$312M in Crypto Unlocks This Week: Is the Crypto Market Plunge Just Getting Started?

0

0

The post $312M in Crypto Unlocks This Week: Is the Crypto Market Plunge Just Getting Started? appeared first on Coinpedia Fintech News

After a volatile start to November, the crypto market continues to struggle for stability. Bitcoin has been consolidating near $107,000, showing limited signs of recovery after last week’s sharp correction. Ethereum has also failed to reclaim the $3,900 mark, while top altcoins like Solana, Avalanche, and Dogecoin are facing consistent selling pressure. The broader sentiment remains cautious, with traders watching whether the market’s bullish momentum from October can be sustained amid growing macro and liquidity headwinds.

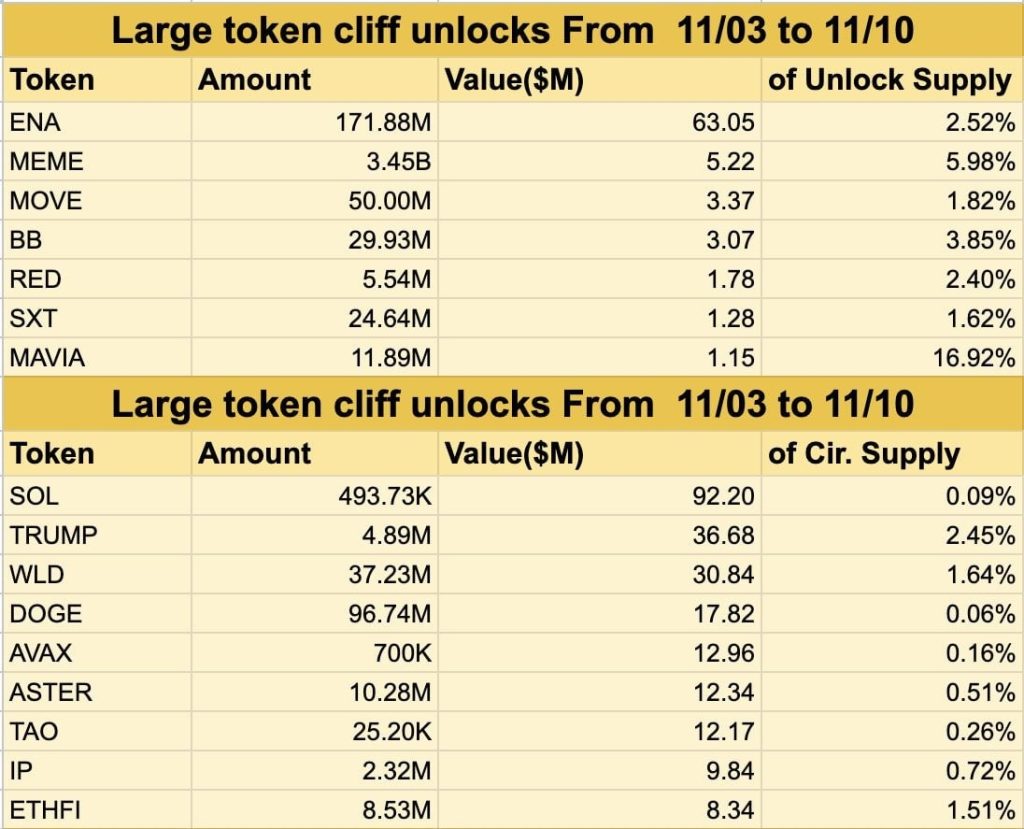

Amid this uncertainty, the market faces another challenge—a massive wave of token unlocks worth over $312 million scheduled for this week. These unlocks, which release previously locked tokens into circulation, could introduce additional supply and potentially intensify the current pullback.

Major one-time unlocks include Ethena ($ENA), Memecoin ($MEME), Movement ($MOVE), Big Time ($BB), and Red ($RED). Simultaneously, daily emissions from large-cap tokens like Solana ($SOL), Dogecoin ($DOGE), Worldcoin ($WLD), and Avalanche ($AVAX) continue to add steady pressure.

Data from on-chain trackers shows Ethena leading this week’s schedule with nearly $97 million in tokens set to unlock, followed by Memecoin and Movement, each contributing sizable liquidity inflows. These unlocks come at a delicate moment when the market’s recovery is losing steam, increasing the likelihood of heightened volatility. Historically, large unlocks during weak market phases tend to accelerate corrections as newly available tokens hit exchanges.

With Bitcoin and Ethereum struggling to attract new inflows and global risk appetite shrinking post-FOMC, traders are likely to remain defensive. The key question now is whether the market can absorb the $312M inflow without triggering another wave of sell-offs—or if this unlock cycle becomes the tipping point for a deeper correction.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.