TRON Price Prediction 2026: Can TRX Rally Past $0.32 Resistance?

0

0

This article was first published on The Bit Journal.

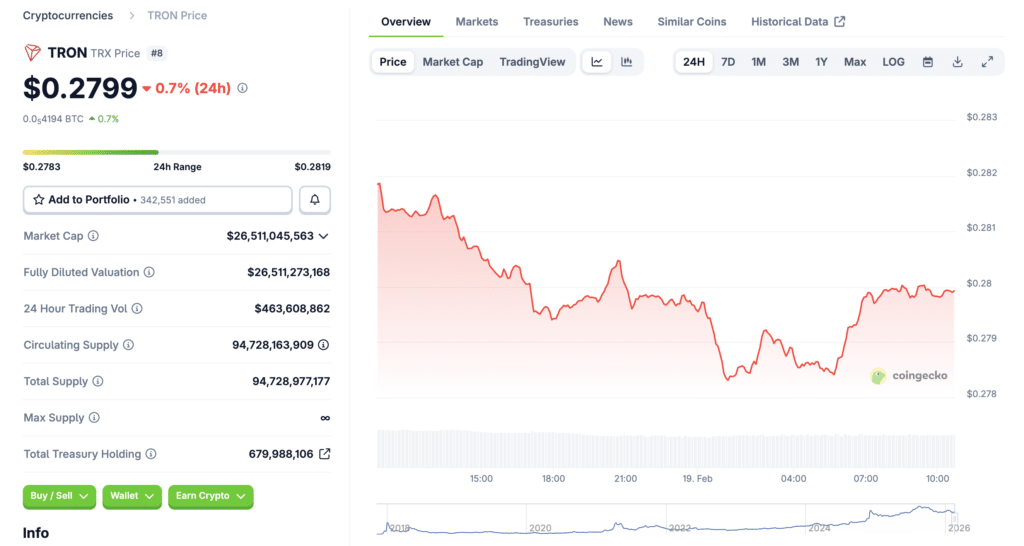

The outlook for TRON (TRX) in 2026 remains a central topic in digital asset markets. With the live TRON price at $0.279991, a 24-hour trading volume of $482.35 million, and a market capitalization exceeding $26.52 billion, attention is firmly placed on whether current momentum supports a sustained recovery.

This TRON price prediction 2026 examines TRX price analysis, TRON $0.32 resistance, and the probability of a TRX bullish breakout using technical, institutional, and market-based perspectives.

Market Snapshot and Current Price Structure

TRON price prediction 2026 begins with an evaluation of present market conditions. TRX is currently trading below the critical TRON $0.32 resistance level, reflecting moderate bearish pressure after a 0.69% daily decline. According to data tracked on CoinMarketCap, the circulating supply stands at approximately 94.72 billion tokens, reinforcing TRX’s high-liquidity profile.

This TRX price analysis highlights stable participation from traders, suggesting that the market remains attentive to TRON crypto news today and broader sentiment shifts that influence short-term volatility.

Technical Indicators and Trend-Based Signals

From a technical standpoint, TRON technical analysis shows mixed signals. Momentum indicators remain neutral, while moving averages suggest consolidation near key support zones. TRX support and resistance levels indicate strong buying interest near $0.26, while sellers remain active near $0.32.

This TRX market analysis supports the view that TRX breakout confirmation signals are still developing. For TRON price prediction 2026, a sustained close above resistance could validate a TRX bullish breakout and establish a higher price structure for long-term traders.

Institutional Activity and On-Chain Accumulation

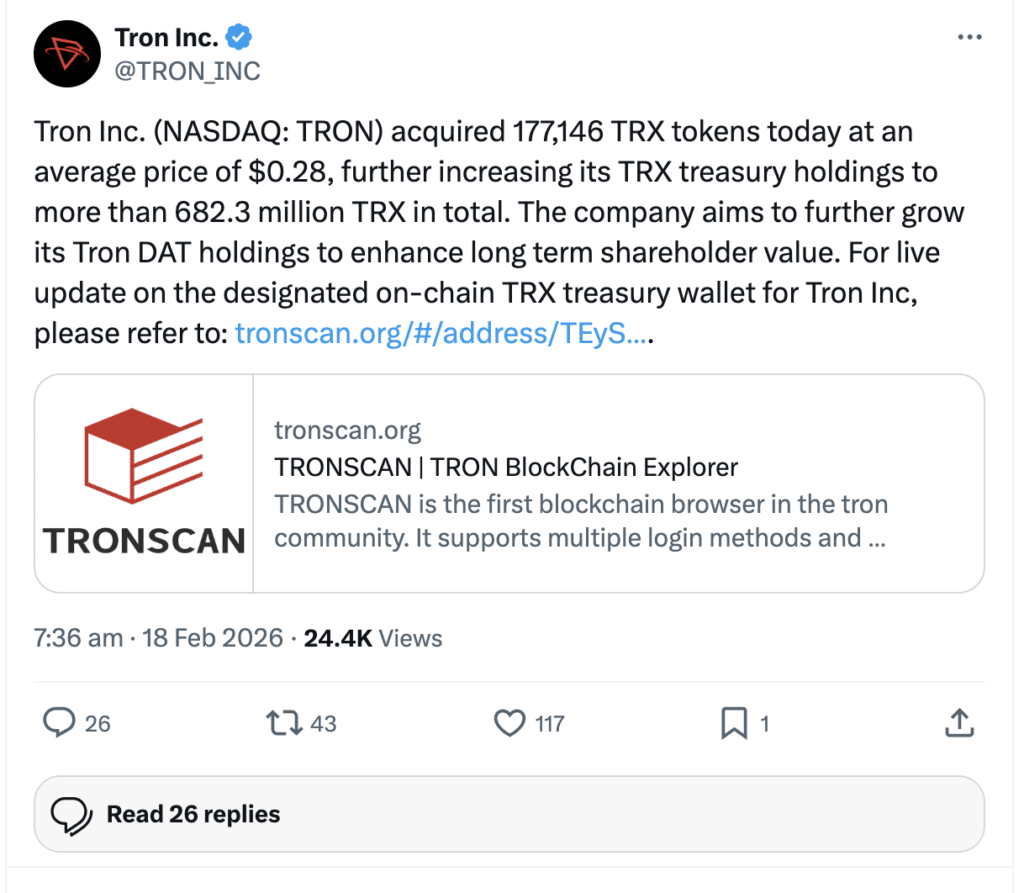

TRX institutional buying continues to attract attention in market reports. Recent accumulation patterns suggest moderate confidence among large holders, reinforcing speculation about TRON institutional accumulation impact. Wallet data shows consistent inflows during market dips, supporting Can TRX recover after dip narratives.

This TRON buying pressure analysis reveals that professional investors appear focused on medium-term appreciation rather than short-term speculation. In the context of TRON price forecast 2026, sustained institutional participation may serve as a stabilizing factor and strengthen long-term price resilience.

Tron Inc. Accumulation Supports TRON Price Prediction 2026

Recent institutional activity is a key factor in TRON price prediction 2026. TRX institutional buying continues to shape market sentiment and stabilize support zones. The screenshot below illustrates Tron Inc.’s treasury increasing TRX holdings, which strengthens the narrative for a potential TRX bullish breakout.

Historically, institutional accumulation during dips tends to support medium-term recovery. This TRON institutional accumulation impact indicates that if buying pressure persists, TRX could test and potentially surpass TRON $0.32 resistance, giving confidence to both traders and long-term holders.

Comparative Market Outlook and Competitive Position

When compared with other layer-one networks, TRON maintains a competitive advantage in transaction efficiency and stablecoin adoption. TRX price analysis indicates that network activity remains relatively consistent despite broader market fluctuations. This strengthens arguments supporting Is TRX a good investment now discussions.

In comparative TRX market analysis, TRON continues to benefit from strong infrastructure usage, which supports higher valuation models. For TRON price prediction 2026, maintaining this operational relevance will be critical in overcoming TRON $0.32 resistance and pursuing higher TRX price targets.

Risk Factors and Volatility Considerations

Despite optimistic projections, TRON price prediction 2026 must account for structural and macroeconomic risks. Regulatory uncertainty, liquidity shocks, and global risk sentiment remain influential variables. TRON technical analysis also highlights vulnerability to sharp reversals during low-volume periods.

Furthermore, external shocks could weaken TRX bullish breakout scenarios. Will TRON reach $0.32 in 2026 depends not only on internal growth but also on broader crypto adoption trends. Effective risk management remains essential for participants navigating these volatile conditions.

Conclusion: Outlook for TRX in 2026

The current TRON price prediction 2026 reflects a cautiously optimistic stance. TRX price analysis, institutional participation, and network fundamentals support the possibility of testing TRON $0.32 resistance in the medium term. However, confirmation of a TRX bullish breakout requires sustained volume and positive sentiment.

Investors monitoring TRON price forecast 2026 should prioritize technical confirmation and fundamental developments. Continuous evaluation of TRON crypto news today and TRX market analysis remains essential for informed decision-making.

Frequently Asked Questions About TRON Price Prediction 2026

Will TRON reach $0.32 in 2026?

Market indicators suggest potential, but confirmation depends on sustained demand.

Is TRX a good investment now?

TRX remains attractive for long-term strategies, subject to risk tolerance.

Can TRX recover after dip?

Historical patterns suggest recovery is possible with sufficient volume.

What is the main TRX price target?

Short-term targets focus on $0.32, with higher levels dependent on momentum.

How important is institutional buying?

TRX institutional buying supports market stability and confidence.

Appendix: Glossary of Key Terms

TRX Price Analysis: Evaluation of price trends using technical and fundamental indicators.

TRON $0.32 Resistance: A psychological and technical price barrier.

Institutional Buying: Large-scale purchases by professional investors.

Breakout Confirmation Signals: Indicators validating a trend reversal.

Market Capitalization: Total circulating supply multiplied by price.

References

TRON Price Prediction 2026 Market Overview

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency prices are highly volatile. Readers should conduct independent research and consult qualified financial professionals before making investment decisions.

Read More: TRON Price Prediction 2026: Can TRX Rally Past $0.32 Resistance?">TRON Price Prediction 2026: Can TRX Rally Past $0.32 Resistance?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.