Yearn Finance [YFI] 100x Surge Begins to Show Cracks, Is it Over?

4

2

Crypto markets witnessed a 100x with a massive surge in Yearn Finance [YFI] this week. The price on 18th July last week was around $34, it topped out this morning at $4699 (a 138x rise).

There are many arguments for and against the YFI surge. No pre-mine, limited supply of 30,000 tokens and a bridge between all other DeFi projects stand for YFI. The total value locked in the YFI pool has also surged sufficiently to point at a market capitalization 4-5x higher than the current valuation.

Dovey Wan, crypto analyst and partner at Three Arrows tweeted,

Honestly speaking I think @CurveFinance is the real winner with long last value and users retention of this modern agriculture movement, not the farms

Remember during the gold rush, Levi’s and folks who sold shovels made a real fortune

Could it be a Ponzi Scheme?

However, the astronomic rise is also raising sufficient doubts around its’ sustainability. There are proofs around a recursive practice by which borrowers are continually re-lending on DeFi platforms recursively to inflate the market total value. Due to the interoperability due to stablecoins like DAI, USDT and USDC, investors are lending and borrowing on multiple platforms (for Compound to Balancer and so on).

Moreover, the annual return to yield farmers is greater than 1000%. This is by lending stablecoins backed by the US Dollar. Even for crypto markets, such abnormal returns are to be questioned.

Still, watching one or the other DeFi tokens pump 2x almost every day makes traders wary of their small percentage increase in Bitcoin or Ethereum. Moreover, it might even be worthwhile to take the risk for a short pump and dump.

Nevertheless, the sustainability of the entire ecosystem is beginning to show weakness with the rise of Ethereum transaction fees. Most of these DeFi projects are built on Ethereum and the increasing fees will be counter-productive for the yield farmers and even recursive investors.

$ETH transaction fees are skyrocketing. pic.twitter.com/8iiUMEhGwL

— grubles (@notgrubles) July 24, 2020

YFI Price Analysis

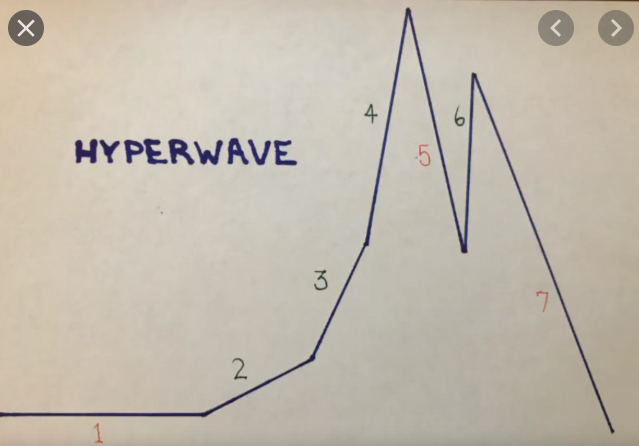

Cryptocurrency traders often refer to the ‘Hyperwave’ introduced by expert trader, (late) Tyler Jenks, to analyse astronomical surges in cryptocurrencies. For the confirmation of the wave, nonetheless, the third phase is critical.

YFI is currently in phase 2, a break-down from current levels could invalidate the bullish perspective. However, this is just an hourly chart and due to the very recent price record, this is the only relevant data for it.

The chart from CoinGecko seems to reflect a similar viewpoint. The dreams of many looking to get rich quick could be shambled with the break down from the current critical levels.

Do you think that the YFI surge to $10,000 will continue? Please share your views with us.

4

2

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.