How to Buy Binance Coin (BNB)

BNB refers to Binance Coin, which is the token used in the Binance cryptocurrency exchange. It is issued on the Binance cryptocurrency exchange, with its trading symbol being BNB. Having initially run on the Ethereum blockchain, it is now native to the Binance Smart Chain. If you want to learn how to buy Binance coin or BNB read on!

Binance coin has a total of two hundred million tokens available in the network. Today, it is the most popular and the largest crypto exchange globally, backed up by a truly impressive efficiency rate of over one million transactions every second.

Binance exchange makes use of one-fifth of its overall profits to burn its Binance coin holdings four times annually, i.e. every quarter. The most recent burn took place on the 15th of April, 2021 where 1,099,888 Binance coins were burned. To put this in perspective, the dollar equivalent of these tokens is a little over half a billion dollars.

Follow our step-by-step buying guide below to buy BNB tokens:

Step #1: Select a Crypto Exchange

Visit the market page on CoinStats to view the exchange platforms supporting BNB tokens. Compare the exchanges’ security, user experience, fee structure, supported crypto assets, etc., to choose the one with the features you need, such as affordable transaction fees, top-notch security, high trading volume, an intuitive platform, round-the-clock customer service, etc. Also, consider whether the cryptocurrency exchange is regulated by the Financial Industry Regulatory Authority (FINRA) and allows you to buy crypto using your preferred payment method.

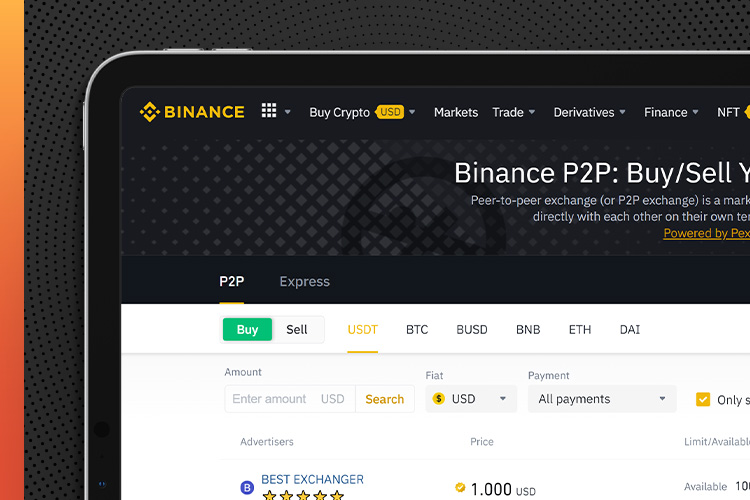

To trade cryptocurrencies, you must use a centralized or decentralized crypto exchange, so let’s look into the details of each type below.

Centralized Exchange

A centralized crypto exchange or CEX, such as Coinbase, eToro, Binance, etc., functions as a middleman between buyers and sellers and charges specific fees for using their services. Most crypto transactions are conducted on centralized exchanges, allowing users to buy and sell cryptocurrencies for fiat currencies such as the US dollar or digital assets like BTC and ETH. Centralized exchanges require their users to follow KYC (know your customer) and AML (anti-money laundering) rules by providing some information and personal identification documents. However, the drawback of trading on a CEX is that it’s highly vulnerable to hacking or cybersecurity threats.

Decentralized Exchange

On the other hand, a decentralized exchange (DEX), like Uniswap, SushiSwap, Shibaswap, etc., is a non-centralized alternative to a centralized exchange and isn’t governed by any central authority. Instead, it operates over blockchain and charges no fee except for the gas fee applicable on a particular blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use smart contracts to let people trade crypto assets without needing regulatory authority. They deploy an automated market maker to remove any intermediaries and give users complete control over their funds. This method is safer since no security breach is possible. However, decentralized exchanges are less user-friendly in terms of interface and currency conversion. For instance, they don’t always allow users to trade crypto with fiat currency; users have to either already own crypto or use a centralized exchange to get crypto. Another drawback of decentralized exchanges is that it has failed to achieve liquidity levels comparable to centralized exchanges. It also takes longer to find someone looking to trade with you as DEX engages in peer-to-peer trade, and if liquidity is low, you may have to accept concessions on price and quickly sell or buy low-volume crypto.

You can list anything on a DEX, which means you have access to new, in-demand assets while also taking on more risk.

Step #2: Create an Account

After you’ve chosen a cryptocurrency exchange that suits your investment needs, you must register with the exchange using a valid email or mobile number. A link will be sent to your address, and you must click it to verify your account. Once the account is activated, you must create an elaborate password, and you’re good to go.

Some exchanges have strict KYC and AML requirements, and in order to get verified, you must provide personal information such as:

- Full name

- Residential address

- Date of Birth

- ID Document.

In some cases, you might also need to upload a selfie or undergo video verification to finalize the verification process.

Once your identity verification is complete, it’s recommended to activate two-factor authentication (2FA) for an extra layer of security.

Step #3: Deposit Funds

The next step is to deposit funds into your account. Many crypto exchanges support fiat currencies like USD, EUR, etc. Simply select your preferred deposit method, such as a bank transfer, wire transfer, credit or debit card, e-wallets, PayPal, etc., and the currency you wish to deposit. Tap on “Deposit Funds,” enter the amount you want to deposit and click “Deposit.”

Some deposit methods are extremely fast, while others, depending on the amount, require confirmation from authorities. Remember to evaluate the fees of different deposit methods since some have larger fees than others.

- Credit or Debit Card

Linking your debit card to your crypto account is advantageous as it lets you make instant or recurring purchases, but be aware that it attracts an additional fee.

- Bank Account

It’s usually free to make a bank transfer from your local bank accounts, but you should still double-check with your exchange.

- Cryptocurrency

BNB tokens can be traded for another cryptocurrency or a stablecoin; the trading pairs vary between exchanges. So, you must search for BNB on the spot market to select a pair from the list of available trading pairs.

Step #4: Buy BNB

Follow the steps below to place a market order to buy BNB instantly at the current market price:

- Click the search bar, enter BNB, and select “Buy BNB” or the equivalent.

- Select a trading pair you wish to buy BNB against

- Choose the payment method, the currency you wish to use, and input the amount of BNB or the fiat amount to be spent. Most exchanges will automatically convert the amount to show you how many BNB tokens you’ll get.

- Double-check the transaction details and click “Confirm.”

- The BNB tokens will be displayed in your balance once the transaction is processed.

You can also place a limit order indicating that you want to buy BNB at or below a specific price point. Your broker will ask you the number of coins you wish to acquire and the maximum price you’re ready to pay for each once you’ve placed an order. The coins will only appear in your wallet if your broker fulfills your order at or below your requested pricing. The broker may cancel your order at the end of the day or leave it open if the price increases over your limit.

If you’re planning to keep your newly purchased coins for an extended period, we highly recommend securely storing them in a hardware wallet.

To trade BNB on spot markets, go to the Trade page and search for the BNB pairs ( BNB/USD or BNB/USDT). Select the trading pair and check the price chart. Click “Buy BNB,” select the “Market,” enter your amount or choose what portion of your deposit you’d like to spend by clicking on the percentage buttons. Confirm and click “Buy BNB.”

Congratulations on adding BNB tokens to your crypto portfolio!

How to Buy BNB on CoinStats?

Did you know that you can buy BNB directly on CoinStats with 0 additional fees? It’s super quick and secure and allows you to buy crypto with your credit card right where you track and manage it. Here’s how you can buy BNB on CoinStats on web and mobile in a few simple steps.

- Head over to the CoinStats homepage

- Navigate to the Cryptocurrencies tab in the menu bar above and pick your desired cryptocurrency.

- Click Buy Crypto

- Select a portfolio or add a wallet address where the funds will be deposited

- Choose MoonPay as the provider

- Add the credentials of your payment method

- Complete the payment

Store BNB

While your BNB tokens can be stored in your brokerage exchange wallet, experts highly recommend storing your precious coins away from exchange wallets, as those might be susceptible to hacks and interference.

We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets:

Software Wallets

If you’re looking to trade BNB regularly, software or hot wallets provided by your selected crypto exchange will suit you. The strength of software wallets lies in their flexibility and ease of use. A software wallet is the most easy-to-set-up crypto wallet and lets you easily interact with several decentralized finance (DeFi) applications. However, these wallets are vulnerable to security leaks because they’re hosted online. So, if you want to keep your private keys in a software wallet, conduct due diligence before choosing one to avoid security issues. We recommend a platform that offers 2-factor authentication as an extra layer of security.

Examples of software wallets include CoinStats Wallet, MetaMask, Coinbase Wallet, Trust Wallet, and Edge Wallet, amongst others.

Hardware Wallets

Hardware or cold wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. These are more suitable for experienced users who own large amounts of tokens.

Ledger hardware wallets are arguably the most secure hardware wallets letting you securely manage your digital assets. The Nano X is designed for advanced users and offers more storage space and advanced features than Ledger Nano S, designed for crypto beginners.

A hardware wallet is more expensive than a hot wallet, with prices ranging between $50 – $200.

Examples of cold wallets are Trezor Model T, Ledger Nano X, CoolWallet Pro, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

Bonus Step: Track BNB Tokens

The crypto market is volatile, and managing your portfolio could get tricky if you hold multiple assets. Utilizing a portfolio tracker will help you keep track of your BNB tokens and all your crypto investments from one platform at all times. CoinStats offers one of the best crypto portfolio trackers in the market; you can find more information here.

You can also monitor the profit, loss, and liquidity of BNB across several exchanges on CoinStats.

CoinStats supports over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It offers charting tools, analytical data, advanced search features, and up-to-date news. Here you have the opportunity to connect an unlimited number of portfolios (wallets and exchanges), including:

- Binance

- MetaMask

- Trust Wallet

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To connect, go to the CoinStats Portfolio Tracker page and:

- Click Add Portfolio and Connect Wallet.

- Click the wallet you want to connect to (e.g., Ethereum Wallet).

- Input the wallet address and press Submit.

History and Overview of Binance Coin

The word Binance is derived from the two words Finance and Binary. Today, Binance is one of the leading cryptocurrency exchanges in the world, with its Binance coin the preferred utility token for the exchange. BNB Coin is used in the form of an intermediary with trades involving fiat currency and other cryptocurrencies.

The history of Binance and its respective Binance Coin can be traced back to 2017 when Chinese founder ChangPeng Zhao established Beijie Technology, the company managing and running the Binance crypto exchange. The company has its headquarters in the Hong Kong province of China.

In the creation of the exchange platform, the founder and his team of developers created the Binance Coin token, raising sufficient funds via an Initial Coin Offering (ICO). This ICO lasted for up to one month, with around fifteen million dollars raised as a result. The resulting funds were channeled into startup expenditure e.g. paying new developers, marketing, and securing the exchange platform’s servers.

A truly innovative creation, Binance Coins quickly grew in popularity thereafter. There was a 50% reward for users who purchased the token, using it as a tender for trading fees. On the exchange, Binance Coins are burnt periodically, reducing supply and automatically increasing value.

What Can You Do With Binance Coin

Binance coins are some of the most popular crypto tokens in existence today. As a cryptocurrency, it can be used for a variety of purposes:

- Binance Coin can be used to finance trading fees on the Binance Smart Chain, Binance DEX, and Binance.com

- It can be used to pay transaction fees during coin conversion, e.g. converting Bitcoin to Litecoins.

- Binance Coin can be used to make payments on Crypto.com, HTC, and Monetha. Payments can also be made for the purpose of booking travel accommodation on sites like TravelbyBit. In addition, you can access loans, e.g. via ETHLend.

- You can also buy Binance Coin and use it to make charitable donations.

How Does Binance Coin Work

It makes use of ERC20 tokens and is created on the Ethereum blockchain. Tokens cannot be mined, however, because the Initial Coin Offering ensures that all of the tokens have been distributed and pre-mined.

Traders use Binance coins to pay transactions fees on the network, while its developers use them to generate computing power for apps on Binance’s network- Binance Smart Chain.

In fact, this Smart Chain is what makes Binance Coin unique from other trading tokens across different crypto exchanges.

The network is programmable and executes smart contracts, serving as a platform for other cryptocurrencies and apps.

How to Buy Binance Coin if You Do Not Have Crypto

If you do not have crypto at all, you will have to buy some before you can buy actual BNB because the Binance exchange does not use fiat currencies such as the dollar. Since it is your first crypto purchase, you will do well to purchase a stable one, e.g. Bitcoin and Ethereum.

To do this, however, you will have to acquire it from an exchange platform that is legal in your country. An example of a good one is Coinbase. Coinmama is also ideal. After acquiring, you can then follow the steps highlighted in the previous section in order to buy Binance Coins.

Why Should You purchase Binance Coin

Now that you know how to buy Binance Coins, there is a chance that some of the, ahem, doubting readers are still unsure whether to delve in or not. If you’re not certain, here are four reasons why BNBs are a good investment for you:

- Cost: Binance Coins have a low price compared to that of other coins. Trading on the Binance crypto exchange is also quite easy.

- Demand and Supply: In any digital exchange, what determines the value and growth of a token is its demand and supply. As its popularity increases, so does the supply decrease, thus increasing its value.

- Reputation: Most investors prefer to subscribe to trustworthy coins, as they cannot afford to lose coins and make significant losses. Binance is one of the most trusted cryptos as it is easy to operate. The withdrawal threshold of $30,000 is also very appealing.

- Exchange Versatility: Other than its obvious use as a valuable token, its parent exchange platform, Binance, allows you to make currency exchanges with many other tokens, e.g. Cardano, Bitcoin Cash, ChainLink, Litecoin, Ethereum, EOS, VeChain and Cosmos.

- Participation in ICOs: Binance Lauchpad hosts the sales of new tokens that can be purchased using Binance Coins, prior to when they are available to trade on Binance exchange.

Conclusion

Binance Coin is rather very promising, seeing how its success does not rely on it being an alternative cryptocurrency. As a cryptocurrency, it can be used to power applications and generate computing power for the network.