Cardano Jumps 10%, Profit Supply Spikes as ADA Bulls Regain Control

2

0

Cardano’s price has surged 10% over the past 24 hours, riding the wave of a broader crypto market rally to reach a two-month high.

The sharp move upward has pushed ADA to levels last seen in early March and has reignited bullish sentiment among spot and derivatives traders.

Cardano’s 10% Pump Sparks Surge in Profitable Supply

On-chain data from Santiment reveals that Cardano’s double-digit rally has boosted the percentage of its supply in profit. As of this writing, approximately 74.14% of ADA’s circulating supply—equivalent to 26.91 billion tokens—is now held at a profit.

Cardano Percent of Total Supply in Profit. Source: Santiment

Cardano Percent of Total Supply in Profit. Source: Santiment

When an asset’s profit supply spikes, it means that a significant portion of its circulating supply is now worth more than when it was acquired. Historically, a rise in profit supply correlates with renewed accumulation and often hints at further upward momentum as market sentiment improves.

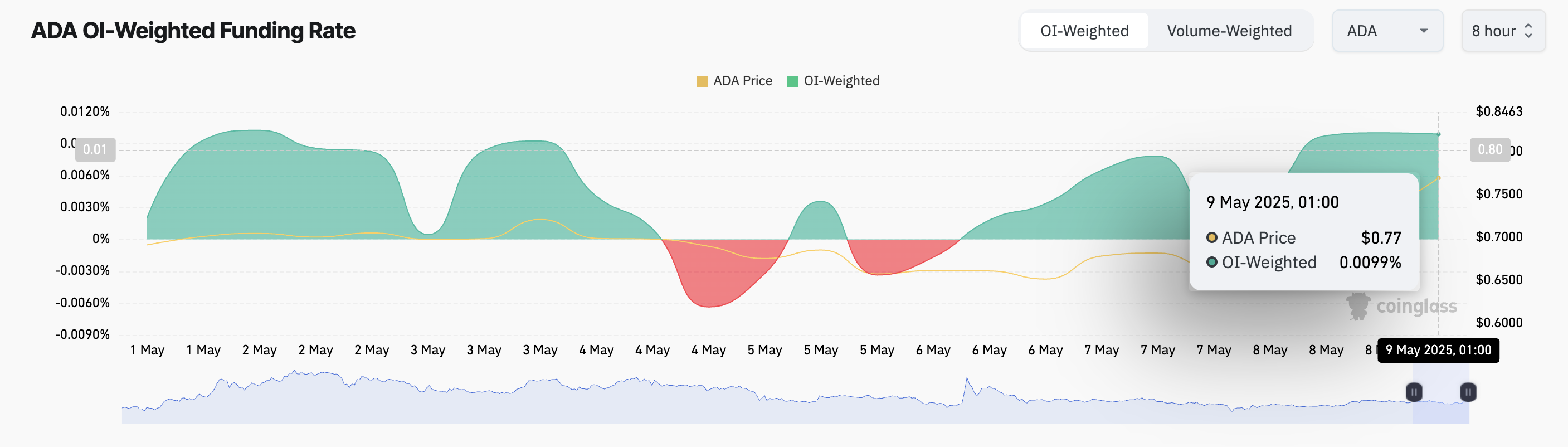

Moreover, in the ADA derivatives market, the coin’s funding rate remains firmly positive, indicating that traders are increasingly taking long positions in anticipation of continued gains. This is currently at 0.0099%.

ADA Funding Rate. Source: Coinglass

ADA Funding Rate. Source: Coinglass

The funding rate is a recurring payment between traders in perpetual futures contracts, designed to keep the contract price aligned with the spot market.

When positive like this, traders holding long positions are paying those with shorts, indicating bullish sentiment and expectations of further price increases.

ADA Rally Gains Steam, but Profit-Taking Could Threaten $0.76 Support

With technical indicators flashing bullish and sentiment strengthening, ADA buyers have regained control, at least for now. If buying pressure strengthens and bull dominance remains, ADA could maintain its upward trend and rally to $0.84.

ADA Price Analysis. Source: TradingView

ADA Price Analysis. Source: TradingView

However, once buyers’ exhaustion sets in and traders begin to lock in their soaring profits, ADA could break below the support at $0.76 and fall toward $0.66.

2

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.