ETH Price Recovery to $3,000 Soon Amid Staking Push for Ethereum ETFs

0

0

Amid the broader market sell-off, the Ethereum (ETH) price has dropped to $2,500 recently, however, on-chain data and rising inflows into spot Ethereum ETFs show that a recovery to $3,000 could be coming soon. Additionally, SharpLink Gaming has filed a prospectus with the U.S. Securities and Exchange Commission for $1 billion common stock offering to build its Ether Treasury.

On-Chain Metrics Support Ethereum Price Recovery

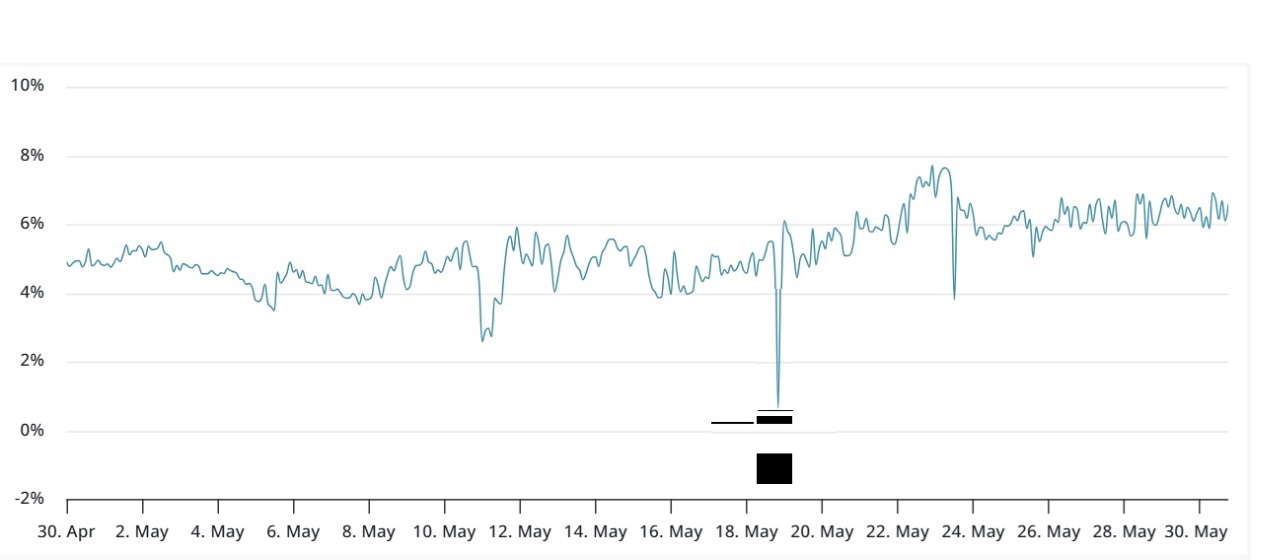

Some of the key on-chain metrics clearly support ETH price recovery in the near term. Following the rejection at $2,700, Ethereum corrected 9% in the last two days, dropping to $2,500 once again. This led to $160 million in liquidations in bullish leveraged ETH futures positions. However, despite this drop, ETH futures’ annualized premium continues to stay near 6%.

In neutral market conditions, the premium usually floats between 5% to 10%, reflecting the compensation sellers seek for delayed settlement.

Amid the recent rejection at $2,700, the ETH price has faced some pullback in the last two days. But as per data from Rekt Capital, as long as the altcoin defends $2,468, the gates for a rally to $3,900 remain open from here.

Ethereum has been successfully retesting black as support for the past few weeks

In doing so, Ethereum is repeating early 2024 history (green circle) with a successful retest, the only difference is that it has just taken longer this time#ETH #Crypto #Ethereum https://t.co/MbGqBBZxCI pic.twitter.com/6RIWCEqYTJ

— Rekt Capital (@rektcapital) May 29, 2025

SharpLink Gaming Files With US SEC For $1 Billion ETH Purchases

In its filing to the U.S. Securities and Exchange Commission (SEC) on Friday, May 1, SharpLink Gaming plans to conduct $1 billion common stock offering in order to increase the holdings in Ethereum Treasury. The SEC filing notes:

“We intend to use substantially all of the proceeds from this offering to acquire Ether, the native cryptocurrency of the Ethereum blockchain, commonly referred to as “ETH”.

The development follows SharpLink’s May 27 announcement of its plans to introduce an Ethereum-based corporate treasury strategy. In a significant move, the company also appointed Ethereum co-founder Joseph Lubin as chairman of its board of directors. Following the news, SharpLink Gaming’s stock skyrocketed, surging 400% during the May 27 trading session.

Ethereum futures annualized premium | Source: Laevitas.ch

REX Shares files for Staking on Ethereum ETFs

As per the recent filing by REX Shares, staking for spot Ethereum ETFs could be coming within the next few weeks. James Seyffart, Bloomberg’s prominent ETF analyst, has revealed that REXShares has filed an effective prospectus to introduce Solana and Ethereum staking ETFs in the United States.

These funds, structured as 40-Act funds, utilize a unique approach that bypasses the traditional 19b-4 approval process.

On the other hand, inflows into spot Ethereum ETFs have picked up pace once again. The Ether ETFs have recorded ten consecutive days of inflows, with BlackRock’s iShares Ethereum Trust (ETHA) making a majority contribution.

The post ETH Price Recovery to $3,000 Soon Amid Staking Push for Ethereum ETFs appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.