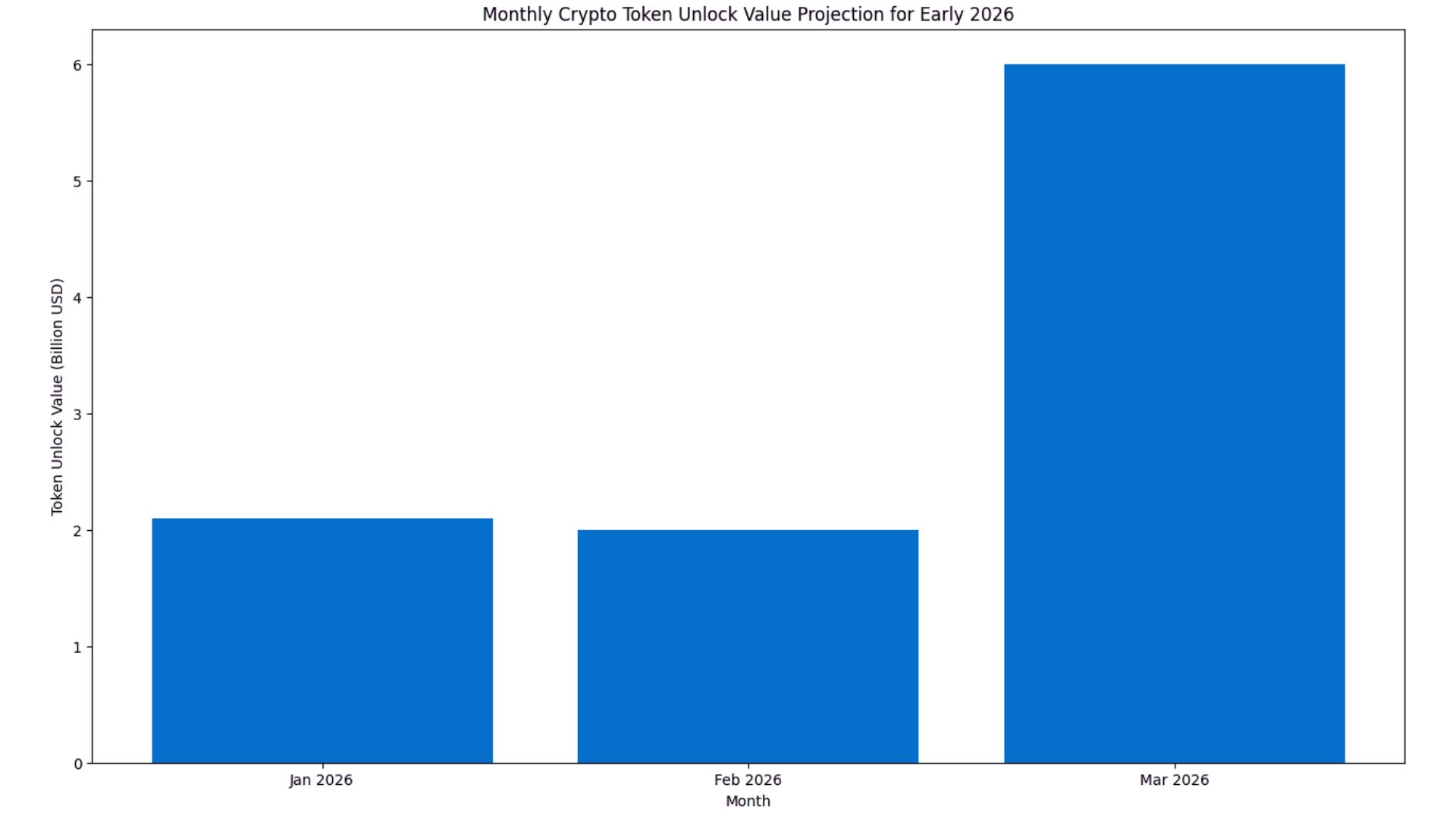

Record $6B Token Unlock Set for March 2026 Markets

0

0

This article was first published on The Bit Journal.

Token unlock events rarely dominate headlines, yet March 2026 is emerging as a moment that could reshape short-term expectations across digital assets. A projected wave of newly tradable supply is drawing intense scrutiny from traders, analysts, and developers who understand how timing and liquidity often decide market direction.

According to the source, more than six billion dollars in assets may enter circulation during a single month, nearly tripling the normal pace. This scale places the coming token unlock at the center of debate while raising fresh concern about unlock volatility across altcoins and broader trading sentiment.

A Sudden Supply Shock With Real Market Consequences

Each token unlock releases coins previously held by early investors, project teams, or ecosystem reserves. When large allocations become liquid at once, the balance between buyers and sellers can shift quickly.

Historical datasets discussed in recent market research show that heavy distributions tend to spark short bursts of price swings rather than permanent declines. Analysts cited in recent industry analysis explain that transparent vesting structures often build long-term credibility even when unlock volatility appears in the short run.

Still, March stands apart. Compressing months of scheduled releases into one window creates unusual pressure. A single oversized token unlock can influence liquidity conditions across multiple exchanges within hours, encouraging rapid repositioning by funds and algorithmic traders.

Why Unlock Volatility Carries More Weight in 2026

Market structure has matured since earlier crypto cycles. Institutional participation, derivatives exposure, and deeper exchange liquidity now shape reactions to every token unlock. When leverage rises, even moderate selling can intensify unlock volatility and spread weakness between correlated assets.

Researchers highlighted in a broader market coverage note that sentiment ultimately decides whether supply becomes a crisis or a routine adjustment. Strong bullish demand may absorb new tokens smoothly. Fragile confidence, however, can turn the same token unlock into a trigger for cascading liquidations.

On-chain monitoring adds another clue. Transfers toward exchanges often signal intent to sell, increasing unlock volatility. Tokens that remain in long-term custody suggest patience and belief in future growth.

Strategy, Timing, and Investor Psychology

Professional investors rarely treat a token unlock as purely negative. Many hedge risk before release dates or wait for panic-driven discounts to appear. Market behavior frequently reflects emotion more than mathematics.

Fear surrounding unlock volatility often peaks before the actual event. Prices sometimes stabilize once uncertainty fades, revealing how crowd psychology shapes short-term movement. Yet concentration risk remains important. When a few holders control large allocations, a single decision can redirect momentum quickly.

Because of this dynamic, the March token unlock is being watched not only for price impact but also for signals about market maturity and resilience.

Conclusion

The approaching token unlock represents one of the most significant supply events of 2026. Its effect will depend less on raw numbers and more on liquidity strength, investor confidence, and disciplined risk management. If markets absorb the release calmly, trust in crypto stability may deepen.

If unlock volatility spreads sharply, caution will again guide strategy. Either outcome will offer a powerful lesson about how modern digital markets process pressure and evolve through uncertainty.

Glossary

Token unlock

Release of previously restricted crypto tokens into open market circulation after vesting periods expire.

Unlock volatility

Short-term price instability caused by sudden increases in tradable token supply.

Vesting schedule

Timeline controlling when insiders or investors gain access to allocated tokens.

Liquidity

Ability to buy or sell assets quickly without causing major price movement.

FAQs About Token Unlock

Why does a token unlock influence prices?

New supply can raise selling pressure, which may push prices lower for a limited time.

Are unlock events always bearish?

No. Strong demand or bullish sentiment can absorb supply with minimal disruption.

How do traders prepare for unlock volatility?

They monitor vesting data, hedge exposure, and track exchange inflows before release dates.

Why is March 2026 important?

Projected releases exceed six billion dollars, making it among the year’s largest crypto supply events.

Sources

Read More: Record $6B Token Unlock Set for March 2026 Markets">Record $6B Token Unlock Set for March 2026 Markets

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.