0

0

This article was first published on The Bit Journal.

Ethereum whale activity has returned to the spotlight after a massive $63 million short position surfaced during a key resistance test. The trade landed just as the Ethereum price approached a tightly watched zone between $3,200 and $3,400, a range that has stalled rallies more than once. The timing raised eyebrows across trading desks and on-chain circles.

Momentum had already slowed before the position appeared. According to the source, blockchain monitoring tools flagged the leveraged bet as markets showed signs of strain rather than strength. That discovery shifted attention away from price optimism and toward risk management.

The Ethereum whale placed a short using 3x leverage, a structure that magnifies both gains and losses. At current levels, even modest price swings carry outsized consequences. If Ethereum price pushes sharply higher, the position risks liquidation near the mid-$4,000 range. If resistance holds, the trade could benefit from a controlled pullback.

Large traders often move early when sentiment turns crowded. Market studies on derivatives behavior show that leveraged shorts frequently appear near resistance when funding rates rise, and buyers become more aggressive. This pattern has repeated across past crypto cycles, especially in assets with deep futures liquidity.

Independent research on crypto market structure explains how whale positioning can influence short-term direction by pulling liquidity toward key levels. That dynamic now appears active again.

While the Ethereum whale trade drew attention, technical signals quietly supported caution. Ethereum price hovered near $3,300, according to live market data from aggregated pricing feeds. The Relative Strength Index (RSI) climbed above 70, signaling overbought conditions, a common warning during range-bound markets.

Momentum indicators also weakened. The MACD showed a loss of bullish strength, suggesting that buying pressure was fading as price approached resistance. Analysts tracking similar setups in prior cycles noted that sideways movement or brief pullbacks often followed.

Charts circulating on trading platforms revealed how closely participants are watching the same resistance band. When the price approaches such crowded zones, reactions tend to be sharper and faster.

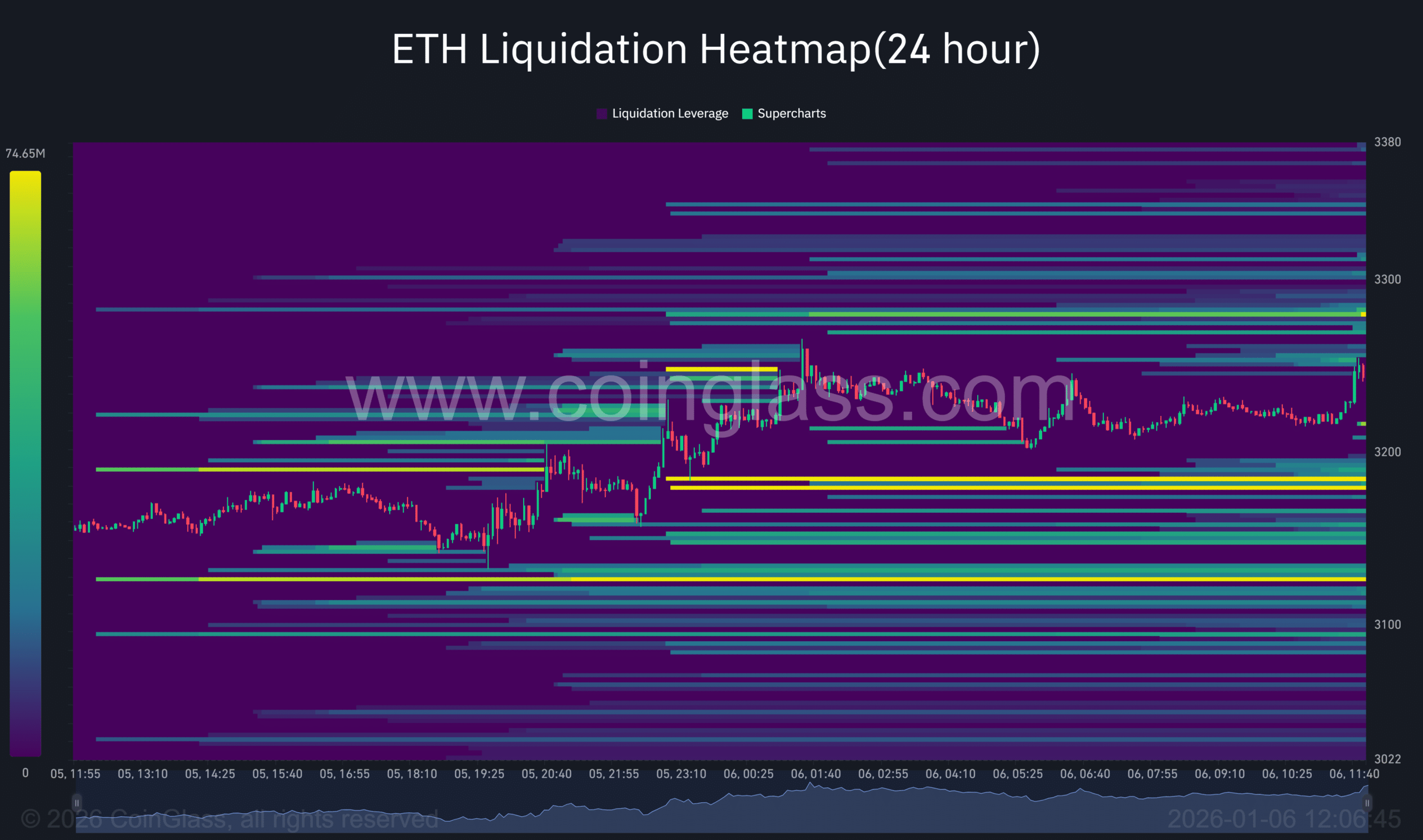

On-chain liquidity maps showed dense clusters around the $3,000 level, an area where leveraged positions are heavily concentrated. Data visualizations show that these zones often act as magnets during corrections.

The Ethereum whale bet appears aligned with that structure. Rather than calling for a broader downtrend, the position reflects expectations of rejection and reset. If Ethereum price dips toward liquidity, rapid moves could follow as positions unwind.

Academic studies on leveraged markets highlight how liquidation clusters accelerate price discovery. That process unfolds quickly once key thresholds are reached.

Despite near-term pressure, the longer-term context remains supportive. Historically, Ethereum has often rebounded in Q1 following softer year-end performance, keeping bulls from fully capitulating. Even if the Ethereum whale trade plays out, broader demand could re-emerge at lower levels.

Developers and institutional observers continue to focus on network upgrades and long-term adoption rather than daily volatility. That divide between speculation and fundamentals often defines market turning points.

The Ethereum whale short has sharpened its focus on leverage, liquidity, and timing. Ethereum price now sits at a technical crossroads where resistance meets concentrated risk.

Whether this trade proves timely or premature, it underscores how a single prominent position can reshape sentiment. The next move will reveal whether caution or conviction carries more weight.

Ethereum whale: A large holder capable of influencing price action.

Short position: A trade that profits when prices fall.

Liquidity zone: A price area with heavily clustered orders.

Leverage: Borrowed funds used to amplify trade exposure.

A major investor whose trades can impact market direction.

It reflects expectations that resistance may hold.

Short-term risk exists, but long-term outlook remains mixed.

The $3,000 support zone and $3,400 resistance area.

Read More: $63M Ethereum Whale Trade Puts ETH Price at Risk">$63M Ethereum Whale Trade Puts ETH Price at Risk

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.