Solana Holds Key Support as 98,000 SOL Whale Exit Unfolds

0

0

This article was first published on The Bit Journal.

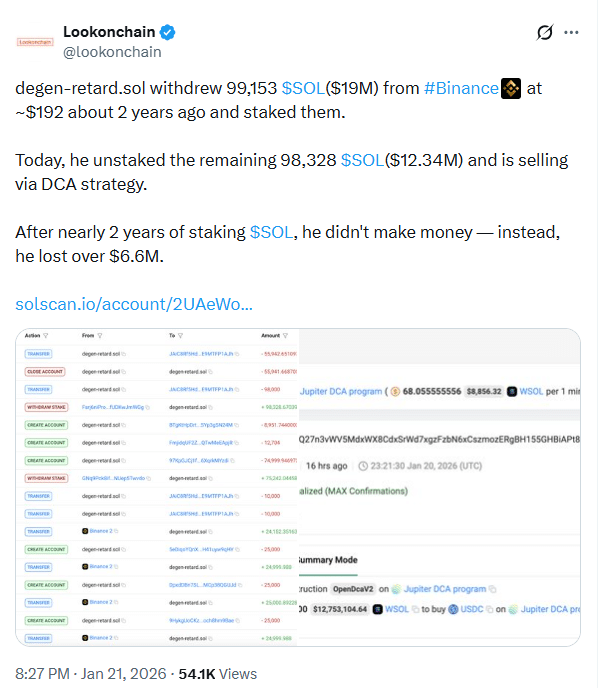

Solana price remained stuck in a tight range as a long-term staker started a slow exit. The wallet unstaked more than 98,000 SOL after nearly two years of holding.

It had originally withdrawn the tokens from Binance near cycle highs. The holder then committed the assets to staking for an extended period.

Now the exit is unfolding at much lower valuations. On-chain estimates suggest the move has locked in a realized loss of more than $6.6 million.

The seller is not dumping everything at once. Instead, the wallet appears to be using a dollar-cost averaging approach to distribute supply. This reduces shock risk. But it adds steady overhead pressure.

At the same time, buyers continue to defend key demand levels. That sets up a direct test between long-term supply and short-term demand.

98,000 SOL Unstaked in Gradual Sell-Off

A long-term holder has begun distributing a large SOL stake into the market. The wallet unstaked over 98,000 SOL and shifted from staking to selling. The exit is taking place far below the original accumulation zone.

The selling method also matters. The wallet appears to be using gradual selling rather than one large market exit. This keeps volatility contained. It also spreads supply across multiple sessions. That reduces liquidation-style spikes. But the pressure stays in place.

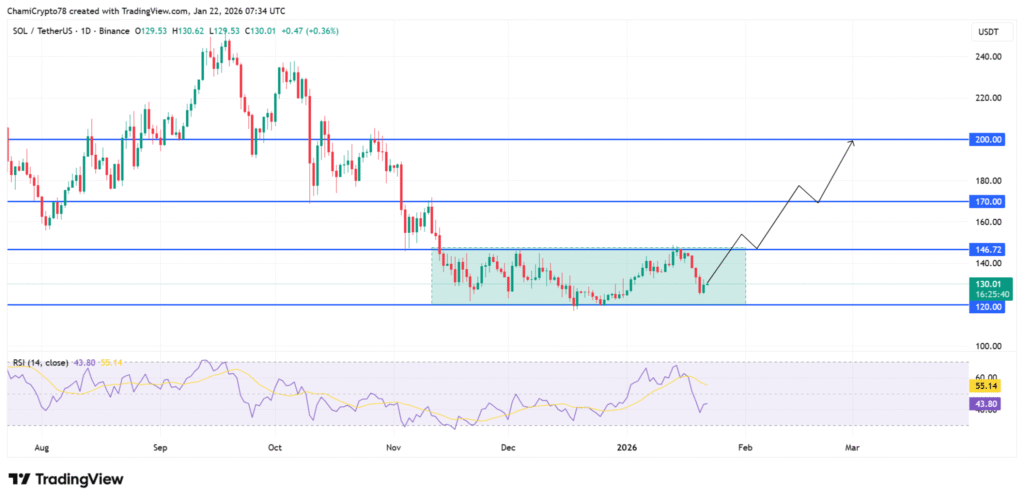

Buyers Defend $120–$125 While Resistance Stalls Near $150

Solana price traded inside a clear consolidation box at press time. Buyers repeatedly defended the $120–$125 zone. Each dip into that area triggered quick reactions. Sellers failed to push price lower for long.

However, upside attempts also struggled. Every rally toward $146–$150 lost momentum. That region matched the upper boundary of the range. It also aligned with prior rejection zones. The market continues to rotate between these levels.

This reflects balance, not trend control. The market is absorbing supply. But it has not proven breakout strength.

Range Structure Keeps Solana Compressed

The current price behavior shows compression. The market keeps printing lower volatility candles. Swings remain controlled. This often happens before expansion. But expansion needs confirmation.

Also Read: Solana vs Ethereum: Perps Volume Flip Signals Faster Risk

The $135 zone has acted as a pivot. It flipped between support and resistance in recent sessions. When price holds above it, bullish sentiment improves. When it breaks below, traders become cautious.

As long as Solana price stays inside the $120 to $150 band, the structure remains neutral. Range traders will keep buying support and selling resistance.

Whale Distribution Adds Overhead Pressure

The unstaking wallet changes the supply picture. It introduces consistent selling into rallies. Even if each sale is small, the flow adds up. The market must absorb that supply before a sustained rally can form.

A DCA exit strategy reduces panic. But it acts like friction. It makes rallies harder to sustain. Buyers may step in at support, but they still need enough demand to clear long-term supply.

This is why Solana price is struggling to expand. The range is holding, but upside follow-through remains limited.

| Month | Min. Price | Avg. Price | Max. Price | Change |

|---|---|---|---|---|

| Jan 2026 | $ 126.95 | $ 133.96 | $ 142.38 |

11.89%

|

| Feb 2026 | $ 141.73 | $ 154.23 | $ 162.30 |

27.54%

|

| Mar 2026 | $ 158.94 | $ 160.69 | $ 162.24 |

27.49%

|

| Apr 2026 | $ 152.07 | $ 156.12 | $ 160.52 |

26.14%

|

| May 2026 | $ 156.00 | $ 159.24 | $ 164.93 |

29.60%

|

| Jun 2026 | $ 144.82 | $ 150.66 | $ 155.61 |

22.28%

|

| Jul 2026 | $ 150.20 | $ 153.92 | $ 157.05 |

23.41%

|

| Aug 2026 | $ 151.36 | $ 152.73 | $ 153.57 |

20.68%

|

| Sep 2026 | $ 152.13 | $ 158.69 | $ 162.33 |

27.56%

|

| Oct 2026 | $ 153.90 | $ 155.89 | $ 158.70 |

24.71%

|

| Nov 2026 | $ 151.90 | $ 153.86 | $ 156.43 |

22.93%

|

| Dec 2026 | $ 152.26 | $ 152.61 | $ 153.03 |

20.26%

|

RSI Cools Without Confirming Breakdown

Momentum indicators point to exhaustion rather than collapse. Daily RSI rolled over after earlier strength near 70. It then drifted down toward the low-40s. At press time, RSI was near 43.8.

That reading does not signal oversold conditions. It also does not confirm strong bearish dominance. RSI remains above the 30 level, which is often linked to panic selling.

Still, RSI is struggling to reclaim the 50 midline. That level matters during consolidation. If RSI stays below 50, bullish momentum stays capped. That keeps Solana price compressed.

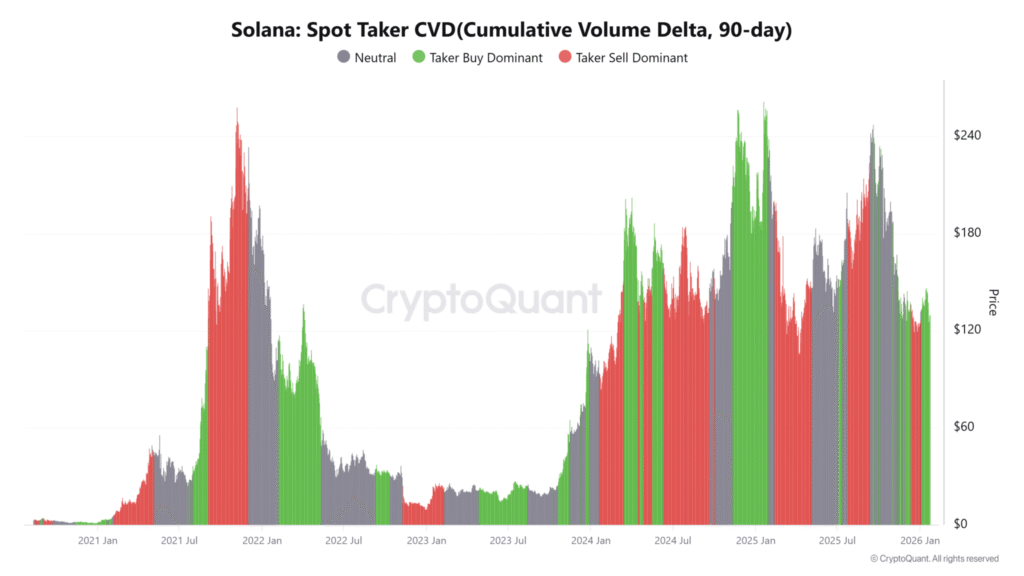

Spot Order Flow Shows Buyers Absorbing Supply

Spot taker CVD over 90 days remained buyer-dominant. This suggests aggressive buyers keep lifting offers. That matters because it shows demand is still present.

But the price has not expanded. That points to absorption. Buyers are meeting supply, but they are not chasing higher levels. The result is stability. The downside risk becomes lower. But upside momentum stays muted.

In this setup, Solana prices can stay flat for longer than traders expect. Absorption takes time. It is not an instant breakout signal.

Binance Top Traders Stay Long Despite Consolidation

Positioning data also reflects confidence. Binance top traders remained heavily long at press time. Around 80.86% of top trader accounts held long positions. Only 19.14% remained short.

That placed the Long/Short Ratio near 4.22. It shows long exposure is far larger than short exposure. The ratio has eased slightly from prior highs. But it still signals strong bullish bias.

However, positioning alone does not move price. The market still needs confirmation. Solana price must break the ceiling to validate the trader bias.

Conclusion

Solana price reflects a market absorbing distribution without losing structural support. A long-term staker has unstaked more than 98,000 SOL and started a gradual exit. The move is locking in heavy losses.

Support remains firm at $120–$125. Resistance remains strong at $146–$150. RSI is cooling, but not collapsing. Spot taker flow remains buyer-dominant. Top traders remain strongly long.

Also Read: Solana Price Forecast: $SOL Eyes Breakout After Channel Break

Appendix Glossary Key Terms

DCA Selling: Gradual selling in small parts over time.

Overhead Supply: Extra selling pressure that limits price rallies.

Consolidation Range: Sideways trading between support and resistance.

Demand Zone: Price area where buyers step in strongly.

Resistance Zone: Price area where sellers block upward moves.

RSI: Momentum indicator showing overbought or oversold conditions.

Taker CVD: Metric tracking aggressive buying versus selling volume.

Absorption: When buyers absorb selling without sharp price drops.

Long/Short Ratio: Indicator showing trader bias between longs and shorts.

Frequently Asked Questions About Solana Price

1- Why does the staker exit matter for Solana price?

It adds steady sell supply, which can cap rallies and keep Solana price under pressure during rebounds.

2- What is the key support zone?

The $120–$125 area is the main demand zone supporting Solana price.

3- What resistance must break for a bullish move?

A breakout above $146–$150 would confirm expansion in Solana price.

4- Is Solana oversold based on RSI?

No. RSI near 43.8 shows weak momentum but not oversold conditions for Solana price.

References

Read More: Solana Holds Key Support as 98,000 SOL Whale Exit Unfolds">Solana Holds Key Support as 98,000 SOL Whale Exit Unfolds

0

0

Управляйте всей своей криптовалютой, NFT и DeFi из одного места

Управляйте всей своей криптовалютой, NFT и DeFi из одного местаБезопасно подключите используемый вами портфель для начала.