Arthur Hayes Predicts: Bitcoin to $250K and Dogecoin’s Rise

0

0

Former BitMEX CEO Arthur Hayes shared bold predictions about Bitcoin and Dogecoin during an interview with Alpha First. Discussing global economic trends and potential policies under Trump’s administration, Hayes offered insights into how these factors could shape the crypto market over the next 12 months.

Bitcoin Could Surge Amid Economic Shifts

Hayes believes that Trump’s potential focus on monetary expansion and increased credit distribution could lead to significant inflation in the U.S. Such a scenario, he argues, would benefit Bitcoin, which has already outperformed traditional banking assets.

He noted that nationalist economic policies are not unique to the U.S. Countries like China and Japan are also emphasizing internal growth, creating a favorable environment for decentralized assets. As people move away from globalization, Hayes predicts that Bitcoin will thrive in this evolving economic landscape.

Diversification Beyond Bitcoin

While Bitcoin remains dominant, Hayes emphasized the importance of exploring other asset classes within the crypto market. He highlighted that as Bitcoin’s price rises, investors often shift to meme coins, NFTs, Layer-1 and Layer-2 solutions, and gaming-related tokens to maximize their gains.

“Bitcoin leads the market,” Hayes said. “Then everyone starts investing in everything else, because, at the end of the day, the goal is to accumulate more crypto—not to go back to fiat, which I know is fundamentally worthless.”

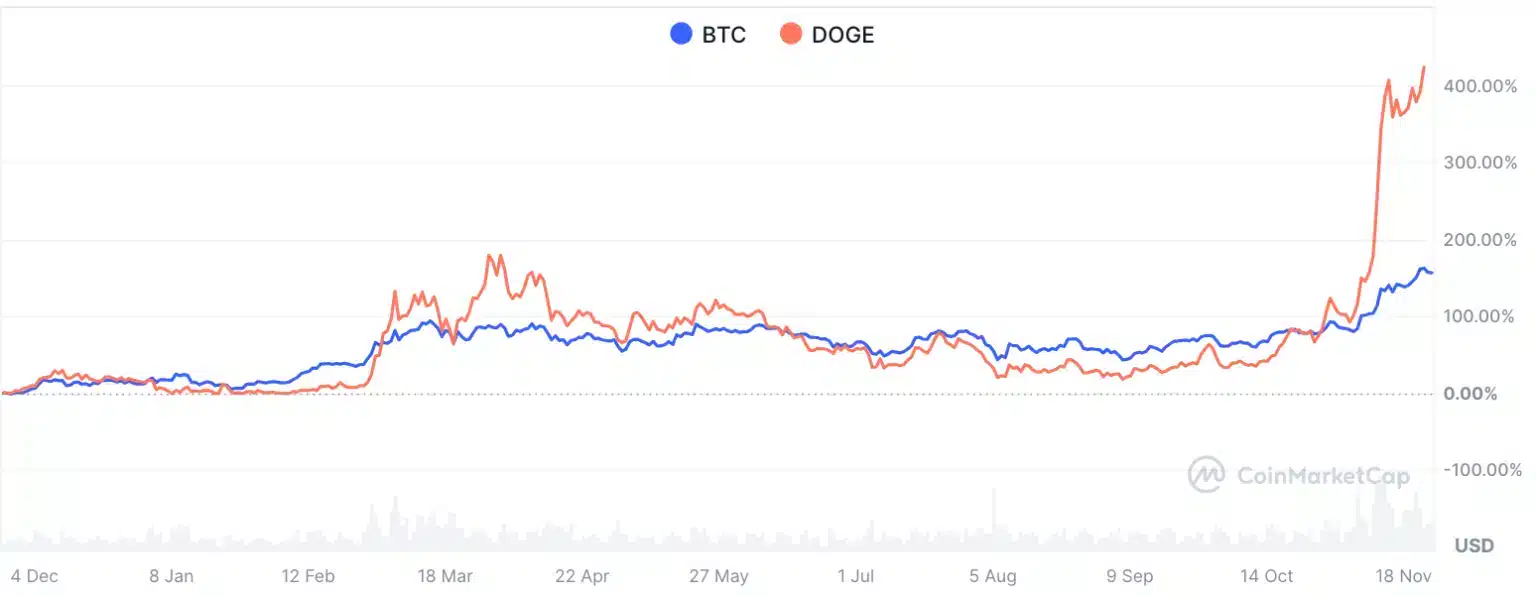

Dogecoin’s Potential and Meme Coins’ Volatility

Hayes also touched on the excitement surrounding meme coins, driven by their rapid price movements. He pointed to Dogecoin’s ability to reach a $2 billion market cap in just nine days, fueled by speculative hype. Hayes suggested that Dogecoin could reach $1, although he acknowledged the inherent volatility of such assets.

“I wish I had bought some Dogecoin—it’s ‘so good,’” he joked, adding a warning about staying disciplined and avoiding emotional decisions in the speculative market.

Bold Bitcoin Forecast

Hayes remains optimistic about Bitcoin’s long-term trajectory. He projects Bitcoin will reach $100,000 by the end of 2024 and potentially hit $250,000 by late 2025, driven by increasing institutional interest and capital inflows from traditional finance sectors.

Advice for Investors

Drawing from past market cycles, Hayes advised investors to take profits during significant gains and avoid being swayed by emotions. “There’s always time to re-enter the market,” he said, encouraging both new and experienced investors to stay cautious and strategic in their decisions.

The Bit Journal will continue to provide updates on Arthur Hayes’ predictions and their implications for the crypto market.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.