The Most Shocking Ties Between Epstein and Bitcoin/Crypto Revealed

0

0

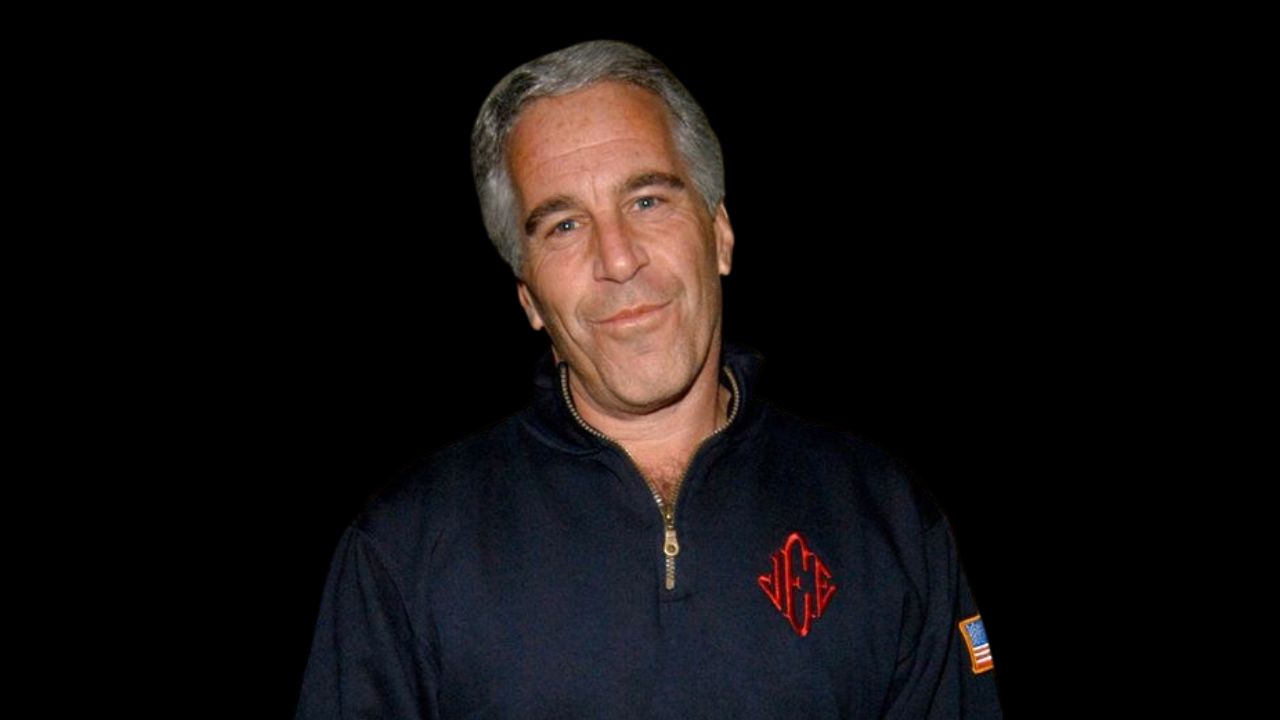

Jeffrey Epstein, the disgraced financier convicted in 2008 of soliciting prostitution involving a minor and later arrested on federal sex-trafficking charges, had cultivated powerful connections across finance and technology for years.

Recent releases of internal documents from the U.S. Department of Justice have stunned both the tech world and the cryptocurrency community by revealing an extensive link between Jeffrey Epstein and early cryptocurrency organizations.

However, while his criminal record is well known, what has drawn fresh scrutiny is his direct and indirect involvement with Bitcoin and the broader crypto ecosystem, including major players and institutions that helped shape digital finance.

Epstein’s Footprint in Crypto: From Academia to Markets

The uproar began with the public release of parts of the so-called “Epstein Files,” millions of pages of emails and documents now available under transparency orders. Among these were communications between Epstein and influential figures tied to crypto research and investment.

Notably, experts stress this does not mean Epstein created Bitcoin or controlled it. Rather, what emerged paints a picture of influence, access, and controversial money relationships with crypto-related institutions.

Additionally, one of the most direct links centers on the MIT Media Lab’s Digital Currency Initiative (DCI), a research group focused on Bitcoin and related technologies. Records show that MIT accepted funds tied to Epstein after his 2008 conviction, a decision the university later acknowledged as a serious error.

Emails revealed that the former Media Lab director, Joi Ito, used Epstein-linked money to support various research efforts, including digital currency projects. When this information became public, backlash came quickly.

Academics and developers expressed outrage, seeking Ito’s resignation and a formal apology from MIT’s leadership.

Nonetheless, despite these connections, it is essential to separate funding influence from technological control. Bitcoin, launched in 2009 as open-source software, has never been owned or governed by any individual, institution, or donor.

Moreover, thousands of developers worldwide contribute to its code, and its decentralized structure prevents centralized authority. Epstein’s money may have touched certain research circles, but it did not create Bitcoin, nor did it direct its development.

A Surprising Investment: Epstein and Coinbase

Perhaps the most explosive revelation from the files is Epstein’s investment in Coinbase, one of the world’s largest cryptocurrency exchanges.

In 2014, Epstein invested $3 million in Coinbase during a funding round that valued the company at roughly $400 million. At the time, Coinbase was an early but growing platform that would later become a cornerstone of mainstream crypto trading and public markets.

While $3 million represented a small slice of the nearly $75 million raised in that round, the fact that Epstein gained access to Silicon Valley investment deals so soon after his high-profile conviction shocked observers.

Furthermore, the investment came through a holding company based in the Virgin Islands and was facilitated by blockchain investor Brock Pierce, co-founder of Tether and partner in the venture firm Blockchain Capital.

Epstein held his Coinbase stake for several years. In 2018, he sold half his investment for about $15 million, roughly five times his original outlay. Coinbase went public in 2021 and today boasts a multi-billion-dollar market value.

This episode raised immediate questions on social media and within the crypto community: why would big-name venture capitalists and founders allow this connection? Several people involved in the deal have declined to comment or pointed out that Epstein was investing independently, not through their firms.

Nonetheless, the optics have fueled heated online debate about due diligence, reputation, and how elite networks operate behind the scenes.

Rumors, Reactions, and Clarifying the Record

Once the documents leaked, the internet exploded with speculation. Some commentators claimed Epstein must have funded Bitcoin itself. Others even suggested he authored the Bitcoin code or was connected to the mysterious creator known as Satoshi Nakamoto. These claims spread rapidly through forums, YouTube videos, and social media posts, despite lacking evidence.

Video titles and online commenters used eye-catching language like “Is Epstein Bitcoin’s Founder?” but experts quickly debunked these assertions.

Undeniably, Bitcoin’s open-source development history is public, with thousands of independent contributors. Key developers and firms like Blockstream publicly denied any financial or managerial connection with Epstein or his estate.

Notably, the most grounded reporting reveals three real strands of connection. Firstly, Academic Funding Epstein-linked donations helped finance MIT’s Digital Currency Initiative, which supported researchers involved in Bitcoin and crypto work.

Secondly, Epstein’s personal capital bought a stake in Coinbase, tying his money to a major crypto exchange’s growth.

Finally, Emails show Epstein communicated with venture capital figures and crypto players, sometimes inserting himself into elite tech circles.

Crypto analysts warn that rumors about Epstein actually founding Bitcoin distort reality and distract from valid ethical questions: what lines should academia and tech investment draw when it comes to money from controversial individuals? Should firms accept funds from convicted criminals if it accelerates research or innovation? These are tough questions with no simple answers.

As a result, many in the Bitcoin community have turned to public forums to voice frustration. Some argue that even indirect associations with Epstein cast a shadow over crypto’s early history. Others counter that Bitcoin’s decentralized nature shields it from the actions of any individual, however notorious.

How the Revelations Affected Public Trust in Crypto

When news of Epstein’s crypto ties surfaced, reaction was swift and emotional. Social media platforms are filled with accusations, memes, and conspiracy theories. For critics of cryptocurrency, the revelations became ammunition to argue that the industry lacked ethics and accountability.

Crypto advocates pushed back, stressing that decentralized systems cannot be corrupted by individual investors. They pointed out that Bitcoin has survived scandals involving exchanges, founders, and governments, all without altering its core design. In this view, Epstein’s involvement reflects failures in human institutions, not failures in technology.

Still, the episode exposed a deeper challenge for crypto’s public image. As governments consider stricter regulations and mainstream adoption grows, ethical scrutiny is intensifying. Universities and startups are now under pressure to disclose funding sources and apply stronger standards when accepting donations or investments.

Some academics argue the controversy may ultimately strengthen the industry. Greater transparency, clearer funding disclosures, and ethical guidelines could help prevent similar situations in the future. Several research groups have already revised their donation policies following the Epstein fallout.

Moreover, others call these ties a distraction, insisting that decentralized systems cannot be claimed or controlled by any one person, let alone a convicted sex offender.

In short, while Epstein’s name now appears in crypto’s early history, there’s no credible evidence he invented Bitcoin or steered its development. Rather, the files show a wealthy and connected individual leveraging his network to stay close to rising tech trends, and in doing so, left a complicated legacy.

The post The Most Shocking Ties Between Epstein and Bitcoin/Crypto Revealed appeared first on CoinTab News.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.