Futures Volatility and Long-Term Holder Activity Signal a New Phase for Crypto Markets

0

0

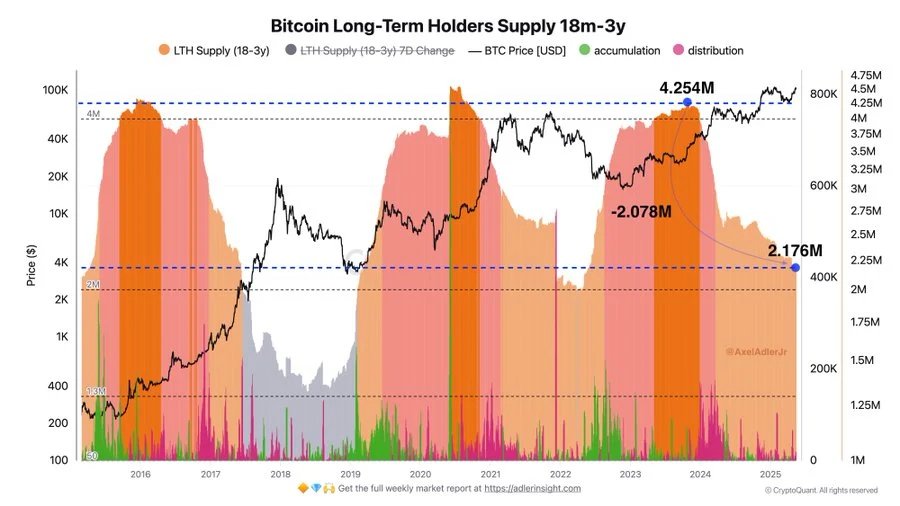

Since November 2023, around 2 million BTC have left the accounts of Bitcoin holders who have owned it for 18 months to 3 years. Axel Adler Jr. reports that this group has reaped $138 billion through dividends in the last period. While a major part of their holdings was sold, these investors still hold about 2.176 million BTC, and another 500,000 BTC may be added before the end of the year.

Long-term investors are now taking their recent gains and investing them elsewhere. Influencers observe that companies are perhaps making plans to invest heavily in Bitcoin. Still, since installment plans are not offered in Bitcoin, you need to have the funds available to buy it when you decide to purchase. Giving for Bitcoin held by investors to corporate and institutional organizations is a sign that the market structure is maturing.

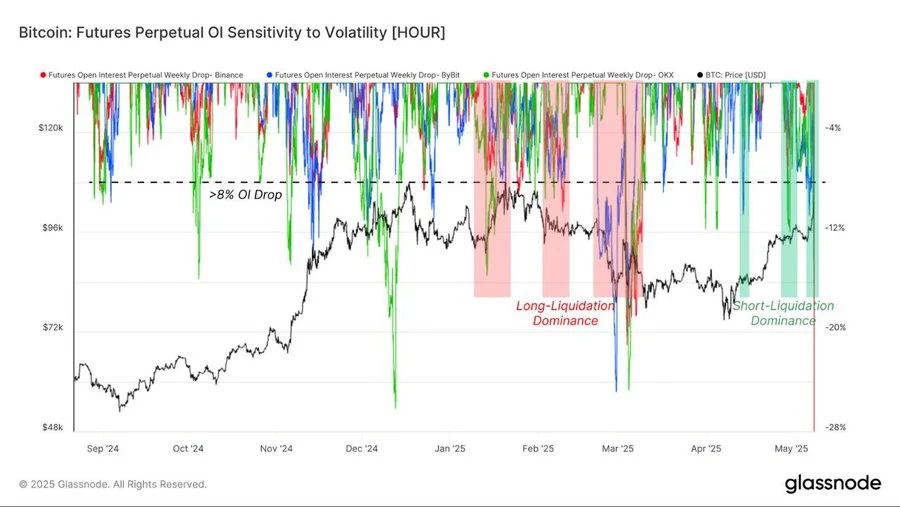

Futures Market Experiences Significant Liquidations on Both Sides

Apart from changes in Bitcoin held by long-term investors, the futures market is also showing more volatility. Kyledoops a popular crypto analyst, has pointed out that longs and shorts have incurred major drawbacks lately, with the former sacrificed under $80,000 and the latter crushed over $90,000. This is because traders keep changing their feelings and behaviors, which results in major liquidations from both sides.

Since the North American stock market has been falling, about 10% of total open futures interest is gone. This indicates that many short-term traders have left. Within a short period, liquidations can drive away those who are less confident. Notably, this may result in a stronger and steadier recovery.

In the futures market, traders on both sides work against one another and frequently adjust their actions to match changes in the market. It is important here to watch for strong liquidations and high open interest to determine if the market is stable and investors are religiously following their plans.

Interconnected Market Dynamics and Future Outlook

Bitcoin’s short-term prices are influenced by changes in long-term holders and trading on the futures market. On one hand, selling by those who have held the coins for a long time can lead to a decline in price. At the same time, if many firms get rid of their positions in the futures market, it could allow certain buyers to gain a foothold, driving up prices in the long run.

Corporations taking part in the market could stabilize prices by reducing the frequency of Bitcoin’s value increases. Besides, when things are volatile in the futures market, speculative oxidation happens, paving the way for the market to grow healthily.

Those leading in the investment industry should carefully follow market supply and futures trends. The combination of these components will affect the price, volatility, and growth of the crypto market.

The large sell-offs by Bitcoin’s long-term holders and volatile futures trading are leading to big liquidations. Because of these dynamics, the market is now shifting from trade-based to stronger and more organized patterns. When weaker traders leave the market, the entrance of major players may pave the way for Bitcoin to rise again.

The post Futures Volatility and Long-Term Holder Activity Signal a New Phase for Crypto Markets appeared first on Coinfomania.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.