HYPE Jumps 19% as Hyperliquid Backs Prediction Markets Proposal

0

0

This article was first published on The Bit Journal. HYPE surged into double-digit gains on Monday as Hyperliquid prediction markets moved closer to reality, following support from the team behind HyperCore, the core infrastructure powering Hyperliquid’s layer-1 network.

It was propelled by the support of HIP-4, a governance proposal that would transform Hyperliquid past perpetual futures into fully collateralized Hyperliquid prediction contracts. Hyperliquid is now the biggest decentralized perpetual futures exchange in crypto, and the suggestion is an important move towards wider participation of markets onchain.

HIP-4 Enables Hyperliquid Prediction Markets

Assuming it passes, HIP-4 would enable traders to bet on political elections, sporting results, and other events happening in the real world on outcome-based contracts directly constructed into the Hyperliquid ecosystem. Such Hyperliquid prediction products would not need leverage, liquidations, or margin calls and will have a more controlled risk profile than more traditional derivatives.

On Monday, Hyperliquid posted an X post affirming that it supported HIP-4 due to a large user demand of prediction markets and limited options-like instruments. The team further stated that the development of Hyperliquid prediction markets could bring into reach emerging applications and financial products that would be created on its infrastructure.

HyperCore will support outcome trading (HIP-4). Outcomes are fully collateralized contracts that settle within a fixed range. They are a general-purpose primitive that are useful for applications such as prediction markets and bounded options-like instruments. There has been…

— Hyperliquid (@HyperliquidX) February 2, 2026

Hyperliquid USDH Set for Market Settlement

Hyperliquid states that the HIP-4 results would act as a betting slip up to a limited payout. The contracts would clear in a definite range, eliminating liquidation risk, and still be fully collateralized onchain. This structure will attract merchants who are interested in less complicated exposure but not in complicated margins.

The outcomes trading feature is still in development and is still being tested on the testnet of Hyperliquid. The platform reported that the early canonical Hyperliquid prediction markets would be settled in its own stable currency, Hyperliquid USDH (USDH) so that the settlement would be stable.

HYPE Rallies as Markets React Positively

The development was positively responded by markets. HYPE was up 19.5% to $37.14 on Monday, and it builds on a robust run that has seen the token surge almost 47% in the last month. It is the performance of the larger crypto market that has also indicated signs of cooling, despite the move, according to CoinGecko figures.

The suggested integration would bring together two of the most active fields in crypto during the last two years onchain perpetual futures and prediction markets run with blockchains. The two segments are used to conduct hundreds of millions of dollars in trading volume each day and prediction markets based on Hyperliquid would only speed up the same.

Perps Trading Stays Strong Despite Pullback

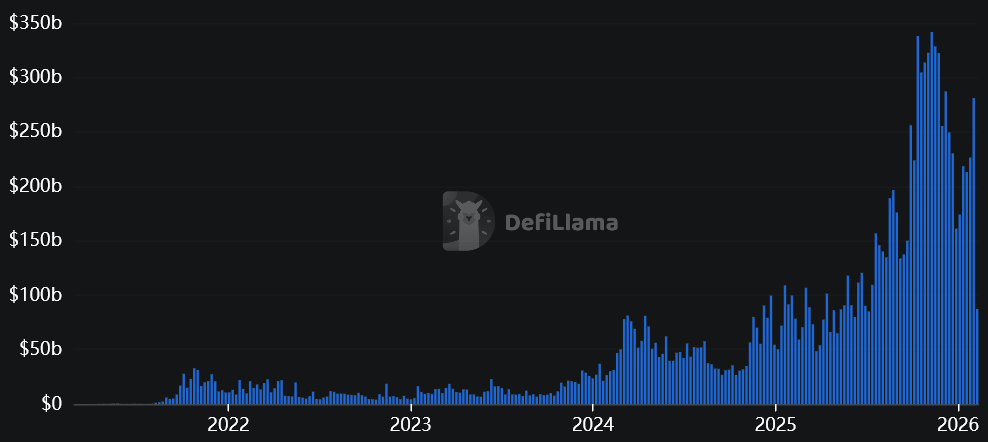

Although the volumes of perpetual futures trading have relaxed since the beginning of November, when weekly volume recorded a record of 341.7 billion, activity levels are high. According to DeFiLlama data, the perps volumes have remained over 200 billion in every one of the last four weeks.

It is worth noting that the weekly volumes are still three to four times higher than January 2025. Should HIP-4 proceed to further development, Hyperliquid prediction markets might be a major growth engine to the protocol, which strengthens its presence as a core node in decentralized trading innovation.

Conclusion

If HIP-4 advances beyond testing, Hyperliquid could broaden its role beyond perpetual futures into prediction markets with defined risk. As trading volume remains high and users are influencing the development, the growth positions the protocol to gain continued activity with the broader crypto market, indicating a cooling effect.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- HYPE jumps 19.5% after Hyperliquid backs HIP-4 proposal.

- Prediction markets expansion would allow fully collateralized outcome contracts.

- Feature in testnet, settled in Hyperliquid USDH stablecoin.

- Trading volumes remain high, well above January 2025 levels.

Glossary of Key Terms

HYPE: Native token of Hyperliquid.

Hyperliquid: Decentralized perpetual futures and prediction market platform.

HyperCore: Core infrastructure powering Hyperliquid’s network.

HIP-4: Proposal for fully collateralized Hyperliquid prediction markets.

Leverage: Borrowed capital to increase trade size (not used here).

Liquidations: Forced closure of risky positions (avoided in HIP-4).

USDH: Hyperliquid stablecoin for market settlements.

Testnet: Safe environment to test features before mainnet launch.

Perpetual Futures (Perps): Derivatives with no expiry for asset speculation.

Trading Volume: Total value of trades in a period.

Frequently Asked Questions about Hyperliquid HIP-4 & HYPE

1. What is HIP-4?

A proposal to launch fully collateralized Hyperliquid prediction markets for real-world events.

2. Why did HYPE rise?

HYPE jumped 19.5% after HyperCore backed HIP-4, continuing its strong monthly rally.

3. How do prediction markets work?

Contracts act like capped betting slips, with no leverage, liquidations, or margin calls.

4. Are the features live?

Not yet; outcome trading is on testnet and settles in USDH stablecoin.

References

Read More: HYPE Jumps 19% as Hyperliquid Backs Prediction Markets Proposal">HYPE Jumps 19% as Hyperliquid Backs Prediction Markets Proposal

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.