Worldcoin price risks further loses amid 18% weekly dip

0

0

Worldcoin price is trading at $0.93, down 8.2% in the past 24 hours, with a 24-hour trading volume of $241 million. According to CoinGecko data, Worldcoin’s daily trading volume has spiked 96% in the last 24 hours..

Largely, the token’s performance in the past few days mirrors broader cryptocurrency market volatility. Bitcoin (BTC) and Ethereum (ETH) are also in the red over the past day, with heightened geopolitical tensions fueling panic selling.

Amid the market uncertainty, WLD’s market capitalization has dropped to $1.5 billion. This comes as Worldcoin price dips 18% in the past week to currently hover at a pivotal level, well below the highs seen in May 2025.

WLD price today: Will bears extend the 18% dip?

Worldcoin has experienced a sharp 8% 24-hour dump and nearly 18% decline over the past seven days.

Looking at the charts, this shows the cryptocurrency has underperformed the global cryptocurrency market, which was down 1.9% in the same period.

As noted, the downturn aligns with escalating Israel-Iran tensions, which have rattled risk assets across markets. On June 13, 2025, Israel’s strikes on Iranian nuclear facilities triggered a risk-off sentiment, with Bitcoin falling 4.5% and WLD facing intensified selling pressure.

Beyond geopolitics, profit-taking after WLD’s failure to breach the $1.35 resistance likely exacerbated the dip. Regulatory concerns surrounding Worldcoin’s biometric data practices, particularly in Europe, may have further dampened investor confidence.

Declining open interest, down 11.5% to $217 million, suggests waning interest.

If selling continues, fresh bearish pressure could push prices below $0.9. The all-time low of $0.58 reached on April 7, 2025, could be a key target.

Is Worldcoin price set for reversal amid fresh accumulation?

While Worldcoin continues to struggle with downside pressure, encouraging signs of fresh accumulation have emerged.

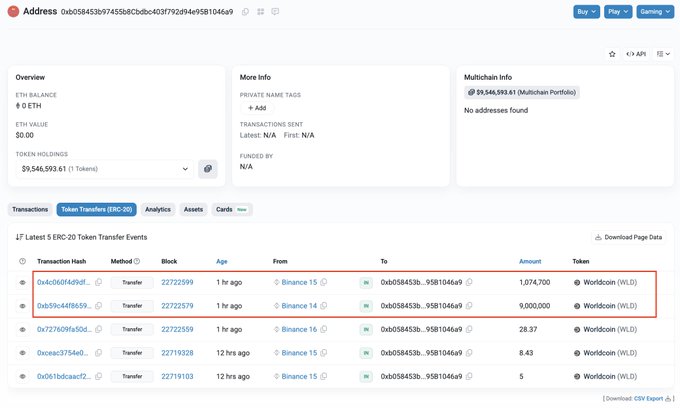

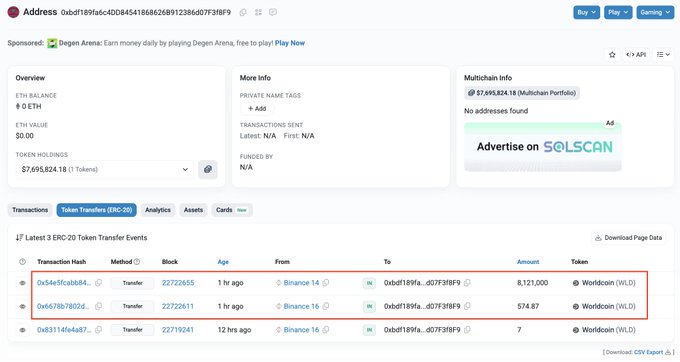

On-chain data indicates large investors withdrawing 2.8 million WLD tokens from exchanges, tightening supply and potentially supporting price recovery.

On the daily chart, Worldcoin’s price hovers precariously near the $0.93 support, a level bulls are defending with cautious optimism.

Technical indicators present a largely bearish outlook. The Relative Strength Index (RSI) at 36 and sloping signals bearish momentum, while the Moving Average Convergence Divergence (MACD) shows a recent bearish crossover.

These indicate a potential for further downside.

As highlighted above, a drop below $0.90 could see bears test $0.74 and possibly eye $0.58 or lower.

Conversely, if bullish momentum builds, WLD could target the $1.00 psychological level, with a break above $1.2 opening the path to $1.59.

The post Worldcoin price risks further loses amid 18% weekly dip appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.