CLV price prediction 2025-2031: Will Clover Finance ever go back up?

0

2

Key takeaways

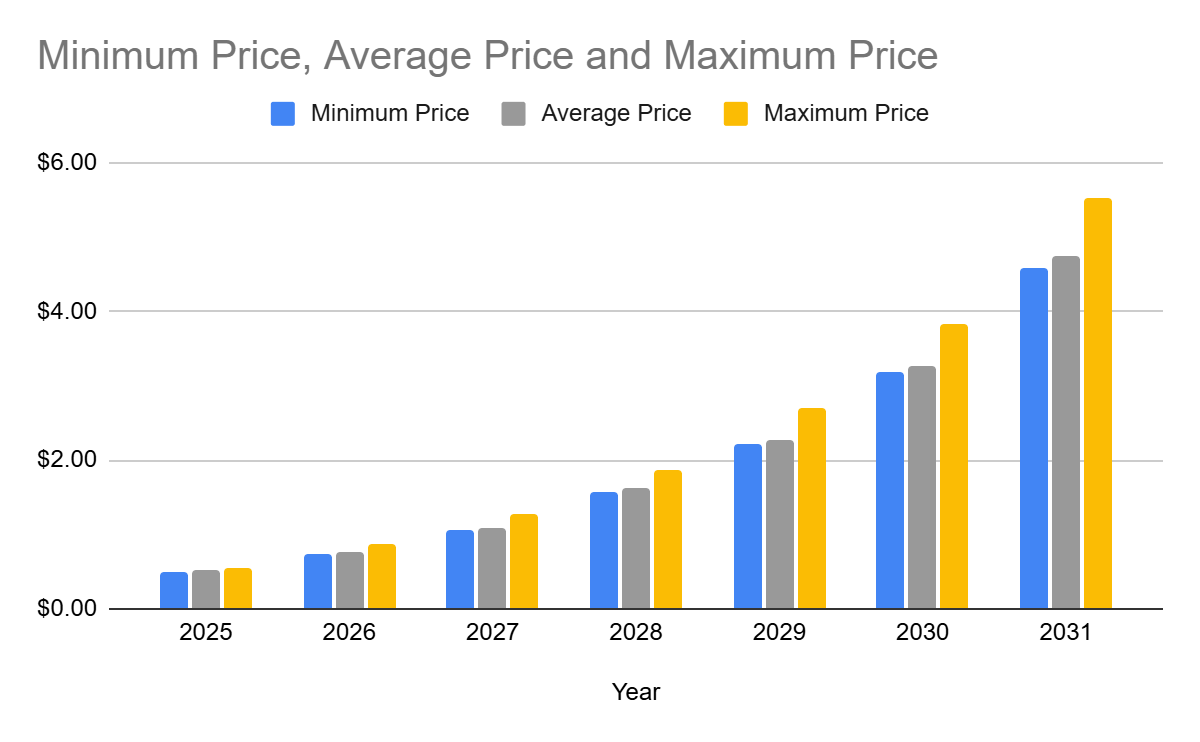

- Current CLV price prediction suggests that the coin’s price can reach $0.5605 by the end of 2025.

- By 2028, CLV may reach a peak price of $1.86 and an average price of $1.62.

- In 2031, the target price for CLV is between $4.58 and $5.52, with an average price of $4.75.

Clover Finance (CLV) is one cryptocurrency many traders are looking at, especially its future price movements and long-term potential in the cryptocurrency market. While it continues to develop its existing infrastructure and use cases, recent updates hint at a pivot from finance-based offerings to focus on powering Web3. According to its whitepaper, Clover Finance is built to simplify the DeFi experience. Different from many platforms that require gas fees in a specific native token, Clover allows users to pay transaction fees in the same token being transacted, a major usability benefit. The CLV token powers several essential functions across the network, including deploying DApps, paying fees, staking, voting, and nominating node validators.

Recently, Binance delisted the CLV/USDT trading pair on March 11, 2025, removing a major source of liquidity and contributing to a notable drop in trading activity. Due to that delisting over the past few months, there has been a sharp drop from its all-time high (ATH) of $2.17 in August 2021, a decline of over 98%.to its all-time low (ATL) of $0.01884 on July 5, 2025. These price movements raise key questions: Will CLV reclaim its previous highs? Is it heading toward a recovery in 2025 and the next several years? In this detailed Clover Finance price prediction for 2025 to 2031, we analyze market trends, current sentiment, technical indicators, and long-term forecasts to help determine if CLV offers a good investment opportunity soon.

Overview

| Cryptocurrency | Clover Finance |

| Token | CLV |

| Price | $0.02414 |

| Market Cap | $29.55M |

| Trading Volume | $2.63M |

| Circulating Supply | 2B CLV |

| All-time High | $2.17, Aug 31, 2021 |

| All-time Low | $0.01884, Jul 05, 2025 |

| 24-hour High | $0.02524 |

| 24-hour Low | $0.02383 |

CLV technical analysis

| Metric | Value |

| Price Prediction | $ 0.023947 (-0.36%) |

| Volatility | 7.31% |

| 50-Day SMA | $ 0.022372 |

| 14-Day RSI | 64.78 |

| Sentiment | Bearish |

| Fear & Greed Index | 72 (Greed) |

| Green Days | 19/30 (63%) |

| 200-Day SMA | $ 0.028413 |

CLV price analysis: Resistance holds as bullish momentum cools

- CLV declined by 4.35%, pausing its recent bullish rally near $0.02562 resistance.

- The support of clover finance is at $0.02383, which it has held during previous dips.

- Key Resistance Level is $0.02562 for CLV on the daily chart.

As of July 22 2025, the Clover Finance price stands at $0.02395, showing a drop from the previous daily close. The price touched a 24-hour high of $0.02562 before facing rejection at key resistance level. Despite recent bullish momentum, CLV price movements show signs of market volatility as it pulls back toward support at $0.02383. Technical indicators suggest weakening momentum, though the MACD remains bullish, keeping the short-term outlook optimistic but cautious.

CLV 1-day price chart shows momentum slowing as it holds neutral zone

On 1-day chart, clover finance price movements at $0.02395, after retreating from the day high of $0.02562. The MACD line at 0.00047 remains slightly above the signal line at 0.00035, suggesting weakening bullish momentum. The RSI reads 59.25, indicating that current clover finance price is at neutral territory, with no immediate signs of being overbought or oversold. Price action shows consolidation between support at $0.02383 and the resistance near $0.02562.

Clover Finance 4-hour price chart

Clover Finance (CLV) current price at $0.02403 on the 4-hour chart, showing signs of consolidation after recent volatility. The Relative Strength Index (RSI) stands at 52.17, placing the token in a clear neutral zone, with neither strong buying nor selling momentum. The MACD line is at 0.00042, slightly above the signal line at 0.00038, signalling mild bullish momentum, though the gap remains narrow. This suggests CLV is expected to continue moving sideways unless a significant shift in trading volume or sentiment occurs.

What to expect from the Clover Finance price analysis

Clover Finance’s price may continue to move sideways in the short term. The narrow MACD separation and mid-range RSI reading suggest limited momentum for a breakout. Traders should watch for a confirmed move above $0.02562 to validate renewed strength. On the downside, a break below $0.02383 could shift the Clover Finance forecast into a more bearish setup..

Is Clover Finance a good investment?

Based on the latest Clover Finance price movements, Clover Finance (CLV) shows signs of market interest. With a current price of $0.0551 and a market capitalization of $55.09 million, Clover Finance reflects steady growth within the crypto market. The 14-day Relative Strength Index (RSI) stands at 55.15, and the tightening Bollinger Bands point to a stable trading environment. While there is mild short-term bearish sentiment, the broader bullish momentum and increasing investor confidence support a positive Clover Finance forecast, suggesting the token could sustain further gains and become a potentially strong investment shortly.

Will Clover Finance reach $0.1?

Yes, analysts’ Clover Finance 2025 prediction suggests the token will exceed the $0.1 mark soon next year.

Will Clover Finance reach $0.5?

Yes, Clover Finance could potentially reach a maximum price of $0.5 by the end of this year.

Will Clover Finance reach $1?

Having attained an ATH of over $2, recapturing the $1 mark remains a possibility. However, analysts suggest this will not happen soon due to several factors.

Does Clover Finance have a good long-term future?

Yes, based on the long-term price predictions and latest data from 2025 to 2031, Clover Finance shows significant growth potential, with projected increases in minimum, average, and maximum prices each year. This suggests a positive outlook and potential for sustained growth in the cryptocurrency market.

Recent news/opinion on Clover Finance

Binance recently delisted the CLV/USDT trading pair on March 11, 2025, reducing a major source of liquidity for Clover Finance. Since the removal, CLV’s trading volume has dropped to $2.52 million, with a turnover ratio of 8.54%, signalling weakened market depth.

Clover Finance Price Prediction July 2025

The price for Clover Finance in July 2025 can range between $0.19 and $0.29. While the average trading price should be around $0.25.

| Clover Finance price prediction | Minimum Price | Average Price | Maximum Price |

| Clover Finance price prediction July 2025 | $0.19 | $0.25 | $0.29 |

Clover Finance price prediction 2025

As per the forecast price and technical analysis, In 2025 the price of Clover Finance is predicted to reach at a minimum level of $0.15. The clover finance’s value can reach a highest price of $0.5605 with the average trading price of $0.5197.

| Clover Finance Price Prediction | Minimum Price | Average Price | Maximum Price |

| Clover Finance Price Prediction 2025 | $0.15 | $0.5197 | $0.5605 |

Clover Finance price predictions 2026 – 2031

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2026 | $0.7342 | $0.7550 | $0.8691 |

| 2027 | $1.07 | $1.10 | $1.27 |

| 2028 | $1.57 | $1.62 | $1.86 |

| 2029 | $2.21 | $2.27 | $2.70 |

| 2030 | $3.18 | $3.27 | $3.82 |

| 2031 | $4.58 | $4.75 | $5.52 |

Clover Finance Price Prediction 2026

Clover Finance price is forecast to reach a lowest possible level of $0.7342 in 2026. Clover Finance

price could reach a maximum possible level of $0.8691 with the average forecast price of $0.7550.

Clover Finance Price Prediction 2027

The price of Clover Finance is predicted to reach at a minimum value of $1.07 in 2027. The Clover Finance price could reach a maximum value of $1.27 with the average trading price of $1.10 throughout 2027.

Clover Finance Price Prediction 2028

According to technical analysis on past price data of CLV, in 2028 the price of Clover Finance is forecasted to be at around a minimum value of $1.57. The Clover Finance price value can reach a maximum of $1.86 with the average trading value of $1.62 in USD.

Clover Finance Price Prediction 2029

The Clover Finance (CLV) price prediction for 2029 estimates a peak value of $2.70. The projected minimum trading price is $2.21, with an average market value projected around $2.27..

Clover Finance Price Prediction 2030

Clover Finance price is forecast to reach a lowest possible level of $3.18 in 2030. As per our findings, the CLV price could reach a maximum possible level of $3.82 with the average forecast price of $3.27.

clover finance Price Prediction 2031

The price of clv price prediction is expected to reach at a minimum value of $4.58 in 2031. The Clover Finance price could reach a maximum value of $5.52 with the average trading price of $4.75 throughout 2031

CLV market price prediction: Analysts’ Clover Finance price forecast

| Firm Name | 2025 | 2026 |

| SwapSpace | $0.03088 | $0.03212 |

| CoinCu | $2.45 | $4.09 |

| Digital Coin Price | $0.13 | $0.15 |

Cryptopolitan’s Clover Finance (CLV) price prediction

Cryptopolitan’s CLV price prediction suggests that in 2025 the price of Clover Finance is predicted to reach at a minimum level of $0.15. The clover finance’s value can reach a highest price of $0.5605 with the average trading price of $0.5197.

CLV historic price sentiment

- CLV started October 2022 at $0.08402 and dropped to $0.05227 by December, reflecting high volatility. In early 2023, it rebounded sharply, starting January at $0.05227 and rising to $0.12701 by March, driven by positive market sentiment.

- After fluctuating between $0.06340 in April and $0.05271 in June, CLV consolidated in the second half of 2023, starting July at $0.03621 and gradually climbing to $0.05820 by December.

- In January 2024, CLV opened at $0.04476 and climbed to $0.05286 by March. The following months saw fluctuations, with a peak in May at $0.06995 before dipping to $0.05271 in June due to market corrections.

- By July 2024, CLV stabilized, trading between $0.051 and $0.059. In December 2024, the price held steady at $0.059.

- As of January, CLV’s price still hovered near $0.059, showcasing a persistent lack of volatility and minimal trading activity over the six months.

- In February 2025, CLV remained flat, ranging between $0.05720 and $0.06015, continuing the pattern of narrow consolidation. March saw a slight downward adjustment, with prices moving between $0.05438 and $0.05812 amid softening market demand.

- April 2025 recorded mild bearish pressure, with CLV dipping to $0.05024, followed by a short-lived recovery to $0.05386. In May, the token briefly surged to $0.06137, supported by increased trading volume, but corrected again toward the end of the month.

- June 2025 experienced renewed selling pressure, pushing CLV to a new low of $0.01884, its all-time low on July 5, 2025, before sharply rebounding in the following weeks.

- As of July 22, 2025, CLV trades at $0.02395, marking a 27.57% recovery from the July low, but still facing resistance below the $0.026 level. The price action reflects increased market volatility, with sentiment shifting as traders await confirmation of a longer-term trend.

0

2

Управляйте всей своей криптовалютой, NFT и DeFi из одного места

Управляйте всей своей криптовалютой, NFT и DeFi из одного местаБезопасно подключите используемый вами портфель для начала.