The 5 key pillars of a strong crypto portfolio for 2025/2026

The 5 key pillars of a strong crypto portfolio for 2025/2026

Meta description: CoinStats’ article explores the 5 fundamentals of building a solid crypto portfolio, to maximize the potential returns of the 2025-2026 crypto market cycle top.

Meta headline: The 5 key pillars of a strong Crypto Portfolio for 2025/2026

The end of 2025 is flashing a unique opportunity for cryptocurrency investors, who are positioned on the right side of the trend.

Choosing the best-performing token out of over 20 million coins is nearly impossible. Yet, most professional traders agree on the same principles of a balanced crypto portfolio allocation.

Understanding the key fundamentals of a balanced portfolio will help you navigate the volatility of the crypto market and maximize your chances of making life-changing returns on your investments.

This CoinStats article will help you construct the best-performing crypto portfolio for the end of 2025 and the beginning of 2026, based on the 5 key pillars of digital asset investment.

5 key fundamentals to maximize your crypto portfolio for 2025 – 2026

1: Investing on the right side of the institutional trend

Finding projects with long-term, sustainable growth drivers from organic blockchain utility is the way to build wealth — more reliably than expecting to catch the next Bitcoin or 1,000x gem before everyone else.

Focusing on high-growth areas is crucial for capturing the most upside of the remaining bull market.

Looking at the current global trends, institutional investors are showing interest in Bitcoin and Ethereum thanks to the spot ETFs and corporate treasuries, select altcoins through blockchain participation, as well as stablecoin and payment-based crypto projects due to emerging United States regulation, such as President Trump’s unprecedented GENIUS Act.

Source: CNBC

Institutional capital comes in a price-agnostic, steady trickle, not emotional bursts of interest that die along with short-term investor sentiment. This type of capital can help projects sustain multi-year growth periods and offer a robust investment signal for your portfolio.

Following the institutional money trail can help you find the investment opportunities with the biggest long-term growth prospects.

Source: CoinStats

Ether’s corporate treasury-driven rally during the summer of 2025 was a great example of institutional trendspotting.

Ether’s price skyrocketed by over 70% in just 3 months since May 27, 2025, when SharpLink Gaming officially announced the establishment of its corporate Ethereum treasury strategy.

Meaning that if you had bought 1 ETH token for below $2,600 by May 27, your investment would be worth over $4,470 at today’s price, a 70% gain in 3 months, just by looking at institutional flows.

Source: SharpLink

But timing the market and aligning with the right side of the wider global macroeconomic cycle is even more important than finding the right token.

2: Timing the market cycle via macroeconomic indicators, historical patterns

Knowing during which faze of the market cycle you’re investing is crucial, both for traditional and digital asset returns.

This is because both equities and cryptocurrency market momentum are dictated by the same fundamental investor emotions – fear and greed – in the same 4-year cyclical pattern observed during the 18th-century rice futures market by Munehisa Honma, the trader most associated with the multi-year cycle theory.

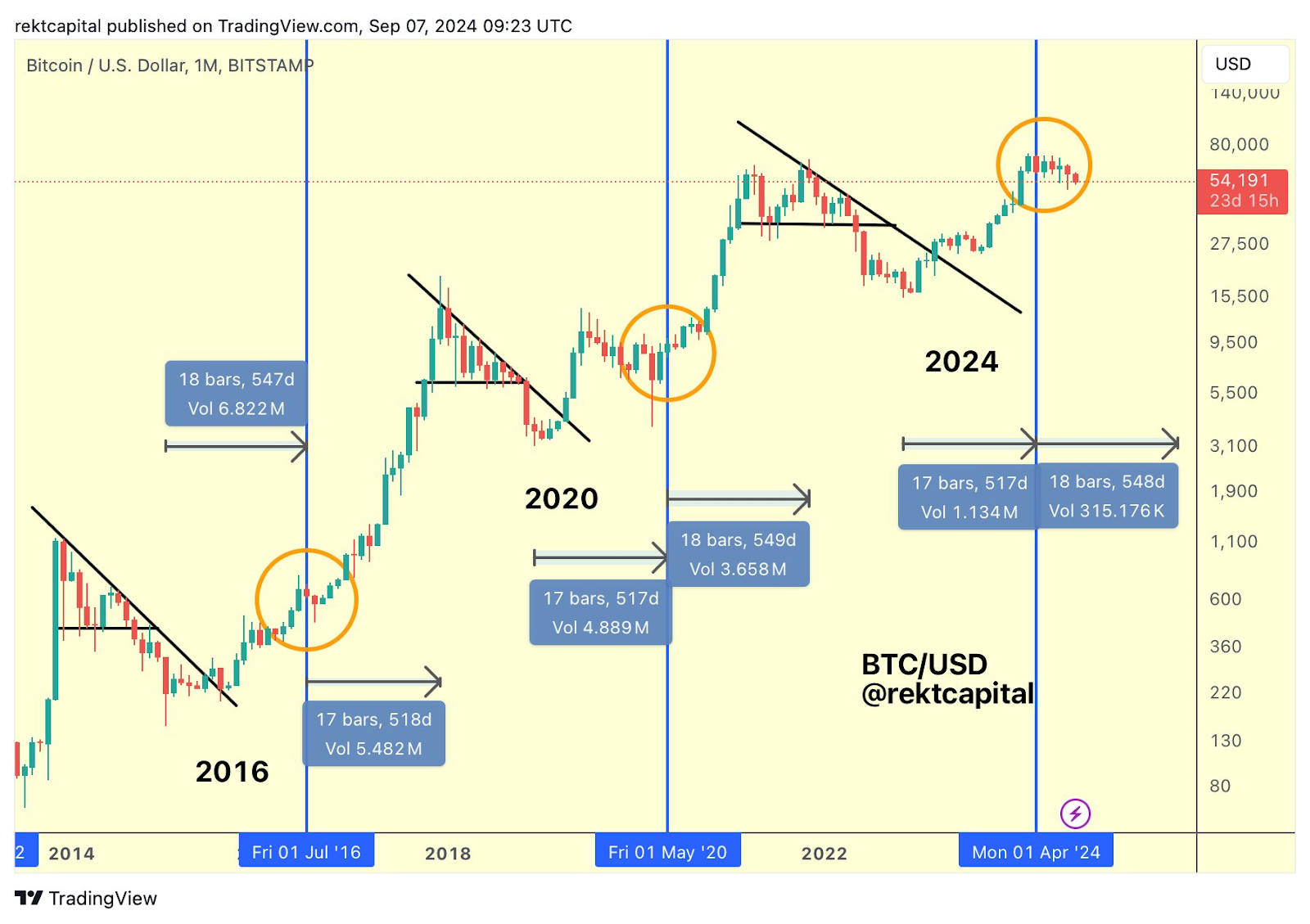

Determining the exact market cycle for digital assets is relatively simple by looking at Bitcoin’s historic patterns.

During the past bull cycles, Bitcoin reached its cycle top 525 days or 549 days after the halving, and in just 367 days after the first halving in 2012. Meaning that on average, Bitcoin’s price tends to peak about 480 days after the previous halving event, which cuts the block issuance reward by half.

If historical patterns hold up, this current cycle will see a Bitcoin top in mid-September or mid-October 2025, according to some of the industry’s most popular analysts, such as Rekt Capital.

Source: Rekt Capital

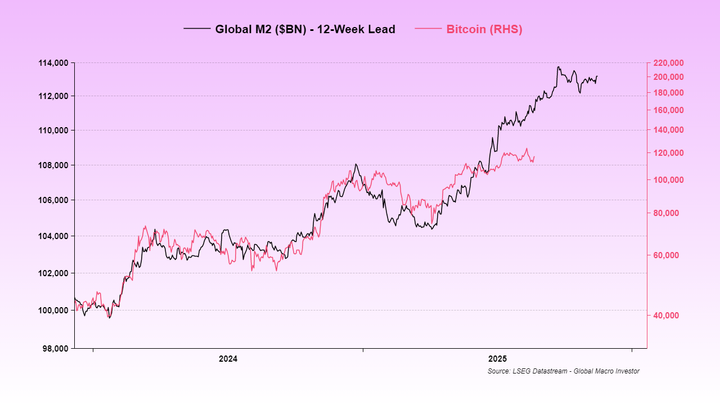

Following other key macroeconomic indicators, such as the United States M2 money supply, may also help you position yourself on the right side of the trend.

This is because Bitcoin’s price has historically benefited from growing money supply, as the increasing money printing and inflation are catalyzing a new wave of institutional demand for hedges against financial debasement.

Source: Raoul Pal

To date, the M2’s correlation with Bitcoin serves as one of the most accurate indicators that signal Bitcoin’s movement patterns with an approximately 12-week delay.

Moreover, identifying the time of the market cycle can help you figure out the ideal portfolio allocation between major cryptocurrencies and altcoins, which brings us to the third key pillar of portfolio management.

3: Portfolio balance based on investor risk-tolerance

Portfolio diversification can help you capture more of the holistic upside of the cryptocurrency industry by having exposure to more of the leading projects.

In most cases, a portfolio allocation of 50% into Bitcoin and 25% into Ether is a great fit for more risk-averse investors looking for exposure to the industry’s two leading cryptocurrencies.

But as discussed above, the Bitcoin cycle is nearing its historic price top, meaning that BTC may not have as much upside this cycle as other cryptocurrencies.

Ether, on the other hand, has barely just surpassed its old all-time high, prompting many new investors to switch it up for the rest of the cycle — reducing their Bitcoin exposure to 25% and allocation up to 50% to Ether, the crypto market’s ‘digital oil.’

For more risk-tolerant investors looking for more upside, a 25% Bitcoin and 25% Ether allocation may be the best fit to capture the movement of the leading coins, with another 45% into altcoins and more speculative investments.

As for the best altcoin picks leading into 2026, look for the tokens that are awaiting an ETF approval with the SEC.

Leading tokens with pending ETF filings include Solana, XRP, Litecoin, Cardano, Chainlink, Avalanche, and the Dogecoin meme token.

4: Investing in high-risk digital assets, memecoins: the remaining 5%

Memecoins can be a great portfolio diversifier for investors with a higher risk tolerance, seeking to maximize upside.

A 5% allocation into the leading memecoins, including Dogecoin, Shiba Inu, or Pepe, can help capture the speculative waves of the market cycle, which usually rotate into memecoins after Bitcoin and altcoins have peaked at new all-time highs.

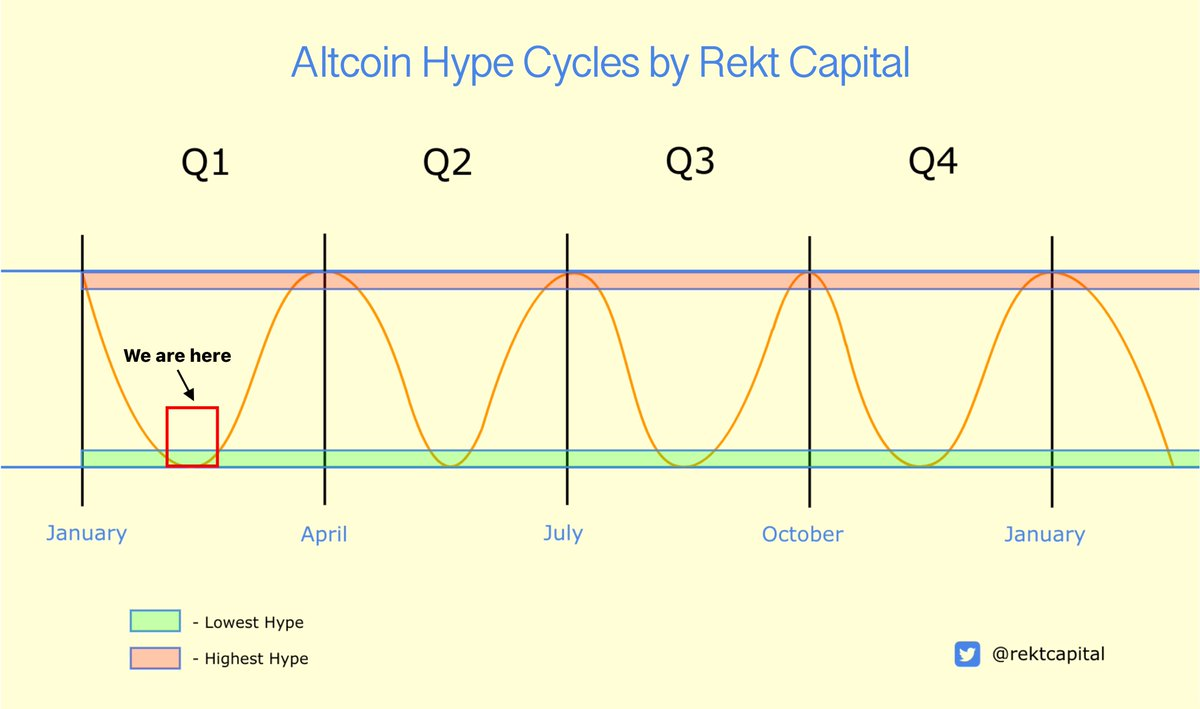

Looking at historic 4-year cycle patterns, the altcoin season begins its parabolic growth in September, lasting between 3 to 6 months, before the profits at the cycle top of the altcoins flow into more speculative meme tokens.

Source: Rekt Capital

However, the 2024-2025 market cycle saw multiple isolated memecoin runs before altseason, including the PEPE token’s explosive 1,200% rally during February and March of 2024.

5: Protect your savings: hedging for the market correction via stablecoins or RWAs

While thinking about the upsize is crucial, protecting your hard-earned profits is even more important, as the bull cycle eventually cools off.

Setting a realistic exit strategy consistent with Bitcoin’s historic cyclical behaviour is crucial to lock in profits and protect your investments from the next bear market, which will eventually happen.

Near the market top, aim to lock in profits and rotate into stablecoins, which are immune to the downside volatility of the bear market and protect your purchasing power from corrections or unexpected black swan events.

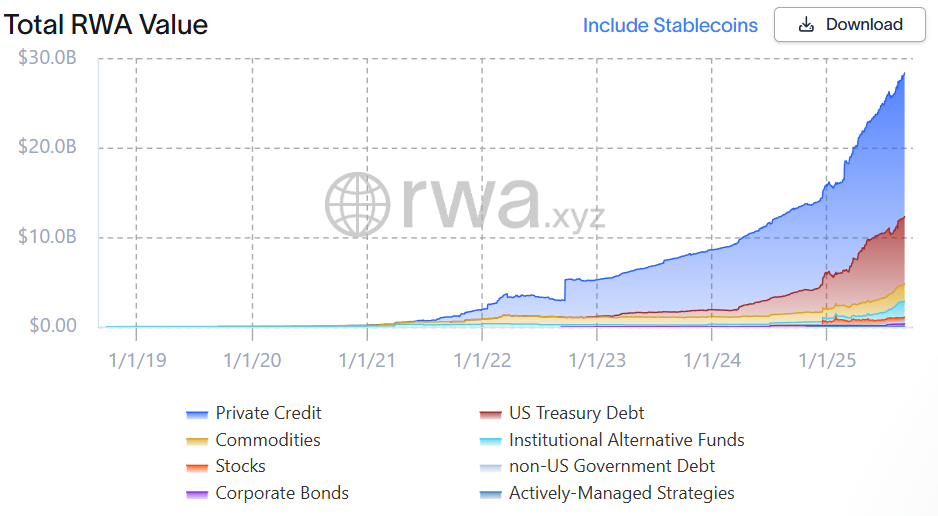

Investing in tokenized RWAs can offer additional safe-haven asset options, including tokenized gold and tokenized US Treasury bills, which offer a passive yield to holders, much like their traditional counterparts.

Source: RWA.xyz

Position your portfolio for the 2025/2026 market peak

Amid ongoing debates about the length of the current cycle, it remains impossible to time the exact market top, nor should you try.

Timing the market is impossible, but building a balanced digital asset portfolio will make sure you’re ready to benefit from the next cycle top, regardless of when it comes.

CoinStats’ 5 key principles aim to help you maximize the upside of the incoming crypto market cycle top and help you identify the right time to rotate your profits into stablecoins, to protect your investments from the next bear market.