Ethereum Price Is 10% From Falling Below $2,000, but There’s a Silver Lining to it

0

0

Ethereum price has declined sharply over recent sessions, rattling investor confidence across the market. ETH has shed significant value in a short period, intensifying fear-driven reactions.

Many investors are now shifting their stance, increasing selling pressure on the altcoin king. While this behavior may extend the decline, it could also create conditions for a healthier long-term recovery.

Ethereum Holders Move Back To Not Buying

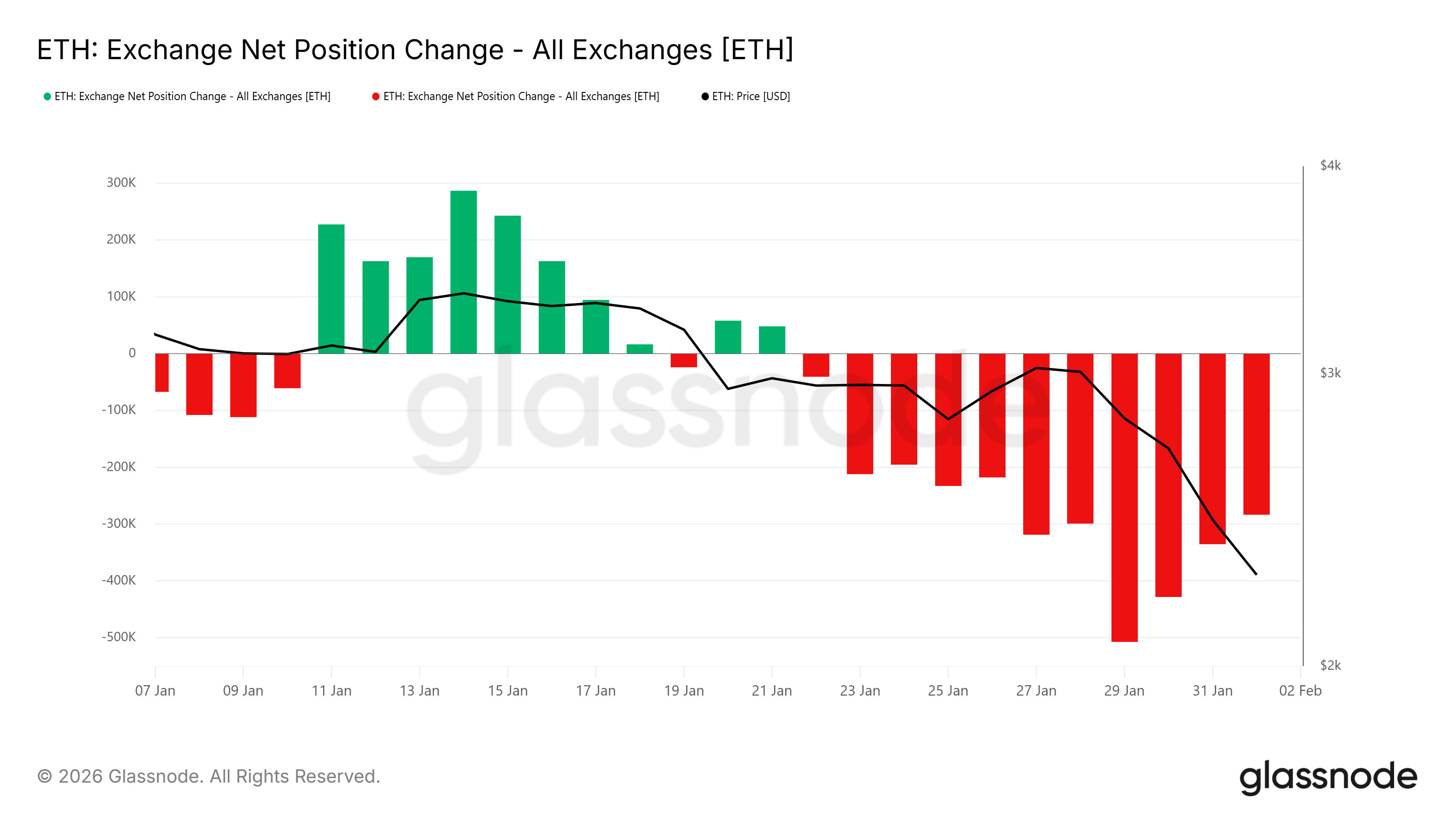

Recent on-chain data highlights a notable change in market sentiment. Exchange net position change shows that the buying momentum built over the last two weeks is fading. The red bars, which track net inflows, are shrinking steadily. This decline signals that aggressive accumulation is slowing.

As buying pressure weakens, selling momentum often follows. Investors who entered earlier may begin exiting positions to limit losses. This transition typically weighs on price action. For Ethereum, reduced demand increases the likelihood of further downside before stability returns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Exchange Net Position Change. Source: Glassnode

Ethereum Exchange Net Position Change. Source: Glassnode

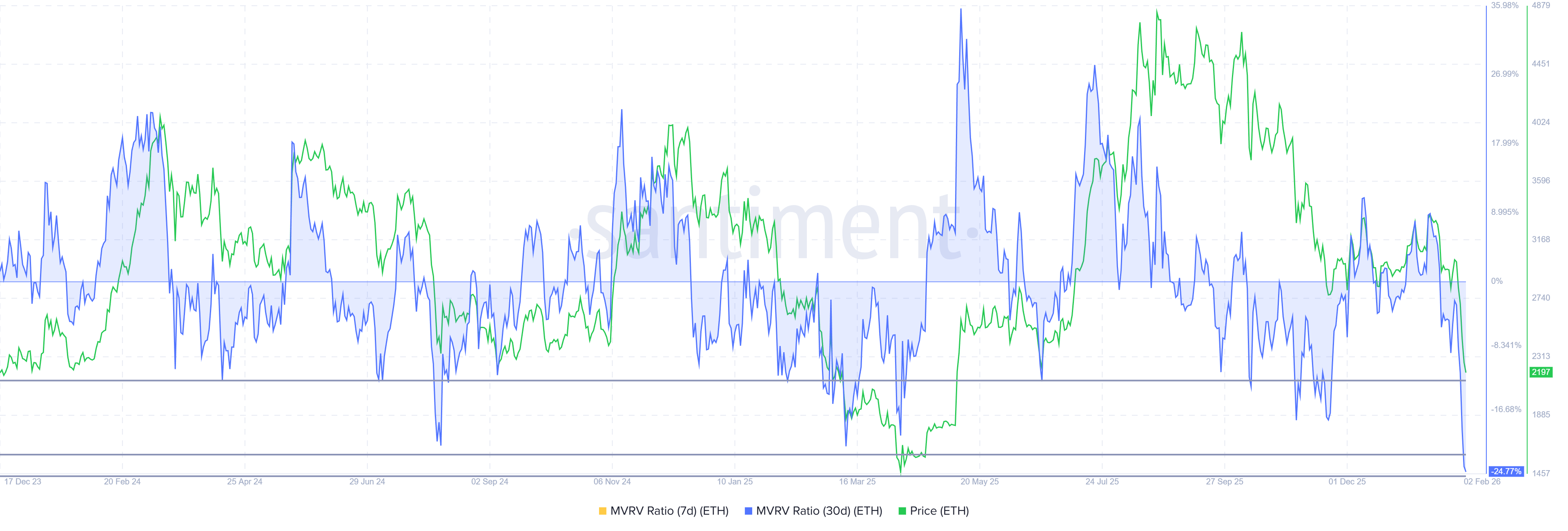

Despite near-term weakness, macro indicators offer a more constructive outlook. Ethereum’s Market Value to Realized Value ratio has entered the opportunity zone. This range, between -12% and -24%, historically marks periods of selling exhaustion.

In previous cycles, ETH price reversals followed shortly after MVRV dipped into this zone. Loss saturation discourages further selling as investors avoid realizing deeper drawdowns. Accumulation often resumes during these phases. Ethereum could benefit from similar dynamics as selling pressure peaks.

Ethereum MVRV Ratio. Source: Santiment

Ethereum MVRV Ratio. Source: Santiment

ETH Price Fall to $2,000 Is Likely

Ethereum is trading near $2,211 at the time of writing, holding just above the $2,205 support level. The asset remains under pressure after extending a 27% decline over the past five days. Current momentum suggests further downside risk remains elevated.

ETH is now only 9.2% away from falling below the $2,000 mark. Given fading buying momentum and rising caution, a move toward this level appears likely. While bearish in the short term, such a drop may attract value-focused investors. Lower prices often encourage accumulation from longer-term participants.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

A rebound scenario depends on renewed demand near key supports. If investors capitalize on discounted prices, Ethereum could recover toward current levels. This move would mark the beginning of a reversal-driven recovery. However, continued bearish momentum poses a risk. Failure to stabilize could send ETH toward $1,796 or lower, delaying any sustained rebound.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.