Bitcoin Price Walks Tightrope as ETF Cost Basis Sits at $84K

0

0

This article was first published on The Bit Journal.

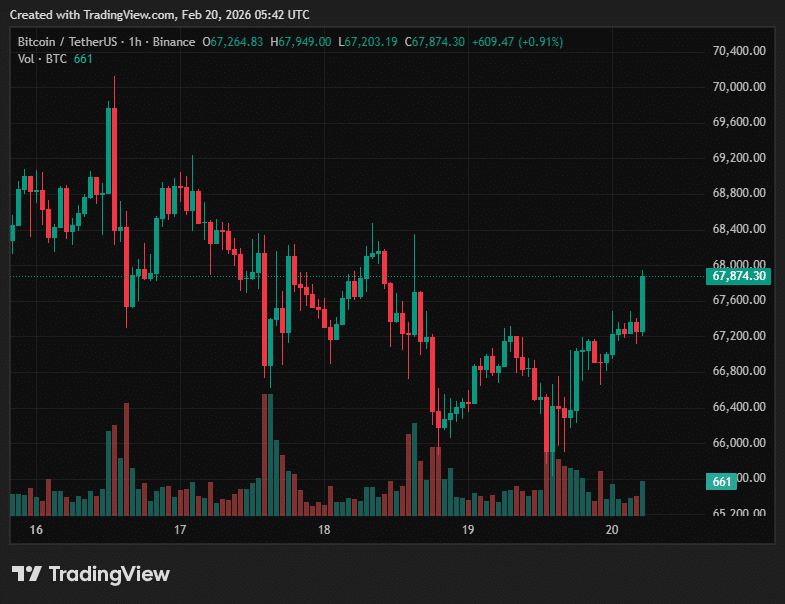

Bitcoin price is walking a tightrope near $67,000, and the market feels the strain. After slipping below $66,000 during early U.S. trading, Bitcoin price regained footing and stabilized above a key support level. The rebound avoided a breakdown, yet the mood remains cautious rather than confident.

According to the source, traders in derivatives markets are actively buying protection against another drop, a signal that fear still lingers beneath the surface.

Recent figures from this live market tracker show Bitcoin price trading around $67,874, up roughly 1.6% in 24 hours. However, the broader crypto complex failed to rally with equal strength. That divergence tells a deeper story about risk appetite.

Altcoins Stall While Bitcoin Price Holds the Line

While Bitcoin price steadied, Ether, XRP, BNB, Dogecoin, and Solana traded flat to slightly lower. When altcoins lag during stabilization, investors often shift capital toward perceived safety. Bitcoin price becomes a shelter during uncertainty, while smaller tokens struggle to attract fresh inflows.

This cautious tone aligns with commentary from this market report, which noted that defensive positioning dominates current trading flows. Such behavior reflects preservation of capital rather than aggressive accumulation.

Bitcoin Price Faces ETF Reality Check

The pressure point now lies with institutional exposure. The average Bitcoin ETF cost basis sits near $84,000. With Bitcoin price around $67,000, many Bitcoin ETF investors hold paper losses close to 20%. That gap creates vulnerability if prices weaken further.

A senior OTC executive at Wintermute recently explained that traders are “effectively paying for insurance against another drop” in derivatives markets, as reported here. This strategy caps upside participation while guarding against steep declines.

Despite those losses, total Bitcoin ETF holdings remain within roughly 5% of their peak in Bitcoin terms. Institutions appear to be trimming positions rather than exiting entirely. That distinction suggests caution, not panic selling, though capitulation risk grows if Bitcoin price breaks support.

Policy Talks Offer Movement Without Closure

At the policy level, White House-hosted discussions on a digital asset market structure bill showed incremental progress. The proposed legislation aims to clarify regulatory oversight between agencies and define rules for exchanges, custody, and token classification.

Incremental progress means negotiators resolved certain technical disagreements. Yet no final compromise has emerged. Regulatory clarity could strengthen long-term confidence in Bitcoin price, but uncertainty remains until lawmakers reach a consensus.

Markets often react sharply to regulatory headlines. Even subtle shifts in tone can influence Bitcoin ETF flows and institutional positioning.

Credit Stress and Oil Rally Add Weight

Outside crypto, stress in private credit markets intensified after Blue Owl restricted redemptions in a $1.7 billion retail credit fund. Its shares fell 6%, while Apollo Global, Ares Capital, and Blackstone each declined more than 5%. When liquidity tightens, risk assets usually feel pressure.

Geopolitical tensions add another layer of concern. Oil prices climbed 2.8% above $66 per barrel, marking the highest level since August. Higher energy prices can revive inflation worries, complicating monetary policy and indirectly impacting Bitcoin price.

Meanwhile, Chicago-based crypto lender Blockfills is exploring a sale after reporting a $75 million lending loss and suspending deposits temporarily. The situation echoes memories of Celsius and FTX in 2022. However, fallout appears contained, and no widespread collapse has emerged. Markets have not yet experienced a full washout.

Conclusion

Bitcoin price has stabilized near $67,000, but underlying forces remain tense. Bitcoin ETF investors face sizable unrealized losses, derivatives traders hedge aggressively, and macro risks continue to mount. Bitcoin price may hold firm, yet support levels will face renewed tests if sentiment weakens.

The coming weeks could define whether Bitcoin price builds a durable base or slips into deeper volatility. Investors, analysts, and developers alike should monitor ETF flows, regulatory signals, and global liquidity trends carefully. Markets reward patience, but they punish complacency.

This article is for informational purposes only and does not constitute financial advice. Readers should conduct their own research before making investment decisions.

Glossary of Key Terms

Bitcoin ETF: A regulated investment vehicle that tracks Bitcoin price and trades on stock exchanges.

Capitulation Selling: A rapid wave of selling triggered when investors surrender after sustained losses.

Downside Protection: Options strategies designed to reduce losses during price declines.

Support Level: A price zone where buying interest historically prevents further decline.

Derivatives Market: A financial market where contracts derive value from assets such as Bitcoin.

FAQs About Bitcoin Price

Why is Bitcoin price holding near $67,000?

Strong technical support and cautious institutional positioning help stabilize current levels.

How does a Bitcoin ETF influence Bitcoin price?

Large inflows or outflows can amplify price swings due to institutional scale.

Are Bitcoin ETF investors selling heavily?

Holdings remain near peak levels, suggesting trimming rather than panic.

What risks could push Bitcoin price lower?

Credit market stress, geopolitical tensions, and heavy ETF redemptions could increase downside pressure.

Sources and References

Read More: Bitcoin Price Walks Tightrope as ETF Cost Basis Sits at $84K">Bitcoin Price Walks Tightrope as ETF Cost Basis Sits at $84K

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.