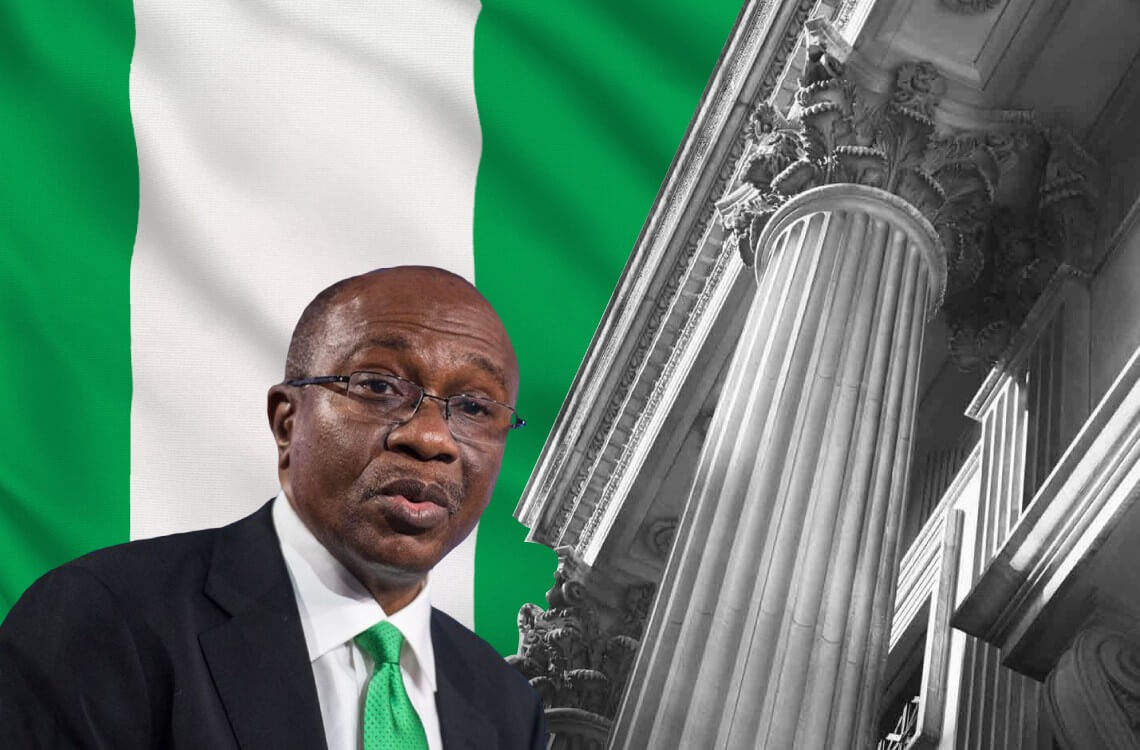

Nigeria’s Central Bank Governor: Nigerian Banks not directly linked to Silicon Valley Bank

2

0

The Central Bank of Nigeria’s Governor recently reported that a review of Nigerian banks’ bond portfolios revealed no direct exposure to Silicon Valley Bank. Furthermore, the governor stated the bank has established stringent guidelines to ensure a secure banking system within the country.

Nigerian Banks’ Bond Portfolios Revealed No Direct Exposure to Silicon Valley Bank (SVB)

At a meeting of the Central Bank of Nigeria’s (CBN) monetary policy committee, Governor Godwin Emefiele reported that an in-depth review of Nigerian banks’ bond portfolios revealed no direct exposure to Silicon Valley Bank (SVB). He further asserted that the CBN’s stringent prudential guidelines help to ensure that only sound financial institutions are allowed to remain in operation. The guidelines take into consideration various factors, including the average non-performing loans (NPL) ratio of 4.2%, capital adequacy ratio of 13.7%, liquidity and loan-to-deposit ratios of 43% and 52% respectively, which suggests that Nigerian banks are “very safe”.

In a recent statement, Emefiele further emphasized that the CBN has, and will always prioritize bank customers, stressing that no Nigerian depositor has lost money to a failed bank since 2003. “We would rather dispose of shareholders than make our depositors lose their money,” he said.

2

0