Solana Price Surges 2% as Circle Mints 750M USDC on SOL Blockchain – Analyst Eyes Breakout to $360

0

0

Highlights:

- Solana price rebounds 2% to $183, as trading volume spikes 12%.

- Circle has minted 750 million USDC on the Solana blockchain.

- The bullish grip in the SOL market hints at a potential breakout to $360.

Solana is showing signs of life, as it has rebounded 2% to $183. Its daily trading volume has notably soared 12% to $6.54 billion, sowing intense market captivity. Solana has come a long way in the crypto world and has made immense developments that have attracted global attention. Recently, the firm behind one of the most popular stablecoins, the USDC, Circle, has minted 750 million USDC on the Solana blockchain. This is a very important step since the Solana fast and scalable platform keeps facilitating the key players in the financial world and projects.

JUST IN: @Circle mints another $750 million $USDC on @Solana. pic.twitter.com/YIUdXaJGqM

— SolanaFloor (@SolanaFloor) August 21, 2025

The inclusion of this large mint of USDC is also likely to bring about additional DeFi (Decentralized Finance) apps onto Solana.

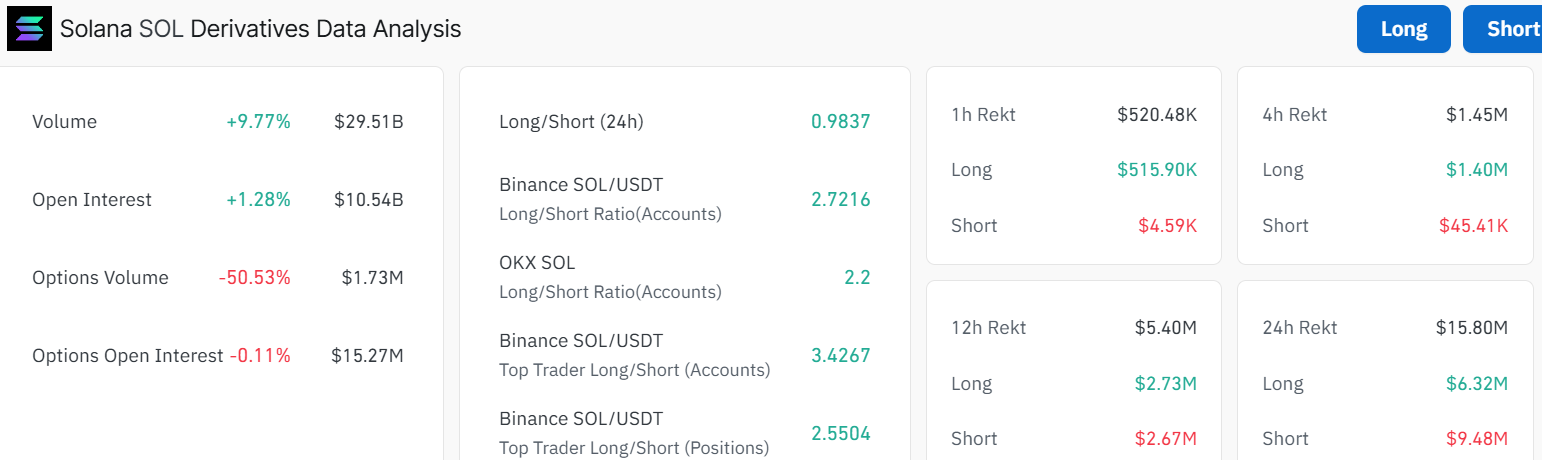

Solana (SOL) has also experienced a significant rise in the number of trades with an overall volume increase of 9.77% to $29.51 billion in total volume. The open interest has increased by 1.28% as well, showing that traders are gaining activity in the market. This is despite the drop in options volume by 50.53%. The overall mood of the marketplace is positive, with most market players displaying a preference for long positions.

The long/short ratio of Solana across various exchanges indicates that the traders have a positive outlook. Currently, the long-to-short ratio sits at 0.98, indicating that more traders are wagering that the price of Solana will rise.

Solana Price Poised for a Breakout Above

A glance at Solana’s technical view, the altcoin is trading at $183.95. The chart shows SOL poised for a breakout above the symmetrical triangle. The token has long been battling around the $176 and $201 area, as today, the bulls are showing strength.

The price smashed through the upper resistance at 180, backed by a solid volume spike, proving the community’s all in. The 50-day Simple Moving Average (SMA) at $174 is trending upward, crossing the 200-day SMA (blue line) at $157, signaling a bullish golden cross.

Zooming in, the Relative Strength Index (RSI) sits at 52.06, signalling some neutral level, but still showing some room to run. The Moving Average Convergence Divergence (MACD) is also bullish, with the MACD line (blue) flying above the signal line, hinting at more upside momentum.

SOL Bulls Eye $360 Breakout

The 2% pump could be the start of a bigger move. Meme coins like YZY thrive on hype, and with the golden cross and volume surge in the Solana market, the sentiment and momentum are strong. Short-term, Solana price may push toward $200-$242, if momentum holds. Long-term, breaking $242 could signal a moonshot, sending SOL to $360, according to an analyst.

Not a bad spot to start loading Solana $SOL before a breakout to $360. pic.twitter.com/N42zXpMzbT

— Ali (@ali_charts) August 21, 2025

However, traders will want to watch those resistance levels that could act as speed bumps. The low of $174 is a solid floor if the market turns bearish. For the next week, traders will want to keep an eye out for community sentiment and volume trends.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.