Analyst Suggests Staking These Altcoins to Qualify for 100 Airdrops

1

0

In the cryptocurrency market, a new strategy is emerging, promising important gains for astute investors. A renowned analyst recently shared a comprehensive guide for staking a select group of altcoins, potentially unlocking over 100 airdrops.

While this strategy is relatively untested, its potential makes it a compelling subject for investors to research and understand its practicality and prospective benefits.

Altcoins Promising Airdrops

An influential X (formerly Twitter) user, Rekt Fencer, aims to benefit from several blockchain ecosystems that promise to yield over “100 airdrops worth more than $1 million this year.” For the Celestia ecosystem, Fencer advised staking TIA through the Keplr Wallet and on MilkyWay, with a minimum stake of 2 TIA. This strategy is designed to leverage Celestia’s network growth.

“TIA Airdrops are currently generating a lot of attention. As of now, there have been 4 confirmed airdrops: Dymension (DYM), MilkyWay (MILK), Movement (MOV), and Doki (DOKI),” Fencer affirmed.

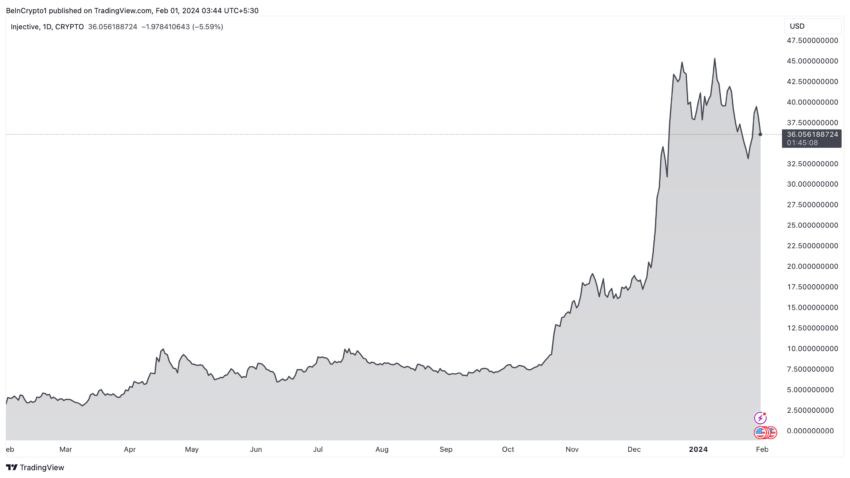

On the other hand, in the Injective ecosystem, the strategy involves staking INJ via Keplr Wallet. Fencer also recommended delegating to Black Panther and Talis Protocol, and engaging with projects like Helix and Hydro Protocol. This approach aims to capitalize on Injective’s robust trading platforms and diverse offerings.

“Injective is up 1,600% and crushing it this year, outperforming SOL, BNB, and ATOM. But when you see the ecosystem, it feels so early, and the majority of projects are still in Testnet. This is the perfect time for projects to issue their token and potentially do airdrops,” another X user, Pepesso, said.

Read more: Best Upcoming Airdrops in January 2024

Injective Price Performance. Source: TradingView

Injective Price Performance. Source: TradingView

The Cosmos ecosystem also provides a more varied strategy. It involves staking multiple tokens, including ATOM, OSMO, TIA, JUNO, SEI, and KUJI through the Keplr Wallet. This diversified approach could potentially yield rewards from several sources within Cosmos’s interlinked networks.

Meanwhile, for Pyth ecosystem enthusiasts, Fencer suggested staking a minimum of 100 PYTH on the Pyth dApp. Likewise, he recommended engaging in trading on platforms like Drift Protocol and Parcl. This method taps into Pyth’s real-time market data feed and its growing list of ecosystem projects.

“Pyth dominates as the largest and fastest-growing oracle network, fueling over 140 dApps. It’s no surprise that tokenless dApps powered by PYTH technology will use PYTH staking as a key criterion for their airdrops,” Fencer added.

More Airdrops on the Horizon

In the Eigenlayer ecosystem, the strategy includes restaking ETH on Eigen Layer and staking on platforms like Kelp DAO and Swell. Meanwhile, the Sui ecosystem strategy encompasses staking over 50 SUI on multiple platforms, including Scallop and NAVI Protocol, and engaging with dApps like KriyaDEX. This plan aims to leverage the high performance of these blockchains for significant returns.

For the Sei ecosystem, Fencer recommended staking SEI on platforms, such as Yaka Finance and Kawa, and trading on vDEX.ai. Lastly, he suggested staking over 5 APT on platforms like Amnis Finance and Pontem Lumio in the Aptos ecosystem. This strategy is designed to benefit from these scalable infrastructures and the DeFi ecosystem.

“Aptos Labs has successfully raised an impressive $350 million in two funding rounds, attracting investors such as a16z, Multicoin Capital, Coinbase, and others. Aptos has only airdropped 3% of the tokens that were reserved for the community. There are still 480 million APT tokens available for the community to claim,” another X user, Ardizor, concluded.

Read more: Earning Passive Income with Forks and Airdrops in 2024

Fencer’s guide, while extensive, requires a deep understanding of the respective ecosystems and their staking processes. Investors should conduct thorough research and consider the risks of crypto staking, including market volatility and technological uncertainties.

By following these steps, crypto enthusiasts could potentially unlock many airdrops, but caution and due diligence are paramount in navigating this high-reward yet high-risk strategy.

1

0

Tüm kripto, NFT ve DeFi varlıklarınızı tek bir yerden yönetin

Tüm kripto, NFT ve DeFi varlıklarınızı tek bir yerden yönetinKullanmaya başlamak için portföyünüzü güvenli bir şekilde bağlayın.