Which crypto exchange is best for scalping? A practical checklist

0

0

We focus on four practical dimensions: taker fees, per-pair liquidity, API and matching-engine latency, and funding and regulatory rules. Each section explains what to test, how to test it, and what to record during a dry run.

Why exchange choice matters for scalping: how the best crypto exchange for day trading affects execution

Scalping is a short horizon trading approach that depends on tiny edges and rapid execution. For that reason, exchange choice can matter more for scalping than for longer-term trades. The phrase best crypto exchange for day trading captures the idea that you want a venue optimized for low execution cost and predictable fills.

Four measurable exchange dimensions usually determine whether a venue suits scalping: taker fees, order-book depth and spread, API and matching-engine latency, and funding options. Each of these directly changes per-trade cost, slippage, or the time it takes to get capital in or out.

Liquidity is concentrated on a small set of top venues, but depth and spreads differ by pair, even on the same exchange. That means a venue ranked highly by overall volume can still have thin depth on the specific pair you plan to scalp, so per-pair checks are essential CryptoCompare benchmark.

Because scalping relies on many small wins, small increases in taker fees or modest latency can erase your edge. Keep your plan focused on measurable metrics and verify them for your exact trading pair before committing capital.

At-a-glance checklist: the four things to check on the best crypto exchange for day trading

Start with this prioritized checklist: 1) low taker fees, 2) tight spreads and sufficient depth on your pair, 3) low API and matching-engine latency, and 4) reliable fiat and stablecoin funding with clear regulatory disclosures. Use this order to rule venues in or out quickly.

Fee schedules are often tiered and conditional. Many exchanges reduce effective taker fees through 30-day volume thresholds or native-token staking. Confirm the exact conditions on the exchange help pages before you assume a low fee applies to your account Binance fee schedule.

Published exchange volume can hide per-pair weaknesses. A high-volume exchange may concentrate liquidity on a few flagship pairs, leaving other pairs illiquid. For scalpers, always pull per-pair snapshots of top-of-book spread and depth at your intended order size before using a venue CryptoCompare benchmark.

How exchange fee schedules affect scalping costs: reading taker fees and maker rebates

For scalping, taker fees matter more than maker fees. Scalpers often execute aggressively or use marketable orders to capture fleeting moves, which means many fills happen at taker rates. Maker rebates help on some strategies but do not remove the need to minimize taker cost.

Focus on taker fees, per-pair liquidity, API and matching-engine latency, and funding rules, then validate these with live tests and third-party data.

Fee schedules are commonly tiered by 30-day volume and sometimes by staking or holding a native token. That conditionality means a low published taker fee may not apply until you reach a volume threshold. Always check the exact qualification rules on the exchange fee page before you assume a rate applies Coinbase trading fees.

Worked example. If your typical scalping edge is a few basis points per trade, a higher taker fee that appears small can remove expected profit. Run the math for your average ticket size and trade frequency. Verify the real fee on fills, since rebates or maker credits often post separately from the trade itself.

Measuring liquidity on your pair: spreads, depth and why per-pair checks matter

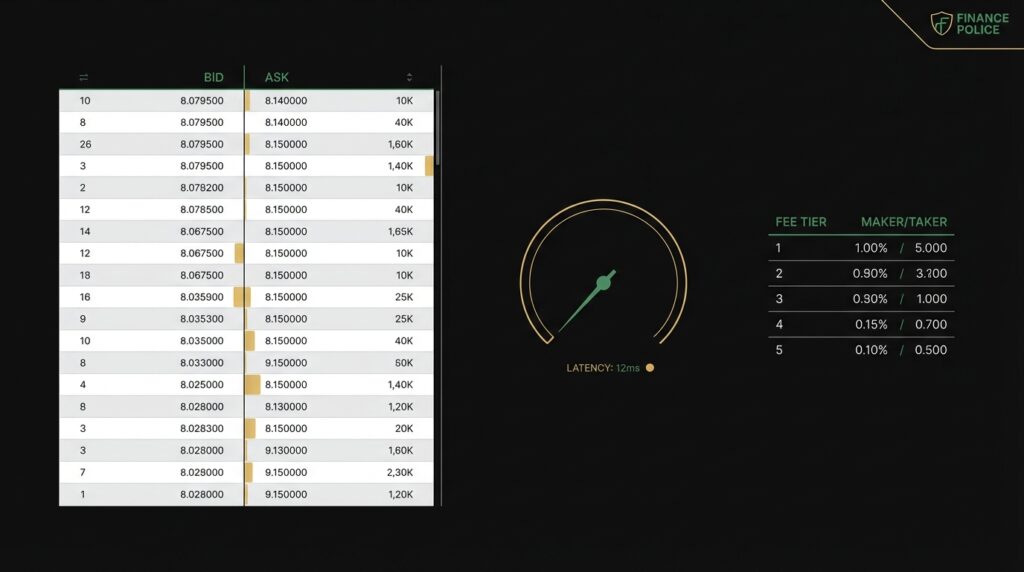

Spread is the difference between best bid and best ask. Depth is the available size at consecutive price levels. Both determine slippage for a scalper. Tight spreads reduce the initial cost to enter and exit; depth determines whether your order will move the market.

Use third-party snapshots or exchange order-book queries to measure top-of-book spread and depth at your typical order size. Look for consistent depth during the trading hours you plan to operate; some pairs show strong midday liquidity and thin overnight depth Kaiko market structure insights.

Exchange-level rankings and headline volume can mislead. A venue that ranks high by total traded volume may still have thin depth on niche pairs. For scalping, treat per-pair liquidity as the primary source of truth and rely on tick-level snapshots when possible CryptoCompare benchmark.

API, matching engine and latency: testing execution quality before you trade

Latency can change execution quality for short-horizon strategies. If you rely on rapid fills or on microstructure signals, API round-trip and matching-engine proximity have material impact on fill rate and slippage.

Run a simple test plan before committing capital: compare tick-level data from the exchange with a third-party feed, measure order round-trip time for small test orders, and log fill rates across different market conditions. Third-party providers recommend per-exchange latency testing rather than trusting public claims Kaiko market structure insights. Also compare a third-party feed such as a market-data API when running tick-level checks CoinAPI blog on live data.

quick test plan to measure API round-trip and market data latency

Run at low sizes to avoid market impact

Public latency numbers can be optimistic. Some exchanges publish measurements that do not reflect tick-level or matching-engine delays. Validate published claims with your own short tests or by checking independent tick-level feeds before you trade live.

Funding, fiat rails, KYC and regulatory factors that shape scalping feasibility

Funding speed and rules shape how quickly you can move capital and scale trades. Direct fiat rails and fast stablecoin on and off ramps make it easier to fund hot trading accounts. Where an exchange limits withdrawals or enforces strict KYC, your ability to move in and out of positions quickly can be constrained.

Regulatory disclosures and published licensing matter because they influence the legal and operational risks of a venue. Check the exchange’s jurisdictional disclosures and compare them to investor guidance from regulators for context before using a venue for scalping SEC investor bulletin.

Stablecoin pairings and margin options change funding costs. Some venues let you fund directly with local currency, others require intermediate stablecoin conversions, which can add steps and delays. Confirm funding rails and typical settlement times for your jurisdiction before you plan frequent intraday transfers CoinMarketCap exchange metrics.

Order types, margin and leverage options to consider for scalping

Order types that matter for scalping include limit, immediate-or-cancel, and post-only. These give you control over whether your orders remove liquidity or rest on the book. Use post-only or maker-only where possible if your plan relies on collecting maker rebates, but remember that many small marketable fills will still be taker fills.

Leverage changes position sizing and financing cost. Isolated margin limits the risk to a single position, while cross margin shares collateral across positions. Margin rules and available leverage vary by venue and jurisdiction, so review the exchange’s margin terms and how funding or interest is charged for margin products Binance fee schedule.

Funding costs and periodic financing terms can change expected return on short trades. If you use leveraged scalping, include the financing cost per day in your per-trade math and verify how the exchange applies funding or interest charges in practice Coinbase trading fees.

Step-by-step checklist: how to compare exchanges for your scalping setup

Follow this sequence: check fee tiers for taker rates, pull per-pair depth and spread snapshots, run short API latency tests, and verify funding and KYC terms for your jurisdiction. Document each step and the date you ran it so you can repeat the check later.

Partner with FinancePolice’s advertising and partnership page

Run the checklist with small test sizes now, and only scale after you validate fees, spreads, latency, and funding for your pair.

When checking fees, look beyond headline numbers. Note the exact tier thresholds and whether the rate shown on the page applies to accounts like yours. For per-pair liquidity, capture top-of-book and depth at your typical order size at the times you plan to trade CryptoCompare benchmark.

Run a dry run with small sizes. A recommended approach is to use trade sizes that are meaningful for your slippage but small enough to limit exposure. Record slippage, fill rates, and any unexpected fee treatment. If slippage consistently exceeds expected spread plus fees, treat the venue as unsuitable.

Common mistakes scalpers make when picking an exchange

Relying on headline volume instead of per-pair depth. Exchange-wide volume does not guarantee tight spreads on your pair. Always check pair-level depth and spread snapshots during your trading hours Kaiko market structure insights.

Using published latency figures without validation. Public latency claims are helpful but can be optimistic. Run independent round-trip tests and compare tick-level feeds to confirm real-world latency for your routing and infrastructure CryptoCompare benchmark.

Underestimating funding and withdrawal friction. Fast scalping needs quick access to capital. Confirm KYC, withdrawal limits, and typical settlement times before relying on an exchange for rapid position changes SEC investor bulletin.

Practical scenarios: spot scalping, leveraged scalping and stablecoin pair choices

Scenario 1. Spot scalping on a high liquidity pair. Inputs: small ticket sizes, low taker fees, and a pair with tight spread and consistent depth. Check depth at your ticket size and validate fill rate across several sessions before increasing size CryptoCompare benchmark.

Scenario 2. Leveraged scalping. Inputs: isolated margin to cap position risk, explicit financing cost in your break-even calculation, and order types that reduce market impact. Confirm margin terms and how funding fees are applied to short intraday exposures Binance fee schedule.

Scenario 3. Stablecoin pair scalping. Inputs: stablecoin funding rails and a pair with narrow spread between stablecoins and the traded asset. Consider how stablecoin on and off ramps affect funding speed and whether conversions add cost or delay CoinMarketCap exchange metrics.

How to test an exchange: live tests, third-party validation and what metrics to log

Design small live tests that record tick-level differences, order round-trip times, fill rates, and the fees that appear on your real fills. Run tests at different times to capture intraday variation and unusual market conditions.

Log metrics that let you compare expected versus actual cost: top-of-book spread, realized slippage per fill, taker fees charged on the trade, and time to settlement for funding moves. Use third-party market-data to validate exchange spreads and latency claims rather than relying solely on the exchange feed Kaiko market structure insights.

When to switch exchanges and how to migrate positions safely

Signals that should prompt migration include sustained widening of spreads on your pair, sudden withdrawal limits, or repeated latency problems that reduce fill quality. Treat these signals as operational risk flags and investigate immediately.

To migrate safely, move capital in small steps while keeping a base position on both venues to avoid market impact. Verify funding and KYC differences before moving significant capital. After migration, reconfirm per-pair depth, fill rates, and any new fees applied to your account CoinMarketCap exchange metrics.

Summary: concise decision checklist to pick the best crypto exchange for day trading

Five final checkpoints: 1) confirmed low taker fee for your account tier, 2) tight spread and sufficient depth at your order size, 3) validated low latency and solid fill rates, 4) reliable funding rails and clear regulatory disclosures, and 5) verified order types and margin rules for your strategy CryptoCompare benchmark.

Keep the checklist current by re-running per-pair and latency checks periodically and after any market structure changes. Use primary sources and third-party market-data to validate claims rather than relying on headline volume or published latency numbers alone.

Taker fees matter because scalpers often use marketable orders that remove liquidity. Even small taker fees can erode narrow per-trade edges, so verify the real taker rate for your account tier and include fees in per-trade math.

Run short API round-trip tests, compare exchange tick data with an independent feed, and log order round-trip times at different times of day. Use low-size tests to avoid market impact.

Confirm fiat on and off ramps, typical settlement times, KYC and withdrawal limits for your jurisdiction, and whether stablecoin funding is supported with prompt conversions.

References

- https://financepolice.com/

- https://www.cryptocompare.com/research

- https://financepolice.com/advertise/

- https://www.binance.com/en/fee

- https://help.coinbase.com/en/exchange/trading-and-funding/trading-fees

- https://www.kaiko.com/insights

- https://financepolice.com/crypto-exchange-affiliate-programs-to-consider-heres-what-you-need-to-know/

- https://data.coindesk.com/trade-data

- https://www.theblock.co/post/267317/a-need-for-speed-how-major-traders-and-venues-think-about-latency-in-todays-crypto-market

- https://www.coinapi.io/blog/live-crypto-data-trading-engines-latency-normalization-multi-exchange

- https://financepolice.com/category/crypto/

- https://www.sec.gov/oiea/investor-alerts-and-bulletins/ib_digitalassettradingplatforms

- https://coinmarketcap.com/rankings/exchanges/

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.