[LIVE] Crypto News Today, October 29 – Bitcoin Price Hovers Around $113K, Ethereum at $4K, and ZCash Could Be Ready for Another Run? Next 1000x Crypto Ahead of FOMC?

0

0

The crypto market is on edge as investors await the U.S. Federal Reserve’s interest rate decision later today. A 25 basis point (bps) rate cut is widely expected, but fears of a more aggressive tone or a delayed 2026 rate path have unsettled traders. However, this uncertainty is not stopping investors from looking for the next 1000x crypto, especially if the market reacts positively to rate cuts.

Exchange order-book liquidity has fallen to just 40% of pre-drop levels, amplifying slippage risks and fueling sharper price swings. briefly dipped below $113,000, while is holding near $4,000. sits at $2.63 (+0.78%), at $1,114.62 (+1.62%), and at $194.07 (+3.84%).

The Bitwise Solana Staking ETF (BSOL), the first U.S. spot Solana ETF, launched on October 28 with $69.45 million in net inflows on its opening day. The fund now holds $289 million in total net assets, representing 0.27% of Solana’s market cap, according to Farside Investors. In contrast, the newly listed Canary HBAR and Canary Litecoin ETFs saw no inflows or outflows in their first session.

For now, all eyes are on Fed Chair Jerome Powell’s commentary at 2:30 PM UTC. Any dovish signal could swiftly reverse today’s dip and re-ignite market momentum.

We almost always dump after the FOMC…

Will this time be different? pic.twitter.com/jk8hhXkLfq

— Mister Crypto (@misterrcrypto) October 28, 2025

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

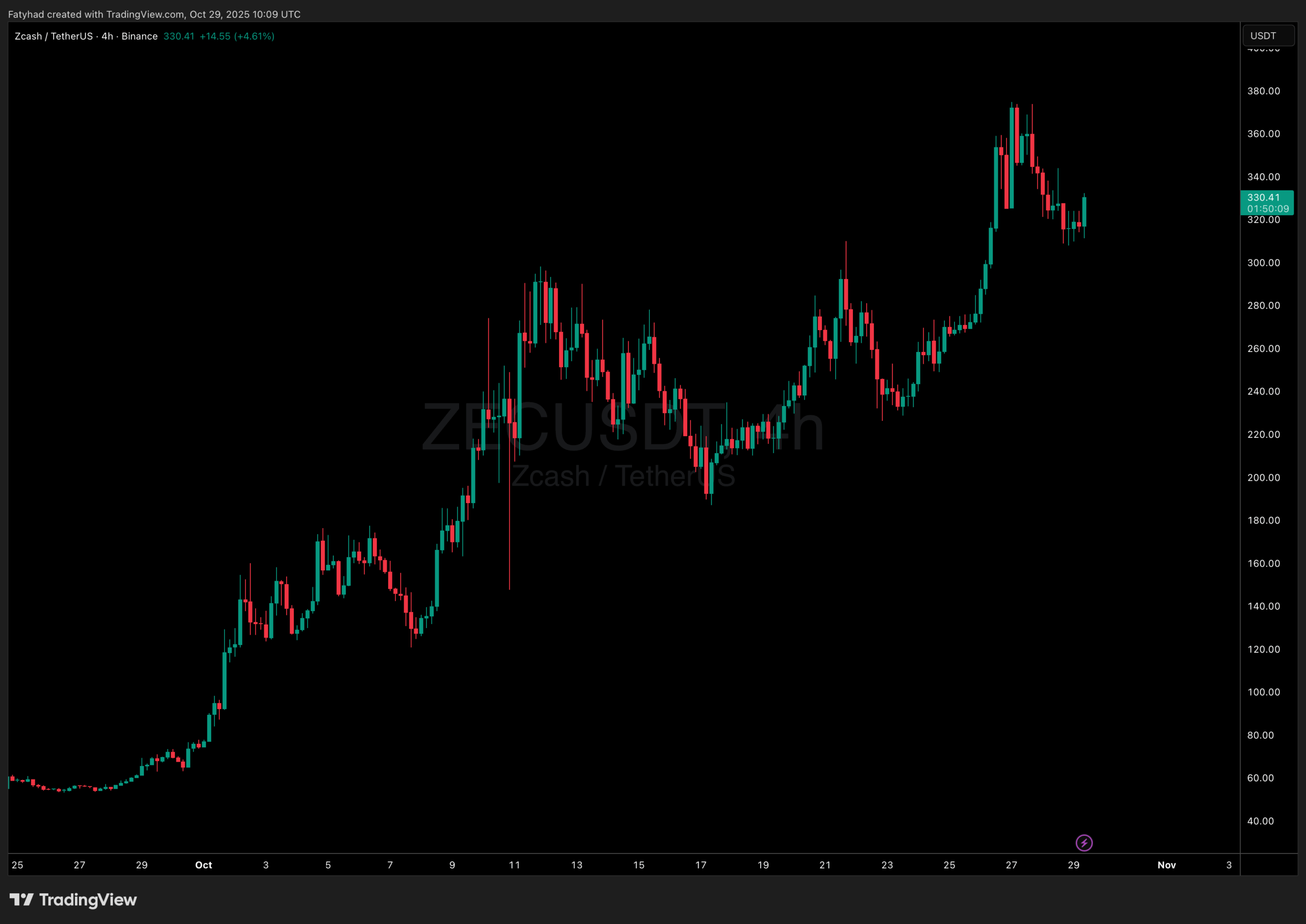

ZCash Eyes Recovery as Traders Hunt for the Next 1000x Crypto

Bitcoin’s recent $240 million futures liquidation wiped out over-leveraged long positions as prices swung between $111,000 and $117,000. While this “stop hunt” cleared excess leverage, it also left spot markets thinner and more sensitive to volatility. Derivatives funding rates have plunged nearly 95% in 24 hours, reflecting traders’ more cautious stance.

Among altcoins, is gaining traction, up 20.97% over the past week to around $329. The price action shows ZEC retesting support near $315, hinting at possible accumulation before another leg higher. With renewed interest and a cleaner market setup, ZCash could attempt to reach new highs. At the same time, if the Fed confirms the rate cuts, following an initial wave of high volatility, the market could be ready to deliver the next 1000x crypto.

(Source: Coingecko)

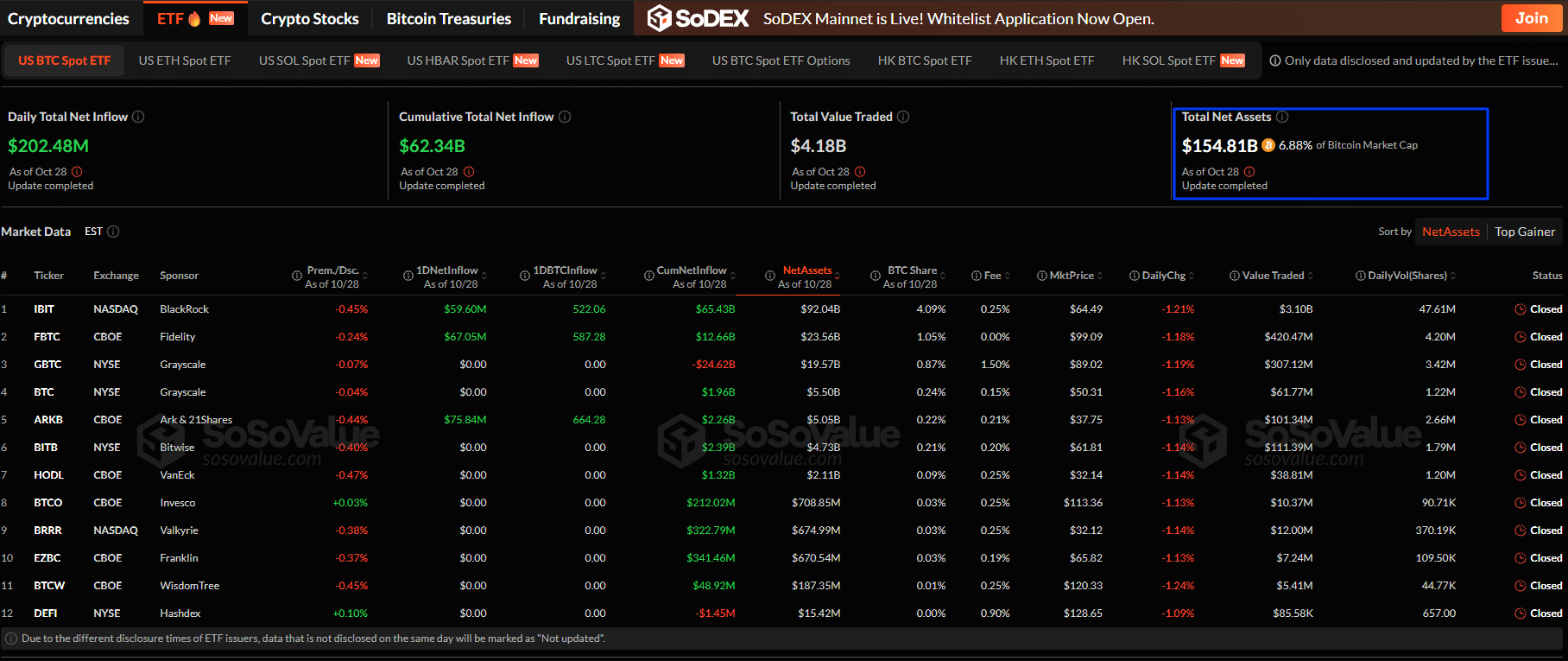

Today’s dip appears to be more of a leveraged flush than a sign of structural weakness. Bitcoin remains above its 200-day EMA ($108K), ETF inflows are steady, and sentiment could turn quickly if Powell’s tone leans dovish. A BTC reclaim of $115K may confirm that the next market leg higher is already taking shape.

Do crypto prices have to 100X before mainstream investors take note? Well, it looks like so. After the listing of Bitcoin futures after the 2017 frenzy, everything has since changed for crypto. The BTC USD price is above $110,000, and there are far more altcoins to choose from in the top 50. True, promising altcoins of the yesteryears, such as Dash and Iota, have faded. In their place, however, are powerhouses. Solana, Hedera crypto, and some of the top meme coins, such as Memecore, dominate. Some have 1000X-ed from their launch prices, and as they evolve and play a key role in the global economy, the big boys of Wall Street want a share. Presently, spot Bitcoin and Ethereum ETF issuers manage over $180Bn, and are some of the most closely watched regulated ETFs. Now, with the launch of multiple spot altcoin ETFs yesterday, the scene is about to change. (Source: SosoValue) Grayscale has officially launched the Solana Trust ETF (ticker: GSOL), giving investors direct exposure to Solana (SOL) and its staking rewards. This marks one of the first mainstream U.S. ETFs to combine both spot holdings and staking features for a major cryptocurrency. The product allows traditional investors to gain access to Solana’s performance and passive income potential through regulated markets. The launch highlights growing institutional interest in Solana’s ecosystem and follows a wave of new crypto ETF products entering the U.S. market amid increasing regulatory clarity. Hedera Hashgraph has been selected to join the Bank of England’s DLT (Distributed Ledger Technology) challenge, which is focused on testing how DLT can be used in finance. HBAR crypto is up +15% on the week following this announcement, alongside yesterday’s (October 28) Hedera ETF launch. The Bank of England is officially committing to exploring DLT innovation, and the inclusion of Hedera is a big deal. It could play out really well for HBAR

crypto, with institutional interest in crypto heating up lately and the UK finally trying to emerge from its dark ages stance on crypto.Altcoin ETFs Slam $69M In Trading Volume As FOMC Set To Pump BTC USD Price

Grayscale Launches Solana Trust ETF With Staking Rewards (GSOL)

Is Bank of England Quietly Tapping HBAR Crypto For Stablecoin Push?

The post [LIVE] Crypto News Today, October 29 – Bitcoin Price Hovers Around $113K, Ethereum at $4K, and ZCash Could Be Ready for Another Run? Next 1000x Crypto Ahead of FOMC? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.