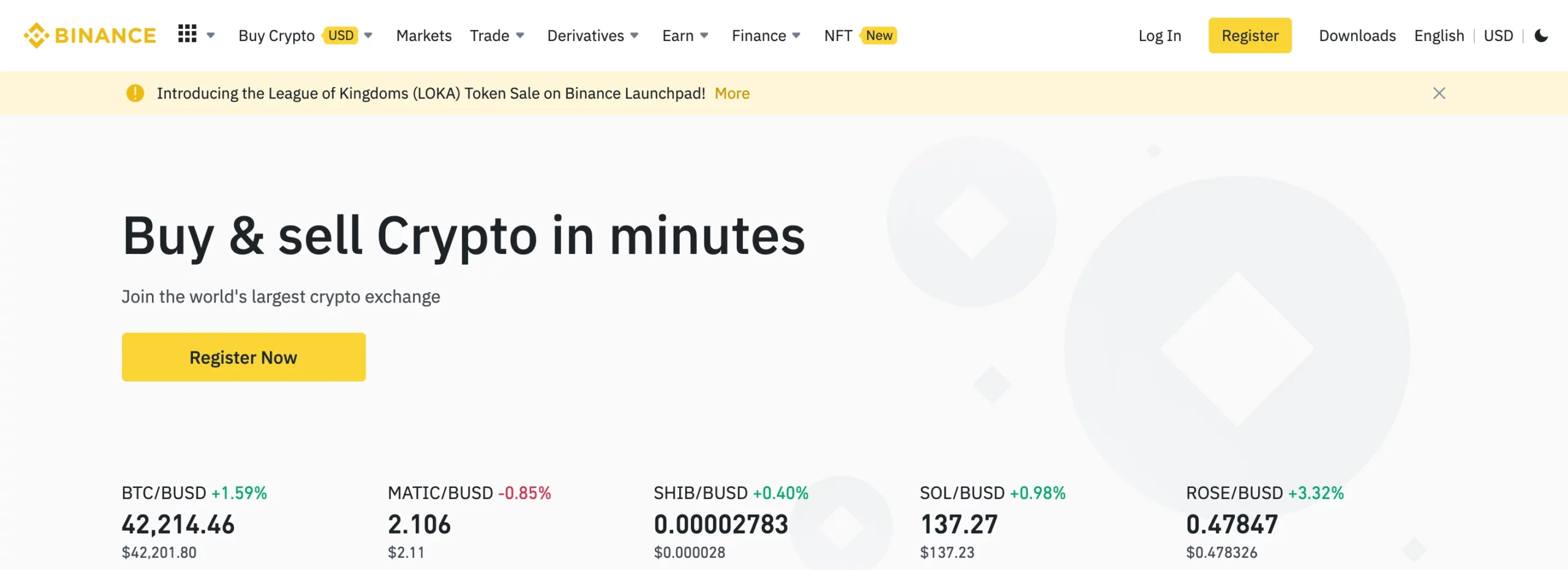

3. Binance

Binance is the world’s largest crypto exchange in terms of the trading volume. Its ease of use, lower fees compared to other exchanges, a vibrant Peer-to-Peer (P2P) platform, and high liquidity make Binance popular amongst traders and investors. If you’re interested in purchasing STORJ on Binance, you must register a Binance account first.

Unfortunately, users in the United States cannot use Binance to buy STORJ because the exchange has been banned in the US. However, you can still try Binance.US, which operates in the US, although it doesn’t offer all the advanced features of Binance global.

4.Kraken

Kraken, launched in 2011, is one of the most well-known crypto exchanges that gives you access to both huge projects and modest or new enterprises.

The exchange keeps the bulk of digital currencies in offline cold storage, and its servers are constantly monitored by military-grade monitoring.

Kraken offers a maker-taker price structure depending on the user’s degree of participation. Costs are the lowest for the most active traders and investors, making Kraken undoubtedly a better option for regular traders or investors wanting to buy STORJ.

5. KuCoin

KuCoin is a global exchange allowing both professional and amateur traders to buy STORJ through cryptocurrencies, credit or debit card, SEPA, PayPal, etc. The trading platform has high liquidity and supports a wide range of fiat currencies and 599 cryptocurrencies, making it a top pick for trades looking to buy STORJ.

Investors looking to purchase STORJ can also use exchanges like Gemini and Paybis.

How to Store STORJ

After successfully purchasing STORJ, the next step is securely storing STORJ in one of the STORJ wallets that stores the public and private keys required to make crypto transactions. While you can leave your tokens on your exchange wallet, this leaves you more vulnerable should your broker be hacked, so we highly recommend creating a private wallet with your own set of keys. There are 2 major storage options to keep your STORJ token off exchange wallets: a Software Wallet (Hot Wallet) and a Hardware Wallet (Cold Wallet). You can also use a mobile wallet that offers the ability to create various types of cryptocurrency wallets, including a Storj wallet.

Hardware Wallet

Hardware wallets, also known as cold storage, are the safest way to store your STORJ tokens. These wallets often take the form of a USB device and are non-custodial, meaning users are in total control of the private keys. They offer offline storage, thereby significantly reducing the risks of a hack, and are secured by a pin, erasing all information after many failed attempts to prevent physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. These are more suitable for experienced users who own large amounts of tokens.

A hardware wallet is more expensive than a hot wallet, with prices ranging between $50 – $200.

The best hardware wallets to store STORJ include the Ledger Nano S, Trezor Model One, and the SafePal S1.

Software Wallets

If you’re looking to trade STORJ regularly, software or hot wallets from your selected crypto exchange will suit you. Software wallets are user-friendly and free to use. They store your keys online and are therefore less secure than hardware wallets, but their ease of use makes them ideal for newbies with a few tokens.

Examples of software wallets include CoinStats Wallet, MetaMask, Coinbase Wallet, Trust Wallet, and Edge Wallet, amongst others.

Tracking STORJ With CoinStats

Cryptocurrency investors looking to take their trading to the next level will require the service of a crypto portfolio tracker to keep up with the pace of the industry. CoinStats offers one of the best crypto portfolio trackers in the market, packed with incredible features to help traders monitor all their holdings across different exchanges from one platform.

CoinStats, the leading crypto and DeFi portfolio tracker, supports over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It offers charting tools, analytical data, advanced search features, and up-to-date news. Here you have the opportunity to connect an unlimited number of portfolios (wallets and exchanges).

CoinStats, allows users to track the prices of all their crypto assets, including STORJ, across several exchanges and wallets. Users can set price alerts, set a watchlist, earn up to 20% APY, get a 24-hour cryptocurrency market report, and the latest STORJ news on CoinStats. CoinStats uses military-grade encryption to protect data and adopts industry best practices for smooth transactions.

With over 400 supported platforms, tracking your STORJ coins has never been easier. Tracking your STORJ with CoinStats is straightforward and quick. To connect, go to the Portfolio Tracker page and:

- Click Add Portfolio and Connect Wallet.

- Click the wallet you want to connect to (e.g., Ethereum Wallet).

- Input the wallet address and press Submit.

Conclusion

So now that you know how Storj works, why it’s unique, and how to buy STORJ in a few simple steps, you can decide if Storj is a suitable investment for you. You might even start using Storj to store your data or use STORJ coins for transactions on the STORJ network.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market and sensitive to secondary activity, do your independent research, obtain your own advice, and only invest what you can afford to lose. There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your own circumstances and obtain your own advice before making any investment. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.

Our information is based on independent research and may differ from what you see from a financial institution or service provider.